In our weekly round-up of the top charts and market-moving analyst insights, Generac’s generators are facing a potentially steep drop in residential sales, Alibaba’s computing and infrastructure sales appear poised to double, and wide-body aircraft deliveries from both Boeing and Airbus are expected to take-off.

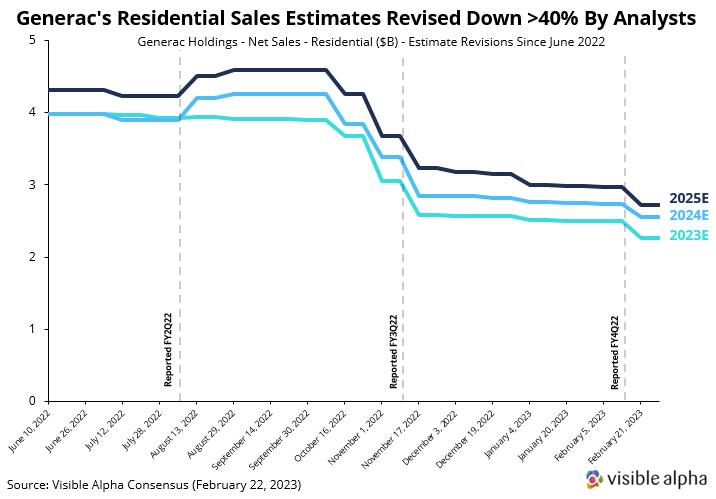

Generac’s Residential Sales Estimates Revised Down >40% By Analysts

Analysts have lowered estimates for Generac’s (GNRC) residential sales by over 40% in the last six months in part due to softening housing demand and higher-than-average field inventory for standby generators. According to Visible Alpha consensus, Generac’s residential segment is currently projected to sell $2.27B this year, revised down from $3.68B last year.

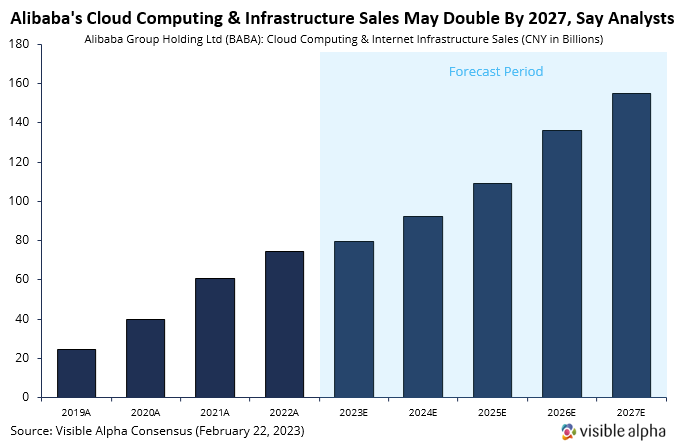

Alibaba’s Cloud Computing & Infrastructure Sales May Double By 2027, Say Analysts

Alibaba’s (BABA) cloud computing and infrastructure revenue is estimated to double by 2027, according to Visible Alpha consensus, as the company is set to benefit from rebounding IT spending as China’s economy reopens. Analysts currently estimate Alibaba’s cloud computing and infrastructure segment will grow to 154.7B CNY by 2027, up from 74.6B CNY in 2022.

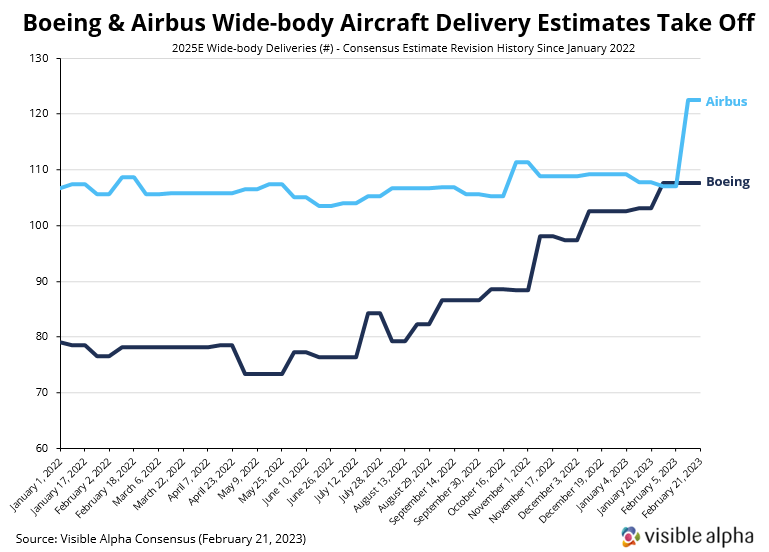

Boeing & Airbus Wide-Body Aircraft Delivery Estimates Take Off

Analysts have been raising 2025E wide-body delivery estimates for Boeing (BA) and Airbus (AIR_FR) since last summer as the industry saw demand returning for long-haul routes that were abandoned during the pandemic. According to Visible Alpha consensus, Boeing is currently expected to deliver 108 787s in 2025, while Airbus is anticipated to deliver 122 A-350s and A-380s.