The real estate market is cooling off, and people are increasingly rethinking their recent desire to purchase a new home. The frenzy of home buying sparked by the pandemic — and spurred on by federal stimulus checks and rock-bottom interest rates — launched the housing market into the stratosphere. But with both pandemic anxiety and prices easing, the market is rapidly returning to earth.

New home construction obstacles

Supply chain disruptions are slowing construction and increasing builder costs. Since January, the federal government’s initiative to fight record inflation has interest rates up, creating a significant deterrent for anyone considering taking on a mortgage; “The monthly payment of a median-priced home is at least 66% higher from last year.” Consumers are taking a pass on the purchase of a new home — and builders are decreasing prices to account for increasing order cancellations.

How are home builders faring?

New home prices are higher than they were a year ago, but the combined pressure of pandemic-related supply chain disruptions and delays, fluctuating costs, labor and materials shortages, and the slow market decline over the past few months has builders scrambling to sell new homes that were in high demand a few short months ago.

New homes by the numbers

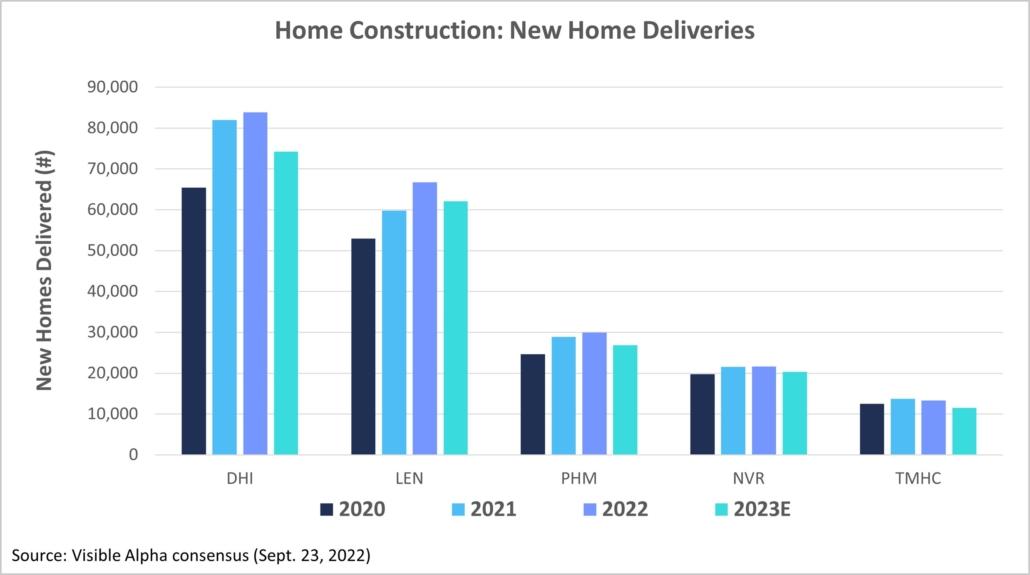

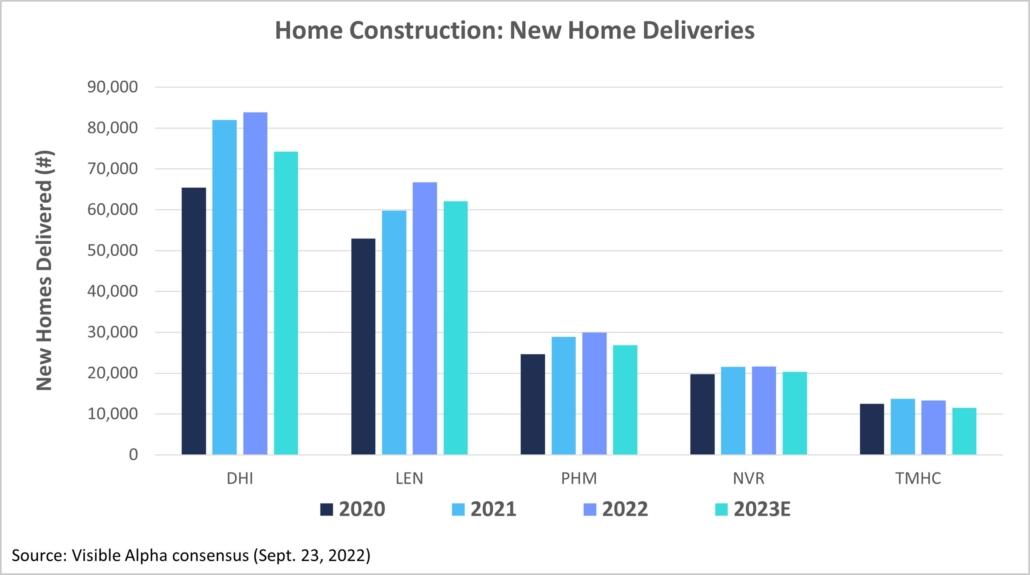

Building a new home is one thing, but finishing, selling, and delivering it in this market is quite another. Over the past few years, D.R. Horton (NYSE:DHI) has continuously increased its number of successful deliveries, selling 25.4% more homes this year than last. Analysts predict single-digit percentage increases in deliveries for D.R. Horton, NVR (NYSE:NVR), PulteGroup (NYSE:PHM), and Taylor Morrison (NYSE:TMHC) in 2023, while Lennar (NYSE:LEN) is expected to deliver 11.9% more homes.

The price of each home sold significantly affects a builder’s profit. While Taylor Morrison has lagged in the number of homes both ordered and delivered, its home prices continue to increase year over year. Home prices increased by 11.8% in 2022 and, analysts predict they will continue to rise by another 19.5% in 2023. Prices are expected to continue to rise year over year, although most builders have increased concessions over the past several months in an effort to spur weakening demand.

