Innovation and Expansion: Visible Alpha in 2023

As we welcome 2024, we reflect on a pivotal year at Visible Alpha — a year not just of growth, but of meaningful evolution. In 2023, we significantly expanded our services and refined our platforms to better serve the needs of financial professionals worldwide. But what does this mean for you, and why are these developments important?

Understanding Visible Alpha’s Role and Impact

Visible Alpha specializes in creating consensus data with unparalleled granularity and transparency, by extracting forecasts, assumptions, and logic from comprehensive sell-side models. This process involves compiling and analyzing vast amounts of data, including detailed financial models, research reports, and market forecasts, to offer a clear view of the financial landscape.

Our goal is to provide financial professionals with clear, comprehensive insights that are crucial for making informed investment decisions.

Why Partnerships and Coverage Expansion Matter

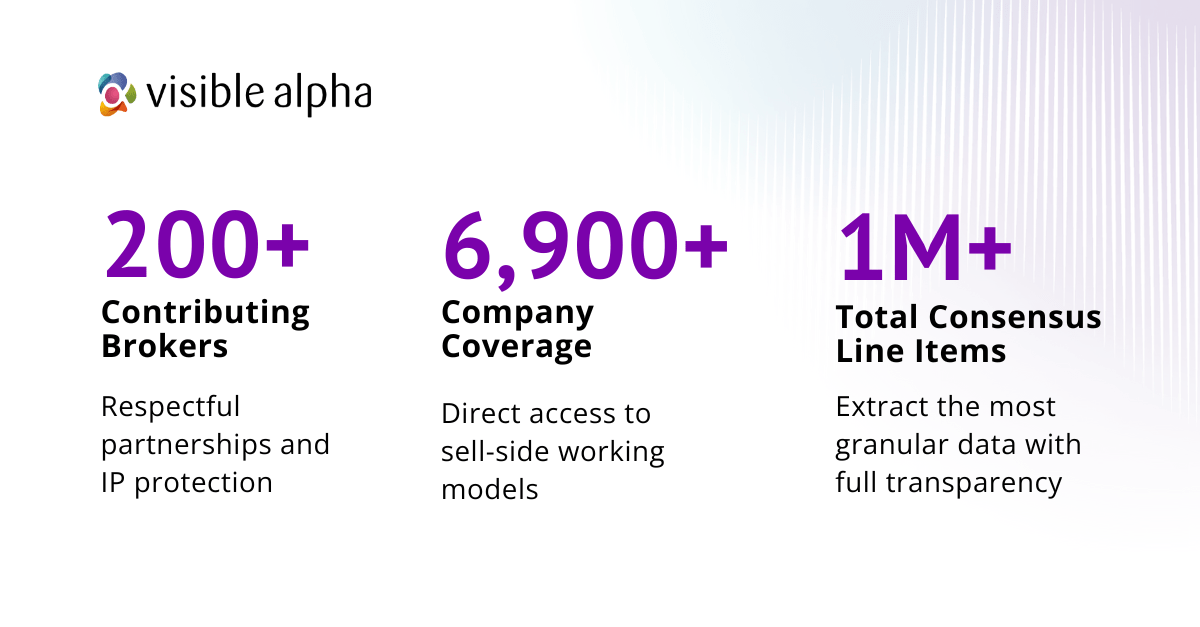

In the past year, we’ve enhanced our services by significantly increasing our global partnerships, notably surpassing 200 sell-side contributors, with 44 new broker partnerships across the globe, including a strong presence in the EMEA and APAC regions. This expansion is not just about numbers. It represents a deeper, more diverse array of market insights that can transform the way financial professionals develop and communicate investment strategies with confidence.

