In the fast-paced world of finance, where timely decisions can make or break success, the creation and analysis of consensus estimates play a pivotal role. This article delves into the multifaceted world of consensus forecasting, exploring the diverse methods and innovative approaches that shape the financial industry’s understanding of market expectations and company fundamentals.

Traditional Methods: The Backbone of Consensus Creation

How is consensus created?

Consensus estimates can be calculated through a variety of methods and approaches, each with its strengths and limitations. Without a reliable and accurate consensus data solution, creating and analyzing consensus is a meticulous and labor-intensive process for the sell side and buy side alike.

Let’s explore some of the traditional methods through which consensus can be generated:

Manual Sell-Side Analysis:

At the heart of consensus creation lies the meticulous work of sell-side equity research analysts. Sell-side equity research analysts play a crucial role in creating consensus by conducting in-depth research and analysis on the companies and industries within their coverage universes. These analysts carefully evaluate financial statements, industry reports, market trends, macroeconomic factors, and company-specific information to develop their forecasts for key financial and operational metrics. These individual forecasts are then averaged across all covering analysts by the buy side and corporations to create consensus for every line item under coverage. By leveraging their expertise and insights, sell-side analysts contribute to the formation of consensus estimates and historicals, which are, in turn, leveraged by corporate and investment professionals to inform their future decisions.

Pro:

- Can choose to leverage estimates only from trusted analysts

Cons:

- Extremely time and resource-intensive

- Line items are not standardized across different sell-side models

- Can be difficult to monitor sudden revisions and other critical changes to models

Traditional Consensus Providers:

Traditional consensus providers offer a consolidated view of analyst estimates by aggregating and analyzing the forecasts from sell-side research reports. These providers employ a process of collecting, adjusting, and aggregating the individual analyst forecasts to determine the consensus estimate for headline financial metrics.

While convenient, their reliance on static sell-side reports, which typically only provide top-level financial metrics, may limit the immediacy of data, sometimes failing to capture analysts’ most current projections.

Pro:

- Consensus estimates are already pre-aggregated, saving time and effort

Cons:

- Consensus is typically only available for the top-level line items that are available within research reports

- Manual work is required for creating custom consensus, as well as consensus on more granular company metrics

Provider-Assisted Manual Aggregation:

An intermediary approach involves providers assisting clients by aggregating forecasts from diverse sources, such as sell-side research reports, investment banks, and brokerage firms, offering a consolidated view. This is a labor-intensive task consisting of aggregating models and creating consensus estimates. This method, leveraging expertise and technology, provides a more auditable consensus estimate while alleviating the labor-intensive burden on clients.

Pro:

- Facilitates more well-rounded consensus while also generating significant time savings

Cons:

- Lack of real-time visibility into changes to individual analyst and consensus estimates

- Manual labor involved may lead to longer wait times from the provider for any updates

While these traditional consensus creation methods can and do serve investment and corporate professionals’ basic requirements, the various limitations of these methods have necessitated the creation of more innovative approaches to generating accurate and timely market consensus data.

Innovations Reshaping Consensus Creation

The Value of Analyst Models

In today’s fast-paced financial landscape, the process of creating consensus estimates can be time-consuming and resource-intensive. However, in addition to the above methods, alternative approaches to consensus creation have emerged, revolutionizing the way data is gathered and analyzed through technology that maximizes efficiency – saving on both time and resources – without sacrificing data quality or freshness. Understanding the fundamentals and mechanics of the actual analyst models becomes paramount in the consensus creation process. Visible Alpha is at the forefront of this innovation, utilizing machine learning algorithms and an in-house team of industry experts to analyze vast amounts of financial and operational estimates and historicals, market trends, and industry KPIs.

Let Us Do the Heavy Lifting

With Visible Alpha, you no longer have to settle for a one-dimensional perspective.

