In 2023, we saw the FDA approve 55 drugs under the Center for Drug Evaluation and Research (CDER) and 17 under the Center for Biologics Evaluation and Research (CBER), one of the most prolific FDA drug approval years. Aside from this high number of approvals in 2023, the innovation in drug development was notable, marked by the approval of the first CRISPR-based gene therapy and the approval of the first beta amyloid antibody therapy for Alzheimer’s disease (see our note on 2023 drug approvals here).

Our evaluation of drug candidates lined up for potential FDA approvals in 2024 looks promising on both the innovation and market potential fronts. Here, we highlight select drug candidates that are expected to be approved in 2024 and that have significant innovation impact and revenue potential.

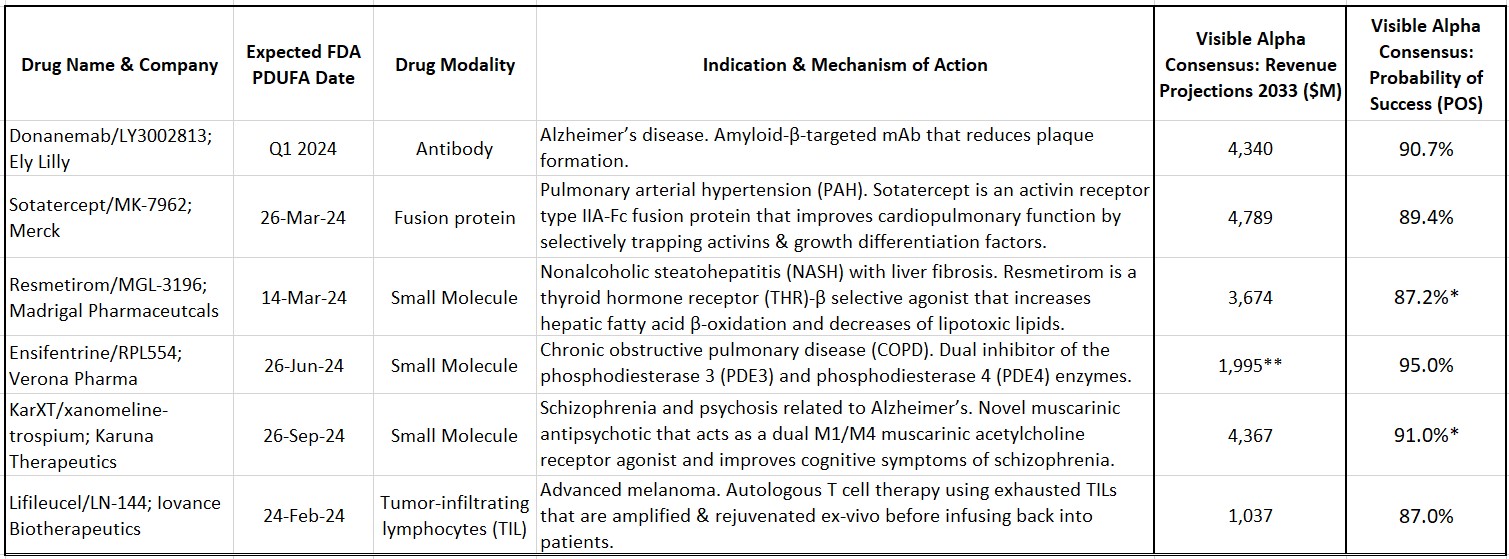

Key drug candidates slated for FDA review in 2024

Sotatercept (MK-7962) is being developed by Merck (NYSE: MRK) for pulmonary arterial hypertension (PAH). PAH is a rare and progressive blood vessel disease accompanied by increased arterial blood pressure and narrowing of the arteries in the lungs. Sotatercept is a first-in-class activin-signaling inhibitor with a novel mechanism of action that will add to the current treatment options for PAH. Based on approval in 2024, Visible Alpha consensus estimates project 2033 risk-adjusted revenues of $4.8 billion (consensus probability of success is at 89.4%).

Resmetirom (MGL-3196) is developed by Madrigal Pharmaceuticals (NASDAQ: MDGL) for nonalcoholic steatohepatitis (NASH) with liver fibrosis. NASH is an advanced form of nonalcoholic fatty liver disease (NAFLD). NAFLD is estimated to afflict more than 20% of adults globally, about 30% in the U.S. Of that NAFLD population, 20% may have NASH. The prevalence of NAFLD/NASH, along with type 2 diabetes and obesity, is rising worldwide. Resmetirom is a thyroid hormone receptor (THR)-β selective agonist that increases hepatic fatty acid β-oxidation and decreases the burden of lipotoxic lipids. Based on approval in 2024, Visible Alpha consensus estimates project 2033 risk-adjusted revenues of $3.6 billion (consensus probability of success is at 87.2% for the U.S./FDA).

