Regal Entertainment Group has been recently under pressure as the movie industry has faced choppy trends. While 1Q opened strongly for the industry, numerous analysts noted that 2Q trends were below expectations. This continues a broader trend of weakness in attendance across the movie industry over the last several years. Analysts have attributed this weakness to competing forms of entertainment and a weaker slate of films. Additionally, analysts worry that a shortening release window for movies could potentially hamper growth further moving forward.

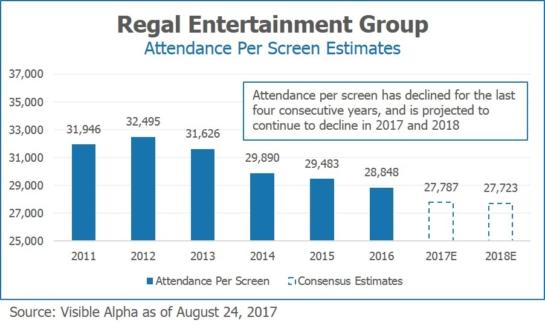

These trends have hurt Regal Entertainment Group, as attendance per screen has declined over the last four years. Visible Alpha’s consensus estimates show that analysts expect these trends to continue in 2017 and 2018.

However, Regal is not sitting idly by. Like the other theater circuits, Regal is currently in the midst of converting their seating to luxury recliners. The financial benefits from the conversion are significant, as Regal and other theater operators have noted increases in attendance per screen, average ticket price, and concession per patron for recently converted screens. Regal has converted nearly 25% of their circuit so far, and aims to have 40-45% of the circuit converted by the end of 2019.

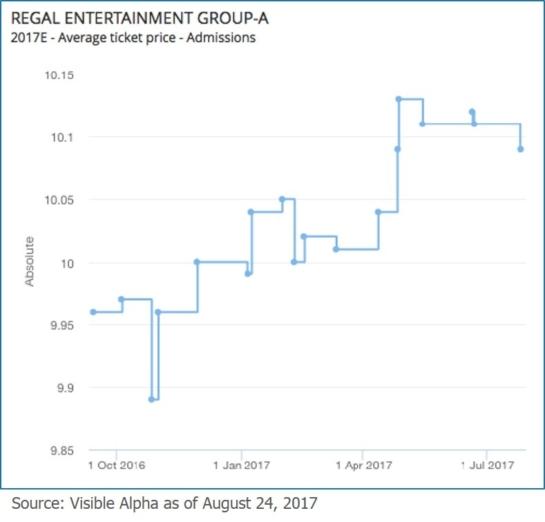

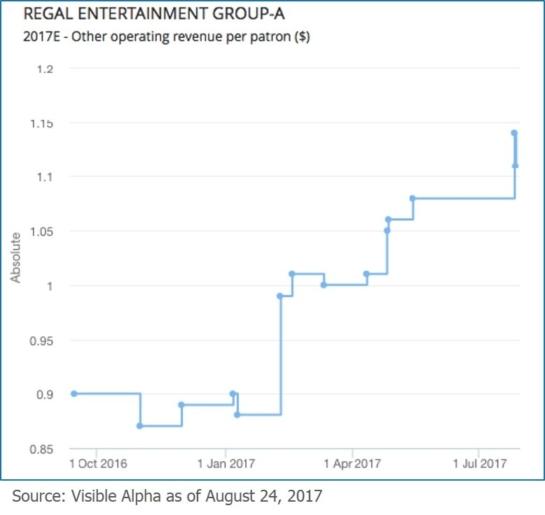

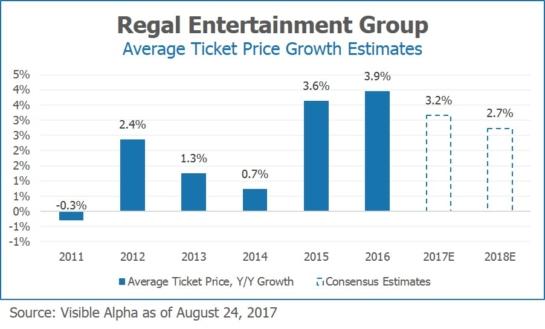

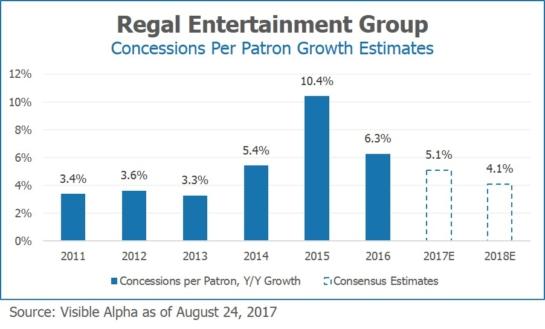

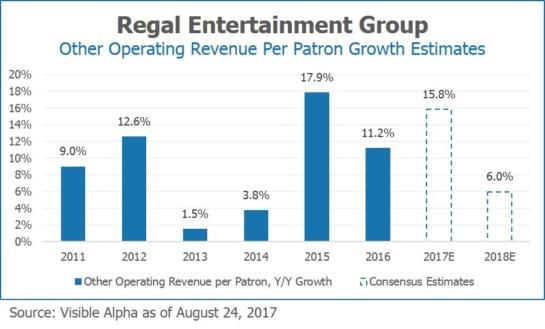

These conversions, along with other improvements that Regal is implementing (expanded concession menus, seat reservations, and other digital enhancements) have driven growth in ticket prices, concessions per patron, and other revenue per patron.

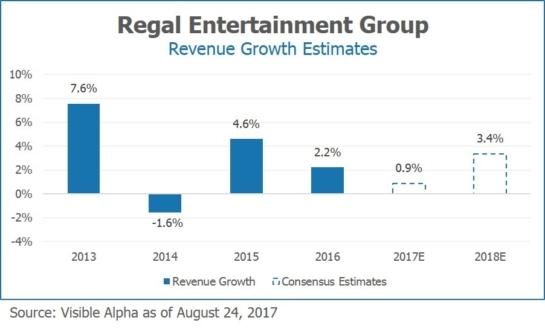

And importantly, these gains have more than offset the decline in attendance. As a result, analysts still model revenue growth in 2017 and 2018 despite the secular headwinds that the industry faces.

And of the metrics mentioned above, the two that jump out the most are ticket prices and other revenue per patron (which includes revenue from digital ticketing platforms). Revision data shows that analysts have become incrementally more bullish on these metrics over the last year.