Netflix Inc. (NASDAQ: NFLX) reported Q2 2023 results on Wednesday, July 19, 2023. What happened in Q2, what is the outlook for Q3, and what are the new questions to focus on?

Overall, Q2 came in light and Q3 guidance came in below consensus, similar to what happened in Q1. According to Visible Alpha consensus, total revenues expected for Q3 have come down by $250 million, from $8.78 billion to $8.53 billion.

The stock has traded down more than -11% since last week’s release. Last quarter, the stock traded down -10% after hours, but then came back on optimism around revenue and subscriber growth. However, this quarter we have not yet seen any significant rebound. The stock has remained lower around $430 from a high of $483 on Wednesday ahead of the release.

The discussion and debate from the earnings interview are around the paid-sharing program and the potential for advertising to drive revenues while maintaining margin and cash levels. In addition, the company noted that the recent strike is not an outcome they wanted.

1. Generative AI images and video are at the heart of the SAG-AFTRA strike. What are the industry dynamics at work?

According to management, a conclusion is needed for the strike, but the issues are still getting worked through. It is worth highlighting the role of AI in the strike. Actors are concerned about where and how their images are shown, especially AI-generated images in advertising and endorsing products and services.

Multimodal AI and text-to-image generative AI are quickly becoming better, making it easier for companies to train models and generate images/videos from text descriptions. The improvement of text-to-image generated AI is potentially threatening the value that a celebrity brings to an endorsement. If potential advertisers leverage the new generative AI image generators, instead of images and videos directly from a celebrity, then there are big questions about how this will impact the cost to the advertisers and the potential income to the entertainers.

In tandem with this capability to generate images/video, celebrities are also concerned about their personal brands and the potential risks of having their images appear in places they do not want them. As it relates to Netflix, it could have an impact on a show’s image and the perception of the content if actors show up in ad campaigns via generative AI that the actor and/or Netflix do not approve of.

New question: When and how will the strike conclude, and what concessions may Netflix make?

2. What happened in Q2 and how has the outlook changed?

Revenue: Q2 year-over-year revenue growth of 3% was in line with guidance, but a bit below consensus estimates. There were no upside revenue surprises in Q2 around the new paid-sharing program, as some analysts were suggesting into the quarter. While monetization for this program is happening, it is at a slower pace than some of the more optimistic analysts expected. In addition, Netflix Q2 revenue guidance of $8.2B came in a bit below consensus of $8.5B. Consensus expectations for Q4 are increasing, as analysts see the revenue impact of the paid-sharing program move further out.

Total revenue expectations of $34.3 billion for FY2023 have come down $600 million to $33.7 billion since July 18, 2023 (before the release), with several of the most bullish analysts revising down their revenue expectations. FY2024 expectations have increased $100 million to $42.7 billion from $42.6 billion, indicating analysts remain upbeat on the 2024 outlook for Netflix.

Operating profit: Coming into Q2, consensus was expecting a 20% operating profit margin, ahead of the 19% guidance. NFLX’s operating profit margin came in better at 22%. The company guided Q3 to a 22% operating profit margin, which was a bit better than the 21.5% consensus estimate. The FY2023 operating profit margin outlook of 18-20% remains in line with guidance, but analyst estimates have moved upward from 19.2% after the Q1 release to 19.7% after the Q2 release.

New question: How will the strike and the focus on growing advertising revenues impact margins going forward?

3. Did the new paid-sharing program updates in the Q2 release reveal anything new?

NFLX pushed out the broader rollout of the paid-sharing program in Q1 to Q2, which will push revenue and membership growth to the second half. In the Q1 earnings interview, NFLX highlighted that they are significantly optimistic about advertising and that margins for this business look promising.

In the Q2 shareholder letter, management highlighted that they are confident in the outlook and expect monetization to increase from the paid-sharing launch and for this acceleration to be weighted to Q4. In the Q2 interview, management explained that when Netflix drops the basic tier, consumers tend to either take the ads plan or move into the standard plan.

Netflix is seeing good demand off a small base for ads, but the company has a lot of work to do on advertising business features both to scale and to build out the technical capabilities. It will be worth watching both operating expenses and capex related to the expansion of the ad business going forward.

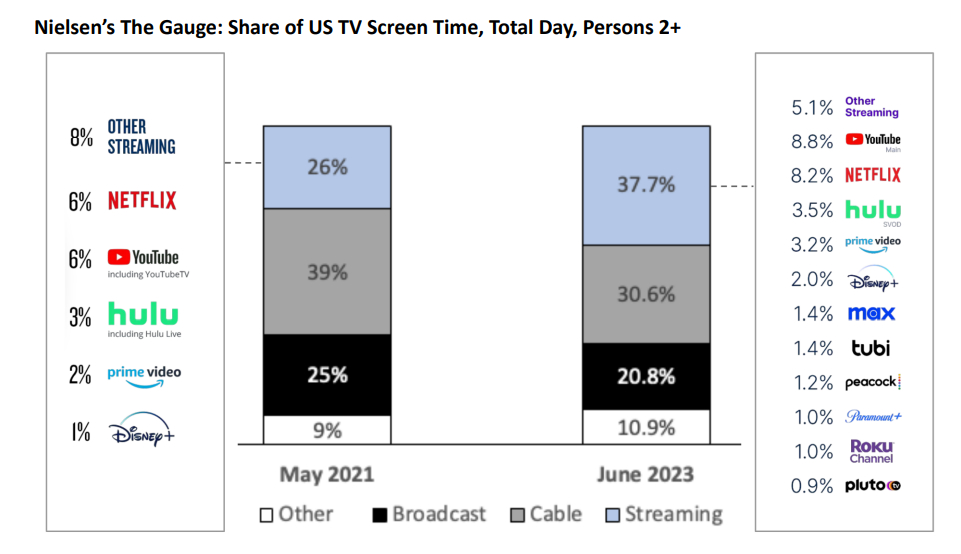

Netflix highlighted the competitive environment and presented a market share chart (Figure 1 below), which shows how both Netflix and YouTube have remained at the top and taken share from competitors. However, YouTube has pulled ahead with a share that’s 60 basis points higher than Netflix. In this new era of AI, will YouTube have an advantage over Netflix and others, given Google’s substantial AI investments? Will Netflix look at making an acquisition to remain competitive?

Figure 1: Share of U.S. TV Screen Time

Source: Netflix Shareholder Letter (July 19, 2023)

New question: How will analysts model this new business and what will be the range of estimates over the next few quarters?

References: https://ir.netflix.net/financials/quarterly-earnings/default.aspx