In late 2015, Under Armour’s senior management established long-term targets of 25% sales CAGR and 23% operating income CAGR through 2018. This translated into $7.5 billion in sales and $800 million in operating income by 2018.

However, since that time, Under Armour has been negatively impacted by several factors, including retailer bankruptcies (specifically The Sports Authority), business mix shifts (lower-margin footwear becoming a greater percentage of the business), ongoing investments in the business to grow faster, and a more competitive environment.

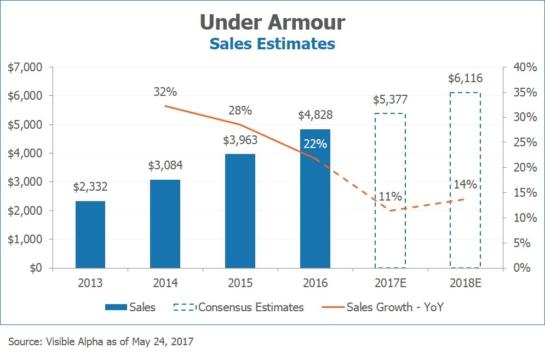

Now, management has noted that they are not looking beyond 2017, where they are guiding to 11-12% revenue growth and $320 million of operating profit. On their 4Q16 conference call, management also noted a desire to get back to the 20% growth at some point.

How do investors see the company’s growth profile going forward relative to those initial targets? Consensus estimates currently point to Under Armour achieving its 2017 sales guidance of 11%, but falling 18% short of its 2018 target established in 2015. However, estimates do point towards a reacceleration in growth to 14% in 2018.

Operating income paints a similar picture. Consensus estimates have Under Armour achieving its 2017 guidance, but falling 52% short of its 2018 target established in 2015. However, on the bright side, analysts do expect operating margin to reverse its declines in 2018 and expand by 20 basis points to 6.2%.

Go beyond consensus with Visible Alpha. Learn how you can uncover deeper insights within analyst models.