In our weekly round-up of the top charts and market-moving analyst insights: Netflix’s (NYSE: NFLX) ad-supported tier expected to see rise in revenue and subscribers; Alibaba (NYSE: BABA) expands internationally; AMD’s (NASDAQ: AMD) data center segment projected to see significant rise in revenue and profitability; BYD’s (SZSE: 002594) EV focus expected to drive growth.

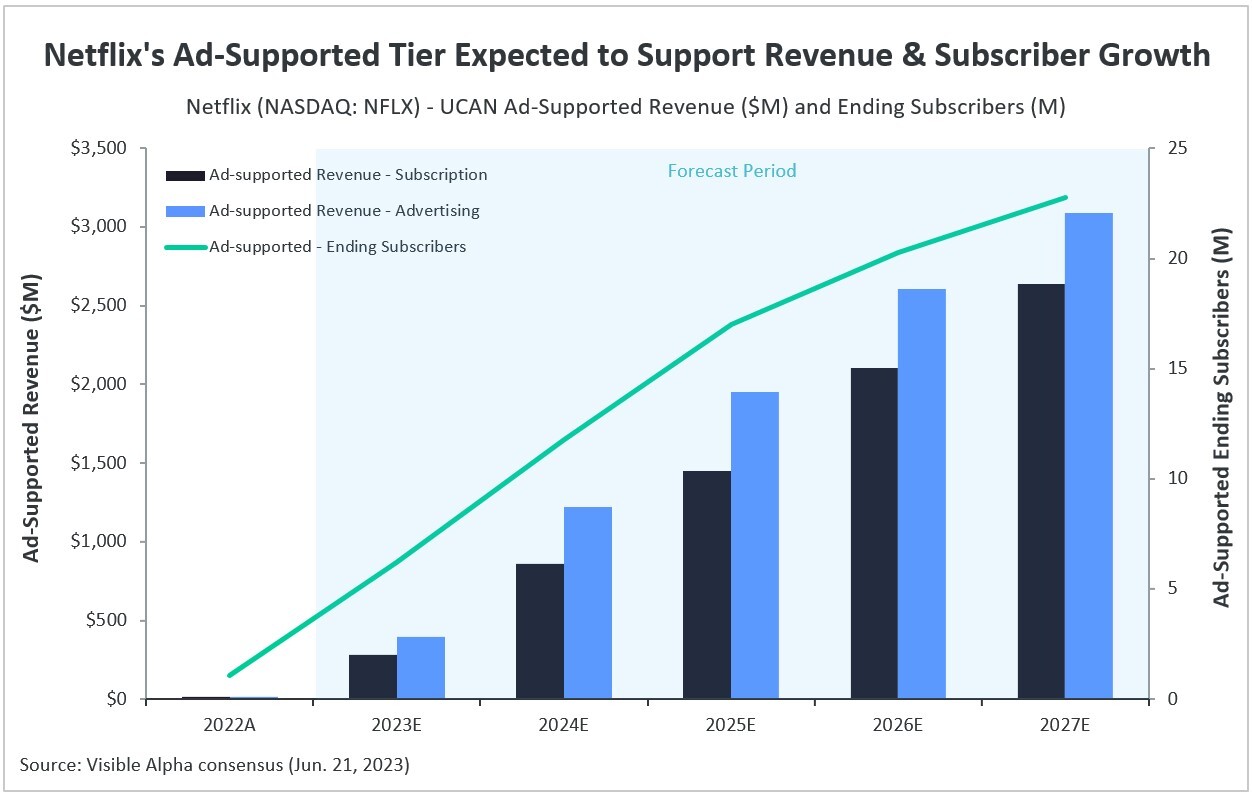

Netflix’s Ad-Supported Tier Expected to Support Revenue & Subscriber Growth

Netflix (NASDAQ: NFLX) is expected to experience a steady rise in both revenue and subscribers for its new ad-supported tier, according to analysts. The company launched this ad-supported plan late last year to help address password-sharing concerns.

According to Visible Alpha consensus, Netflix’s ad-supported tier for the U.S. & Canada (UCAN) is projected to generate $396 million in advertising revenue and $284 million in subscription revenue in 2023, along with an expected 6.2 million subscribers. Analysts expect UCAN ad-supported revenue from both advertising and subscriptions to exceed $5 billion by 2027.

