Almost everyone shops online. It’s so simple to scroll, click, sit back, and wait for your purchase to arrive. Online retailers range from specialized shopping experiences (e.g., Etsy and Pinduoduo) to giant digital “department stores,” à la Amazon, JD.com, and Alibaba, or sell-everything sites, like eBay. No matter what goods companies have on offer, shopping with online retailers is now second nature to most consumers.

Retail in recent years

eCommerce was a major market before the pandemic. Once the world went on lockdown, demand for online order and delivery went through the roof. But the past year has brought supply chain challenges, slower deliveries, and higher prices. High inflation and recession fears are fueling consumer hesitation.

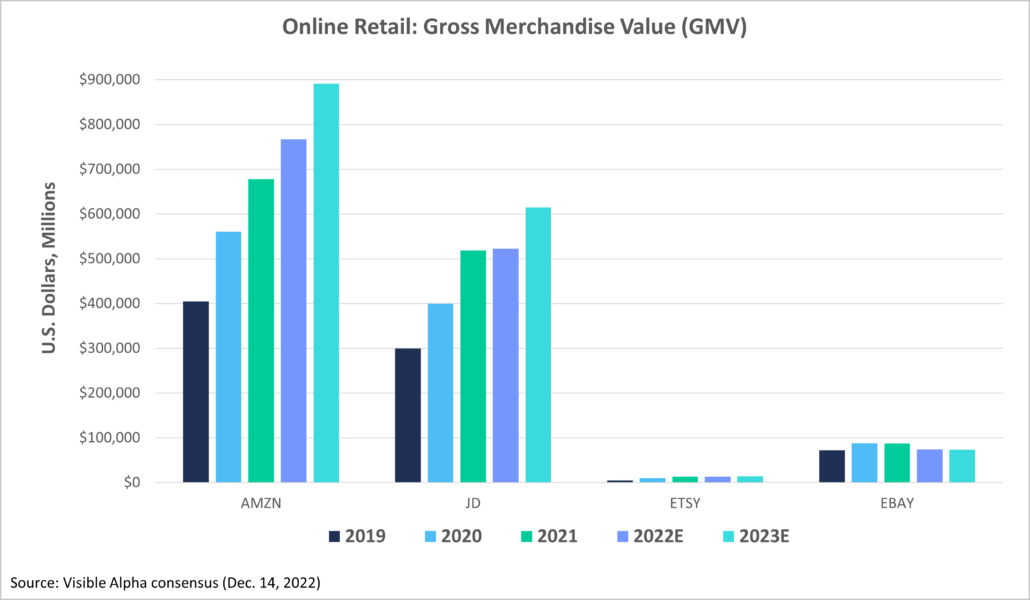

Retail merchandise value

One key metric for analyzing online retailers is their gross merchandise value (GMV), which is the total value of merchandise sold over a given period. GMV is a primary indicator retail analysts examine when assessing the performance of online retailers. How did our sample set of online retailers’ GMV fare in recent years?

Unsurprisingly, Amazon (NASDAQ:AMZN) shows an upward trajectory. In 2020, its gross merchandise value grew by 38.3% year over year (YoY), but while it continues to trend upward, its rate of growth has slowed, dropping to 21.0% in 2021 and 13.1% in 2022. Amazon has announced plans to assess its various business sectors with the goal of pausing or canceling those proving unprofitable. Still, analysts predict a GMV increase of 16.2% YoY in 2023.

JD.com (NASDAQ:JD) enjoyed growth in GMV in 2020 (+25.3%) and 2021 (+26.3%). After faring well into 2021, the retail giant’s GMV growth decreased to 10.6% in 2022. JD.com has responded to recent economic challenges with lean initiatives to reduce operating costs across the board, including marketing and general administration expenses. Analysts forecast GMV growth at 17.7% YoY in 2023.

Etsy (NASDAQ:ETSY) enjoyed astronomical growth during the pandemic — reporting a 106.7% YoY increase in 2019. After a slight dip (-3.3%) in 2020, analysts predict Etsy’s GMV will increase 7.8% YoY for 2023.

While most online retailers have seen tremendous GMV growth, eBay’s (NASDAQ:EBAY) dropped over the past few years. In 2020, it grew by 21.5% YoY but has since decreased, down by 15.3% YoY in 2022 alone. To respond to this decline, eBay is currently working on platform improvements, including better photo and video tools to help sellers create a more interesting sales experience. Analysts predict its GMV will drop by another 0.3% in 2023, but the company is optimistic about its new investments improving growth in the long term.

eCommerce and consumers

Another key performance indicator (KPI) is customer activity. An increase in active customers was expected in 2020, as online retail became an essential business during lockdowns. It’s also reasonable to expect that increasing inflation and a slowdown in consumer spending will cause most online retailers to see a decrease in active customers. That’s exactly what happened for Alibaba (NYSE:BABA). While its overall customer base is growing, the rate of growth has steadily decreased since 2020. It dropped from 11.7% YoY in 2020 to 6.7% YoY in 2022. And analysts predict it will drop again to a mere 4.7% increase in 2023.