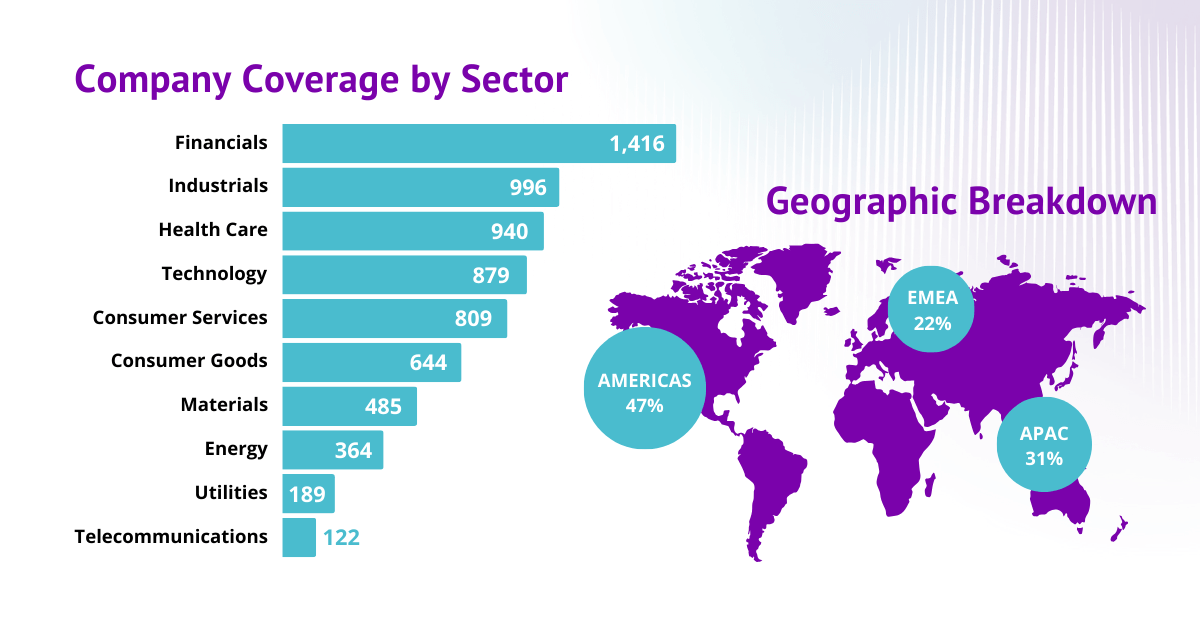

Building on this momentum, our company coverage continues to show robust growth year over year. This past year, we’ve expanded our coverage to over 16,745 companies, with consensus coverage increasing from 6,402 companies to 6,900+. Globally, we have over 26 million total analyst line items and 1 million total consensus line items.

Data Trends

No matter your role in the world of finance, the Visible Alpha Insights platform equips you with unparalleled data and analysis tools. These tools significantly enhance decision-making by offering detailed insights into company performance across various sectors. We looked into what sectors and tickers captivate our users. This past year, buy-side user engagement metrics showed keen interest in sectors such as financials, health care, industrials, and technology, with companies such as Netflix, Amazon, Microsoft, Google (Alphabet), Apple, and Meta leading searches in their respective sectors.

User Perspectives

The feedback from our clients underscores the value that Visible Alpha brings to the table, especially in refining business strategies and aiding critical decision-making processes. Our clients often highlight how the platform’s granular consensus data and access to analysts’ models facilitate deep dives into market trends, tracking shifts, and interpreting sentiment changes with greater efficiency. A standout feature that garners frequent praise is the Visible Alpha Excel add-in, known for its ability to simplify and accelerate intricate data analysis, thereby freeing up time for more strategic pursuits.

Users highlight how Visible Alpha is more than a tool; it’s a strategic partner in navigating the complexities of market analysis and business decision-making. This viewpoint is best expressed through our clients’ statements:

|

“Visible Alpha lets me analyze my payment processor competitors, monitor covering brokers’ perspectives, and easily track revisions to spot changes in market sentiment before my shareholders do.” – Thomas McCrohan, EVP Investor Relations, Shift4 |

| “Visible Alpha is the best source for reported/consensus non-GAAP metrics which, for REITs, is everything. The Excel add-in promotes complex cross-coverage analyses not practical without automation.” – Waterfront Capital Partners ($635m AUM) |

