Martin Pyykkonen, Consulting Analyst

Walt Disney Co (DIS): Post-Earnings Analysis

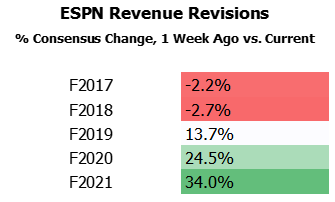

ESPN Estimates Were Revised Down, Again

Visible Alpha’s ESPN revenue consensus was reduced by 2% and 3% for F2017 and F2018, respectively, since this Tuesday’s (February 7, 2017) quarterly report. We think the reductions reflect continuing analysts’ compounded concerns in the near term:

- ESPN’s linear TV channel subscriber declines, and

- Other direct-to-consumer ESPN services, such as OTT (Over-the-Top) and Skinny Bundles are not making up for lost revenue from traditional cable ESPN subscribers.

However, Visible Alpha’s ESPN revenue consensus also shows a notable upward revision(>10%) in segment revenue for F2019 through F2021. The reasons for those upward revisions are unclear, as management did not make any comments to point analysts either way during the conference call .

One possible reason could be that the Street is placing high expectations on Disney’s digital media and distribution stake in BAMtech (currently ⅓ minority stake). Analysts may be interpreting management’s enthusiasm for the outlook at BAMtech as a sign that Disney will move to acquire a majority stake or the whole entity.

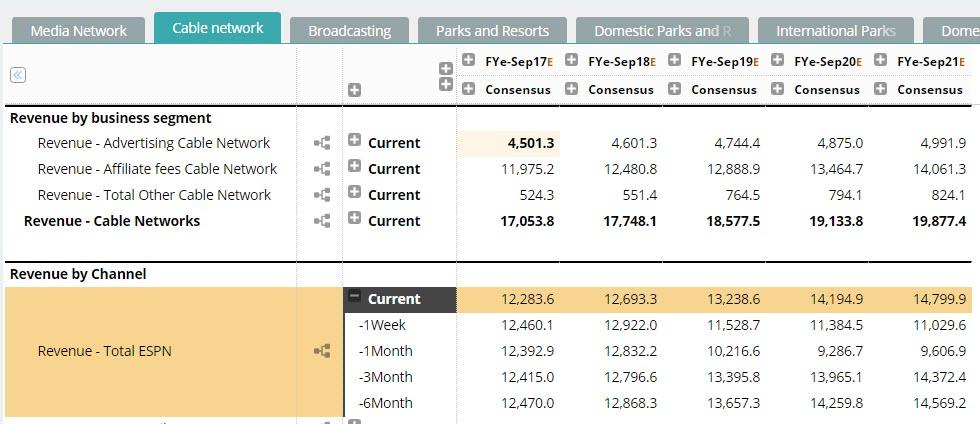

Disney Revenue by Channel Model with Revisions by Visible Alpha

For illustrative purposes only. Learn more about Visible Alpha or request a trial today.

For illustrative purposes only.

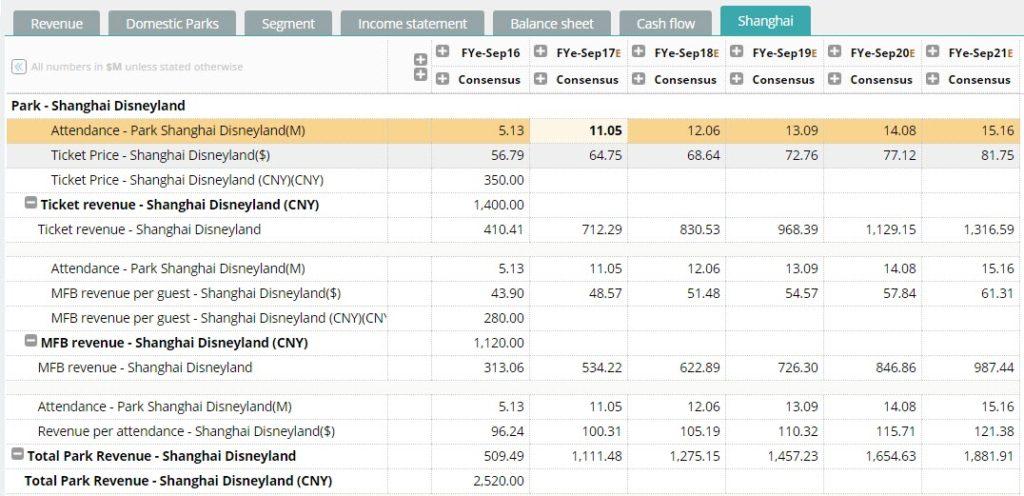

Shanghai Disneyland Could Be An Earlier Growth Driver Than Consensus Expectations Show

The revenue growth experienced from Shanghai Disneyland venture with the Chinese government seems to be ahead of the company’s expectations compared to initial projections two years ago.

With 7 million visitors since its opening in June 2016, the park appears to be operating at maximum capacity and the company expects to reach 10 million visitors by its first anniversary and breakeven operationally.

Disney Shanghai Consensus Model by Visible Alpha

For illustrative purposes only.

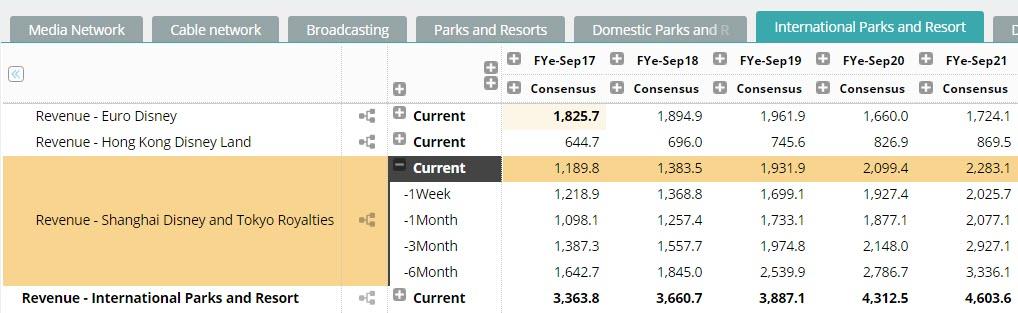

Compared to consensus from six months ago, the revised Visible Alpha consensus for Shanghai Disneyland revenue shows a downward revision of 20% to 30% for full years F2017 through F2021.

Is the current consensus too pessimistic for Shanghai Disneyland? Is there upside from current revenue consensus?

Disney Consensus Model for International Parks and Resorts by Visible Alpha

For illustrative purposes only.