Analyst and consensus estimates revisions are highly sought after by investment professionals, who typically obtain estimates revisions by either collecting and ingesting analyst spreadsheet models directly or by leveraging a third-party service provider to process the models. In the latter approach, investors typically receive analyst and consensus estimates two weeks after earnings and two weeks prior to the next earnings announcement, summarizing any revisions made.

Is there any impact to an investment professional’s workflow and investment choices in receiving delayed analyst revisions? What are investment professionals missing, if anything, throughout a company’s fiscal quarter by receiving revisions to earnings estimates and consensus estimates two weeks after a company reports earnings, and then only once more a couple of weeks before the next announcement?

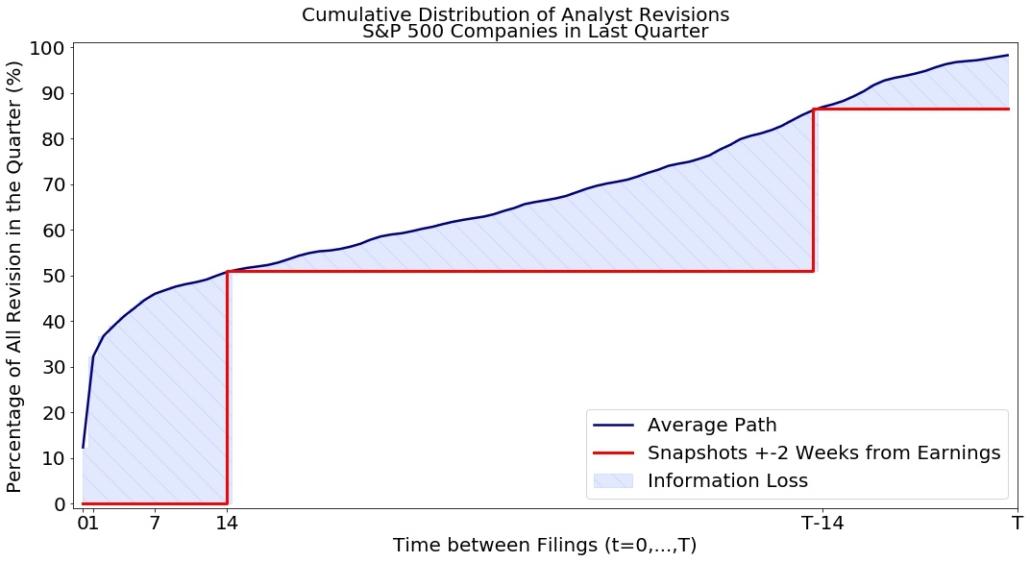

In order to answer these questions, it’s important to understand when and how often analysts revise estimates during a fiscal quarter. Our full methodology can be found here, but we looked at the S&P 500 to see what fraction of revisions were captured day by day and explored how these revisions impacted daily consensus data.

A continuous flow of analyst and consensus revisions

We found that there is a continuous flow of both analyst and consensus revisions throughout the quarter. Information flow is fastest during the first day through the first week, and then becomes steady throughout the rest of the quarter, petering out only at the very end.

In this figure, you can see how disadvantageous it would be to substitute point-in-time analyst revisions with stale snapshots taken around two weeks before and after earnings announcements. Half of all analyst revisions take place within the first 14 days after earnings are reported, and another 35% of analyst revisions take place between the 14-day mark and two weeks prior to the next earnings announcement.

Information losses at these orders of magnitude can prove consequential.

Real-time earnings estimates revisions offer a competitive edge

In summary, we found substantial value for investment professionals to receive and consume sell-side analyst models in as close to real time as possible throughout the quarter. Since analysts keep close track of their covered companies throughout the quarter, point-in-time analyst and consensus revisions provides a true competitive edge.

To learn more, download the full study, Missing Out: Why access to real-time analyst models revisions matters.