Visible Alpha Insights offers a comprehensive solution that goes beyond the offerings of traditional consensus data providers. Our proprietary consensus methodology is created through pulling data directly from the latest sell-side analyst models, followed by a mix of machine learning and human intervention, and rigorous standards for quality control, empowering you to break free from the consensus echo chamber and explore the full spectrum of market possibilities.

Unlike traditional providers of consensus data, our consensus data – which consists of both estimates and historicals and is normalized at the company and industry level for apples-to-apples comparisons – goes beyond headline financial metrics, with an average of over 160 financial line items and operational KPIs per company. Our data also benefits from high broker source counts, regular updates with each new model received from the sell side, and insight into the full calculation logic and audit trails for each individual line item, ensuring maximum data quality and freshness that you can trust. In addition, Visible Alpha includes insight into analyst trends and dispersions, as well as features such as the Revisions Analysis, Surprise Analysis, Target Price & Ratings, Industry Analysis, and Valuations pages.

In the fast-paced world of finance, time is both your most valuable asset and your greatest adversary. The ability to make timely, informed decisions and spot market opportunities can make or break your success.

Example: Imagine analyzing the technology sector and trying to assess the competitive landscape. Visible Alpha Insights offers you access to both consensus estimates and historical actuals that span several years, giving you the ability to analyze a given technology company’s financial performance and key operational metrics over time. Our Industry Analysis feature then enables you to compare these same metrics across multiple industry peers at the same time, giving you greater insight into the technology sector as a whole. With just a few clicks, you can quickly and easily explore the market, uncover emerging trends, and identify potential investment opportunities that others may overlook.

We understand the value of your time and need for streamlined research and optimized data. Visible Alpha Insights empowers you with precision, freshness, and interactivity, freeing you from tedious and time-consuming research and modeling workflows. With data sourced directly from the analyst models of over 200 broking firms, we handle the heavy lifting of ingesting, analyzing, and normalizing consensus data across the companies and industries that matter to you, so you can devote more of your time and energy to identifying advantageous market opportunities.

Visible Alpha disrupts the traditional paradigm by harnessing advanced technology and a cutting-edge data platform. Through our robust solution, we automate the labor-intensive tasks associated with creating consensus estimates, bringing efficiency and automation to the aggregation and analysis of data. This streamlined approach saves valuable time and resources, empowering users with reliable and comprehensive consensus estimates and actuals.

