In our weekly round-up of the top charts and market-moving analyst insights: CRISPR’s (CRSP) new gene-editing therapy is expected to be evaluated by the FDA; franchise sales are expected to drive growth for Xponential Fitness (XPOF); Alibaba (BABA) announces a new organizational structure; Winnebago (WGO) is poised to sell fewer units but at higher prices this year; and analysts continue to cut forecasts for deposits at Schwab (SCHW) Bank.

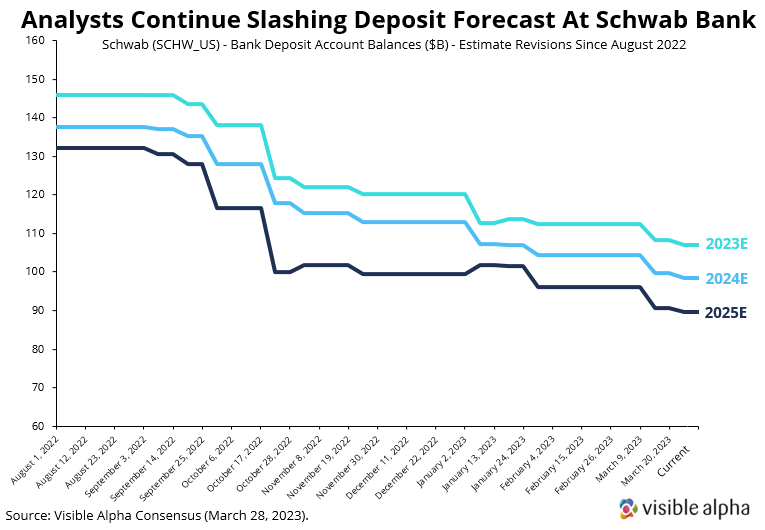

CRISPR Therapeutics Revenue Share of Gene Editing Therapy to Peak at ~$2B/yr by 2030

The first-ever CRISPR gene editing therapy is expected to be evaluated by the FDA and EU regulators, a potentially historic milestone. With a ~40/60% revenue split between CRISPR Therapeutics (CRSP) and Vertex (VRTX), CRISPR’s share of revenue is expected to peak at ~$2B/yr risk-adjusted with a probability of approval at ~79%, according to Visible Alpha consensus.

<h2″>

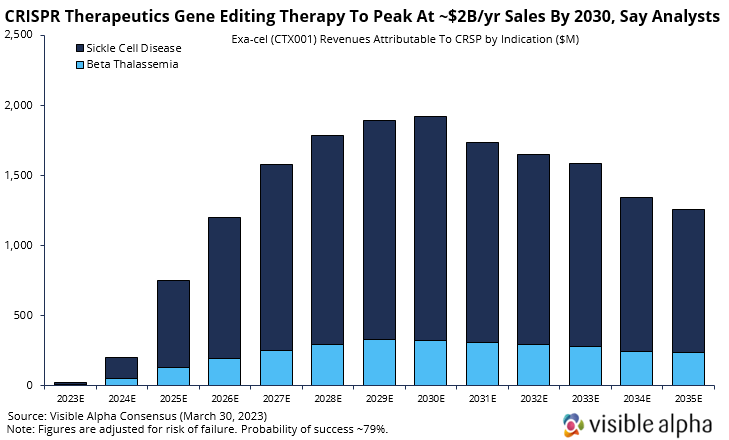

Xponential Fitness Franchise Sales to Drive Growth, According to Analysts

Analysts believe franchise fees will drive sales growth at Xponential Fitness (XPOF) going forward on increasing demand for their boutique fitness studio brands such as Club Pilates, Pure Barre, YogaSix, and Rumble. Franchise revenues are expected to grow nearly 75% by the end of 2025, according to Visible Alpha consensus.