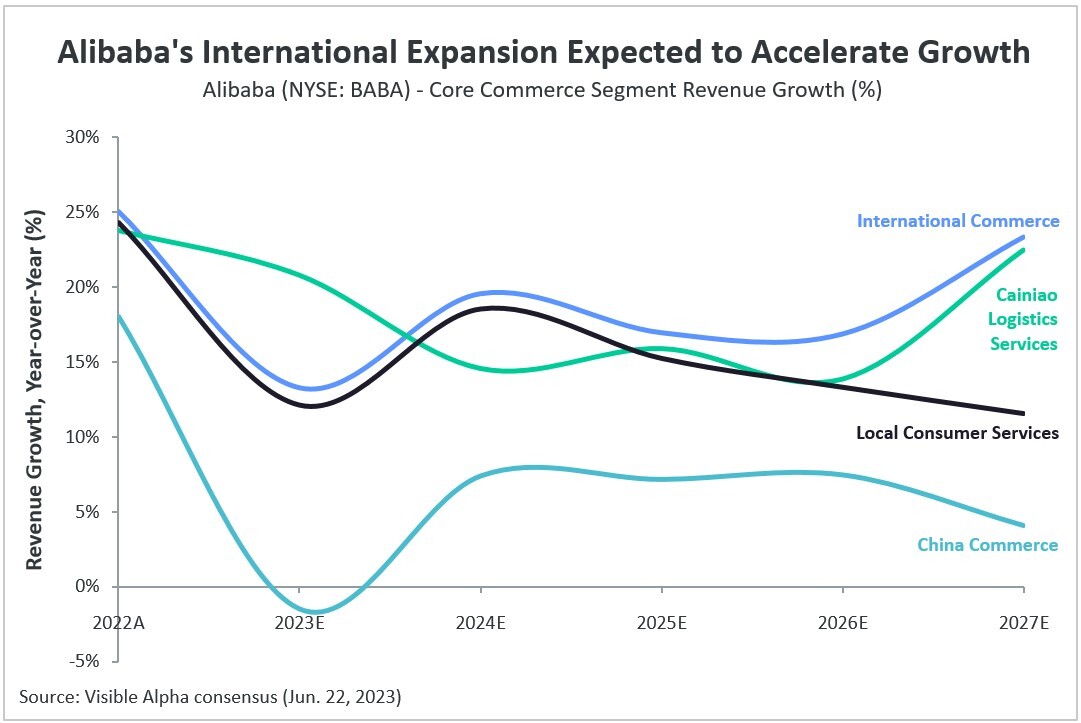

Alibaba’s International Expansion Expected to Accelerate Growth

Analysts expect a robust 19% CAGR from 2023 to 2027 for Alibaba’s (NYSE: BABA) International Commerce revenue as the company forges ahead with its global expansion strategy, highlighted by the introduction of Tmall in Europe. Unlike AliExpress in Europe, Tmall will prioritize the sale of local brands to local customers.

Alibaba’s logistics subsidiary, Cainiao Logistics, also aims to expand internationally and has been constructing its own warehouses and recruiting delivery personnel across Europe and Southeast Asia.

In 2027, analysts project CNY 140 billion in International Commerce revenue, and CNY 103 billion in Cainiao Logistics services revenue, a 17% CAGR from 2023 to 2027. These emerging businesses are expected to grow at a faster pace than the core China Commerce segment that made up ~80% of revenue in 2022, but is expected to generate a lower 7% CAGR from 2023 to 2027, and to decline to 69% of revenue by 2027.

