Luxury goods are, to an extent, exempt from many of the consequences of economic chaos.

“The rich keep on buying” is a prevailing belief, and it remains true thus far. Luxury goods spending was up in the U.S. and European markets even as Covid-19 restrictions contributed to falling revenue in China. The industry’s rapid post-pandemic recovery could stall with both inflation and the threat of recession rising, but industry leaders expect the market to survive, and then some.

Luxury in uncertain times

Luxury goods companies went into the 2008 recession with relative nonchalance. Then president of Neiman Marcus, Burt Tansky, famously said, “Remember, when our customer tightens their belt, it’s generally ostrich or alligator.” While the industry fared better than others, this optimism proved off the mark. The luxury goods market took a 9% overall loss during the last global recession — with high-end retailers among the hardest hit — reinforcing the distinction between “inflation-resistant” and “recession-proof.”

Today, amid ongoing inflation and looming recession concerns, luxury goods brands — most notably Hermès International (OTCMKTS:HESAY) — are defying inflation and beating consensus estimates.

Recovery, inflation, and recession

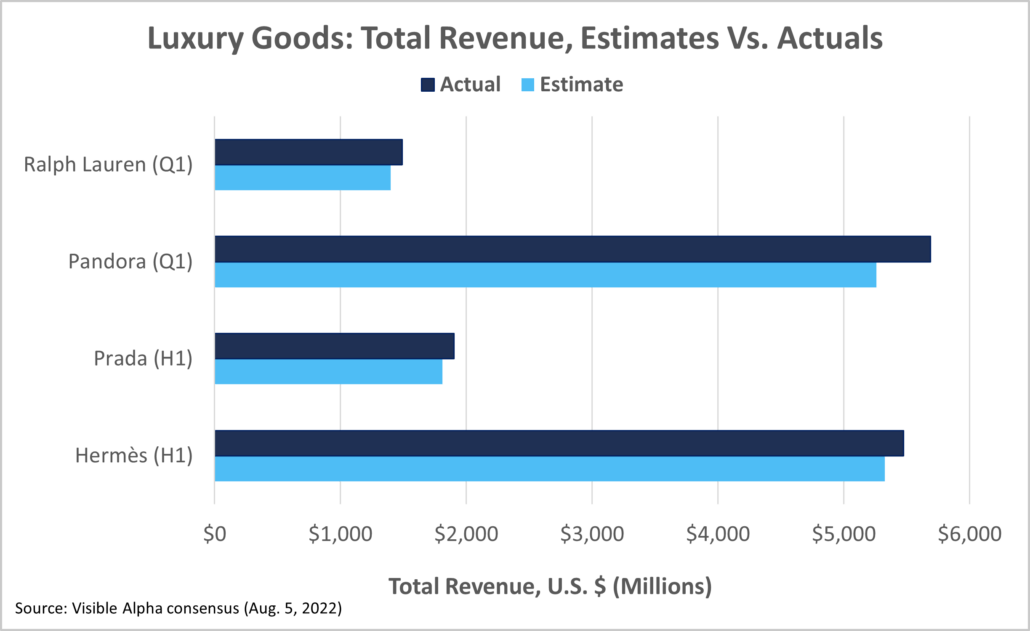

In the last few years, the economy has been subject to a waxing and waning global pandemic, a war in Eastern Europe, Fed rate hikes, relentless supply chain disarray, and in some sectors, a partial, if patchy, recovery. Inflation and a possible recession are just the latest in a pileup of current events, but luxury goods are holding up well, as evidenced by their outperformance vs. Visible Alpha’s consensus data:

- Pandora (OTCMKTS:PANDY) beat first-quarter consensus estimates for total revenue by 8%, setting new first-quarter revenue records. The company also adjusted full-year sales projections up slightly, from a previously forecast 3% to 6% to a more confident 4% to 6%.

- Prada (OTCMKTS:PRDSF) beat total revenue consensus estimates for the first half of 2022 by a sound 8% — a dramatic and unexpected year-over-year increase from 2021.

- Ralph Lauren (NYSE:RL) exceeded total revenue consensus estimates for its first fiscal quarter by 6%. CFO Jane Nielsen spoke with notable confidence, “Our consumers are resilient. They’re at the higher end of income demographics, and they’ve proven through COVID that their desire for the brand has increased.”

