It’s no secret the cost of a week’s worth of groceries has significantly increased. The overall price of packaged goods is at a forty-year high, with the average cost of groceries alone up 12% in twelve months — the highest increase since 1979.

From June 2021 to June 2022, the price of eggs rose 33%, butter 21%, chicken 20%, oranges 11%, and ice cream 13%. Most consumers are adjusting accordingly by swapping out beef for chicken, turning to other protein sources altogether, and shopping more store brands and discount deals to keep costs low.

In such a hot market, consumer packaged goods companies (CPG) need to be both nimble and wise in their decisions. Every part of the business — from packaging and advertising to shipping and labor — is more expensive, and companies are raising prices to cover costs while also working to keep prices reasonable to avoid scaring away shoppers.

Higher prices, creative incentives

So far, even with every major packaged food company raising its prices, sales remain strong, but the impact of inflation on input costs is piling pressure onto already narrow packaged food margins. Nestlé (OTCMKTS:NSRGY) increased its prices by 6.5% in the first half of 2022, and while its profits decreased, its sales exceeded analyst expectations. General Mills (NYSE:GIS) and Kraft Heinz (NASDAQ:KHC) increased their prices and reinstated regular promotions after pausing them during the worst of the pandemic. General Mills launched a brand loyalty program through the Fetch Rewards app, and Kraft Heinz got creative with its Art of the Burger campaign and $1 grilled cheese sandwich nights.

Packaged food predictions

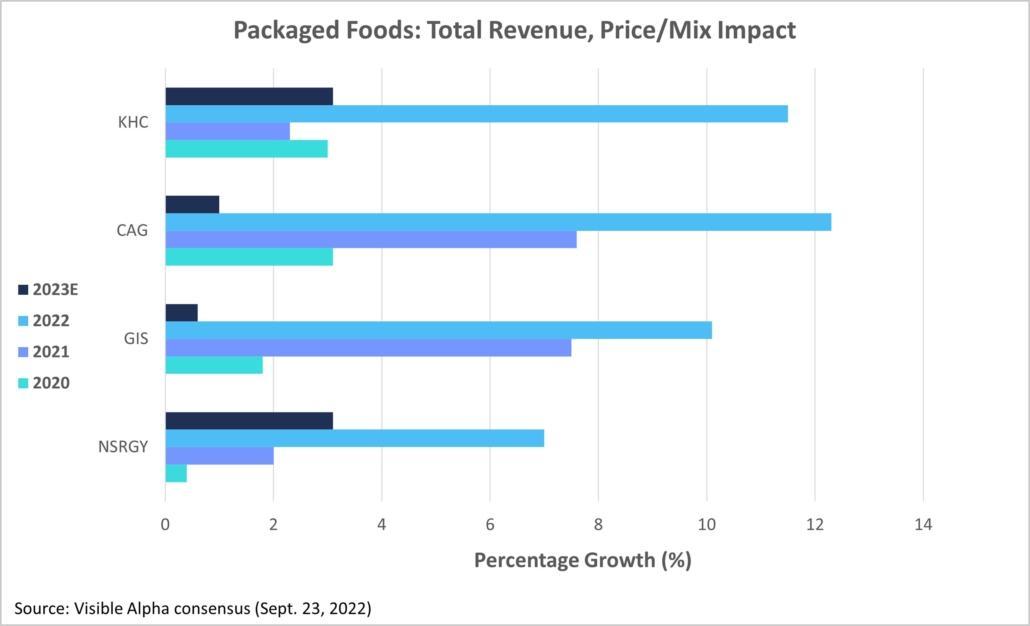

Price/mix impact total revenue is the impact on total revenue of:

- Changes in the prices of the products sold

- The impact of selling different product amounts at different pricesGeneral Mills showed a substantial increase of 5.8 points in 2022, and analysts predict it will have a more minor increase in 2023. Conagra gained 3.6 points in 2022 but is expected to drop 1.1 points in 2023. Nestlé and Kraft Heinz, on the other hand, are predicted to enjoy significant increases in 2023, with analysts forecasting gains of 3.4 points for Nestlé and 7.1 points for Kraft Heinz.