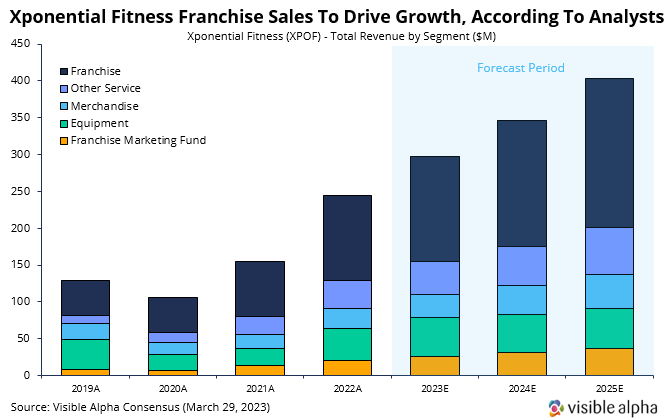

Alibaba’s New Organizational Structure Reshuffles Revenue Segments

Alibaba (BABA) announced a new organizational structure to lead six new business groups that would each have the flexibility to raise outside capital and potentially seek their own IPO, with the exception of Taobao/Tmall, according to company filings.

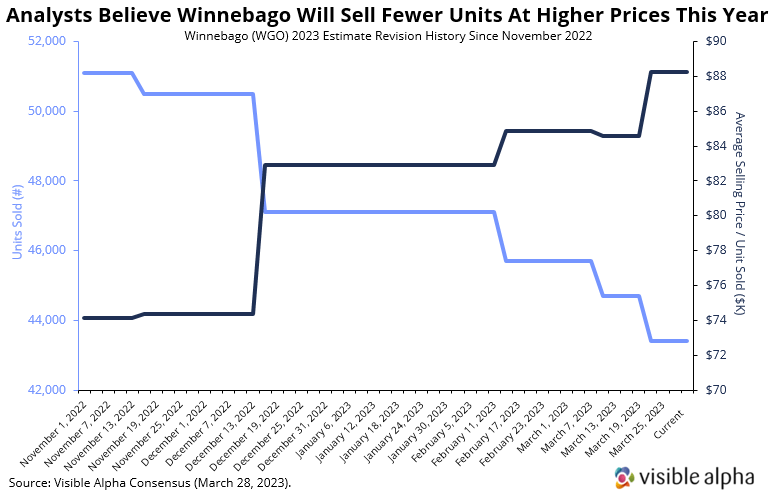

Analysts Believe Winnebago Will Sell Fewer Units at Higher Prices This Year

Analysts have been lowering 2023 estimates for units sold by Winnebago (WGO) while at the same time raising their forecast for prices paid by customers for Recreational Vehicles (RVs) and Towables. Demand for Winnebago’s products has softened post-pandemic, which has resulted in higher-than-normal dealer inventory, but analysts believe price increases will help offset the impact on revenue.

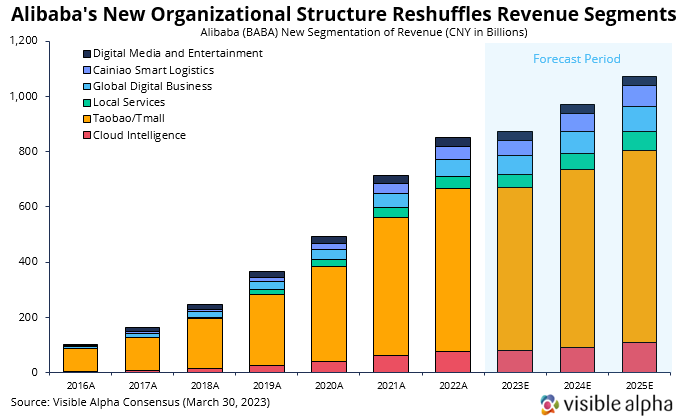

Analysts Continue Slashing Deposit Forecasts at Schwab Bank

Analysts are continuing to cut their forecasts for deposits at Schwab (SCHW) Bank, according to Visible Alpha consensus. Since August of last year, future estimates for bank deposit account balances fell by more than 26% as customers fled to higher-yielding competitors.