Earnings season is here, and companies are expected to update full-year guidance to reflect the impact of the COVID-19 crisis. As events have unfolded since the start of the year some analysts have made revisions to their estimates accordingly.

Historical consensus estimates from January 1, 2020 represent a pre-COVID view. Current consensus estimates include the latest estimates of all analysts covering the company since they last reported earnings. The lowest estimate in consensus is the most bearish forecast in the analyst community and the highest estimate is the most bullish.

|

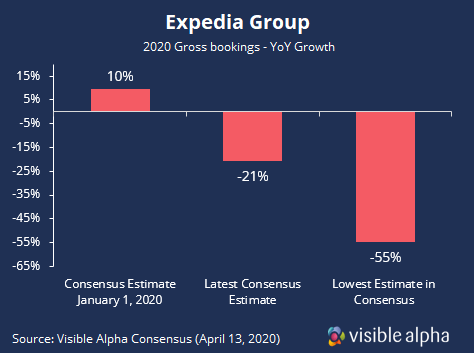

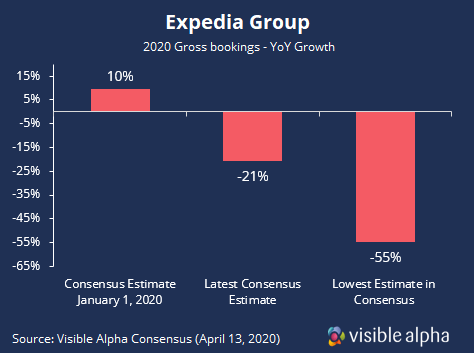

Expedia (EXPE)

Consumer Services – Travel & Tourism

Global COVID-19 travel lockdowns have disrupted Expedia’s hotel and flight bookings. There may also be a shift in corporate traveling demand in favor of video conferencing going forward. At the start of the year, analysts forecasted 10% gross bookings growth in 2020. Now, the average analyst estimate is -21%, with the lowest predicting a -55% drop.

|

|

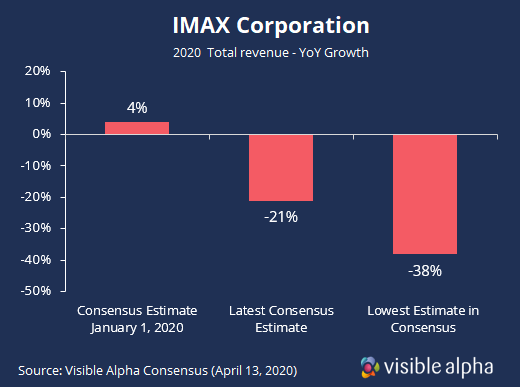

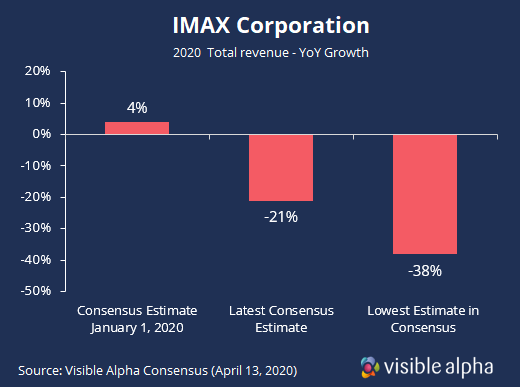

IMAX (IMAX)

Consumer Services – Movies and Entertainment

Social distancing orders have shuttered cinemas globally and are disrupting IMAX’s business, which is disproportionately exposed to China. With some analysts fearing that restrictions could last until June, at least one believes revenue could fall by as much as 38% in 2020.

