This is the second part of a three-part series.

In the U.S., publicly traded companies routinely reward shareholders with cash payouts. There are two types of common payout vehicles:

- Cash dividend per share

- Share repurchases

Dividend-focused research has been quite popular across the financial industry for a long time, but a lack of reliable data has led quantitative researchers to ignore the impact of buyback programs on stock returns. This is particularly notable given that buybacks represent a greater share of payouts than dividends. Visible Alpha’s data science team analyzed a novel dataset that captures both the buyback and dividends expectations, resulting in the first analysis of forward-looking total payout expectations.

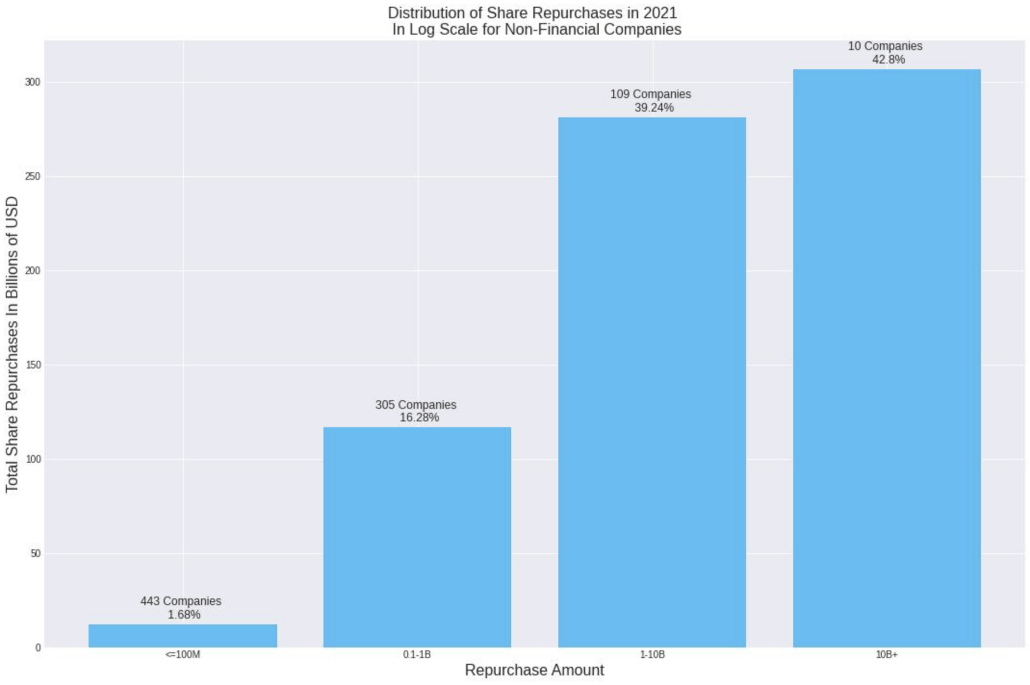

Buybacks today form a larger part of aggregate payouts; they are also highly dispersed across firms. The figure below plots the distribution of share repurchase amounts in each quarter of 2021. The distribution is strikingly skewed; of 859 companies that repurchased shares in 2021, the top 10 companies that spent at least 10 billion dollars make up more than 40% of all money spent on buybacks in 2021. The next group of 109 companies that spent at least one billion dollars, when combined with the top 10, collectively make 80+% of all money spent on buybacks in 2021. This is a staggering 5% of the firms generate 80% of all buybacks in 2021.

Download the full white paper here >

Register For a Live Presentation

Ihsan Saraçgil, Senior Principal Data Scientist at Visible Alpha, will present on the data, methodology, and key findings of the analysis during a webinar presentation on July 12, 2022. Register Now >