On Monday, Netflix reported 2Q17 earnings that sent the stock soaring up 14% on Tuesday. While significant, this represented just another incremental step upwards in the company’s longer-term trajectory. Over the last year, the stock is now up 87%, and over the last 5 years, the stock is up 1,416%.

Bullish on Paid Subscriber Growth

Investors are primarily bullish on paid subscriber growth, which continues to outperform substantially. In 2Q, Netflix had 5.2 million net adds in paid subscribers – well above consensus of 3.3 million net adds. Netflix has now outperformed Visible Alpha’s consensus estimates in 3 of the last 4 quarters.

Investors have been watching this metric carefully due to concerns that growth would begin to slow more drastically. At 50M total Domestic Streaming paid subscribers, some investors feared that Netflix would eventually begin to run up against more competition from HBO Now/Go, Amazon, and other online streaming content providers. However, management noted that they believe they are simply growing the market for streaming content, and the evidence from 2Q continues to support this notion. As a result, Domestic Streaming paid subscriber estimates continue to be revised upwards beyond 2017.

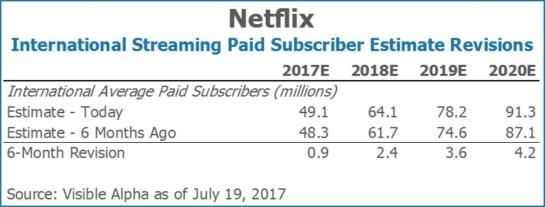

International Streaming Subscribers are Catching Up to Domestic Figures

The International Streaming segment is another source of growth for paid subscribers. Starting in 2010, the company began to expand outside of the US. Today, International Streaming paid subscribers are nearly equal to Domestic Streaming paid subscribers. Going forward, analysts expect the International Streaming segment to be a much larger driver of paid subscriber growth. As shown below, analyst revisions within the International Streaming segment were even larger over the last six months as analysts have turned more bullish on this segment.

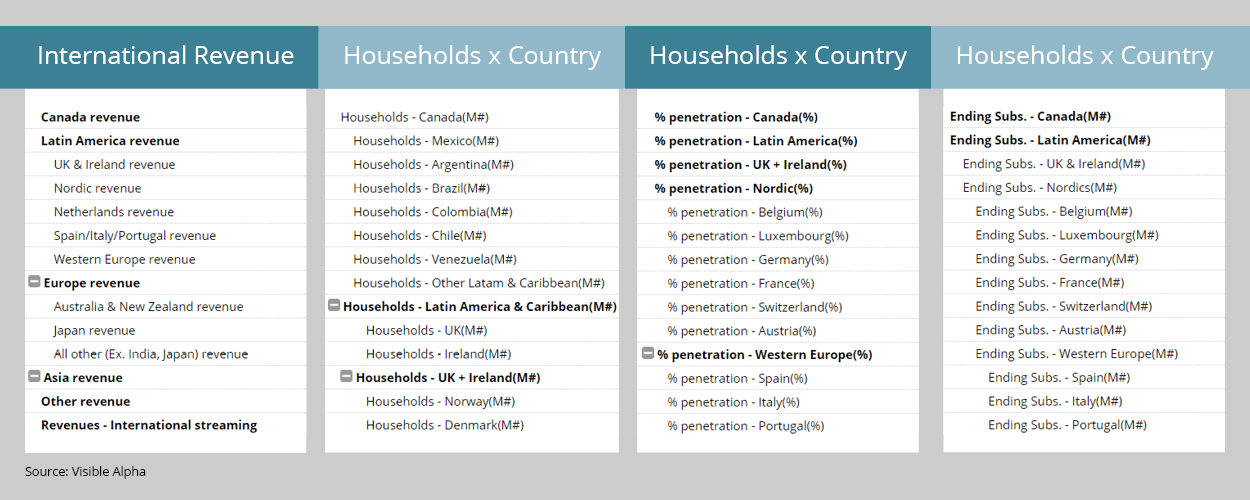

Tip: For a deeper look into Netflix’s international business, visit the International Streaming and International Subs pages where you will find country level estimates of revenue, households, penetration rates, and ending subscriber counts.

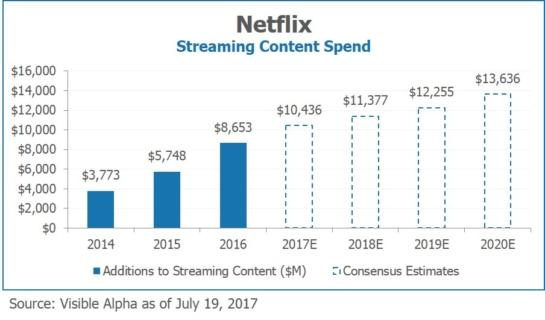

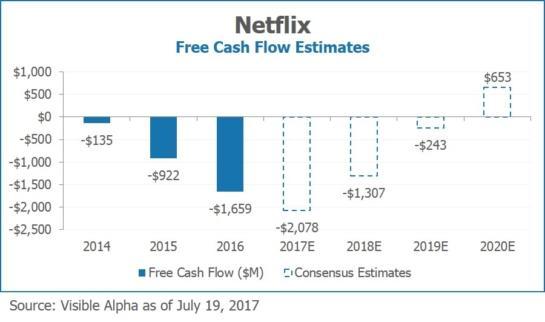

Management noted that subscriber growth is strongly driven by content. As a result, the company plans to continue to invest heavily in programming and expects free cash flow to remain negative for “many years.” Given the ambiguity, consensus estimates here provide increased visibility into investor expectations for free cash flow. Visible Alpha’s data shows that analysts expect Netflix free cash flow to remain negative until 2020. A significant portion of the cash outflow is expected to go towards additions to streaming content assets, which analysts expect to grow each year, reaching $13.6 billion by 2020.