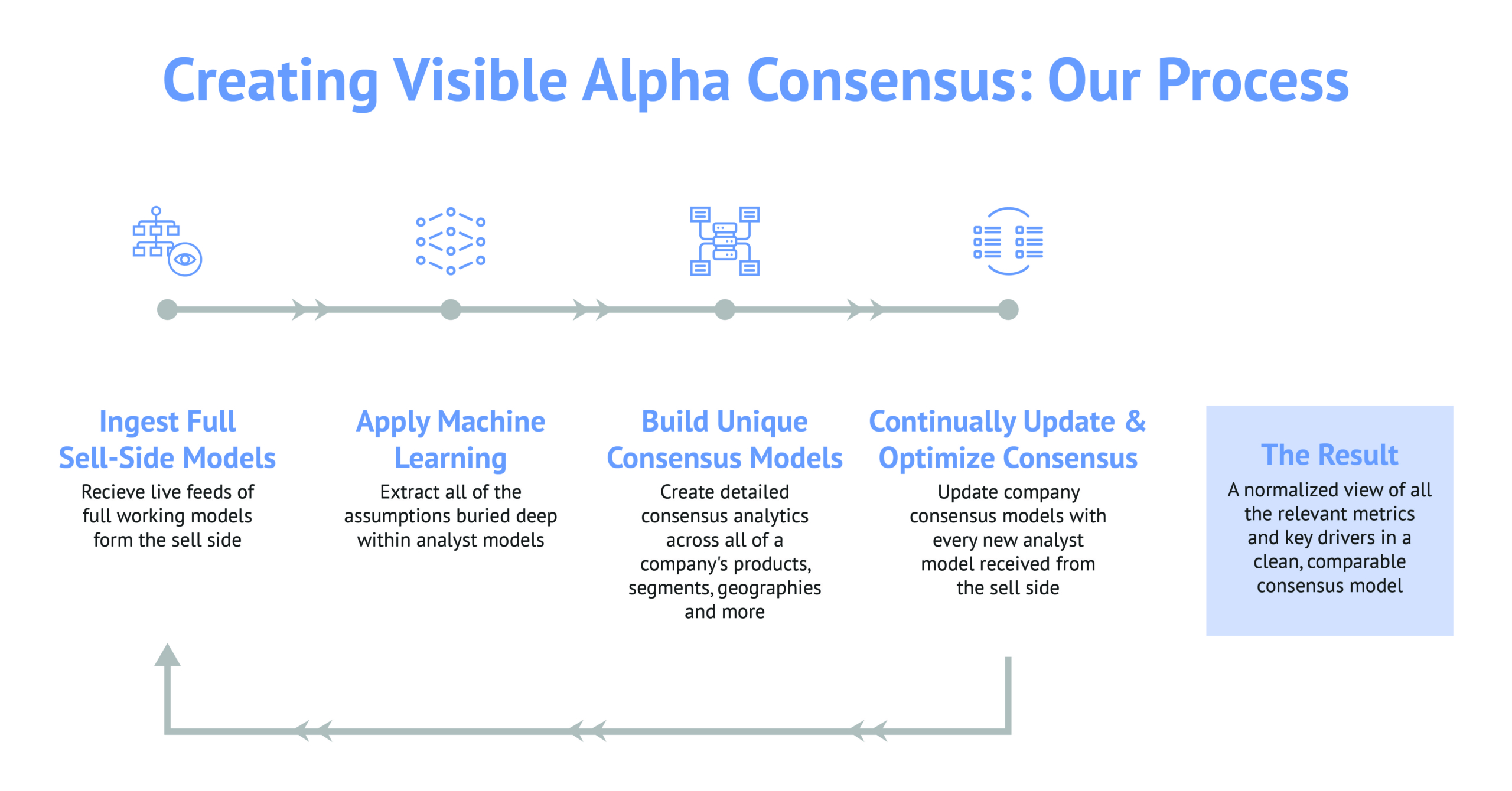

How does Visible Alpha create market consensus?

We first process full working models from the sell side. This involves initially extracting all line items directly from the raw models, presented as each analyst models each line item. We then take this data–line item by line item–and map it to be comparable for each company, including segment-level data, key company drivers, and YoY growth. Lastly, we also make the data comparable across an entire industry, including all financial and operating metrics for easy relative analysis of industry peers. Throughout this process, we apply machine learning and leverage our in-house industry experts to enable detailed, like-for-like comparisons across different analysts’ estimates.

Upon processing a number of analyst models for a given company, we create detailed consensus models across all of that company’s products, segments, geographies, and business drivers. Once the consensus models are uploaded to our platform, we then quickly and continually update any consensus estimates with every new analyst model and revision received. This provides you with a normalized view of all the relevant metrics and key drivers in a clean, comparable consensus model. Most importantly, we tackle the heavy lifting head-on to save you time and ensure the most accurate and timely consensus possible.

