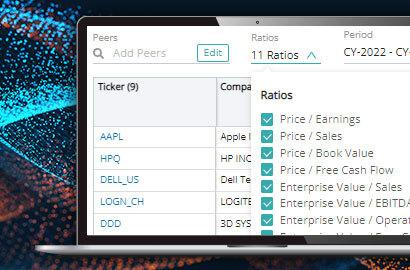

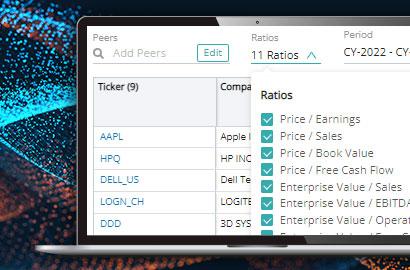

Visible Alpha, a financial technology company that enhances the investment research process by extracting value from sell-side analyst models, research reports and corporate access events, announced today the deployment of valuation metrics and enhanced calendarization methodologies within the Visible Alpha Insights platform. The company’s unique approach leverages Visible Alpha’s best-in-class detailed historical and forecast data to enable users to understand the market view on valuation with information they trust.

The traditional approach to valuation metrics does not provide institutional investors with clarity on whether GAAP or non-GAAP parameters have been blended to create valuation metrics. Visible Alpha has created a robust methodology to determine when valuation metrics should be composed of GAAP metrics, operating metrics or a blend of the two and provides the best, most trustworthy and transparent data for investors to leverage.

In addition, Visible Alpha is pleased to release enhanced calendarization methodologies with two calculation options – annual interpolation and adjusted interim method – to make multi-company comparisons meaningful, particularly in cross-sector and cross-regional situations.

“As with anything we do, the team at Visible Alpha approached valuation and calendarization with an intense attention to detail to provide our clients with the accuracy and integrity they’ve come to expect from us,” said Seth Cutler, Vice President, Product Management. “Our clients told us very clearly that they struggled with mixed concepts in traditional means of viewing valuation multiples. I believe our approach to valuation metrics and calendarization will create measurable value for our clients.”