|

|

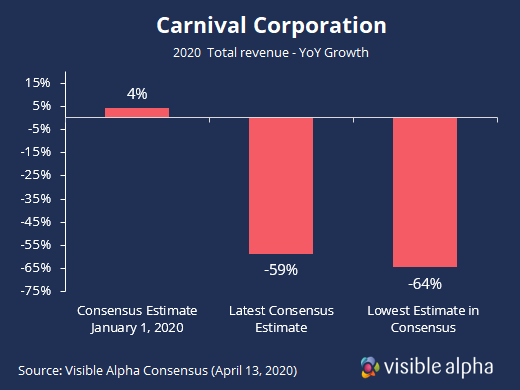

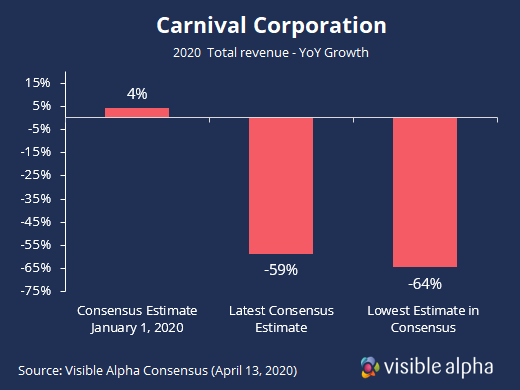

Carnival Corporation (CCL)

Consumer Services – Hotels, Resorts & Cruise Lines

Carnival’s Princess branded cruise liners succumbed to a PR disaster during the COVID-19 crisis with hundreds of passengers on their ships becoming infected with the virus and left stranded out at sea. The average estimate among analysts for 2020 revenue growth is now -59%, down from +4% at the start of the year. |

|

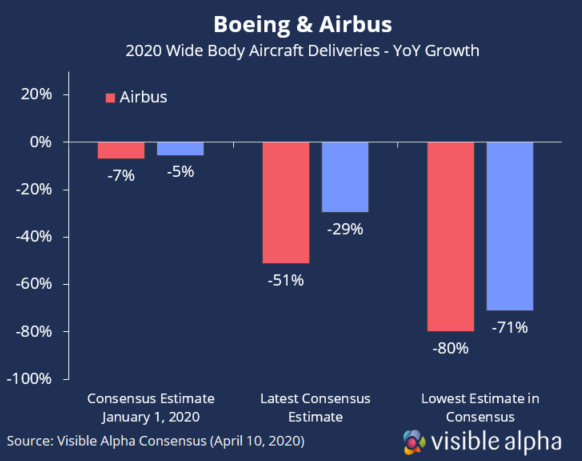

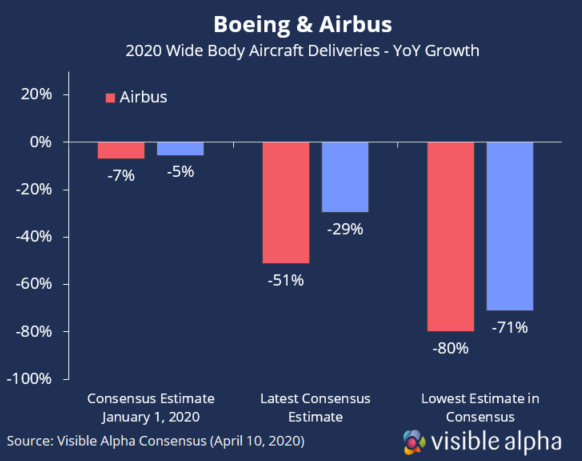

Boeing (BA) & Airbus(AIR_FR)

Industrials – Aerospace & Defense

Wall Street is forecasting that twin-aisle aircraft deliveries could fall as much as 80% for Airbus and 71% for Boeing in 2020 as airlines and aircraft lessors began canceling orders and requesting delivery deferment until 2021 due to the impact of COVID-19. |

