In our weekly round-up of the top charts and market-moving analyst insights: Shell (LSE: SHEL) looks to power up renewables; analysts see declines in North America sales volume for AB InBev (EBR: ABI); WHSmith’s (LSE: SMWH) travel division is expected to see strong revenue growth.

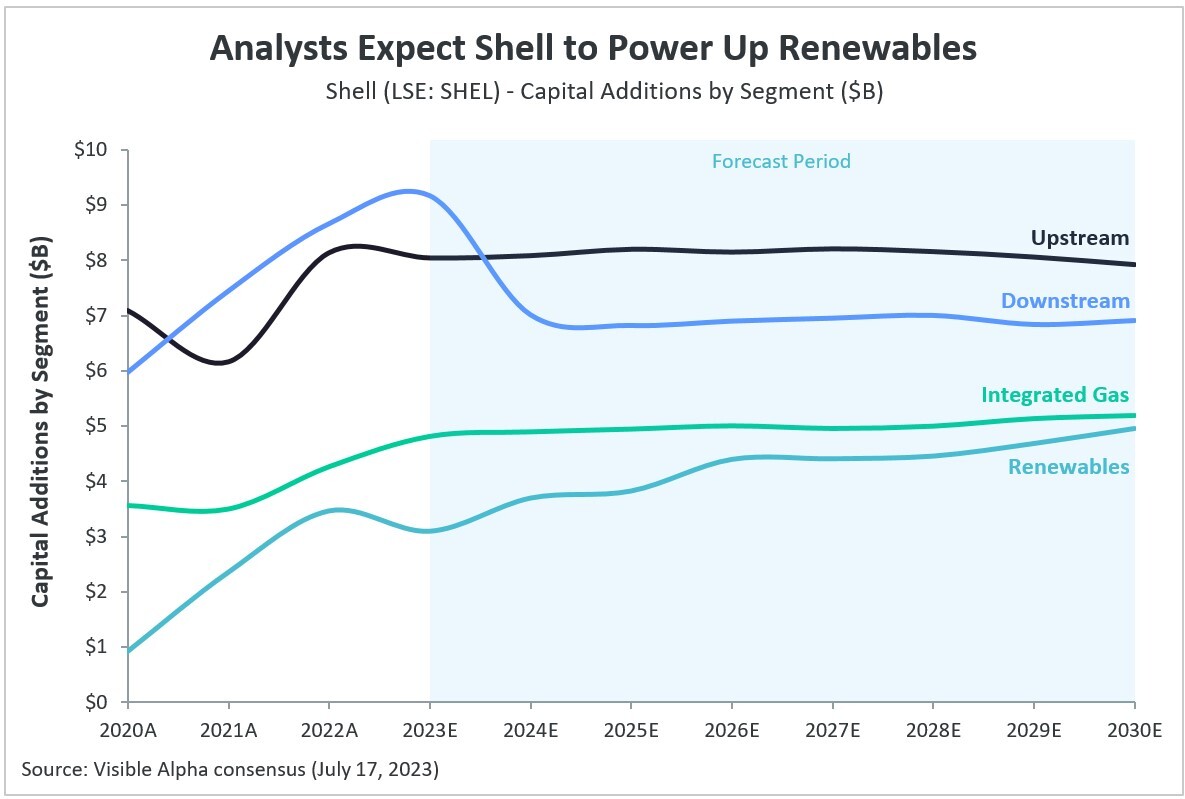

Analysts Expect Shell to Power Up Renewables

Shell (LSE: SHEL) is expected to raise its investment in renewable energy and low-carbon projects in accordance with the EU’s carbon emission regulations. To achieve net-zero emissions by 2050, Shell plans to invest $10-15 billion between 2023-25 in developing low-carbon energy solutions such as biofuels, hydrogen, EV charging, and carbon capture & storage.

In 2023, according to Visible Alpha consensus, analysts expect the company to allocate $9.2 billion to its downstream business, $8.1 billion to its upstream business, $4.8 billion to integrated gas, and $3.1 billion to renewables.