As consumers feel the financial strain, most CPG companies have already experienced a decrease in sales volume, and analysts expect it will continue to decline in 2023. After a jump in 2019, General Mills experienced two years of decline and is expected to drop another 1.9 points in 2023. Kraft Heinz has seen similar decreases in the past two years. Nestlé has fared the best, holding steady with small gains since 2019, but analysts predict Nestlé will finally see its own decline — of 4.2 points — in 2023.

Organic growth refers to sales growth excluding any impact from currency movements or acquisitions. For Nestlé, organic growth was minimal from 2019 to 2020 but jumped 3.9 points for 2022. Still, analysts are forecasting a 0.8-point loss for 2023. Despite a significant increase from 2019 to 2020, analysts predict a slight 2023 decrease for General Mills as well. Conagra’s (NYSE:CAG) organic growth has slowly decreased since 2019, and analysts expect this trend to continue next year.

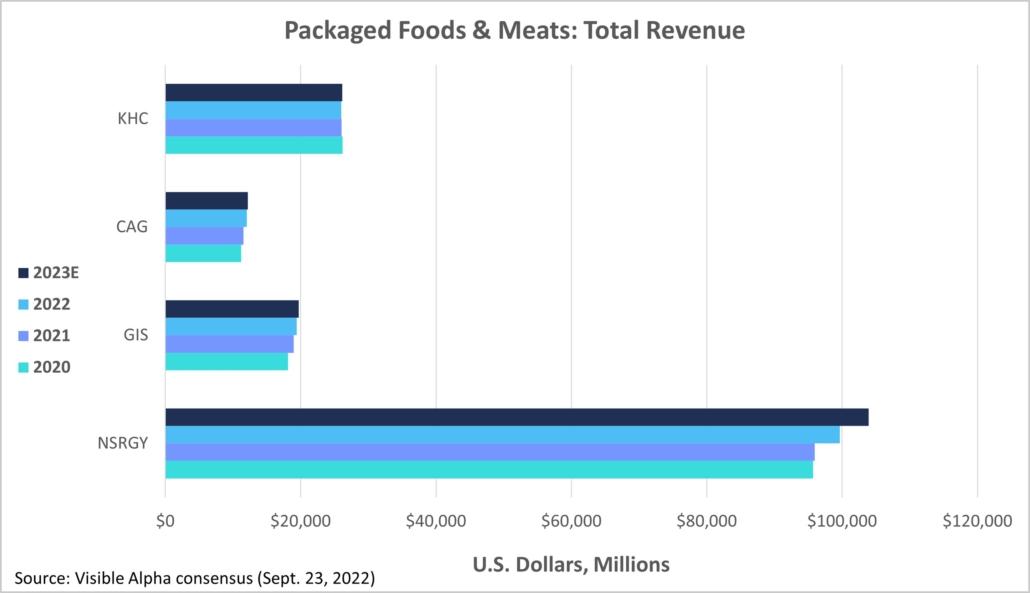

Overall total revenue forecasts predict mostly flat or slight, if any, increases through 2023. Nestlé comes out on top again with an 8.7% year-over-year increase predicted for 2022 and an additional 4.3% boost in 2023. Kraft Heinz comes in last with analysts predicting a 0.1% decrease for 2022 and a mere 0.6% increase forecast for 2023.

CPG outlook

Gas prices declined 7.7% in July, and the U.S. Department of Labor expressed the hope that cheaper gas will help to offset higher grocery bills, even as some economists insist high food prices will stick around for a while. Meanwhile, CPG companies, and the packaged food industry, are measuring rising input costs against consumer needs — with an eye toward raising prices to offset inflationary pressure — and charting a more balanced course for 2023.