|

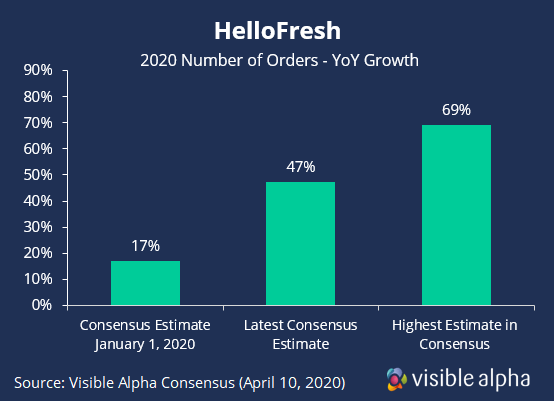

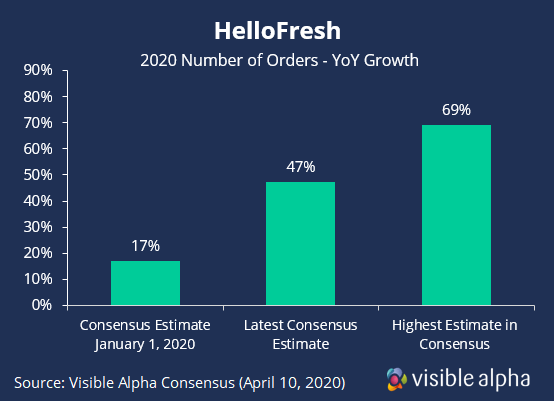

HelloFresh (HFGEUR_DE)

Consumer Services – Other Consumer Services

Demand for delivered groceries began surging in late March as COVID-19 forced people to stay home and turn to cooking. The lockdown-induced demand has increased orders, which analysts believe will increase by 47% by the end of the year, up from 17% at the beginning of the year. |

|

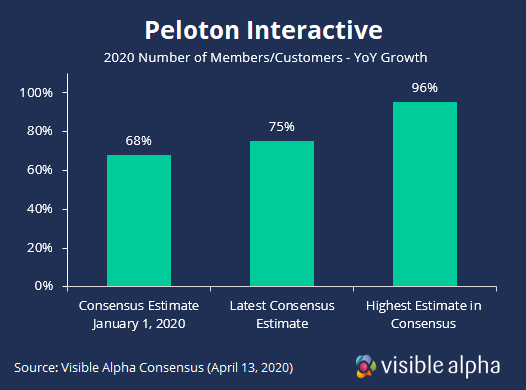

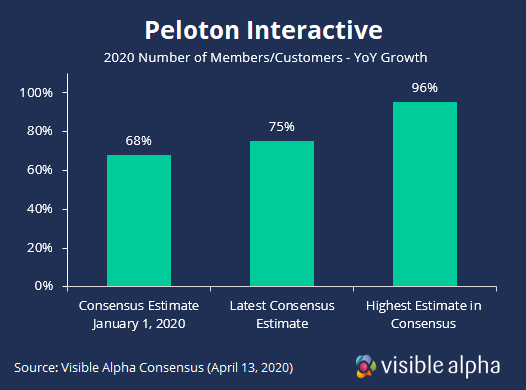

Peloton Interactive (PTON)

Consumer Services – Leisure Facilities

Analysts believe Peloton will benefit from social distancing as people transition from in-person fitness classes to interactive, at-home workouts. The average analyst estimate for 2020 membership growth increased to 75%, up from 68% at the start of the year. |

|

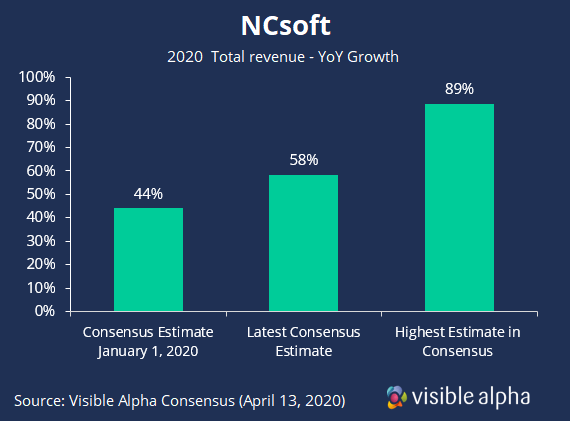

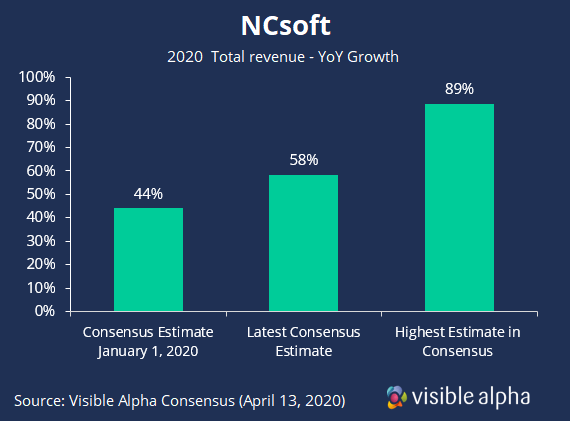

NCsoft (036570_KR)

