Current Asset Management KPI Forecasts

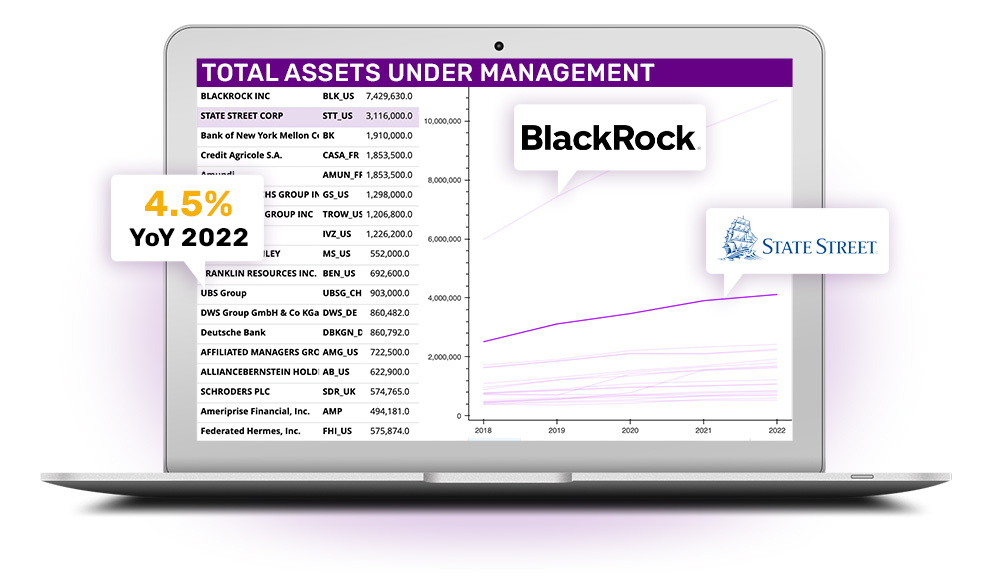

Visible Alpha offers detailed consensus estimates for key performance indicators for asset management, sourced from the world’s leading equity analysts. Uncover current market expectations through our consensus estimates data on capacity metrics, utilization metrics and more to identify asset management trends and future performance of asset management companies.

