Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOGL), and Amazon.com, Inc. (NASDAQ: AMZN) will report results next week. Here are the key numbers that we’re watching.

Earnings Preview Summary: Rotation?

Microsoft, Alphabet, and Amazon have enjoyed strong stock performance year to date. Going forward, consensus 2025 P/E multiples for these stocks are in the 22-32x range with consensus target prices expecting 5-15% further upside for these three mega caps. Performance in the quarter coupled with the outlook will likely determine the path of these three mega-cap tech stocks into the H2 2024. With the sentiment moving toward a September rate cut, the small caps have been rallying. Will investors rotate out of the mega caps and put money to work elsewhere or stay put?

Microsoft (MSFT) Q4 2024 Earnings Preview: AI to drive upside?

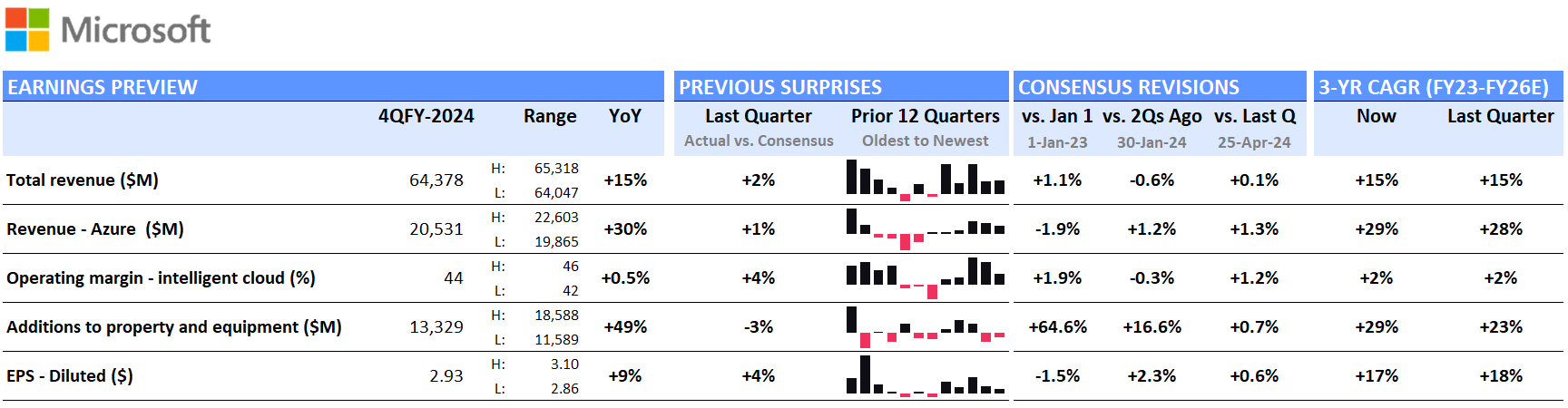

Microsoft – consensus expectations for Q4, past earnings surprises, consensus revisions, and CAGR

Source: Visible Alpha consensus (July 16, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

According to Visible Alpha consensus, total revenues expected for Q4 have remained at $64.3 billion since April, driven by resilience in its core business segments. In particular, the Intelligent Cloud segment, which makes up over 40% of total revenues, is projected to remain solid, with consensus estimates now expecting $105.5 billion for FY2024, driven by Azure. The profitability of this segment is a source of debate among analysts. Currently, the Q4 2024 consensus of 12 analysts for the Intelligent Cloud business’s operating profit margin is 44.3%, but ranges from 42% to 46%, suggesting this segment may deliver a surprise in the Q4 release. This range however has narrowed by 200 bps since last quarter.

We are closely watching what the company will say about the outlook for AI and Copilot, as Microsoft’s FY 2024 CapEx numbers have continued to increase steadily since last year. According to consensus projections, CapEx estimates have climbed over $15 billion from $29 billion in January 2023 to currently $44.5 billion in FY 2024, up now over 3x from FY 2019 and ahead of both Meta’s (NASDAQ: META) and Alphabet’s (NASDAQ: GOOGL) estimated CapEx levels.

