Weakness. Disruption. Delay. Failure. These are the words commonly associated with industry supply chains today. The pandemic threw supply and demand, transport, and production into disarray, and current events still show little sign of relenting. Initial confidence had supply chains restoring and recovering themselves as the economy rebalanced. Today, inflation, the threat of recession, and deteriorating, if not broken, supply chains continue to cause problems for a global economy struggling to recover, and no industry is taking more hits than auto manufacturing.

Chips and other challenges

By now, almost everyone understands the significance of supply chains. Economic disruption continues to dominate headlines and news feeds. But if supply chain fragility was well known in business and industry prior to the pandemic, it was big news to the rest of the world. Long-term shutdowns, materials and labor shortages, war in Europe, spikes in consumer demand, high prices, and transport delays put excessive strain on supply systems that simply were not up to the challenge(s).

In auto manufacturing, a convergence of supply chain disruptors is causing production delays, force reductions and other labor challenges, and lower quality products at higher price points. Automakers continue to confront, and scramble to overcome, relentless challenges, including:

- Lingering consequences of Covid-19

- Global semiconductor chip shortages

- Lithium supply shortages

- EV competition for resources

- Labor challenges

- Production and shipping delays

- The Russia-Ukraine war

- Production quality decline

- Inflation and economic uncertainty

How will this “supply chain hell” play out for automakers and investors in 2022?

“Supply chain hell”

“Supply chain hell” is likely a popular industry term in these complicated times, but credit for coining the term goes to Elon Musk, CEO of Tesla Motors (NASDAQ:TSLA), and it’s an apt description for the endless tangle of cause and effect plaguing the automotive industry.

The semiconductor chip shortage is among the hottest headlines. According to a PBS NewsHour report, “U.S. new vehicle sales tumbled more than 21 percent in the second quarter compared with a year ago as the global semiconductor shortage continued to cause production problems for the industry.” General Motors (NYSE:GM) managed shortages by producing 95,000 unfinished vehicles awaiting delivery of various missing pieces. Toyota (NYSE:TM) was disappointed in its expectation of a faster resolution to the chip crisis — even as chip manufacturers work nonstop trying, and failing, to catch up on production.

Supply chain delays limit production and inventory, drive record price increases, and reduce demand, which leads to fewer sales at significantly higher prices.

Automaker second-quarter earnings

Second-quarter earnings reports reflect the industry’s tough road to recovery. GM reported second-quarter U.S. sales of 582,401 vehicles, down approximately 15% from 2021. Toyota, among the hardest hit in a hard-hit industry, reported 531,105 vehicles sold in the U.S., a decrease of 22%, and surrendered its number one domestic sales status back to GM. Tesla delivered 254,695 vehicles total in the second quarter, a year-over-year increase of 26.5%. Ford reported (NYSE:F) sales of 483,688 new vehicles, up 1.8% from the second quarter of 2021, with significant improvement — up 31.5% — noted for June. Volkswagen (OTCMKTS:VWAPY) reported second-quarter sales of 2.011 million vehicles globally, down 13.5% from 2021 in this year’s second quarter. Overall, total U.S. and retail sales for the second quarter declined 16% and 24%, respectively. For Stellantis (NYSE:STLA), total U.S. second-quarter sales declined 16% to a reported 408,521 vehicles.

By the numbers

As the U.S. federal government moves to secure a future domestic supply of semiconductor chips, automakers are struggling with production, sales, and supply chain fragility today. Analysts use auto manufacturing key performance indicators (KPIs) for production and sales to forecast market share and performance.

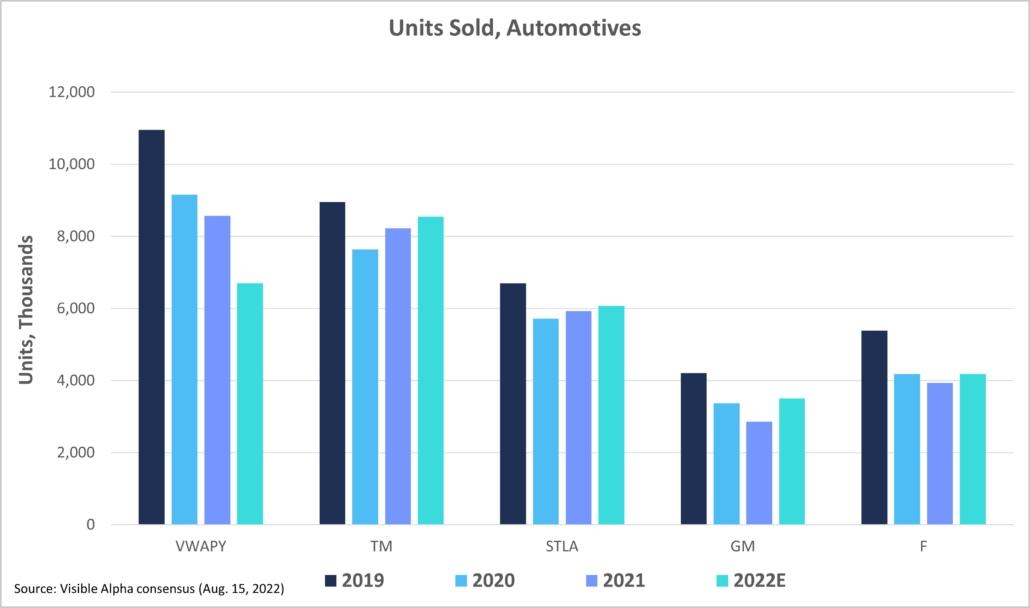

Units sold reflects the number of vehicles sold by an automaker. Analyst forecasts for 2022 predict a decrease in units sold for Volkswagen (-21.8%), low increases for Toyota (+3.9%), Stellantis (+2.5%), and Ford (+6.0%), and a strong showing from GM (+22.6%).

