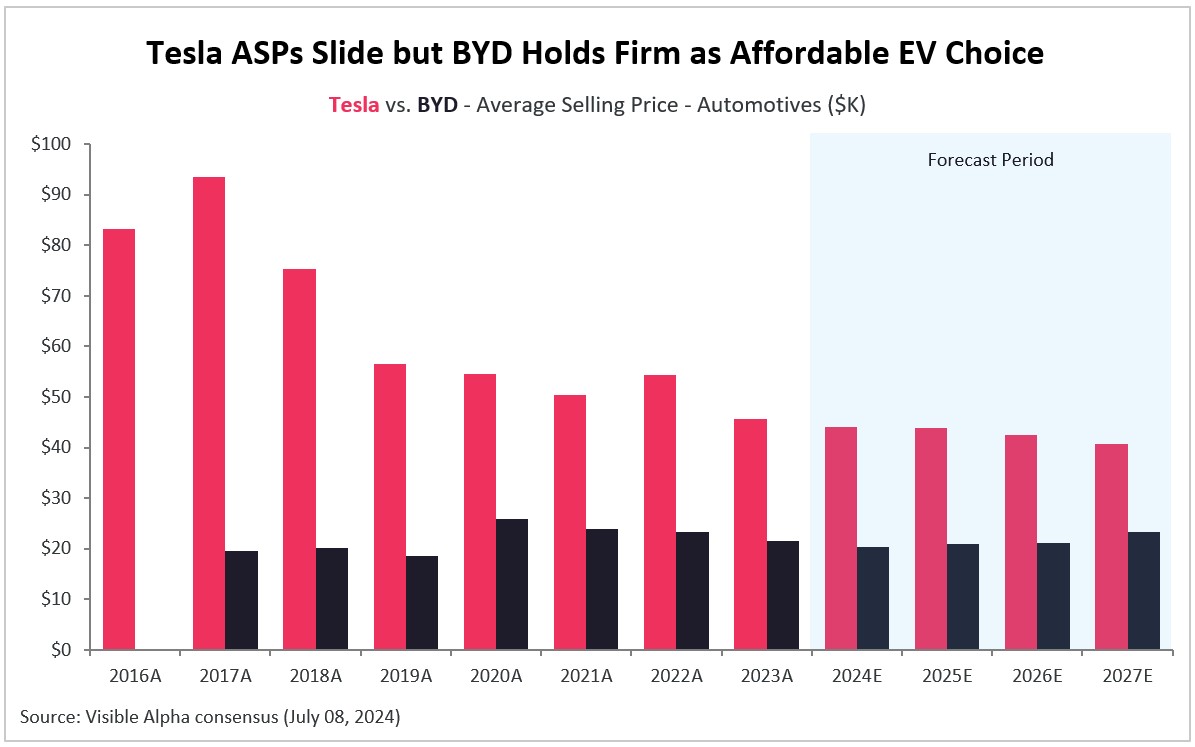

On the long list of rivalries between the U.S. and China, electric vehicles (EVs) have enjoyed an increasingly prominent role, mainly led by two players: Tesla (NASDAQ: TSLA) and BYD (SZSE: 002594). Tesla, a pioneer in the EV market, has traditionally focused on premium quality and performance, often catering to the higher-end market segment. In contrast, BYD has adopted a growth-first strategy, emphasizing affordability and wide market penetration.