Technology – Online Gaming

NCsoft is a leading player in the Mobile RPG gaming segment. Their Lineage 2M game saw average daily revenue increase in March as more users spent more hours gaming because more people are staying home due to COVID-19. |

|

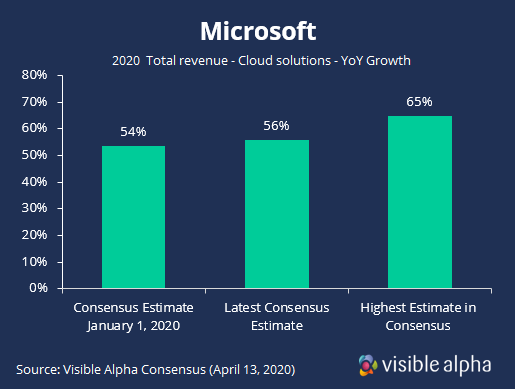

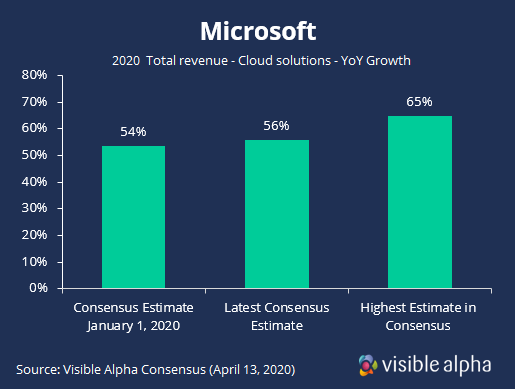

Microsoft (MSFT)

Technology – Systems Software

Analysts believe the COVID-19 pandemic can be a slightly net positive benefit for Microsoft’s cloud service, Azure. Analysts believe a decrease in demand from some businesses is expected to be offset by a surge in demand from others. |

|

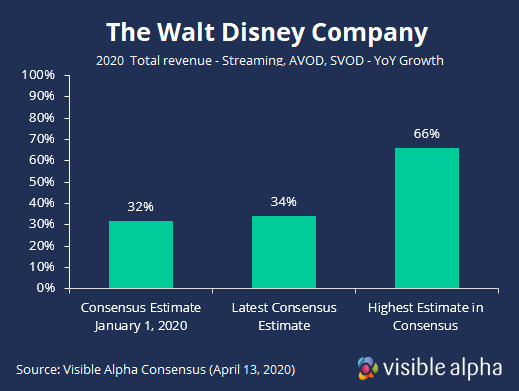

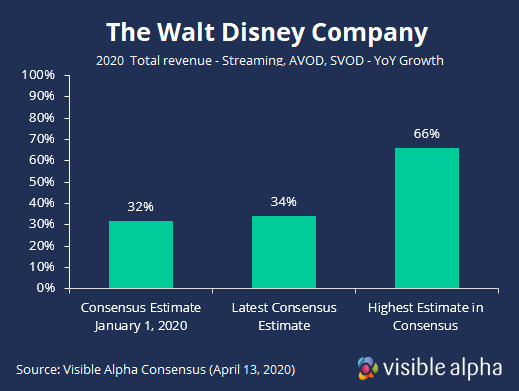

Disney (DIS)

Consumer Services – Movies and Entertainment

Social distancing has increased demand for streaming video content, which may be providing a tailwind for Disney+. The company disclosed last week that the streaming service now has 50M subscribers. The highest analyst estimate is forecasting Disney’s streaming revenue will grow by 66% in 2020. |

Learn more about the ongoing revisions across every sector on our market volatility resource page.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.