The office supply industry has struggled for some time as digitization has hurt office supply consumption. As the leading specialty retailer, Staples has attempted to manage the headwinds through a number of different actions. Last year, the company attempted to drive continued consolidation in the industry by merging with rival Office Depot. However, a federal judge ruled in favor of the FTC and blocked the merger. Now, the company is focused on improving its North American Delivery segment and rationalizing its North American Retail footprint.

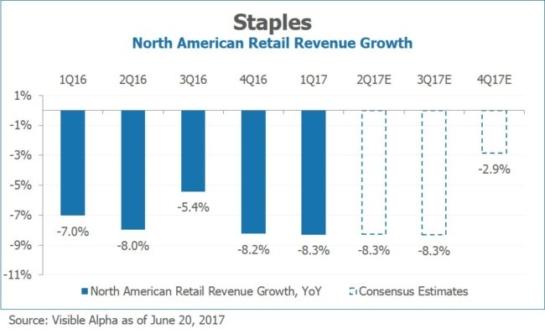

Analysts expect sales to remain challenged in both segments. Within North American Retail, analysts expect continued high-single digit declines until 4Q. However, note that 4Q growth rates are helped by a 53rd week in 2017.

Get access to the deepest analytics on the companies important to you.

Try Visible Alpha today!

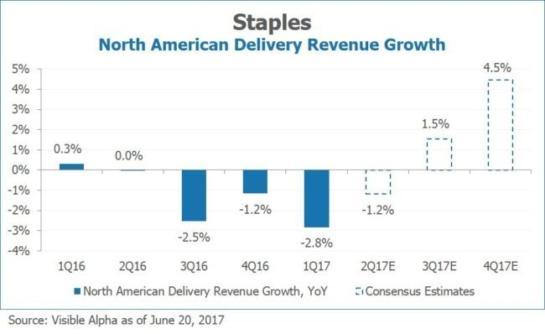

Within North American Delivery, analysts are expecting a slightly more positive picture with modest growth in 3Q and stronger growth in 4Q. However, again, 4Q growth is elevated due to the 53rd week.

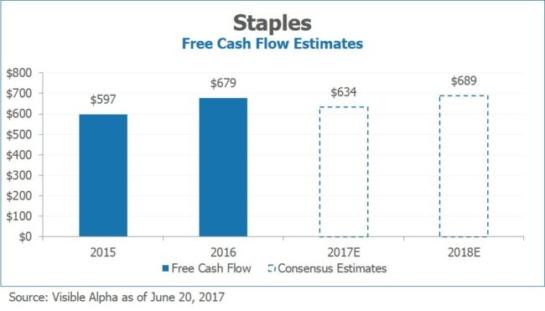

An often-cited offset to the struggling top line is Staple’s significant free cash flow generation.

The company has guided to at least $500 million in free cash flow for 2017, and the company has already generated $221 million of that in 1Q. Analysts currently expect $634 million in total free cash flow for the year and $689 million for next year.