Microsoft stock has traded up 13.8% since the April earnings release, but is up 20.6% ytd, slightly outperforming the 19% delivered by the S&P 500. The consensus P/E for 2025 is 31x. Could the Q4 release and 2025 outlook drive more meaningful outperformance in the stock?

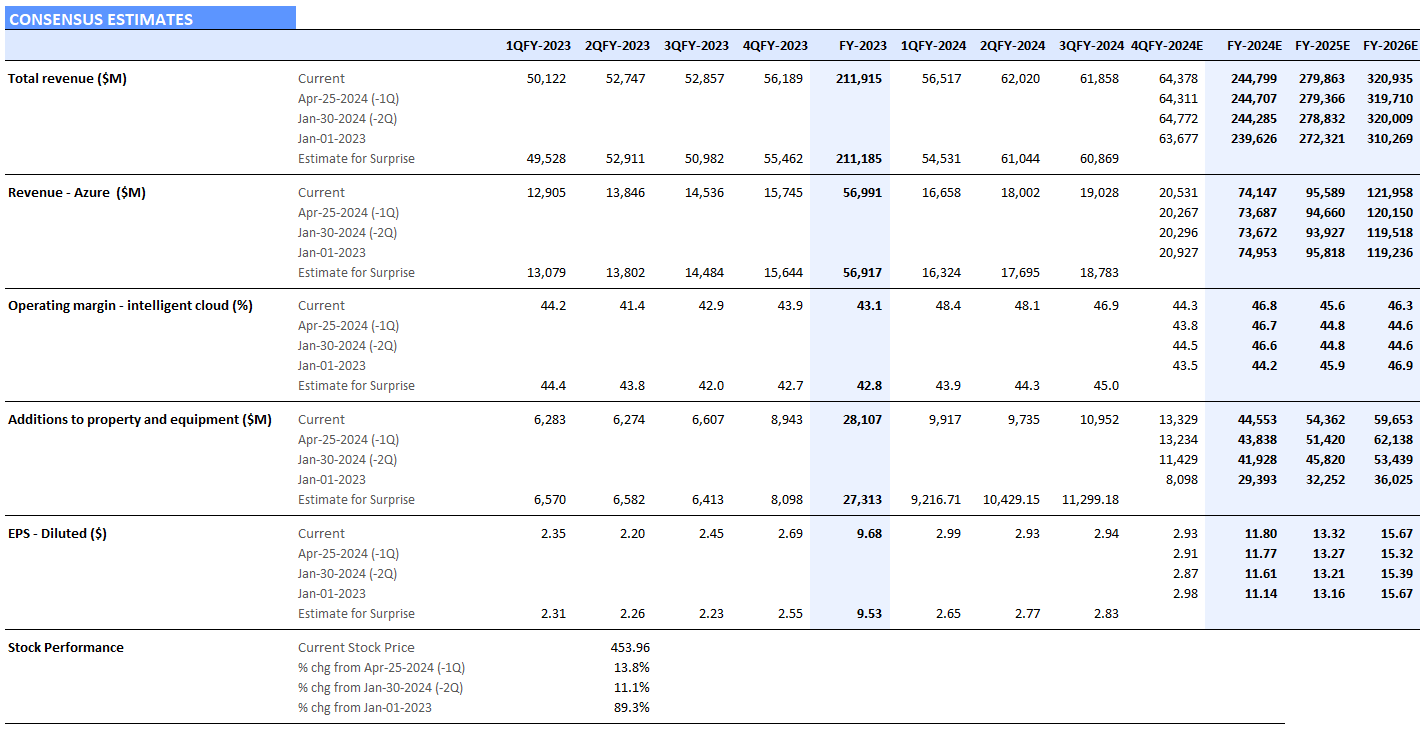

Microsoft consensus estimates

Source: Visible Alpha consensus (July 16, 2024). Stock price data courtesy of FactSet. Alphabet stock price is as of the market close on July 16, 2024.

