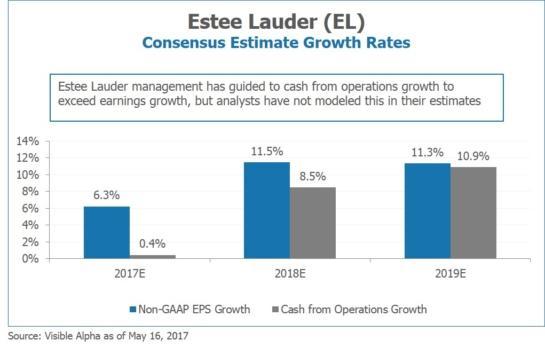

Late last year, on the company’s fiscal 4Q16 earnings conference call, Estee Lauder management noted that they expected cash from operations to grow at a faster rate than earnings growth over the next three years. Much of this was to be driven by an additional $400 million in working capital changes, which in turn was to be generated from closer management of accounts payable, accounts receivable, and inventory.

What do analysts currently have in their models over the next three years? Visible Alpha’s data shows that consensus estimates do not have management achieving their target of cash from operations growth in excess of earnings growth.

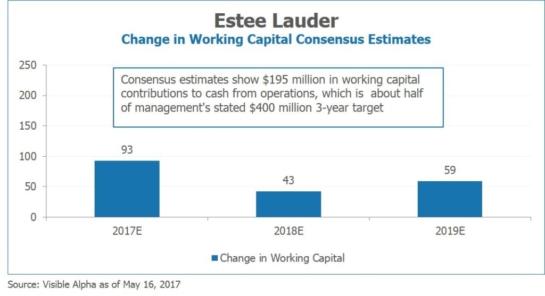

Zooming in further, consensus estimates are only modeling in half of management’s stated goal of $400 million in working capital contributions over the next three years.

Go Beyond Consensus.

Uncover deeper insights within analyst models with Visible Alpha. Request a demo or trial access to our platform.

Some of the shortfall may be due to concern over inventory management (as analysts discussed several times on the fiscal 2Q17 earnings conference call), or it may simply be due to analyst caution. However, revision data suggests that analysts may gradually be turning more bullish, as consensus estimates for changes in working capital have moved up by $26 million over the last three months.