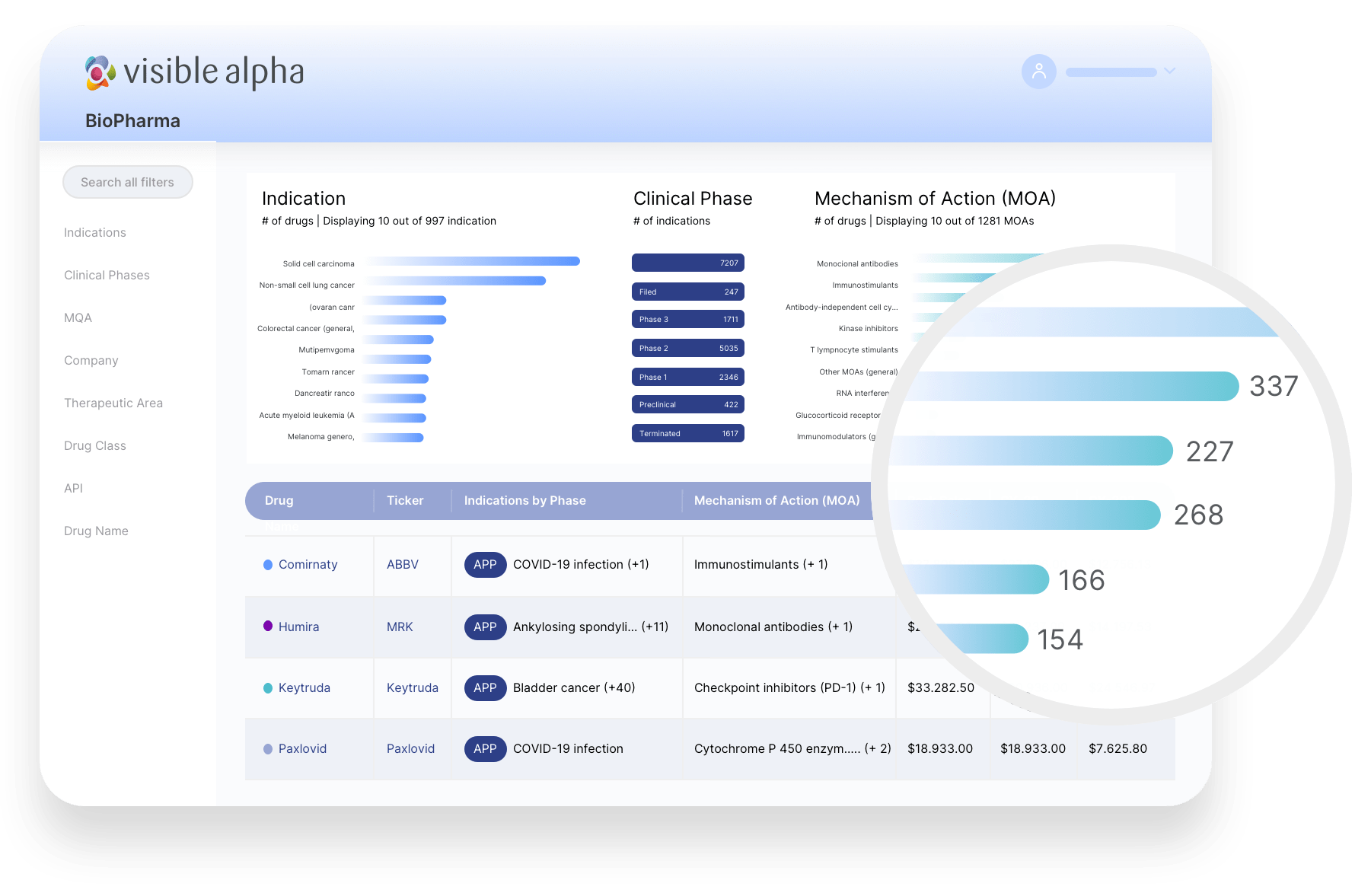

Introducing Visible Alpha BioPharma

We’re excited to announce the launch of Visible Alpha BioPharma, a standalone addition to our suite. This new product is specifically designed to meet the unique needs of professionals in the pharmaceutical and biotech sectors, offering a new dimension of market data analysis.

Alongside this significant development, we have also made several focused updates to our Visible Alpha Insights platform. Key among these are the Industry Analysis and Target Price & Ratings features, further enriching the user experience and data accessibility.

Visible Alpha BioPharma

Visible Alpha BioPharma represents more than just a new product – it’s a bespoke solution designed for professionals grappling with the pharmaceutical and biotech sectors’ unique challenges. Recognizing the challenges posed by rapid drug development innovation, ever-changing regulatory environments, varied clinical trial outcomes, and market volatility, BioPharma steps in as a crucial resource. This platform goes beyond offering comprehensive drug data and granular consensus estimates; it’s a strategic tool that empowers investment professionals with the deep insights needed to make informed decisions in a sector that’s constantly evolving.

With BioPharma, users gain the ability to swiftly identify emerging opportunities, assess market competitiveness, understand market expectations, and delve into detailed historical data and forward-looking estimates. This powerful add-on to Visible Alpha Insights enables you to conduct rapid analysis at the individual drug level, ensuring you’re equipped with the targeted, actionable insights essential for staying informed and ahead in this dynamic field. Leverage BioPharma today, and transform the way you navigate the intricacies of the pharmaceutical and biotech industries.