Asset Management Business Model

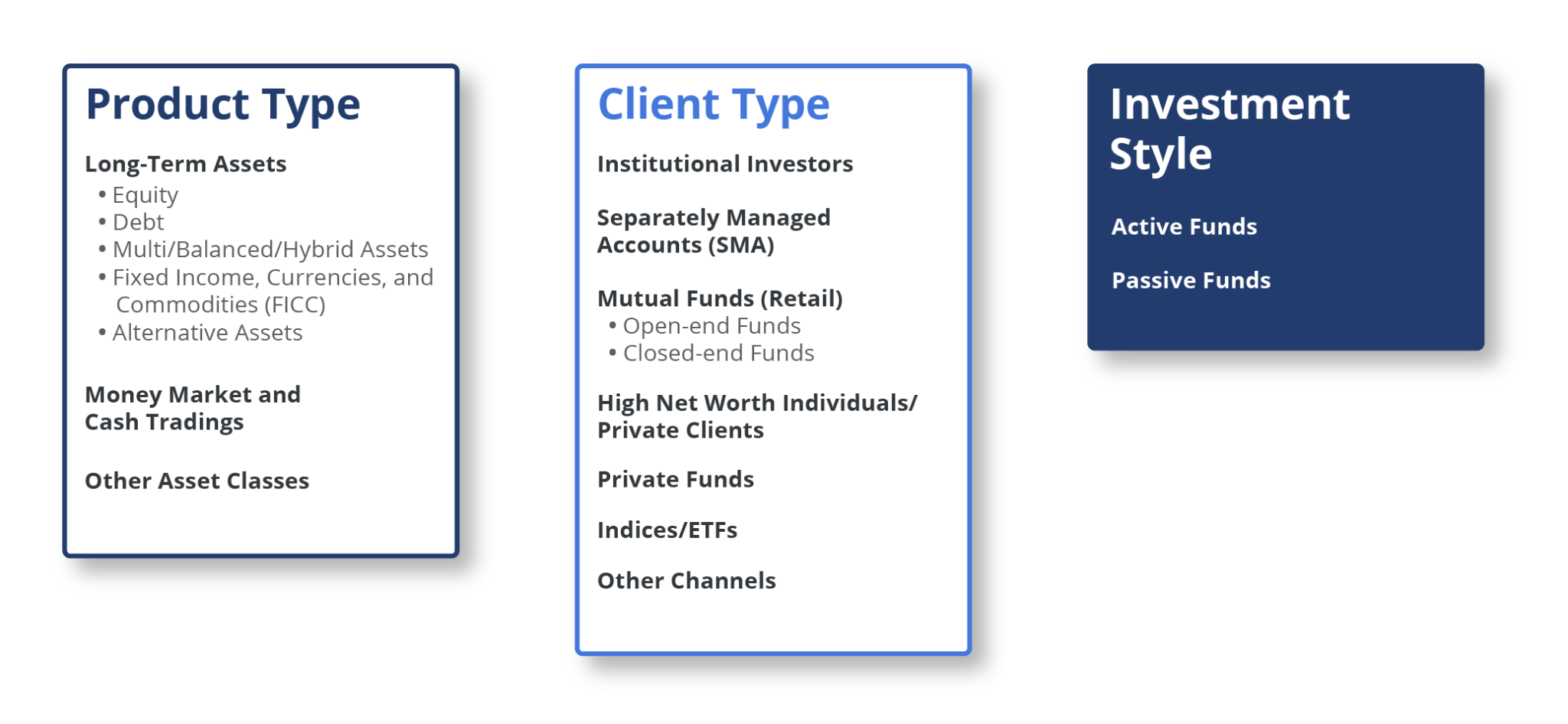

Gain a better understanding of the key metrics that impact the asset management industry’s performance under three sub industries, Traditional Asset Management Companies, Alternative Asset Management Companies, and Investment Holding or Business Development Companies.

Click Image to Expand

A Guide to Asset Management KPIs

This guide highlights the key performance indicators for the asset management industry and where investors should look to find an investment edge, including:

