Forced to pivot almost overnight to contactless delivery, online ordering, and increased demand for takeout, restaurants have had to depend on creative problem-solving to survive the past couple of years. Now, as dining habits return to normal, restaurants face labor shortages, supply chain delays, and high inflation. While some have had to shut their doors forever, others have found ways to adapt and even excel.

Pre-pandemic prep

McDonalds (NYSE:MCD) was already refocusing on its core values prior to the 2020 shutdowns. So, when the pandemic hit, the global chain homed in on what it does best: It limited its menu to bestsellers and increased drive-thru efficiency. By the fourth quarter of 2020, McDonalds sales were back to where they were in Q4 of 2019.

Starbucks (NASDAQ:SBUX) was similarly well-positioned to weather the pandemic storm. The company had recently invested in new equipment and worked to streamline processes. Pre-pandemic, Starbucks had planned to roll out significantly more drive-thrus over the next three to five years. But when the need for contactless pickup and social distancing arose, Starbucks expedited that goal to be completed over 18 months – and it paid off with record-busting results in Q3 of 2021.

But no company appeared more prescient with its pre-pandemic investments than Chipotle (NYSE:CMG). A year before the world changed, Chipotle launched “Chipotlanes,” drive-thru lanes dedicated to picking up online orders. The company had also increased its food safety measures by revamping air filtration systems, increasing the number of sanitizing stations, and improving employee hand-washing protocols. Chipotle was perfectly positioned to handle new demand for online ordering, contactless pickup, and changes in health and safety expectations.

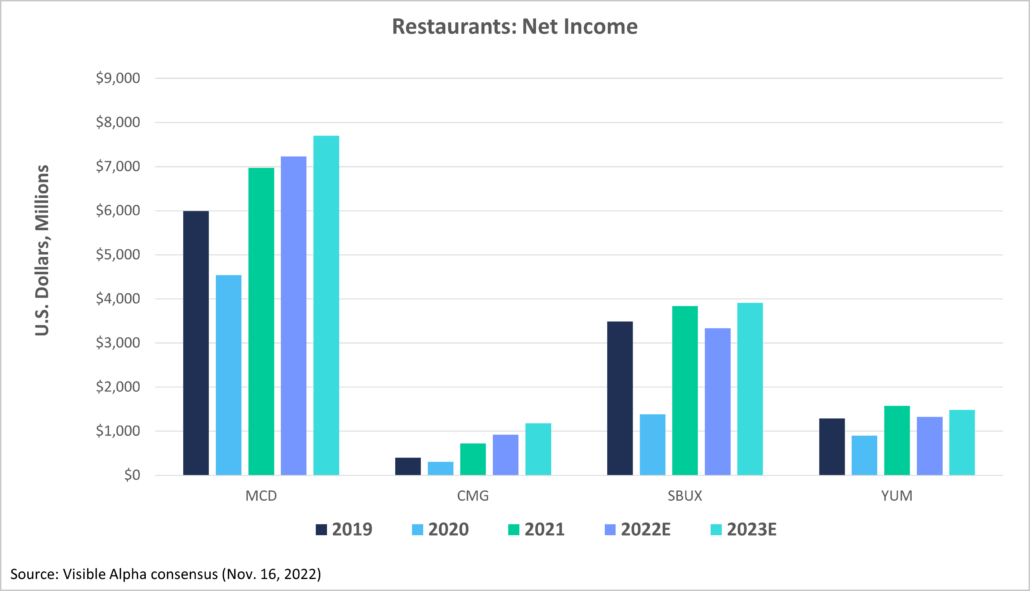

Restaurants by the numbers

While the restaurant industry overall did well, many are still experiencing a post-pandemic lag in same store sales growth. After increases in 2021, analysts predict same store growth for McDonalds will decrease in 2022 and 2023. Chipotle stores took a slightly smaller dip than that of McDonalds in 2020, but analysts still anticipate a decrease next year.

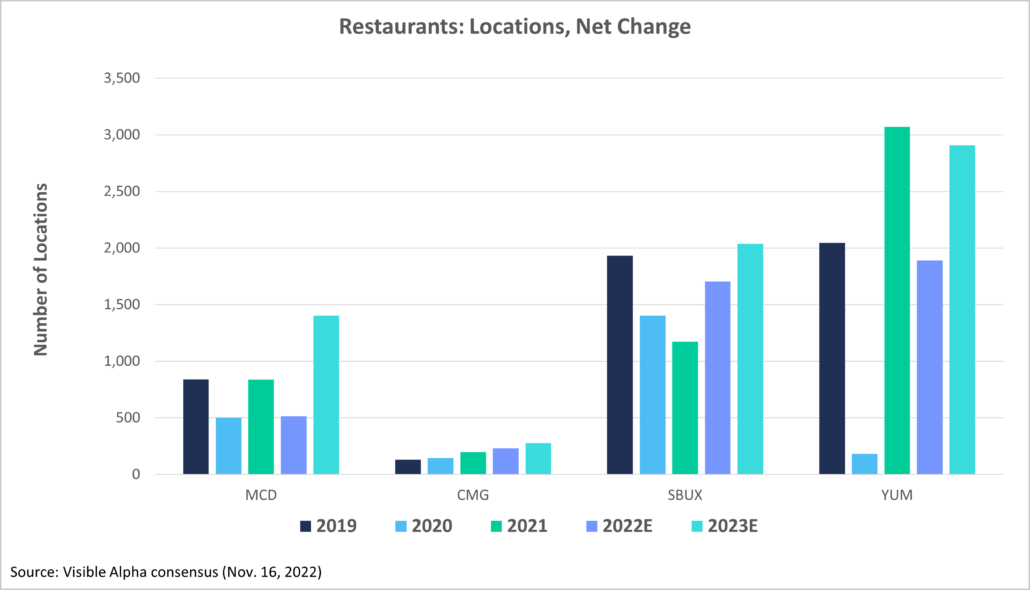

There is considerable movement predicted for net change, which refers to the number of stores opening or closing. Yum! Brands (NYSE:YUM) saw a vast slowdown in 2020 followed by a strong recovery in 2021. Analysts forecast another decrease in new stores for Yum! in 2022 with another period of recovery predicted for 2023.

Starbucks paused new store openings during the pandemic, causing net change to slope downward in 2020, and didn’t start increasing its number of stores again until after 2021. Analysts predict it will continue to grow into 2023. McDonalds has zigzagged back and forth over the past few years, but analysts predict a substantial increase in new store openings for 2023. Chipotle has shown slow and steady growth – with no significant changes in the past few years, it maintained its steady upward trajectory.

For the most part, big-name restaurant brands that adjusted quickly to pandemic-related changes are predicted to continue expansion with new locations, while those that struggled to adjust are experiencing setbacks, closings, or a slower recovery. And while same store growth is forecast down for some brands, both this year and next, companies are showing confidence in their brands – and expectations of further growth – by resuming plans to open new stores.

Takeout outlook

System-wide sales is the total amount of sales generated across the entire system, including franchise and company-owned stores. After a minor dip in 2020, McDonalds enjoyed upward growth over the past couple of years, and analysts predict continued growth in 2023. Yum! had an even slighter 2020 dip than McDonalds, but while it has increased over the last two years, the pace of growth is slower. Chipotle is forecast for consistent, albeit slow, growth with no significant spikes.

From servers to cooks and farmers to factory workers, the restaurant industry continues to struggle to find and retain employees at every level of the industry. Add a decrease in food supply and delivery delays, plus a record-breaking rise in costs, and the restaurant industry continues to face significant challenges – but companies are making sound business decisions, and many have already seen their smart moves pay off.