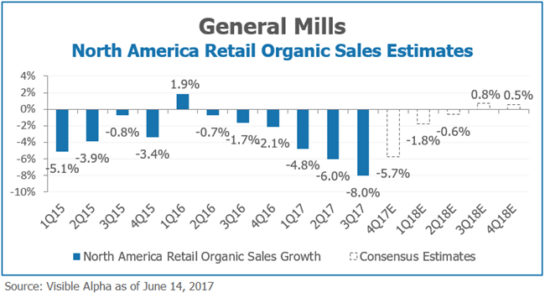

General Mills’ North America Retail segment is a key portion of its business that made up 66% of sales and 78% of operating profit in 2016. The segment has struggled over the last several years, acting as a significant drag on overall company sales.

While some consumers have shifted away from General Mills products towards healthier and cheaper options, the company has also attributed recent under-performance to several internal missteps. Jeff Harmening, the recently-appointed CEO, noted that General Mills took too much price in several high margin categories like dough and soup. He also added that the company was slow to react to competitive developments in yogurt. The company has already taken corrective action, becoming more competitive on pricing and trying to be more innovative in the yogurt space going forward.

Visible Alpha’s consensus data shows that analysts believe that the segment financials could improve. While declines are expected to continue for the next three quarters, the magnitude of the decline is expected to sequentially improve and eventually turn positive in 3Q18.

Go Beyond Consensus.

Learn more or request a free trial of our insights platform today!

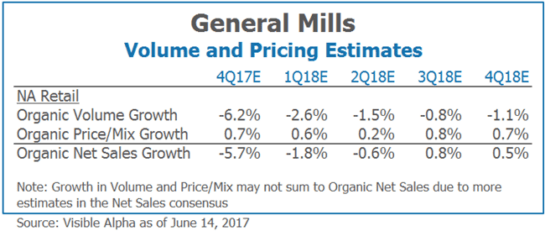

Digging deeper into the estimates, we find that analysts expect volume growth to improve sequentially up to 3Q18 and for price/mix to stay relatively consistent with a 50-100 basis point improvement for most of the quarters.