New Visible Alpha Insights Features

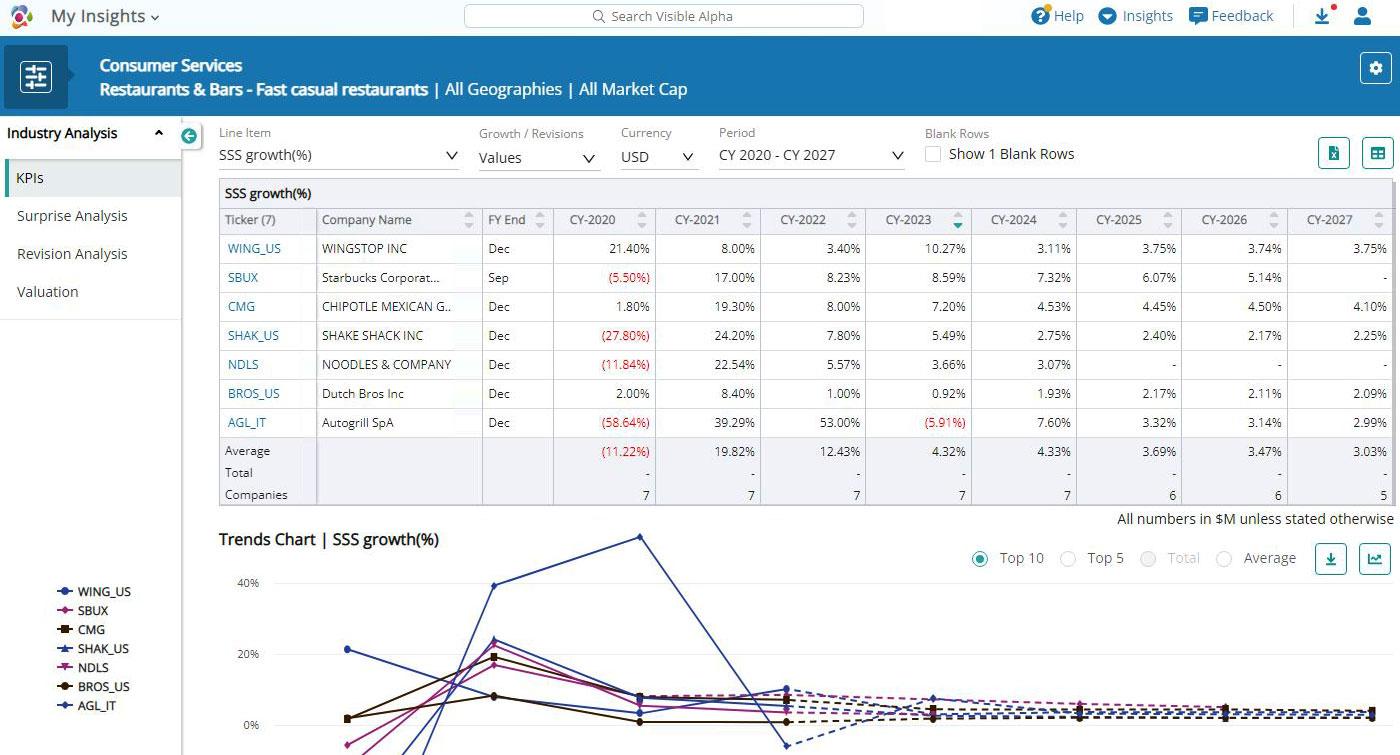

Industry Analysis

The Industry Analysis feature is a game-changer for users looking to stay ahead in their market strategies. It enables a deep dive into industry trends and growth trajectories, allowing you to identify key competitors and benchmark against them. With this tool, you can quickly compare peers using the most relevant performance indicators, tailored to each industry’s unique landscape. This is about empowering you with the ability to make faster, more informed decisions by offering a comprehensive view of companies within the same industry or sub-industry. Additionally, with the inclusion of filters for specific geographies and company sizes, you can tailor your analysis to fit your precise market focus. This feature transforms your approach to industry analysis, making it more efficient, targeted, and strategically sound, ultimately giving you a competitive edge in your market planning and execution.

