Dick’s Sporting Goods (DKS)

After numerous years of bankruptcies and heightening concerns from the ascent of e-commerce, investors are beginning to see value again in brick and mortar retailers.

A Renewed Interest in Brick and Mortar Stores

The renewed interest was best exemplified by Amazon’s recent announcement that it would acquire Whole Foods for $13.7 billion. The announcement was noteworthy for several reasons. Amazon is the largest online retailer, and it has helped put numerous brick and mortar chains out of business. Up to this point, Amazon has shunned having a nationwide physical presence. The acquisition was an implicit admission that brick and mortar stores carry significant value, at least in the grocery space.

There has been interest among investors for other brick and mortar retailers as well. Reuters noted that Sycamore Partners was in advanced discussions to take Staples private. There were also reports that the Nordstrom family was looking to take Nordstrom private.

A Focus on Dick’s Sporting Goods

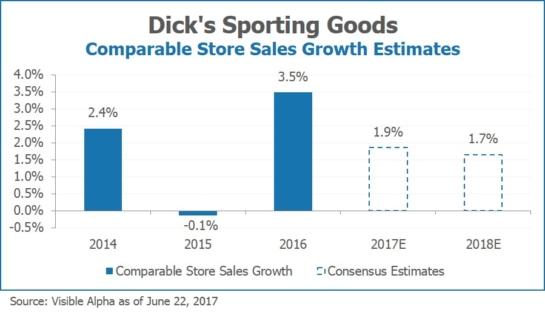

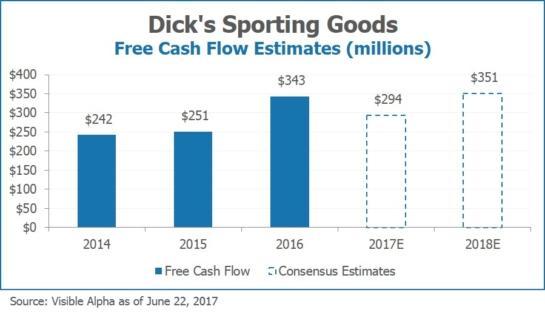

In this environment, attention has also turned to Dick’s Sporting Goods. The stock has underperformed, struggled with top-line growth, but generates strong free cash flow. Dick’s attractiveness to private equity will depend on its comparable store sales outlook and free cash flow prospects.

Visible Alpha’s consensus data shows that the outlook for both metrics is fairly stable. Analysts expect comps to decelerate slightly but remain positive for the next two years.

Uncover trends hidden in analyst forecasts with Visible Alpha. Request a free trial today!

A similar outlook exists for free cash flow, where analysts expect a fairly stable free cash flow outlook.

With stability comes a higher price tag, however. It remains to be seen whether valuation is attractive enough for special situation investors to get involved.