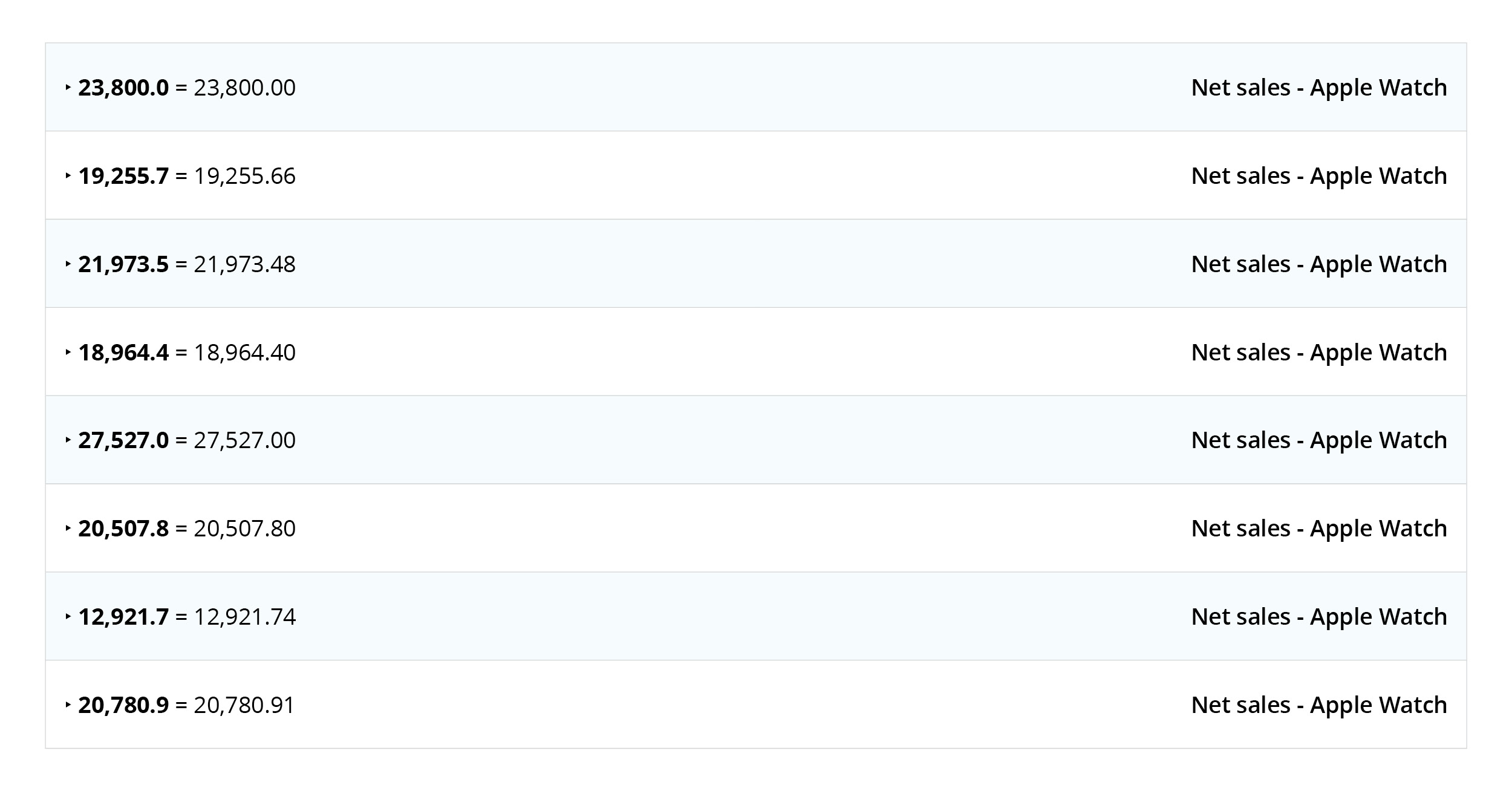

Let’s use Apple (AAPL) as an example. Many analysts covering Apple forecast net sales for the Apple Watch:

By adding all of these estimates together and taking the mean, we find that the FY 2023 consensus estimate for Apple Watch net sales is $19,556.2 million. While the consensus estimates may project a certain level of net sales for Apple Watch, it’s important to recognize that the spread of forecasts from the analyst community holds the true potential for identifying untapped growth opportunities. By exploring the range of forecasts and uncovering the outliers, Visible Alpha enables you to see the real market potential that consensus alone fails to reveal.

With Visible Alpha Insights, you can access consensus estimates with ease, unlocking the power of market insights and gaining a competitive edge. Our advanced technology eliminates the need for cumbersome manual processes, allowing you to make faster, more informed decisions with confidence.