In our weekly round-up of the top charts and market-moving analyst insights: the move to accelerated computing is driving Nvidia’s (NASDAQ: NVDA) data center segment growth; analysts lower earnings and FCF projections for RTX (NYSE: RTX) after Airbus jet grounding announcement; Lundin Mining’s (TSE: LUN) copper mine acquisition is poised to boost production and cut costs.

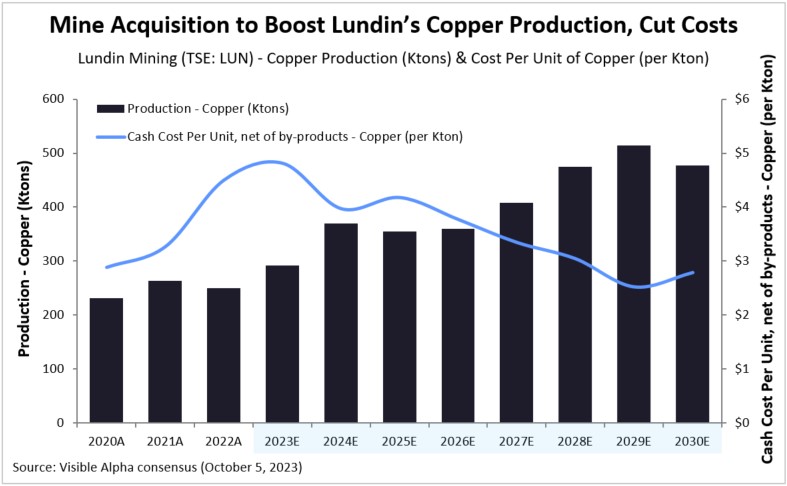

Nvidia’s Data Center Segment Driven by Move to Accelerated Computing

Generative AI’s (GAI) continuing move toward accelerated computing has created a sharply increased demand for Nvidia’s (NASDAQ: NVDA) data center platform, especially its data center GPUs (graphics processing units).

According to Visible Alpha’s consensus, analysts expect the data center segment to account for 76.1% of Nvidia’s total revenue in fiscal 2024, a substantial increase from 55.6% in 2023. Nvidia’s total revenue is estimated to rise by 103% year over year in fiscal 2024, primarily driven by an estimated 178% year-over-year increase in data center revenue. Revenue generated from the data center segment in 2024 is projected to reach $41.7 billion in FY 2024 from $15 billion in FY 2023. Analysts also expect the company overall to generate $26.9 billion in operating income in 2024, up from $4.2 billion in 2023.

To learn more about Nvidia’s latest developments and insights following the company’s Q2 FY2024 earnings report, explore our Post-Q2 FY2024 Earnings Update on Nvidia.

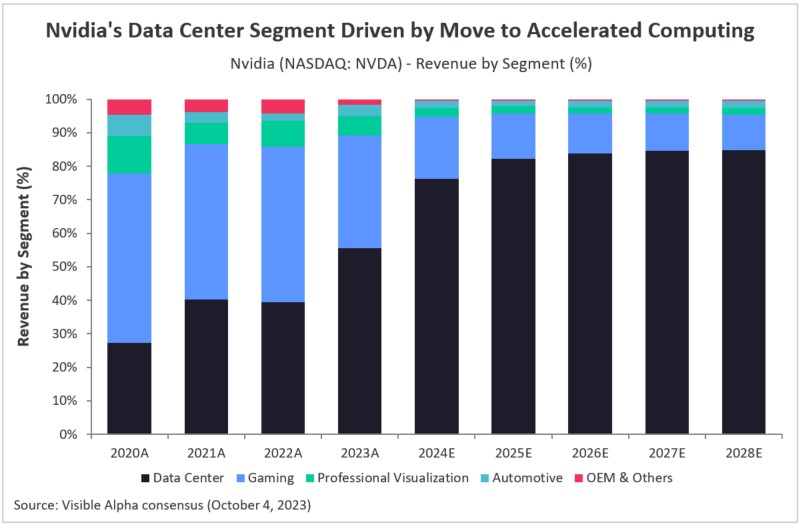

Analysts Lower Earnings and FCF Projections for RTX After Airbus Jet Grounding Announcement

RTX Corporation (formerly Raytheon Technologies) (NYSE: RTX), the U.S. aerospace and defense company, announced on September 11, 2023, the grounding of an estimated 600-700 of its Pratt & Whitney Geared Turbofan (GTF) engines from Airbus A320neo jets. The reason for the grounding is to conduct quality inspections between 2023-2026 due to a manufacturing flaw. RTX operates through four segments: Collins Aerospace, Pratt & Whitney, Raytheon Intelligence & Space, and Raytheon Missiles & Defense, and this issue primarily impacts the Pratt & Whitney segment of the company.

As a result, analysts have adjusted their EPS and free cash flow expectations downward, with a projected decrease in diluted EPS (GAAP) of -44% year over year and free cash flow of nearly -14% year over year in 2023, according to Visible Alpha consensus estimates. Analysts expect an operating loss of -$1.25 billion in 2023 for the company’s Pratt & Whitney segment, but recovery is expected to commence starting in 2024. (Note: These data points are from Visible Alpha’s custom consensus, focusing only on brokers who have factored RTX’s announcement into their models.)