Alphabet (GOOGL) Q2 2024 Earnings Preview: What’s happening to margins?

Alphabet – consensus expectations for Q2 2024, past earnings surprises, consensus revisions, and CAGR

Source: Visible Alpha consensus (July 17, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Alphabet Q4 2023 Earnings Preview

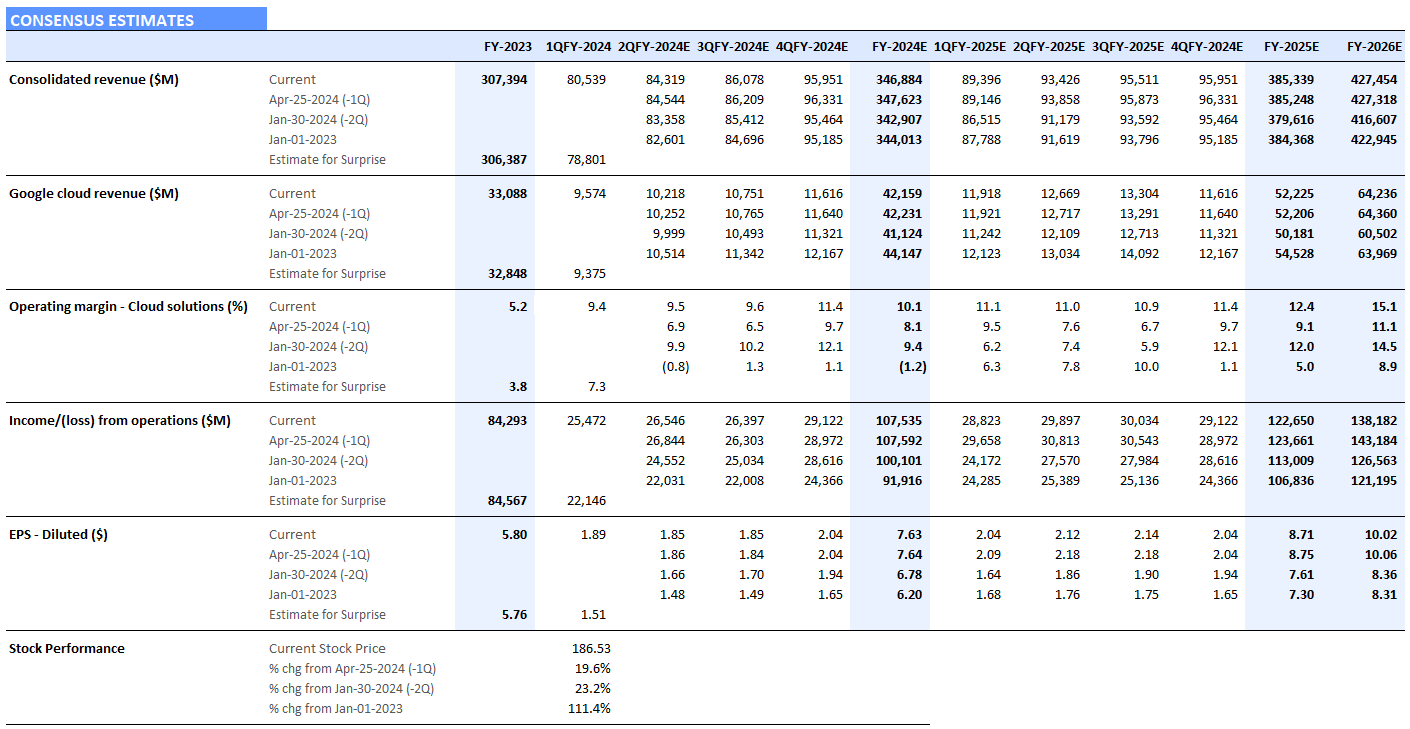

According to Visible Alpha consensus, total revenues expected for Q2 2024 have remained around $84 billion since last quarter, driven by resilience in its ad business. In addition, the Q2 consensus expectations for operating income and EPS remained around $26.5 billion and $1.85/share since last quarter. Questions have been emerging about the impact of AI on its core business, but have not impacted consensus revenue estimates for Q2 or the full year. However, consensus EPS of $1.85/share ranges from $1.66 to $2.01 for Q2, driven by differing assumptions around costs. It will be interesting to hear what Alphabet says about the outlook.

