“Consensus is a lie.” A rather bold statement, don’t you think? When it comes to consensus, we commonly hear:

Consensus is a critical benchmark.

You have to know where the street is.

I don’t care about consensus.

I’m an independent thinker.

The great irony of consensus estimates is that there is no consensus as to the applicability of this data to the investment process.

However, there is one fundamental truth in stock picking: Analysts, directors of research, and portfolio managers must formulate independent views that collectively outperform the market.

The ability to identify unique market opportunities with a differentiated point of view will make or break your success. Interestingly, the fundamental requirement to create differentiated views naturally calls into question the approach of studying ‘consensus.’

However, consensus should not be thought of as a singular datapoint, but rather a collection of views that often differ significantly from one another and change, oftentimes dramatically, through time. Understanding the totality of the market view should, in fact, present opportunities.

Let’s deconstruct notions around consensus further…

What are consensus estimates?

DEFINITION: Consensus can be defined as the average reached by a group of equity analysts who cover a particular stock, regarding the projected earnings and revenues of a public company. It represents the combined estimates derived from individual assessments, forecasts, and subjective inputs of analysts, aiming to predict a company’s financial performance. Consensus estimates serve as a market expectation indicator and can influence investor sentiment and stock price movements.

Consensus estimates serve multiple purposes in the investment landscape:

For investors who have limited time to delve into the intricacies of a company, consensus estimates can serve as a useful tool in forecasting efficiently. They provide a snapshot of market expectations and help identify companies that are forecasted to outperform or underperform other companies in their peer group.

Moreover, consensus estimates can reflect the collective wisdom of the market, offering insights already reflected in the pricing and market sentiment. This creates opportunities for investors to express contrarian views on pricing, revenues, or other variables.

Investors can leverage consensus data to identify the fastest-growing companies within thriving sectors like technology or seek out companies that are emerging within industries facing challenges, such as traditional retail, even in researching publicly traded companies that are contributing to the infrastructure and broad scaling of AI capabilities.

Finally, it is important to note that consensus estimates are not static. As is the case with any investment thesis, consensus evolves as new information becomes available and market conditions change. It is vital for investors to track revisions and understand the dynamics of consensus as investment views are constantly recalibrated for changing market conditions.

Looking Beyond Consensus

When thinking only about consensus as a single data point, it’s understandable why investors may disregard consensus. From an investor’s point of view, consensus is an incomplete metric. Traditionally, consensus, centered on high-level metrics like revenue or EPS, misses out on the intricate factors driving a company’s success.

This narrow perspective can lead investors to overlook valuable insights and unique viewpoints, especially when considering detailed line items beyond basic metrics, found in the dispersion and revision pattern of forecasts from the analyst community. Recognizing the rich source of potential in the spread and revision trend of forecasts from the analyst community becomes crucial for buy-side professionals, as it indicates the presence of varying opinions among analysts as they change through time.

Large dispersion signifies the existence of untapped opportunities, while tight alignment among analysts may indicate limited potential for market gains. Dissenting voices are catalysts for growth and bring high-value unique perspectives to the table.

Example:

Let’s take a closer look at how the analysis of dispersion at a more granular level unlocks these advantages.

