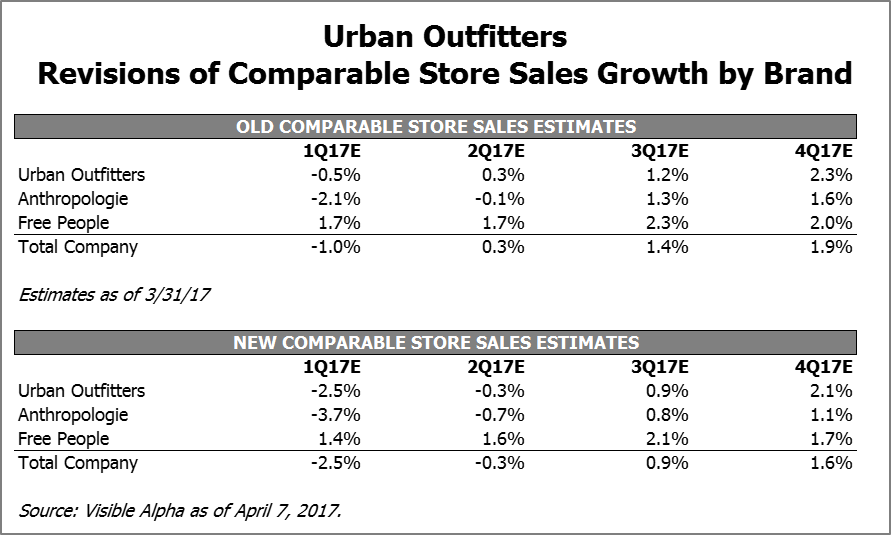

One week ago, Urban Outfitters (URBN) released its 10K which disclosed that 1Q (ending April) quarter-to-date trends were down mid-single digits. This compared to consensus estimates at the time of -1.0% for the quarter. While March was likely negatively impacted by the Easter shift (which was in March last year but is in April this year), analysts reacted negatively to the data and have now shifted comparable stores sales estimates downward for the quarter from -1.0% to -2.5%.

Analyst Expectations Vary by Brand

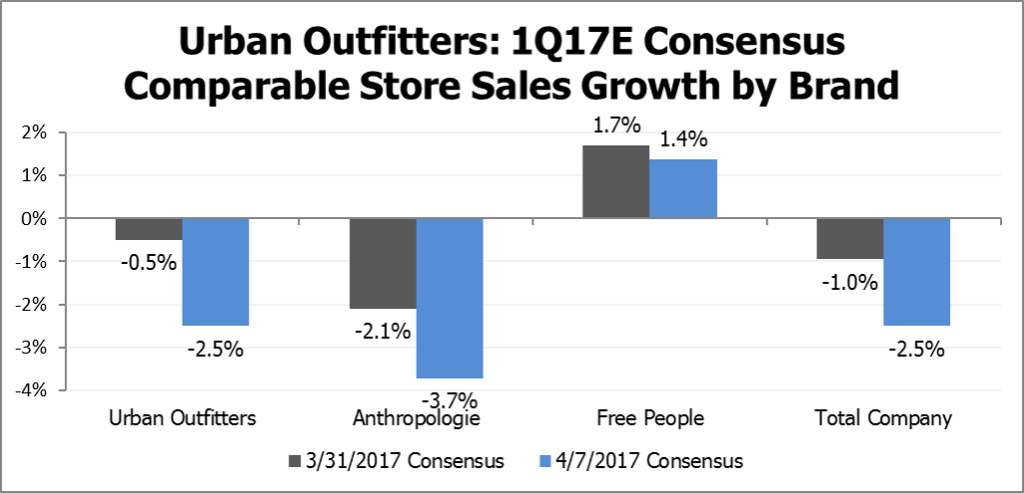

While the comments were for the company as a whole, analyst expectations vary by concept. Urban Outfitters and Anthropologie were expected to slow the most, as consensus 1Q17 estimates for both concepts declined by 2.0% and 1.6%, respectively. Meanwhile, consensus estimates suggest that Free People will be more resilient, as consensus comparable stores sales for the concept declined by just 0.3%. Recall that online makes up a more significant portion of Free People’s sales.

Source: Visible Alpha. For illustrative purposes only.

Improvement in Comparable Store Sales is Expected Throughout 2017

Similar downward revisions occurred for 2Q, 3Q, and 4Q 2017 estimates as well, with the more significant revisions occurring at Urban Outfitters and Anthropologie. However, analysts continue to expect comparable store sales to improve sequentially throughout the year.