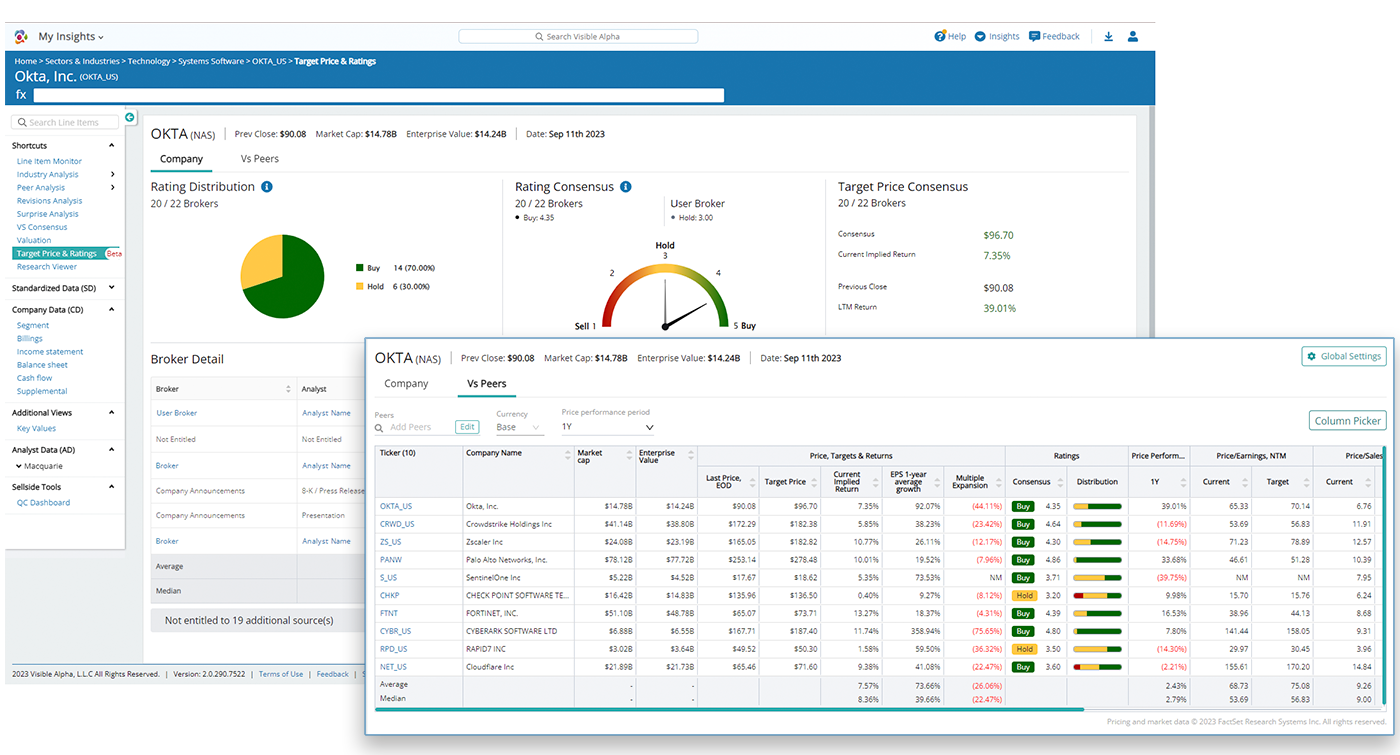

Target Price & Ratings

The Target Price & Ratings feature enables users to easily determine market sentiment – and the drivers behind it – toward a specific company or industry peer group through an easy-to-read overview of broker expectations for a company’s performance. With this feature, viewers can see the various analysts covering a company, along with their individual target price and rating values, and then compare these ratings with some of the company’s closest competitors.

Book a demo to see Industry Analysis and Target Price & Ratings in action.

The Road Ahead

Every feature we introduced, every partnership we formed, was done with a singular focus: to empower our clients with the tools and insights necessary to thrive in a rapidly changing market landscape. Your feedback has been the cornerstone of our evolution, guiding us to refine our services in ways that directly benefit your workflow and decision-making processes.

Looking ahead, Visible Alpha is poised to introduce further enhancements to our existing solutions like BioPharma distribution pages and updates to our entitlements platform. These enhancements are not just additions to our platform; they are reflections of our dedication to staying at the forefront of market intelligence, ensuring that you always have access to the most advanced tools and data.

Stay informed with Visible Alpha by subscribing to our newsletter. You’ll receive the latest product updates, expert analysis, and in-depth market trend insights, all enhanced by the comprehensive data that only Visible Alpha can offer.