In our weekly round-up of the top charts and market-moving analyst insights: Novartis’ Entresto (NYSE: NVS) faces generic competition & Medicare price cuts in the U.S.; Salesforce (NYSE: CRM) mitigates its revenue slowdown with margin expansion; and Sleep Country Canada (TSX: ZZZ) expands its portfolio amid a growth slowdown.

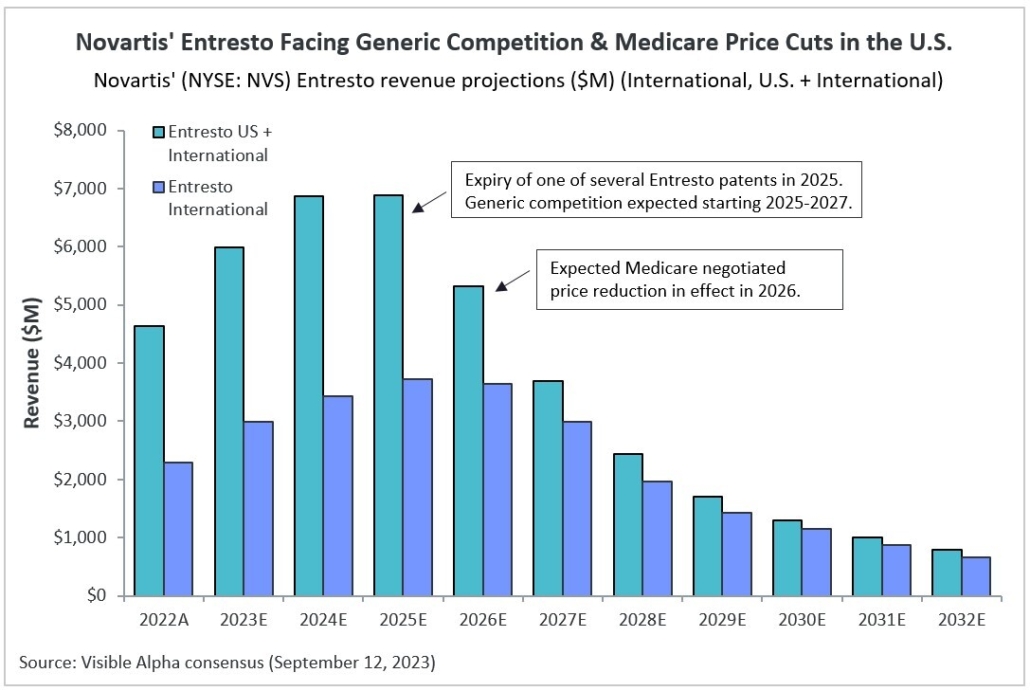

Novartis’ Entresto Facing Generic Competition & Medicare Price Cuts in the U.S.

Novartis’ (NYSE: NVS) Entresto is one of 10 prescription drugs that initially fall under the Inflation Reduction Act (IRA) of 2022, which allows Medicare to negotiate lower prices directly with drug companies. Entresto is prescribed for patients with heart failure to help reduce the risk of death and hospitalization. The expected reduction in U.S. prices will take effect from 2026.

In the case of Entresto, however, generic competition is expected to be a greater threat than lowered pricing for U.S. revenue from 2025 onward. Analysts expect generic competition to begin taking effect between 2025 and 2027.

Novartis has thwarted attempts by generic makers of Entresto since 2019, utilizing patent infringement lawsuits. Notably, the company has settled with several generic companies regarding a U.S. launch date for Entresto generics. Novartis has guided investors to model 2025 as a reasonable timeline to assume generic competition. Even though one Entresto patent will expire in 2025 based on a recent court decision, other key Entresto patents could survive through 2027.