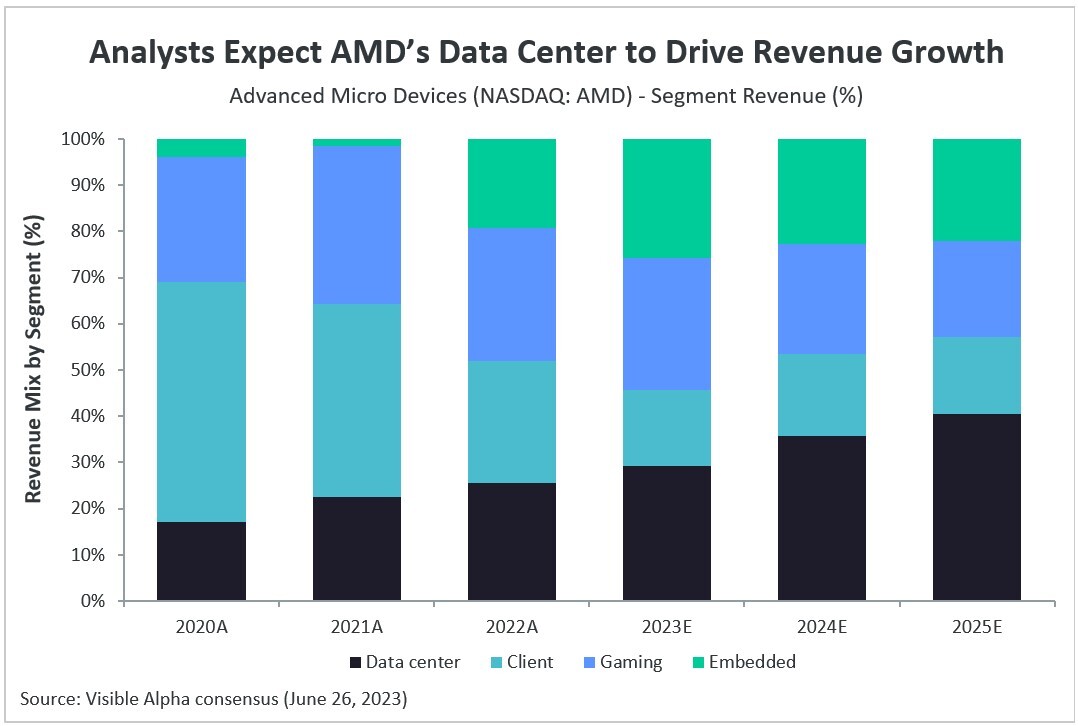

Analysts Expect AMD’s Data Center to Drive Revenue Growth

AMD’s (NASDAQ: AMD) data center segment is expected to see its revenue grow from $6.7 billion in 2023 to $12.2 billion in 2025. In addition, the profitability of the data center segment is projected to expand significantly from $1.6 billion in 2023 to $4.6 billion in 2025, taking the operating profit margin from ~24% to ~38%.

AMD recently announced the launch of its new high-performance MI300X chip, which the company describes as “the most advanced accelerator for generative AI.” This may help drive further growth in 2024 and beyond.

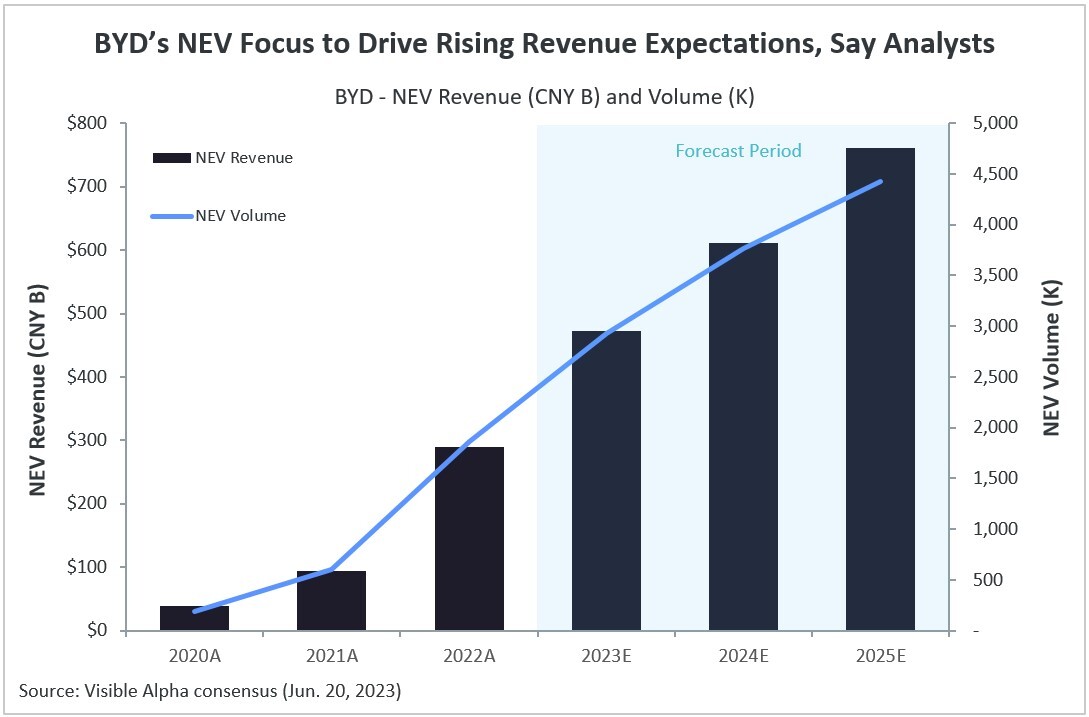

BYD’s NEV Focus to Drive Rising Revenue Expectations, Say Analysts

Chinese automaker and EV-specialist BYD (SZSE: 002594) is expected to increase its vehicle sales to 4.4 million units by 2025. This is a significant jump from the 1.8 million units sold in 2022 and projected 2.9 million units for 2023.

In 2022, the automaker made the strategic decision to discontinue the production of internal combustion engine (ICE) vehicles and instead focus exclusively on manufacturing hybrid and electric vehicles, also known as new energy vehicles (NEVs).

Analysts project BYD’s NEV segment revenue to grow 62% year-over-year in 2023, reaching a total of CNY 471 billion ($66 billion), up from CNY 290 billion ($41 billion) in 2022.