Happy New Year! I hope you had a wonderful holiday season and are ready for the new year and new decade (well, really the last year of the old decade, as I am on Team “1” in the decade wars, but exciting nonetheless!). As we reflect on the past year, I’d like to share some of our highlights from 2019, as well as what you can expect from Visible Alpha in 2020.

The Year in Review

Major News and Events

Executive Team Growth

This year, we appointed two new members to the executive team: Samantha Miller, Chief Product Officer, and Kirsten Behncke Colyer, Chief Human Resources Officer.

Samantha oversees the strategy and management of Visible Alpha’s entire product portfolio. She has deep knowledge in software-as-a-service, data and analytics, APIs and mobile technologies and received a certification in artificial intelligence from MIT Sloan School of Management. Be sure to check out Authority Magazine’s interview with Samantha for their series on strong female leaders.

Kirsten oversees all culture and human resource operations at Visible Alpha across the globe, bringing over 20 years of experience in establishing, reshaping and leading human resource teams at businesses in all stages of development. Kirsten is focused on aligning business practices with company goals, strategies and values to ensure Visible Alpha continues to be a great place to work.

I am thrilled at the progress both Samantha and Kirsten have already made within our company. It was yet another year of incredible growth and progress across the organization, but we are constantly looking for ways to improve efficiency and incorporate better processes to further scale the business and service our clients. Samantha and Kirsten have proven track records at delivering results in high-growth, global ventures, and we look forward to the continued impact of their experience and expertise at Visible Alpha.

Recognition Across the Globe

This year, Visible Alpha and our team were honored with the following awards:

- “Best HR Strategy from Overseas,” HR Magazine’s “HR Excellence Awards 2019”

- “Entrepreneur of the Year,” Information Age’s “Women in IT Awards,” awarded to Emma Margetts, Visible Alpha’s Director of Sell-Side Services

- “Efficiency Booster Award,” Battle of the Quants “Big Data 2019”

We would also like to extend a congratulations to our clients and contributors for their accolades throughout the last year as well.

New India Office

In December, we expanded our Mumbai office into an amazing new space to accommodate our growing team and provide our employees with a best-in-class facility.

Regulatory-Driven Changes

While MiFID II regulations have led to dramatic changes in the broker research landscape in Europe, the impact in the U.S. has been more muted. While continuing to welcome comments from the FCA and other industry players on the issue, in 2019 the SEC again delayed any substantive reaction to the European regulations by extending their stop-gap “no action letter” from 2017 until mid-2023. This allows the SEC to continue watching the impact and unintended consequences of the regulations in the EU research ecosystem before reaching a conclusion on research unbundling. It still remains unclear how research in the U.S. will be funded over the long term, and the process of ‘price discovery’ in what has traditionally been a very opaque market continues.

Two years after the roll out of MiFID II, the biggest positive impact has been increased transparency for both the buy side and sell side. Nevertheless, many investment managers remain unclear on the best practices to valuing research, relying more on quantity than quality – though a general shift toward an increased focus on quality seems to have begun. Meanwhile, despite high profile examples to the contrary, we have seen coordination of investors meetings with corporate management teams still largely driven by the brokers. To keep things that way, smart sell-side corporate access teams are working hard to create additional value.

Company Milestones

Company coverage on Visible Alpha Insights grew to over 10,600 companies, with consensus data on over 4,700 companies, thanks to our more than 700 sell-side contributors and our amazing team. We now have over 13 million total analyst line items and 700,000+ consensus line items. In 2019 alone, we processed over 250,000 model revisions. To learn more about the importance of real-time model revisions, take a look at our study.

A few other interesting data points as we increased company coverage:

- 3,200+ companies in Asia and over 2,600 companies in Europe

- 1,000+ companies with consensus forecasts in the Financials sector, with approximately 34% growth across all sectors

This coverage growth was paired with immense sales growth and an increase in general awareness in the market. Our consensus forecast data was cited by numerous industry publications, including The Wall Street Journal, Barron’s and Bloomberg News. We’ve also been sharing interesting and timely stories on popular companies, such as Uber, Roku and ASML.

New Product Features and Enhancements

While we regularly release enhancements to our products, we launched a few key features on a few of our platforms.

- Resource Tracking: We finished rolling out a new version of our Resourcing Tracking platform to increase stability, enhance performance and increase transparency. A few features include:

- Simplified tabs to streamline the review process

- Introduced a powerful new audit tool for interactions in the data grid

- Integrated the back-end of Resource Tracking with our Provider Evaluation product to ensure stable data connectivity across both platforms

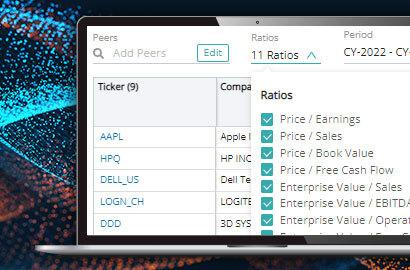

- Insights: The Insights platform has new functionality to allow users to:

- Set up Earnings Preview Alerts two days or two weeks before a company reports

- View research and model data side-by-side in one environment

- Use time-based and data-based consensus filters

- Export revision and surprise analysis tables as a chart or image

- Upgraded Excel Add-in: The Excel add-in went through a major redesign and a substantial increase in functionality this year. The latest version lets users:

- Use dynamic Earnings Preview and Revisions Analysis templates

- View comparison tables

- Export revision and surprise analysis tables into Excel

- Time-based and custom data-based consensus filters to plug into templates

The Year Ahead

I am extremely proud of what we have accomplished over the past year and since our commercial launch just under three years ago. Both our platform and our company are in a great place as we enter a new decade (OK, I’ll be on Team Zero for this one), and I’m excited for some incredible developments in the pipeline for 2020 and beyond.

Our plans for growing the Insights platform include:

- Industry KPIs dataset: While we already offer some standardized data, this year we will take our consensus data to the next level by offering dramatically expanded industry-level datasets and new pages on the platform for easy comparison and quick industry analysis.

- Feed/APIs: We are constantly working on improving our API and feed products to further integrate into client workflows, but the new standardized data sets will fundamentally improve the ability for clients to algorithmically manipulate model data.

- Global Coverage Growth: We will continue expanding our global company coverage, with a particular focus on APAC.

With these great product developments comes rapid company growth, and we are looking for great individuals who want to join our team. View our open career opportunities here.

If you’d like to stay in-the-loop with Visible Alpha, subscribe to our newsletter and get industry insights, company updates and more.