BYD’s rise and Tesla’s strategic shift in the global EV market

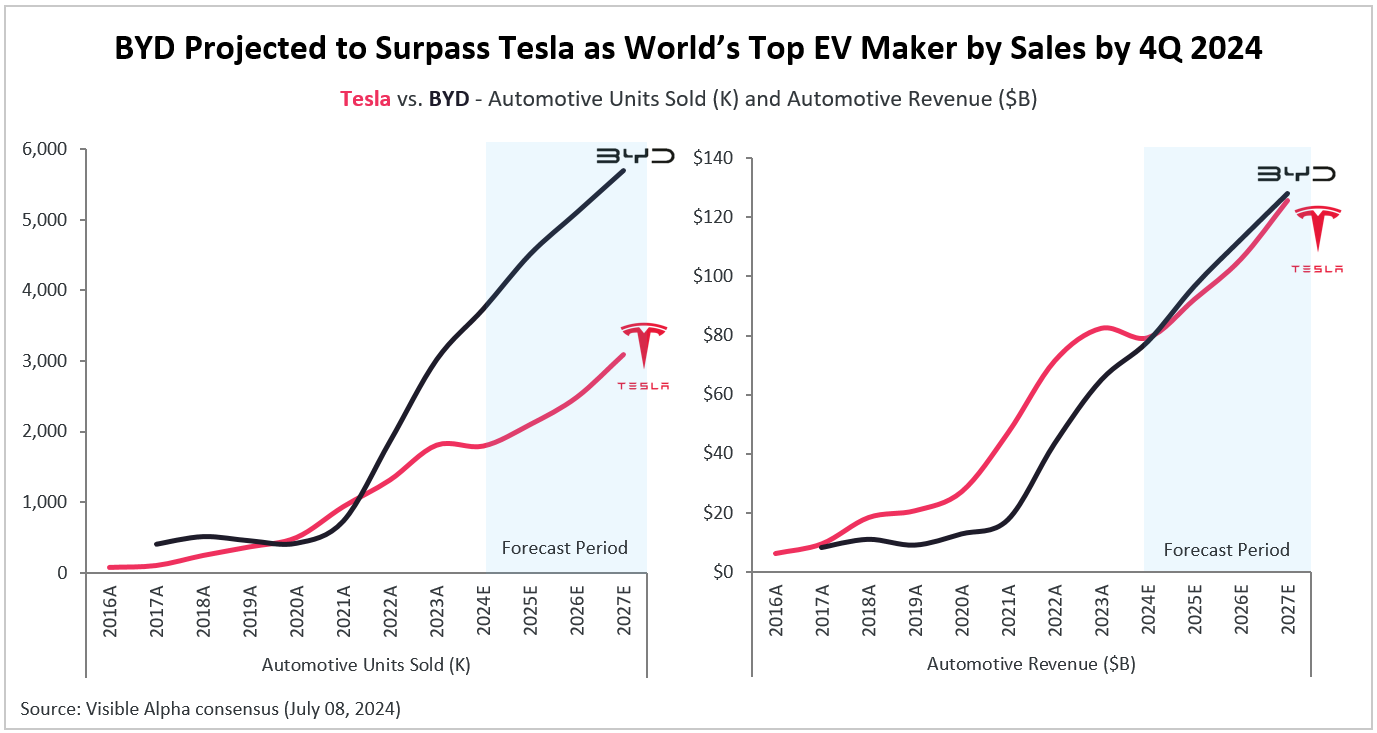

BYD surpassed Tesla in terms of the number of cars sold globally as early as the second quarter of 2022. The company is expected to sell 3.7 million vehicles in 2024, 1.9 million more than the estimated 1.8 million vehicles to be sold by Tesla. Despite this gap, Tesla has so far remained the largest EV player by sales. However, based on Visible Alpha consensus estimates, BYD is projected to drive past Tesla as the world’s top EV maker by sales in the fourth quarter of 2024, marking a significant milestone in the rivalry between the two companies.

Tesla’s automotive sales in 2024 are estimated to decline by -4% year over year to $79.1 billion, impacted by declining average selling prices (ASPs) and reduced deliveries, mainly of its Model 3 (-6.2% YoY), Model S (-5.3% YoY), and Model Y (-3.1% YoY) vehicles. In contrast, BYD sales growth is projected to remain strong at +23%, clocking in automotive revenues of $77.9; $1.2 billion lower than that of Tesla.

Analysts expect Tesla’s automotive sales to rebound in 2025, increasing by +16% from the previous year, driven by improved deliveries and production from the ongoing ramp-up of Tesla’s new factories in Texas and Germany. To compete with the growing number of inexpensive EVs, including those from China’s BYD, Tesla is also switching up its strategy and expanding its affordable offerings. The company plans to launch the Model 2 in 2024 and its compact series in 2025, which are expected to be priced lower than the Model 3 sedan, its cheapest car yet. The Model 3 has a projected average revenue per user (ARPU) of $37K in 2024. The Model 2 and compact series are anticipated to have an ARPU of $31K and $32K, respectively, in 2025.

Global EV competition: Chinese giants surge ahead of U.S. rivals

Taking a closer look at other EV manufacturers in the two countries reveals a dynamic similar to the Tesla versus BYD narrative. Chinese EV makers such as Li Auto (NASDAQ: LI), Nio (NYSE: NIO), and XPeng (NYSE: XPEV) have gained a substantial lead in the race, largely due to over a decade of support from Beijing through subsidies, tax breaks, and consumer incentives. Li Auto leads this group with an estimated automotive revenue of $19.7 billion in 2024, marking a 19% increase year over year. Nio follows with expected automotive sales of $8.3 billion (up +22% YoY), while XPeng is estimated to generate automotive sales of $5.5 billion, reflecting a +42% growth.

While U.S. EV companies Rivian (NASDAQ: RIVN) and Lucid (NASDAQ: LCID) are anticipated to see strong sales growth in the forecast period; they currently lag behind their Chinese counterparts. Rivian (NASDAQ: RIVN), is projected to generate $4.6 billion in automotive sales in 2024 (a modest +6% YoY increase), but is expected to see growth accelerate starting from 2025. Analysts expect Rivian to surpass XPeng in automotive sales by 2027, and Nio by 2028, positioning itself as the fourth largest pure-play EV player globally, trailing only BYD, Tesla, and Li Auto.

Meanwhile, Lucid (NASDAQ: LCID) is forecasted to experience a significant surge in automotive sales as well, with a projected +21% increase in 2024, driven by higher units sold on the back of declining average selling prices (ASPs). Similar to Tesla, Lucid is also cutting its prices to boost sales. Analysts expect Lucid’s ASPs to decline by -17% year over year in 2024, having declined by -29% last year. The company’s ASPs have gone down from $184K in 2021 to an estimated $83K in 2024, and are expected to drop further to $71K by 2028.

China’s strategic advantages power its EV market leadership

While Rivian and Lucid adopt alternate strategies to boost sales in a market that is already pressured by higher lending rates and difficult economic conditions, China’s dominance in the EV supply chain is supported by key advantages including access to critical resources such as graphite and government support. China has a monopoly on several key materials used in battery production. Furthermore, the government in China has long offered both direct subsidies to automakers and tax exemptions for consumers, while also investing in building a robust public EV charging infrastructure.

This advantage has allowed Chinese EV companies to offer competitive pricing while still incorporating more powerful batteries and advanced technology. As a result, these companies have historically led in high-volume deliveries. Analysts anticipate strong delivery volumes for both U.S. and Chinese EV pure-plays in the forecast period. However, Chinese companies are expected to significantly outsell their U.S. counterparts.

The growth story of Chinese EV manufacturers, though, is not without challenges. In early June, the EU revealed plans to impose extra tariffs, potentially as high as 38%, on imported EVs from China, in addition to existing 10% car tariffs. This decision follows the U.S. announcement last month of increased tariffs on Chinese EVs and clean energy products, including 100% tariffs on EVs and 25% on EV batteries. Similarly, Canadian authorities have proposed additional tariffs on Chinese-manufactured EVs and batteries, mirroring actions by the U.S. and EU to curb the influx of lower-cost imports from China.