The success of a builder’s business also relies on its ability to keep the number of backlogged houses low. No one profits when a builder is unable to deliver on an ordered home. The builder cannot collect revenue on an incomplete house, and the longer it takes to finish an order, the higher the risk of customer cancellation. Most builders experienced a sharp backlog uptick in 2020, but the number of unfinished houses has steadily decreased over the past year. Analysts predict this trend will continue, forecasting 2023 backlog decreases for Taylor Morrison (-15.7%), D.R. Horton (-14.8%), Lennar (-11.6%), PulteGroup (-10.3%), and NVR (-3.4%).

New home construction outlook

In the U.S., the number of new homes ordered correlates directly with housing demand. D.R. Horton received a 38.7% increase in orders from 2020 to 2021. A remarkable leap in less extraordinary times, this growth reflects pandemic era housing trends. Lennar saw its profits nearly double, and Taylor Morrison enjoyed a 43.3% increase in orders in 2021.

Analysts predict D.R. Horton will hold steady in 2023 with an order increase of 1.7%, but the forecast isn’t as sunny for other industry leaders. NVR’s orders are expected to decrease by 0.8% in 2023. Lennar’s orders are forecast for a 1.9% drop, and analysts predict PulteGroup’s orders will decrease by 10.9%. Taylor Morrison — already forecast down 4.4% for 2022 — is expected to drop another 12.7% in new orders in the upcoming year. Recent surveys show builders’ confidence in their ability to sell homes down for the ninth consecutive month. With analysts forecasting decreases in new orders for 2023, many builders are slowing production.

With ongoing inflationary conditions and the corresponding increase in interest rates, the housing market is slowing down across the board. Buyer’s remorse and mortgage hesitance are contributing to new home order cancellations, leaving builders with completed — or nearly completed — homes and no one standing by to pay for them. Discounts and concessions are a popular strategy for builders increasingly desperate to move homes, and analysts predict new home prices will continue to rise year over year, even as demand continues to fall.