We are closely monitoring the trend of the Cloud business. The operating profit margin has been trending better. The margin turned positive in Q1 2023, but missed expectations in Q3 by 200 bps, coming in at 3% instead of 5%. More recently, the Q1 2024 Cloud margin came in at 9.4%, beating consensus by ~200 bps. Looking ahead to Q2 2024, analysts expect the Cloud business to generate a 9.5% operating profit margin, up 260 bps since last quarter. However, the 22 estimates range from 2.9% to 16.1% with 10 of the analysts estimating the margin to be over 10% and 4 analysts estimating it to be below 7%, signaling divergent views about the performance of this business.

For the full year, analysts are also split in their views. For the Cloud business, Visible Alpha consensus expects the operating profit margin to hit over 10% in FY 2024, but ranges from 4.3% to 15%. Longer-term, the consensus Cloud margin is estimated to generate a 15% margin by the end of FY 2026, ranging from 9.5% to 20.6%. What will be the right margin level for Alphabet’s Cloud business?

Alphabet stock has traded up 19.6% since last quarter’s April release and up 33% in 2024, outperforming the S&P 500’s 19% return. The consensus P/E for 2025 is 22x. The stock has remained resilient, driven by solid ad growth in its core business. However, questions remain about the profitability of the Cloud business and its Unallocated and Other Bets. Could the Q2 release provide more visibility into the trajectory of 2024 profitability and give shares a further boost?

Alphabet consensus estimates

Source: Visible Alpha consensus (July 16, 2024). Stock price data courtesy of FactSet. Alphabet stock price is as of the market close on July 15, 2024.

Amazon.com (AMZN) Q2 2023 Earnings Preview

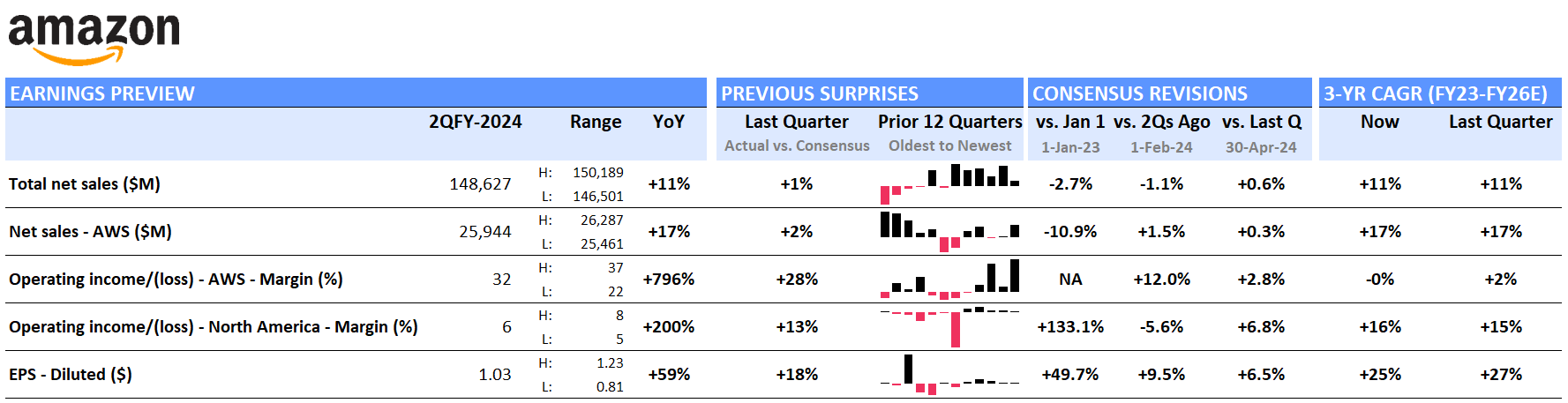

Amazon – consensus expectations for Q2, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (July 18, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Amazon Q2 2024 Earnings Preview

