Analysts are forecasting a more opportunistic growth and profitability outlook for U.S. home builders than before the pandemic started. Residential housing is experiencing record demand, as the CEO of Toll Brothers recently stated it to be the strongest housing market in his 30 years of experience. The boom is due in large part to the virus, which increased demand for additional space amid growing work-from-home and social-distancing trends. The timing of Covid-19 induced demand was aligned with an already tight supply of homes and a vast pool of potential buyers, as many millennials postponed homeownership after the 2008 recession. Record low mortgage rates also provide consumers further incentive to purchase a home, and after eight years of consecutive gains in nominal home prices, many current homeowners have profits to move up.

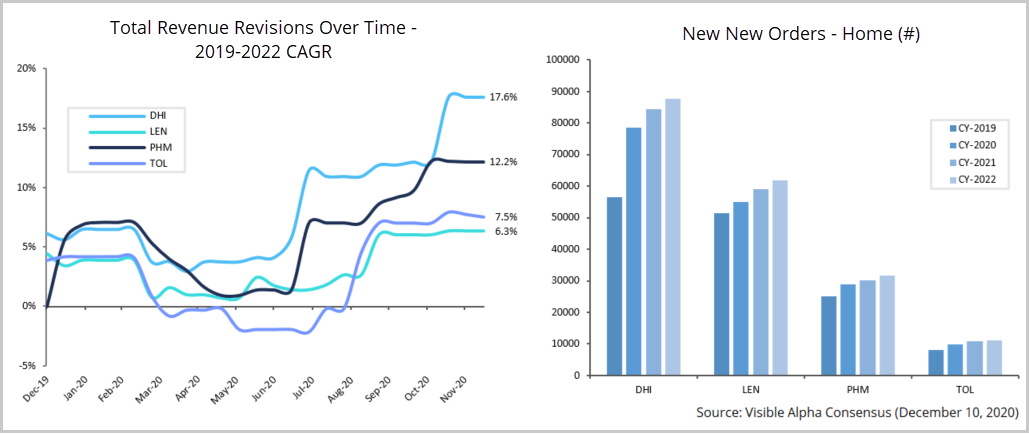

Analysts initially revised estimates lower earlier this year, but in the middle of March there was some realization the impact to consumers could be transitory and less disruptive than initially thought. Growth estimates have since been reinvigorated, and according to Visible Alpha consensus, analysts are now estimating the compounded annualized growth rate (CAGR) for home building revenue from 2019 through 2022 for all large-cap home builders will be higher than before Covid-19 existed.

Analysts estimate D.R. Horton (DHI) will see the most order growth because they already had large exposure to the fast-growing entry-level market. PulteGroup (PHM) has been increasing its mix into the entry-level segment in response to increased demand. Lennar (LEN) has the slowest projected growth estimates due in part to a lower sales mix of affordable homes. Toll Brothers (TOL) operates at the higher-end segment and is more sensitive to the wealth effect, which is why analysts originally revised their estimates lower than peers.

Excel Add-In codes: ‘Total revenue – Home Building’ or ‘S_55509’ : ‘Net new orders – Home(#)’ or ‘S_77827’

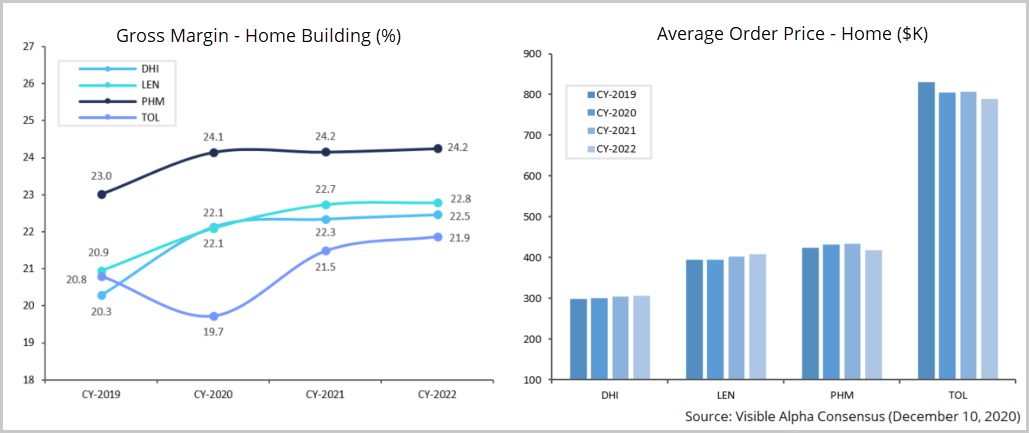

The rising costs for labor and materials such as lumber and copper are weighing on home builder margins, but rising home selling prices – especially in the entry-level segment – are helping to offset higher construction costs. Analysts believe entry-level home prices will outpace more expensive segments, which they view as favorable to DHI. PHM is expected to increase their sales mix of entry-level homes, and analysts have forecasted a significant drop in their average order price per home in 2022. TOL is the least exposed to the secular growth story, but analysts expect they can leverage SG&A investments and improve profitability through 2022.

Excel Add-In codes: ‘Gross margin – Home Building(%)’ or ‘S_67370’ : ‘Average order price – Home’ or ‘S_72252’

For more information on the key performance indicators in the home buildling industry, read our home building industry guide.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.