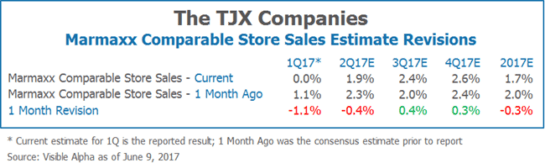

A month ago, the TJX Companies (TJX) reported 1Q17 earnings that slightly missed expectations and sent the stock downward. The company’s Marmaxx segment, which consists primarily of T.J. Maxx and Marshalls stores, reported flat comparable store sales growth and missed consensus expectations of 1.1%. The company also gave 2Q Marmaxx comparable store sales guidance of 1-2%, falling below below consensus expectations of 2.3%.

Why the Stock Under-Performed

Management cited a number of temporary factors behind the under-performance of Marmaxx, including unseasonably cold and wet weather, and delayed tax refunds. Subsequently, they have maintained guidance for the full year as they believe results will return to a more normalized rate once those temporary headwinds disappear. In support of the guidance, management noted that comparable store sales growth accelerated in April and May once the weather normalized.

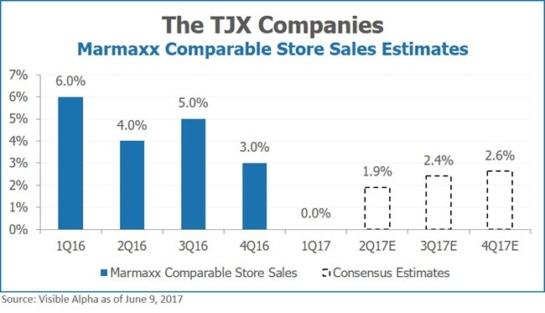

Analysts Still Optimistic on Comparable Store Sales

Analysts appear to agree with management’s assessment. Looking at consensus estimates for the segment, analysts currently expect comparable store sales growth to accelerate sequentially for the remainder of the year.

Additionally, revision data from Visible Alpha shows why the stock has only declined 7% over the last month. While analysts brought down 2Q estimates in light of softer guidance, they also revised their 3Q and 4Q comparable store sales estimates upwards. As a result, despite missing the consensus estimate for 1Q and guiding below consensus for 2Q, the full-year comparable store sales growth estimate was only revised down by 30 basis points.