- Hermès International is being called the “most resilient” luxury goods company. It beat H1 consensus estimates for total revenue soundly with a record-setting H1 revenue increase; “The French company’s shares soared as much as 8.5% after it said its recurring operating margin reached a historical high of 42%, up from 41% a year earlier.”

All four big-name luxury brands raised prices in response to inflation and supply chain challenges. Each also reported temporary but improving setbacks in the Chinese market, a consequence of recently lifted Covid-19 restrictions. After earnings, management for all four adjusted sales outlooks upward.

Luxury by the numbers

Analysts are forecasting more increases across key performance indicators (KPIs) for these four brand names, and so far, support luxury brand confidence for full-year 2022, with more modest increases predicted for 2023.

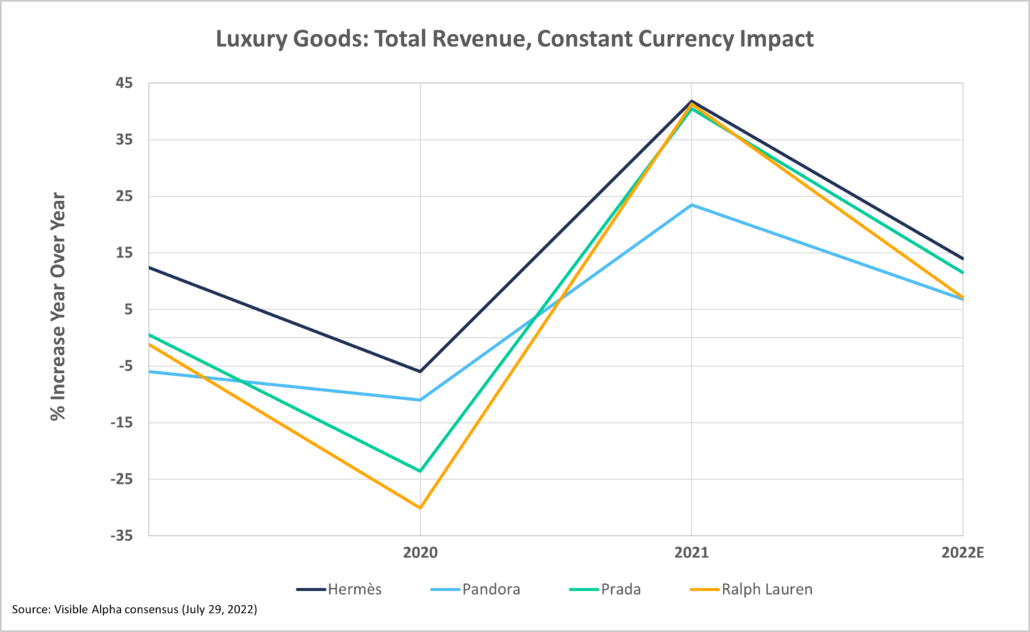

For the most part, while analysts predict a slowdown from last year’s meteoric rise in constant currency revenue growth, they continue to expect solid growth for 2022. Pandora registered an increase of 24.5% last year. Analysts expect a much lower increase of 6.8% year over year. Prada’s 2021 boost of 40.5% is forecast to continue up with an 11.5% increase. Ralph Lauren is forecast up 7.1%, and analysts predict industry standout Hermès to climb 14%. Constant currency impact is the core growth rate excluding currency movements, an important metric made more so by the current economic environment.

Total revenue growth — which includes foreign exchange effects (FX) — reveals a similar trend, with strong growth continuing more slowly after last year’s dramatic post-pandemic recovery gains. Forecasts include a slower climb overall, with Ralph Lauren at the low end with a predicted 3.4% increase. Pandora and Prada are expected to show more modest gains, at 11.1% and 13.4% respectively, and Hermès comes out on top again with a forecast 17.7% rise year over year.

The big picture

Analyst predictions bear out the theory of an “inflation-resistant” luxury goods market, but whether luxury brands are in fact “recession-proof” remains to be seen. Today’s economic circumstances are more complex than those of 2008, and it’s worth noting that luxury goods proved less than recession-proof last time around.

For now, an impending recession remains more threat than a fact, and luxury goods’ market performance continues to improve.

For deep consensus data on demand, visit visiblealpha.com.