Ensifentrine (RPL-554) is being developed by Verona Pharma (NASDAQ: VRNA) for chronic obstructive pulmonary disease (COPD). Ensifentrine is a first-in-class, inhaled, dual inhibitor of the phosphodiesterase 3 (PDE3) and phosphodiesterase 4 (PDE4) enzymes. The selective and dual inhibition combines bronchodilator and non-steroidal anti-inflammatory properties in one compound, differentiating it from other marketed COPD drugs. In addition, Ensifentrine activates the Cystic Fibrosis Transmembrane Conductance Regulator (CFTR), making it effective in reducing mucous viscosity and improving mucociliary clearance (currently in Phase 2 for cystic fibrosis). Based on approval in 2024, Visible Alpha consensus estimates project 2032 risk-adjusted revenues of $2.0 billion (consensus probability of success is at 95.0%).

Table 1: Select drug candidates with upcoming 2024 Prescription Drug User Fee Act (PDUFA) dates

Source: Visible Alpha consensus (January 30, 2024) *POS for Resmetirom and KarXT are for U.S./FDA approval **Reflects 2032 revenues for Ensifentrine

KarXT (xanomeline-trospium) is being developed by Karuna Therapeutics (NASDAQ: KRTX) for schizophrenia. KarXT is based on a novel mechanism of action in the treatment of schizophrenia. It is a muscarinic antipsychotic that acts as a dual M1/M4 muscarinic acetylcholine receptor agonist in the central nervous system and improves cognitive symptoms of schizophrenia. KarXT does not block dopamine receptors like currently approved schizophrenia therapies and presents as a new mechanism of action in the treatment of schizophrenia. It is also in development for psychosis related to Alzheimer’s disease. Based on approval in 2024, Visible Alpha consensus estimates project 2033 risk-adjusted revenues of $4.4 billion (consensus probability of success is at 88.9% for the U.S./FDA for schizophrenia).

Lifileucel (LN-144) is being developed by Iovance Biotherapeutics (NASDAQ: IOVA) for advanced melanoma. Lifileucel is the first tumor-infiltrating lymphocyte (TIL) therapy to be reviewed by the FDA. TILs are immune cells that have recognized tumor antigen but are rendered ineffective or “exhausted” by the tumor. These TILs can be harvested from the patient, expanded, and rejuvenated ex-vivo and then infused back into the patient. TIL therapy is a novel approach in immunotherapy based on the pioneering work of tumor immunologist Steve Rosenberg at NIH. Based on approval in 2024, Visible Alpha consensus estimates project 2033 risk-adjusted revenues of $1.0 billion (consensus probability of success is at 87.0%).

Donanemab (LY3002813) is being developed by Eli Lilly (NYSE: LLY) for early Alzheimer’s disease. Donanemab is a beta-amyloid targeting antibody that follows in the footsteps of Leqembi (lecanemab), approved in 2023. Both Donanemab and Leqembi reduce amyloid plaques and slow disease progression. Based on approval in 2024, Visible Alpha consensus estimates project 2033 risk-adjusted revenues of $4.3 billion (consensus probability of success is at 90.7%). Our previous evaluation of Leqembi and donanemab can be viewed here.

Drug development themes and trends continuing in 2024

The following drug development trends will continue to interest investors and corporate business development through 2024 and beyond:

- Antibody Drug Conjugates (ADC)-based drugs will continue to drive investor and corporate interest with several acquisitions already completed in recent months. Even though we don’t see any FDA approvals upcoming for novel ADC drugs in 2024 (except for supplemental applications for indication extensions for already approved ADCs), ADC drug development remains an area of significant innovation and Big Pharma acquisitions. Notable was Pfizer’s (NYSE: PFE) acquisition of Seagen in 2023 and Johnson & Johnson’s (NYSE: JNJ) acquisition of Ambrx (NASDAQ: AMAM) in January 2024.

- Investors will be anxiously watching the performance of beta-amyloid antibodies for Alzheimer’s disease — Leqembi approved in 2023 and donenamab (PDUFA date in March 2024). Unlike currently marketed drugs, Leqembi and donanemab target the underlying cause of Alzheimer’s and have the potential to modify the course of the disease. Several next generation beta-amyloid targeting inhibitors for Alzheimer’s disease are in the pipeline.

- Investors will also keep an eye on the 2020 Nobel Prize winning technology, CRISPR-based gene therapy. Following the approval of the first CRISPR gene therapy, Casgevy, for sickle cell disease (SCD) in 2023, we expect novel CRISPR-based gene therapies to progress to the market in the near future. Casgevy for beta thalassemia was recently approved by the FDA on January 16th, 2024.

- The GLP-1 pathway space will continue to be prominent beyond just the blockbuster revenues for the two leaders, Novo Nordisk (NYSE: NVO) and Eli Lilly. Several GLP-1 mid-stage and late-stage clinical trials are ongoing in cardiometabolic indications other than obesity and type 2 diabetes. The developing pipeline for the next generation GLP-1 is long and other Big Pharma companies are vying to compete with the leaders. The frequent business development activity that occurred in 2023 is bound to continue in 2024. Big Pharma companies are seeking novel early-stage private and public GLP-1 and GLP-1-related pathway assets.