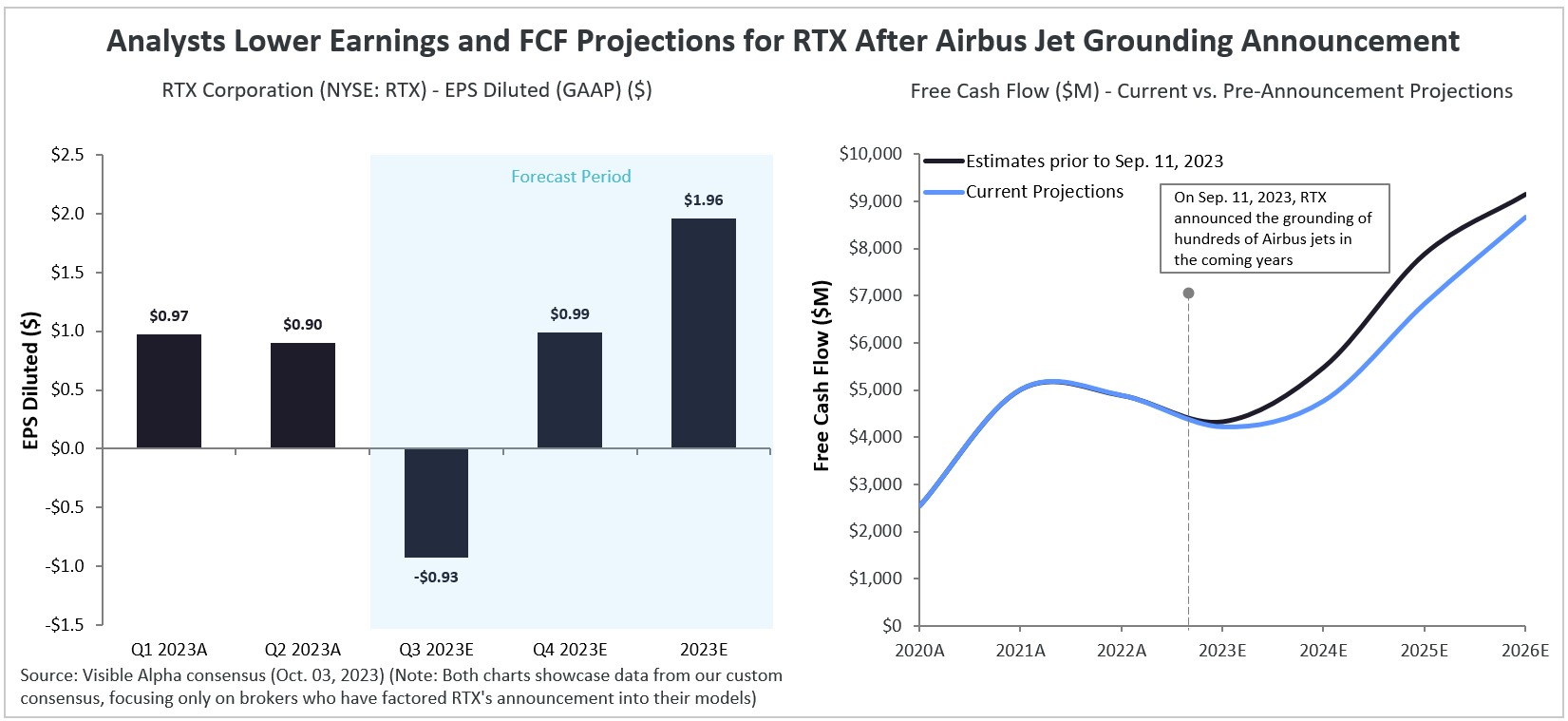

Mine Acquisition to Boost Lundin’s Copper Production, Cut Costs

Toronto-based mining company Lundin Mining (TSE: LUN) made a significant move in July 2023 by acquiring a 51% ownership stake in SCM Minera Lumina Copper Chile, which operates the Caserones copper-molybdenum mine in Chile. This mine is strategically located just around 100 kilometers away from Lundin’s Candelaria operation in Chile and only 20 km from its Josemaria project, located across the border in Argentina.

Based on Visible Alpha consensus estimates, following the acquisition, Lundin’s cash cost per unit net of by-products – copper (per Kton) is projected to trend downwards starting in 2024, while copper production volume is expected to pick up. The geographic proximity among the three mines is expected to create opportunities for synergies in terms of supply, logistics, and management. Analysts anticipate that these synergies will result in cost reductions for the company as shared resources and infrastructure are efficiently optimized. In 2024, copper production is projected to ramp up to 370 Ktons from an expected 292 Ktons in 2023 (+26.5% expected year-over-year). Meanwhile, cash cost per unit, net of by-products, is estimated to be $3.98 per Kton of copper in 2024, down from a projected $4.82 per Kton in 2023 (-17.5% expected year-over-year).