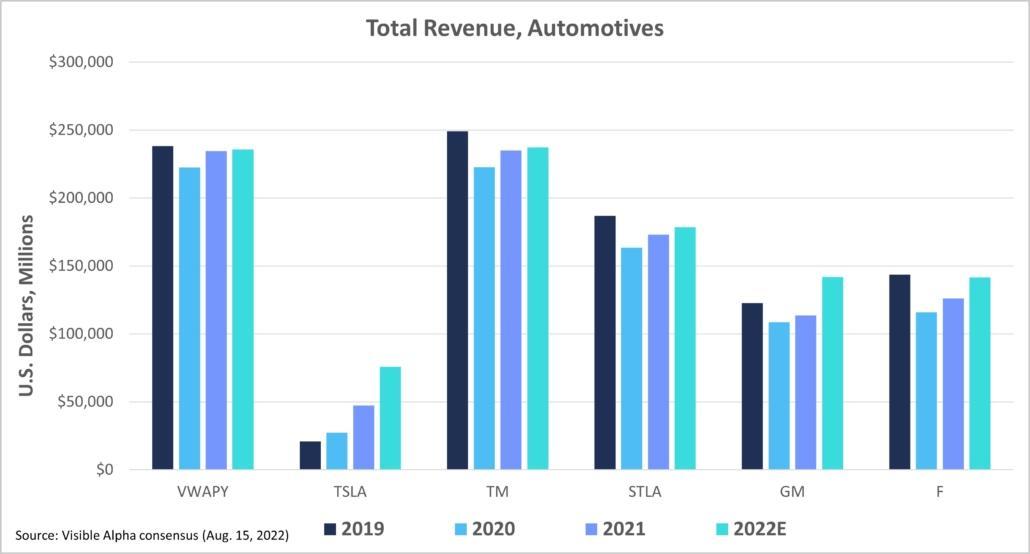

Total automotive revenue uses automaker revenue to measure market significance by auto segments. Of the manufacturers discussed, analysts predict 2022 increases across the board. While most increases are moderate — including Volkswagen (+9.4%), Toyota (+13.3%), Stellantis (+12.4%), and Ford (+12.3%) — GM is forecast for a strong showing (+22.2%). Tesla’s market differs from the others, but its total automotive revenue increase is forecast at an extraordinary 60.3% as they continue to increase production.

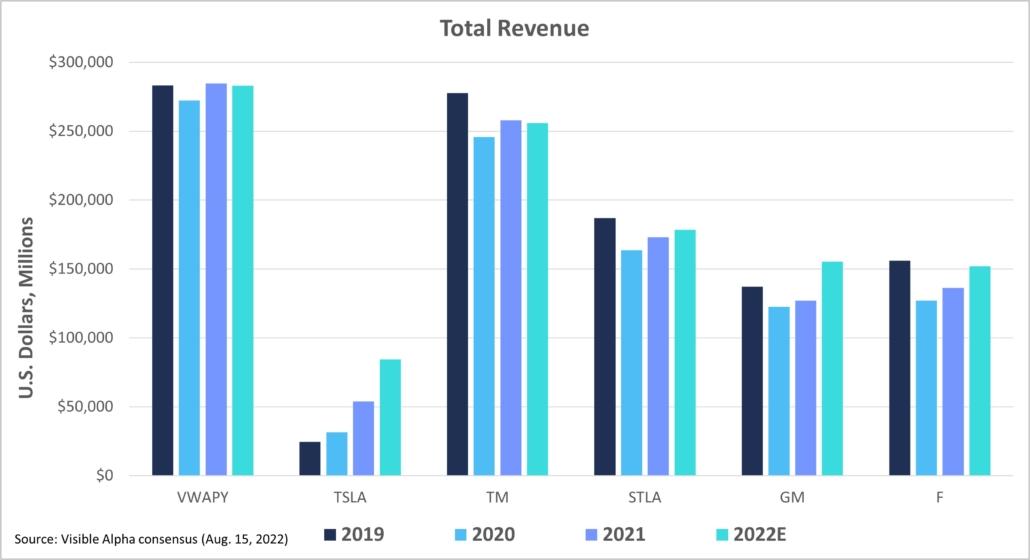

Total revenue — a total measure of market significance — follows a similar trend, with Volkswagen forecast up 8.4% on the low end and GM up 22.2% in another standout prediction for 2022. Toyota (+11.4%), Stellantis (+12.4%), and Ford (+11.4%) are forecast for modest gains, and Tesla hits another high with a 56.7% boost predicted for total revenue year over year.

The road ahead

Deep consensus data shows a long recovery road ahead for automakers, but revenue increases reflect higher prices that are already having negative effects on demand. Long-term plans to address supply chain disruption will have limited impact on the immediate outlook, but industry leaders are optimistic, with a healthy dose of caution, that the road ahead will eventually end in recovery.

For more deep consensus data on demand, visit visiblealpha.com.