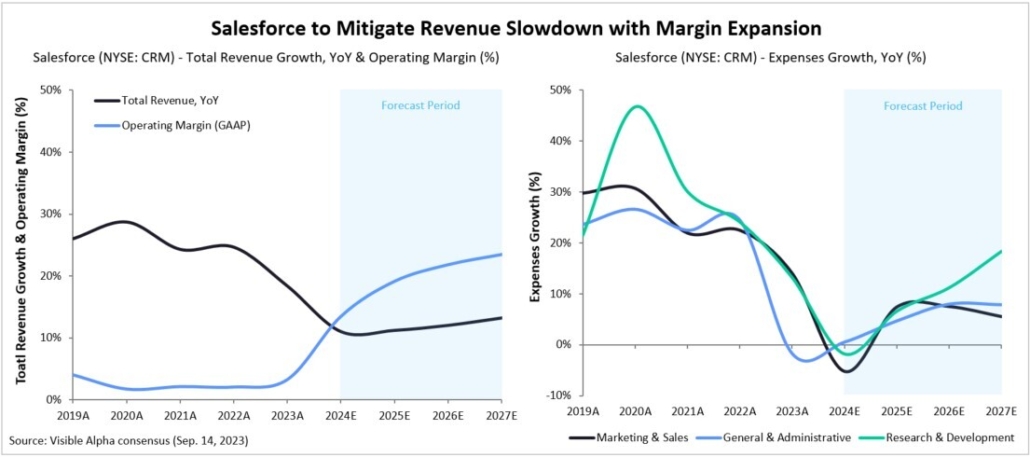

Salesforce to Mitigate Revenue Slowdown with Margin Expansion

Salesforce (NYSE: CRM) has seen its revenue growth slow down significantly over the last year as economic challenges prompted many companies to tighten their spending. Analysts expect the company’s total revenue to increase by 11% in 2024, a notable slowdown from its 18.3% growth in fiscal 2023 and the 24.7% surge in fiscal 2022.

According to Visible Alpha consensus, however, Salesforce’s margins are expected to continue to expand. Analysts expect the company to generate an operating margin (GAAP) of 13.5% in 2024, up from 3.3% in fiscal 2023, and 2.1% in fiscal 2022.

The growth in profitability is on the back of several measures the company has implemented over the past year. Salesforce laid off about 10% of its workforce in early 2023, halted all major acquisitions, and has also reined in its operating expenses. The company’s selling and marketing expenses, a major expense line for the company, are projected to decline by -5.2% in 2024, while total operating expenses are projected to fall by -2.8%.

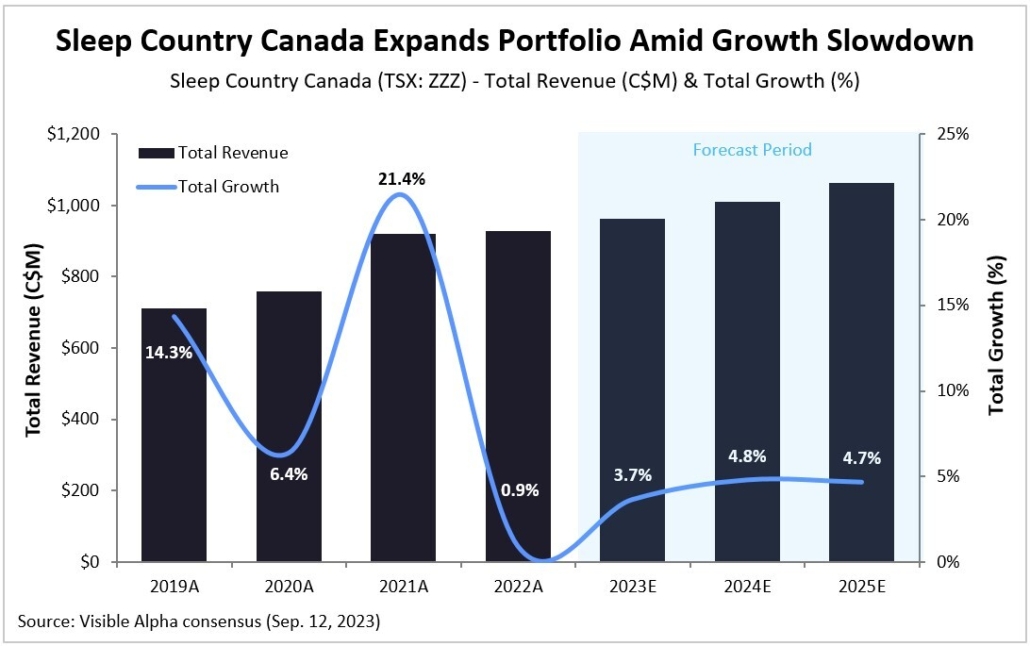

Sleep Country Canada Expands Portfolio Amid Growth Slowdown

Analysts expect Canadian specialty sleep retailer Sleep Country Canada (TSX: ZZZ) to see total growth improve starting in 2023, following a sharp decline in 2022, according to Visible Alpha consensus. The company has seen total growth slow down since last year due to reduced consumer spending on big-ticket discretionary items. Total growth combines the percentage increases in same-store sales and sales from new stores.

In an effort to enhance its portfolio, the omnichannel specialty sleep retailer has been on an acquisition spree since 2021. Earlier this year, the company acquired the Canadian operations of mattress retailer Casper Sleep, and late last year, it acquired the direct-to-consumer sleep brand Silk & Snow. Additionally, in 2021, Sleep Country Canada made investments in Hush Blankets and Sleepout, a start-up curtain company.