Experts say the consumption of alcoholic beverages rose significantly during the pandemic, but there hasn’t been nearly as much news on how the industry fared as a result. How did companies that brew, distill, distribute, and sell alcoholic beverages do over the past few years? And what do analysts predict for the alcoholic beverages sector in the New Year?

Drink up?

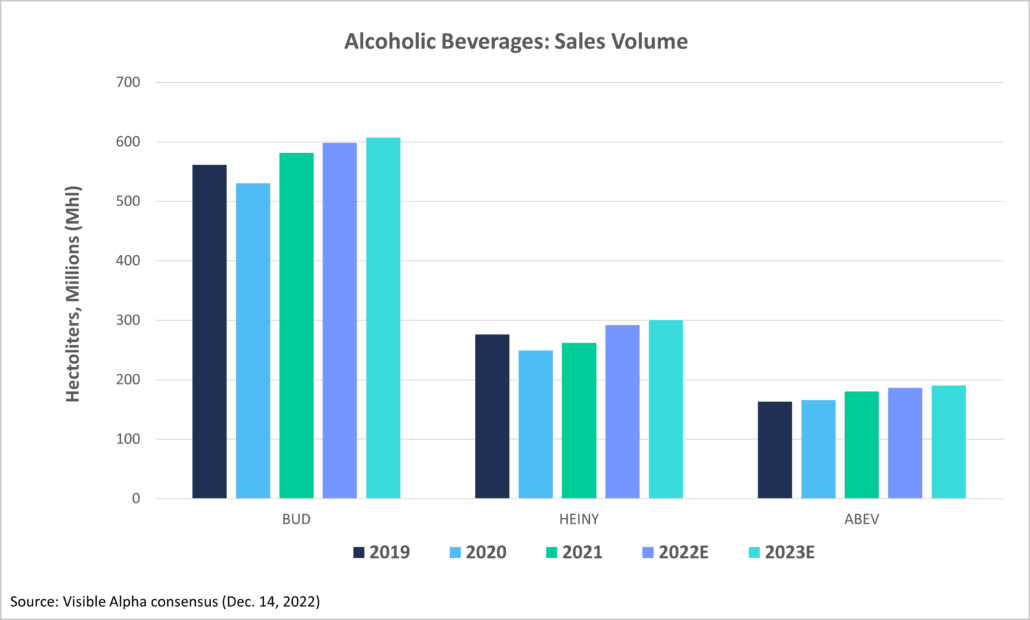

A key performance indicator (KPI) for alcoholic beverage companies is sales volume. With consumption up in 2020 and 2021, it’s easy to assume sales volume followed suit, but that’s not exactly what the numbers show.

Anheuser-Busch InBev (NYSE:BUD) is the largest brewing company in North America. It is home to many famous beers, including Budweiser, Bud Light, Stella Artois, and Hoegaarden, and it’s also expanded to offer seltzers, canned wine, canned cocktails, and craft beer. As the largest beer supplier in the country, it’s not surprising when sales go well. The company experienced a slight year-over-year dip (-5.5%) in 2020 but has since recovered and increased its numbers. Analysts predict Anheuser-Busch InBev’s sales volume will continue to grow in 2023.

Kweichow Moutai (SHA:600519) is known for its Chinese spirit, Maotai Baijiu. Dubbed “the world’s most mysterious spirit,” its tasting notes are a combination of soy sauce, pear, walnuts, and almonds. Its sales volume dipped by 0.9% YoY in 2020 but has since increased. Analysts predict 8.0% growth for 2023. Heineken (OTCMKTS:HEINY) endured a 9.9% YoY loss in 2020 but has since improved, with an 11.4% YoY increase in sales volume expected for 2022. Analysts forecast continued growth for Heineken in 2023.

Ambev SA (NYSE:ABEV) is one of the few alcoholic beverage companies not to lose any ground in sales volume in recent years. Ambev’s sales have slowly increased, though only by 1.6% YoY in 2020, and analysts predict sales will continue to climb in 2023.

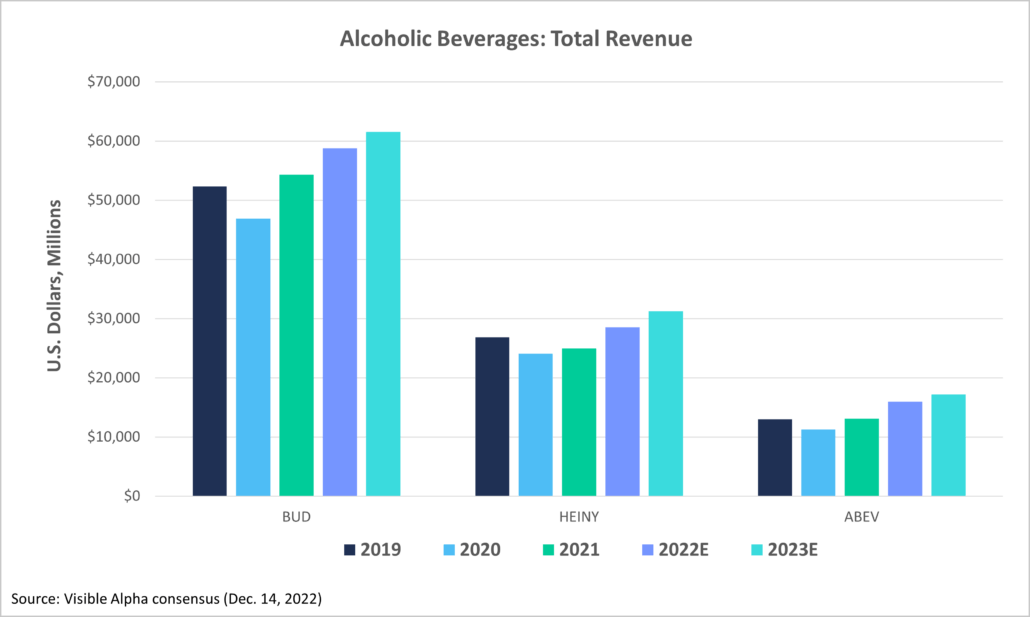

Beverage revenue

While sales didn’t show the growth one might expect, most companies did enjoy revenue increases — a trend analysts expect to continue. After a 10.4% year-over-year decrease in 2020, Anheuser-Busch InBev’s revenue jumped 15.8% in 2021. It continues to climb in 2022, and analysts forecast more growth of 4.7% in 2023.

Kweichow Moutai’s revenue has steadily climbed year over year since 2019. In 2022 alone, it’s grown by 17.9%, and analysts predict it will continue to increase by another 16.7% in 2023. By contrast, Heineken experienced a 17.7% decrease in revenue in 2020, but it has grown again over the past two years. In 2022, Heineken’s revenue increased by 28.6%, and analysts are forecasting an increase for 2023 as well. Ambev saw a slight revenue drop in 2020, but it has steadily climbed over the past two years. Analysts predict Ambev’s revenue growth will increase in 2023, if at a slower pace than in previous years.

Alcoholic beverages outlook

The industry’s recent performance provides an interesting example of reasonable expectation vs. actual reality. When sales volume decreases, it’s reasonable to assume revenues will decline to match. But while the numbers show a slightly different ending for this story, analysts predict increases in both sales and revenue for the alcoholic beverages industry in 2023.