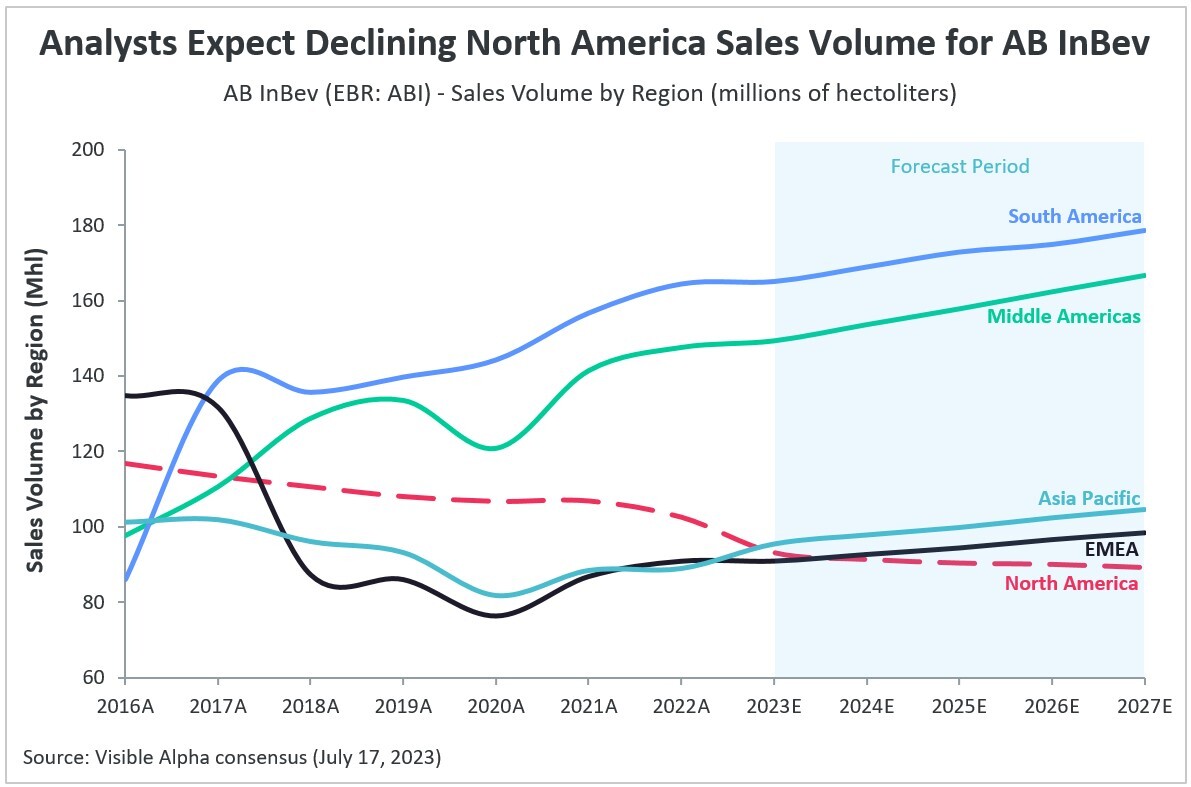

Analysts Expect Declining North America Sales Volume for AB InBev

Analysts expect North America sales volume for AB InBev (EBR: ABI), the company behind Budweiser and Bud Light beer brands, to decline by 9% year over year in 2023, according to Visible Alpha consensus.

The U.S. is expected to account for this sharp decline, with U.S. sales volume projected to fall by 10%. The strongest sales volume growth in 2023 is projected to occur in the Asia-Pacific region at 7%, followed by the Middle Americas (Central America, Mexico, Caribbean) at 1%.

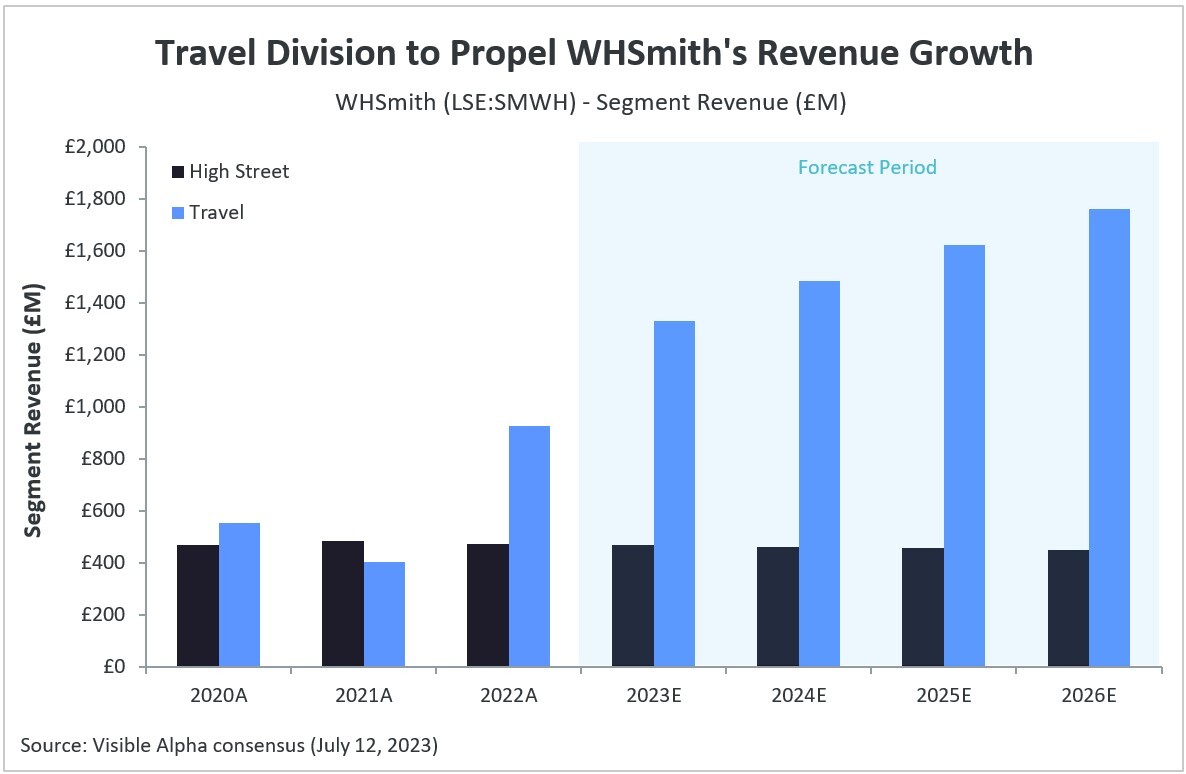

Travel Division to Propel WHSmith’s Revenue Growth, Say Analysts

UK-based books and convenience retailer WHSmith (LSE: SMWH) is expected to continue seeing revenue growth driven by its travel division (airports, train stations, motorway service areas, and hospitals).

According to Visible Alpha consensus, the retailer’s travel segment revenue is expected to increase by 44% in 2023 compared to the previous year. The British retailer is expanding its travel division, with focused store expansions outside of the U.K., especially in North America.