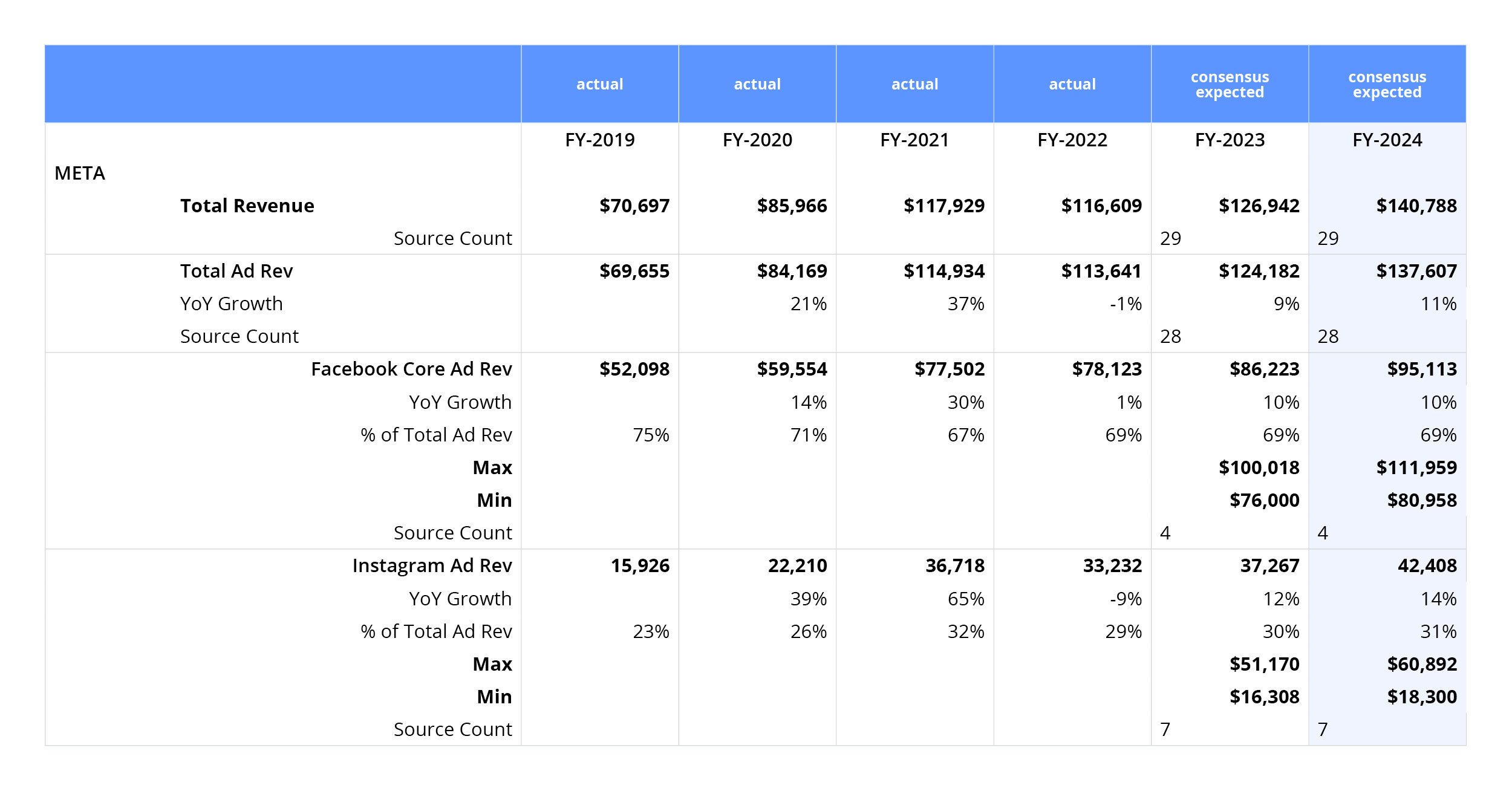

On the Q1 2023 earnings call, Meta CEO Mark Zuckerberg emphasized the significant impact of AI on Facebook and Instagram. AI recommendations now contribute to approximately 20% of the content in the feeds. This AI-driven enhancement to content and messaging in feeds has prompted analysts to revise their revenue estimates, reflecting anticipated increases in ad revenue.

When examining Facebook’s core ad revenues, our platform reveals consensus estimates that have been revised upward. Following Q1 2023, even the most conservative estimates have increased by $9B, narrowing the range. For 2023, the low-end estimate is now $76B (-12% below consensus), while the high-end estimate is $100B (14% ahead of consensus). These unique line items provide crucial insights into the growth potential of Facebook.

Collectively, the potential for AI to impact Facebook’s ad revenue led to a 12% increase in FY2024 expectations relative to consensus on January 3, 2023.

Delving into Instagram ad revenues, Visible Alpha highlights significant debate among the seven analysts forecasting. Varying views and calculations of the Instagram business and its projected growth result in a wide range of estimates. In 2023, estimates range from $16B (-56% below consensus) to $51B (38% above consensus), showcasing the importance of understanding these key drivers of growth.

Looking ahead to 2024, the range of estimates for Instagram ad revenues further expands. The high-end estimate of $61B contributes a remarkable 45% to total revenues, surpassing consensus by 43%. Conversely, the low estimate is -57% below consensus, reflecting the diversity of opinions among analysts.

By leveraging the dispersion of estimates of granular line items and embracing the varied viewpoints within the analyst community, investors can discover valuable opportunities that others might overlook and make informed decisions that set them apart.

The status quo

Traditional consensus providers have confined us to a narrow, one-dimensional perspective. Many consensus providers have historically relied on scraping sell-side research reports for analyst estimates, aggregating those estimates, and calculating the mean to create consensus. However, there are limitations with this methodology that hinder our understanding and ability to explore the full breadth of market possibilities:

- Lack of granularity: Sell-side research reports typically only include forecasts on top-level line items, such as revenue and EPS. Therefore, traditional consensus providers often miss the granular issues that are central to the investment thesis.

- Lack of comparability: The concern about comparability arises because traditional consensus estimates often don’t reveal the specific assumptions analysts make for each forecasted figure. This lack of transparency makes it challenging to compare one analyst’s forecast to another’s effectively, as each may use different bases for their predictions. Clarifying these assumptions is crucial for accurate comparison and a deeper understanding of the investment landscape.

Revolutionizing Consensus Creation

Unlike traditional consensus providers, Visible Alpha goes beyond top-level line items. We provide direct access to sell-side analyst models and offer deep consensus estimates on thousands of companies across various industries. With our tools at your disposal, you can explore the range of opinions and formulate a new perspective on market opportunities.

“Investors are looking for insights to understand what is behind analyst views for any key issue on a company. Visible Alpha’s deep consensus data addresses this buy-side problem of getting complete information about assumptions behind forecasts by providing a complete representation of analyst views sourced directly from analyst models.”

– Rodney Pedersen, Chief Revenue Officer, Visible Alpha

Our platform enables investment professionals and investor relations teams to identify the key drivers of revenue according to analysts’ perspectives. Moreover, we offer full transparency by allowing you to identify the spread of estimates including each individual analyst’s forecast for any line item. Finally, Visible Alpha offers a point-in-time snapshot of historical estimates allowing you to understand how market conviction on key issues is changing through time.

With Visible Alpha, you gain a competitive advantage by accessing consensus estimates with an unrivaled level of granularity, transparency, and historical context. This comprehensive view empowers you to perform relative analyses and extract actionable insights from sell-side models, ensuring that you make informed and independent investment choices.

“Visible Alpha’s consensus estimates can be used to represent what the market believes and what is already reflected in current pricing, providing scope for expressing contrarian views on pricing, revenues, or other variables.”

– Scott Rosen, Founder and Chief Research and Innovation Officer, Visible Alpha

It’s time to go beyond the limitations of traditional consensus, to go beyond the average.

See consensus in a new light with Visible Alpha