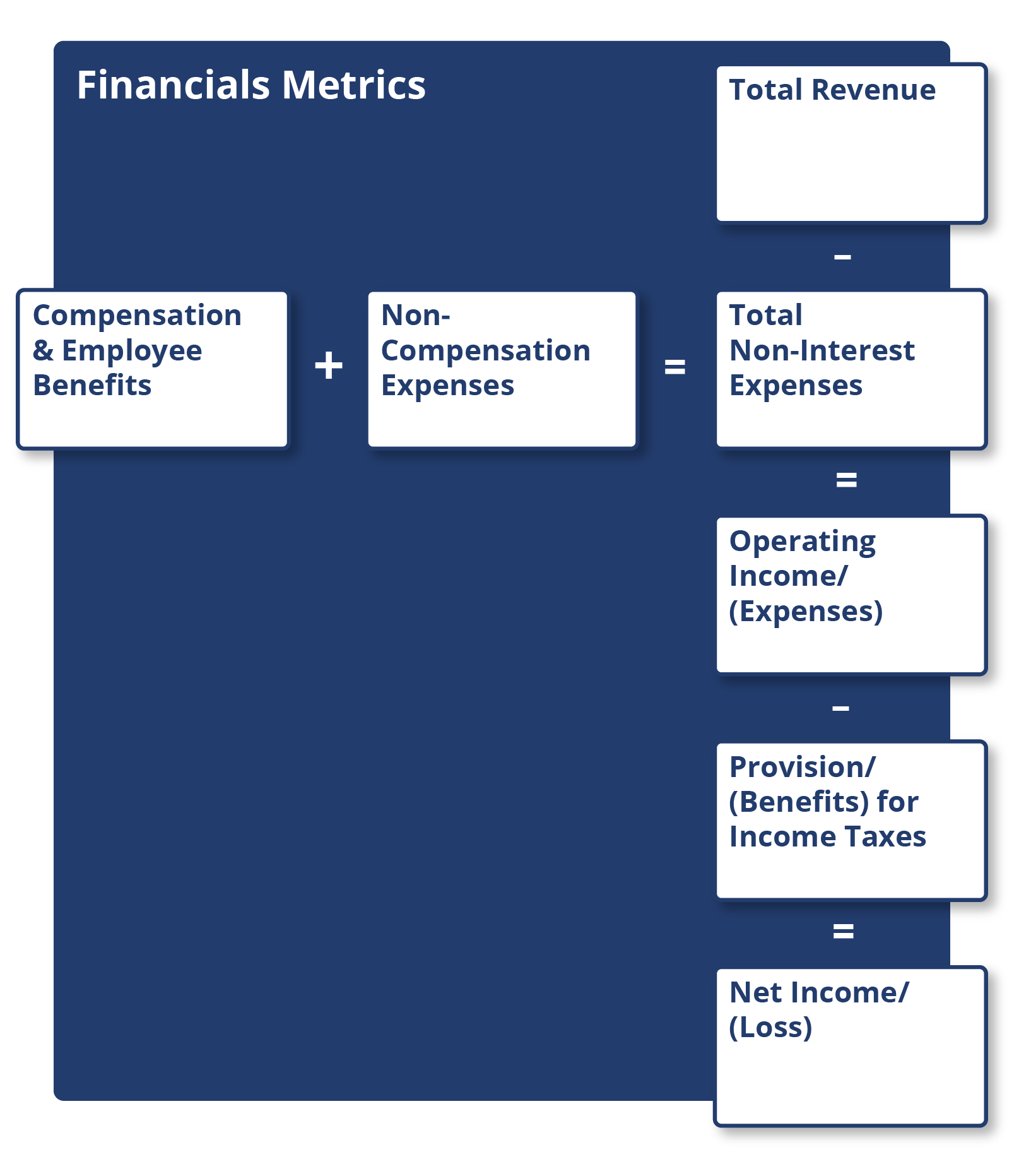

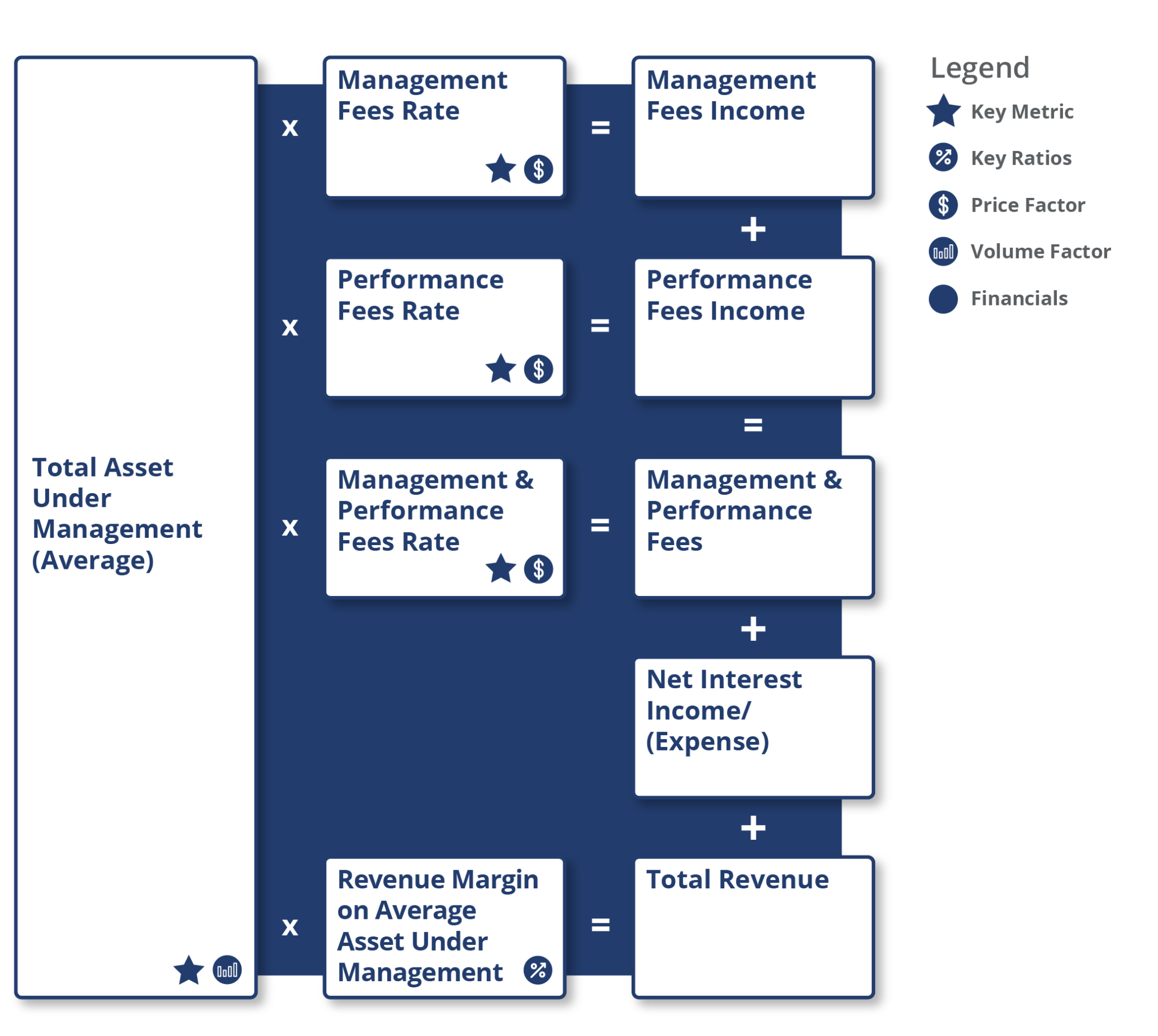

- Asset Management Industry Business Model & Diagram

- Key Asset Management Metrics PLUS Visible Alpha’s Standardized Industry Metrics

- Available Comp Tables

- Industry KPI Terms & Definitions

Request a Demo

Let our expert team show you how our deep consensus data provides a quick understanding of the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.