JD.com saw significant growth between 2019 and 2020. Its active customer base grew by 30.4% YoY. But come 2022, growth had slowed to only 1.1% YoY. Meanwhile, Amazon’s customer base has zig-zagged through the past few years. In 2020, it rose by 12.3% YoY, but it completely stalled in 2021 — at 0.0%. Its customers were active again in 2022 (+10.4%), but analysts predict it will only experience a 5.1% increase in 2023.

After a slight increase in 2019, eBay’s customer activity has slowed over the past few years, and analysts predict it will continue to decline in 2023. Etsy’s customer activity grew by 76.7% YoY in 2019. It took a slight dip in 2022, but analysts predict it will gain ground again in 2023.

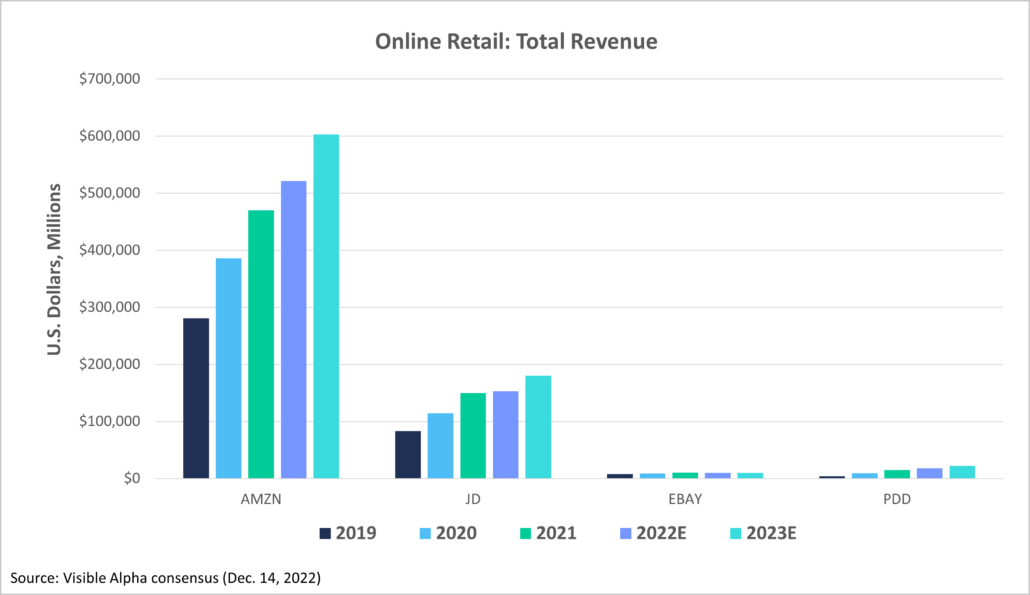

Retail and total revenue

GMV and active customers point to a company’s success, but nothing showcases it more than total revenue growth, and in recent years, Amazon’s has nearly doubled. Amazon’s total revenue increased by 37.6% YoY in 2020. After a slight leveling-off in 2022, analysts predict Amazon’s revenue will grow by 15.6% in 2023.

In 2020 alone, Pinduoduo’s (NASDAQ:PDD) revenue grew by 97.4% YoY. Since then, its rate of revenue growth has steadily declined, dropping from 57.9% in 2021 to 32.3% in 2022. In response, Pinduoduo has postponed several projects and cut as many low-priority expenses as possible.

JD.com has seen a similar slowdown in revenue growth. This past year might be its lowest dip (at 12.2% YoY in 2022), but analysts predict its revenue will grow by 17.6% YoY in 2023. Alibaba is also experiencing a decline in growth. It gained 40.7% YoY in 2020 but saw that drop to 6.2% in 2022. Analysts predict it will grow by another 12.1% in 2023.

Interestingly, even with its decrease in both GMV and active customers, eBay’s revenue grew by 25.3% YoY in 2020. With all the economic challenges of 2022, eBay’s revenue growth dropped into the red (-6.6% YoY), but analysts predict it will be back in the black in 2023.

Online retail outlook

Heading into the holidays, and one of the industry’s busiest times of year, inflation and supply chain issues have had significant effects on even the most prominent online retailers. Analysts predict a modest increase in overall growth for 2023, and with companies making moves ranging from employee layoffs to platform improvements, online retailers appear ready to get back in the game.