Martin Pyykkonen, Consulting Analyst

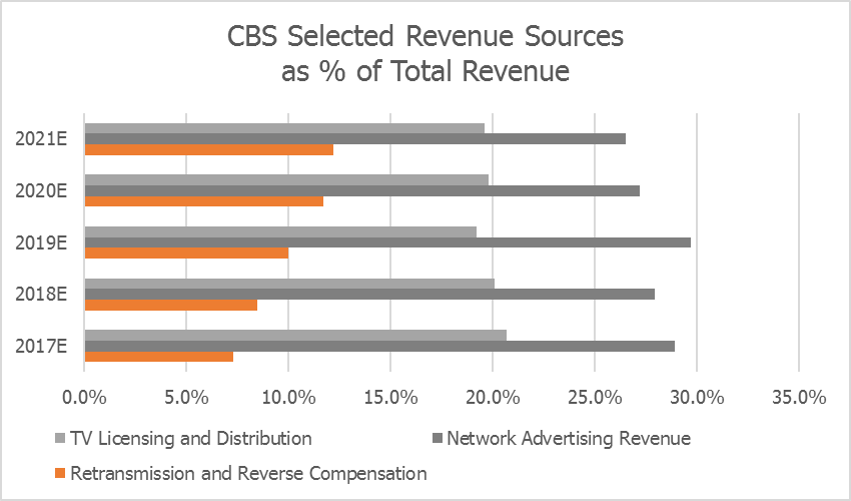

After the 2008/2009 recession, CBS’ stock was hit particularly hard for having the highest revenue dependency relative to its large M&E peers. Since this time, the company has aggressively pursued increasing non-advertising revenue as a percentage of total revenue. This non-advertising revenue is expected to be generated from the company’s retransmission (cable/satellite distributors) and reverse compensation (local TV stations) businesses.

Using Visible Alpha, we were able to uncover a couple of trends in CBS’ non-advertising revenue sources before the company reports today.

Retransmission Revenue To Double Within 5 Years

Based on Visible Alpha consensus, CBS’ Retransmission and Reverse Compensation is expected to more than double to an annual run rate of $2B within five years (2021).

Source: Visible Alpha. For illustrative purposes only. Learn more about Visible Alpha.

Analysts have become increasingly positive on the segment, as well. Consensus revenue for retransmission and reverse compensation has been revised upward by 6.5% over the past six months to the current level of $1.04B consensus revenue for 2017.

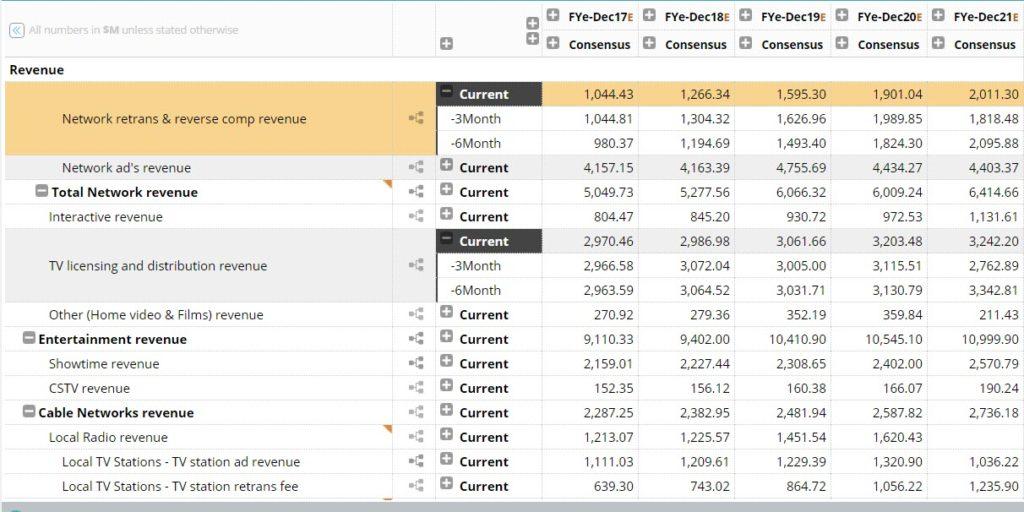

CBS Segment Consensus Model by Visible Alpha

For illustrative purposes only.

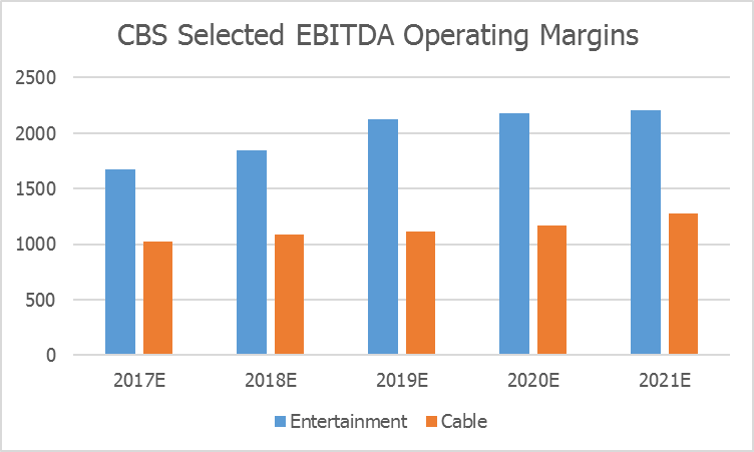

TV Content Licensing and Distribution Is Another Non-Advertising Growth Driver

In recent quarters, CBS has driven a higher mix of TV content licensing and distribution revenue, especially in foreign markets. Visible Alpha’s current consensus shows Entertainment segment EBITDA margin increasing by 200bp from this year to 2019 when it is estimated to reach 20.4%, and then still remain above 20% through 2021. TV content licensing/distribution and retransmission/reverse competition are likely key drivers in upward trends for CBS’ Entertainment segment EBITDA margin.

Source: Visible Alpha. For illustrative purposes only.