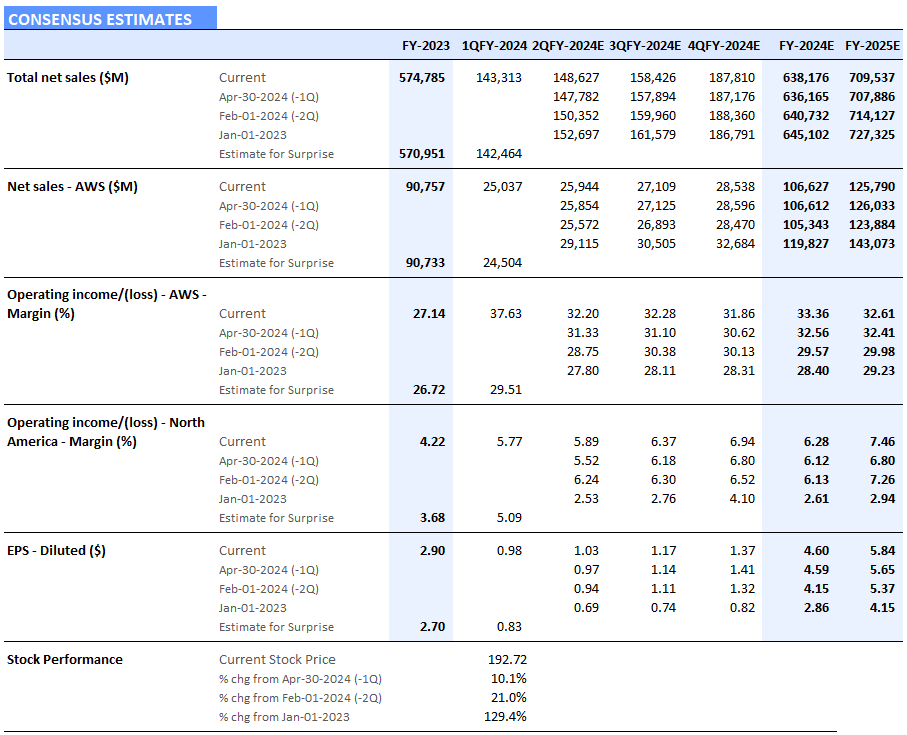

According to Visible Alpha consensus, total revenues expected for Q2 have come up slightly from last quarter, from $147.8 billion to $148.6 billion, driven by strength in Amazon’s online retail business. Consensus expectations for AWS have remained around $25.9 billion. The focus will likely be on the Q2 performance and 2024 outlook for the online retail and AWS margins and their impact on EPS.

The North America retail operating margin has increased significantly from a meager 1.1% at the beginning of last year to an estimated 5.9% for Q2. Operating margin expectations for North America have edged higher since April, but are lower than the 6.2% margin initially targeted after Q1. For 2024, the estimated margin range increased from 3.6% to 6.3% last quarter to 5.3% to 7.6% now, with consensus at 6.3%, instead of at the top end of the range. What will the company say about the outlook for the online business?

AWS margin came in at 37.6% last quarter, and for Q2, has steadily increased up to an expected 32.2% level, up nearly 350 bps since early February. There is, however, a significant range of estimates for the Q2 AWS margin into next week’s release, with analysts expecting from 22% to 37%.

The stock has traded up 10% since late April and up 29% year to date, outperforming the S&P 500. The consensus P/E for 2025 is 33x. Could the Q2 release provide the next positive catalyst for the stock?

Amazon consensus estimates

Source: Visible Alpha consensus (July 17, 2024). Stock price data courtesy of FactSet. AMZN’s current stock price is as of the market close on July 16, 2024.