Whole Foods reports fiscal 2Q results on Wednesday, with the results being scrutinized more closely than usual. The reason: activist investor Jana Partners disclosed a 9% ownership stake on April 10th. Jana is pushing for a close review of the business and a potential merger or sale, while management is in the midst of attempting a turnaround. The pressure is on to show results.

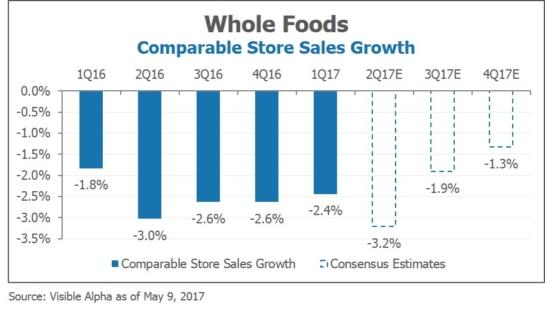

In terms of financials, comparable store growth (comps) will be closely watched, as they will need to reverse for the turnaround to succeed.

With weak consumer spending in February and March, ongoing food deflation (a headwind that Costco also faces), an Easter shift that will hurt the current quarter and help the next quarter (similar to Urban Outfitters), and a reported -3.2% comp in the first three weeks of the quarter, analysts expect comps to remain pressured in 2Q, with a -3.2% consensus estimate for the full quarter. Importantly however, analysts do believe that comps will become less negative through the remainder of the year as management initiatives begin to play out.

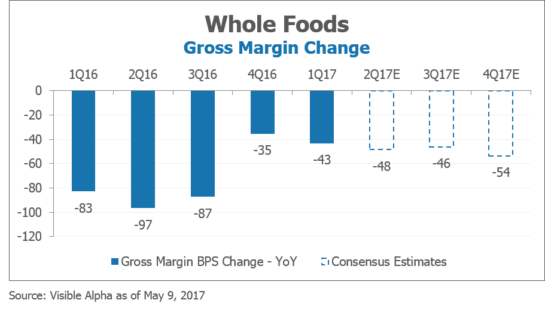

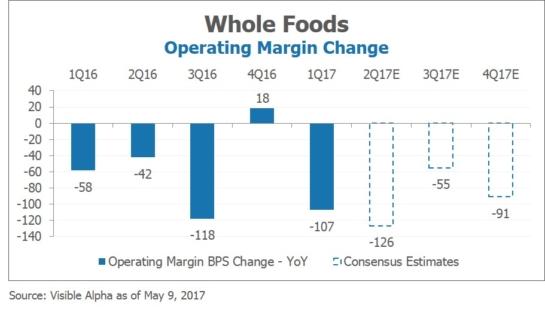

Investors will also be closely following margins.

Gross margin in particular will be scrutinized as the company is making price investments to attract consumers. Visible Alpha’s consensus estimates have gross margin declining at roughly the same rate throughout the year. Operating margin is also expected to be pressured by lower sales, higher marketing spend, investments in technology, and the gross margin declines highlighted above. Analysts expect significant declines to continue, with a smaller decline in 3Q from easier comparisons.

Overall, analysts expect $0.37 in non-GAAP EPS. The company will report results after the close on Wednesday.