Tesla’s growth and margin profile is more aligned with a technology company than a traditional automobile manufacturer, which may explain why the market believes the company should trade at a relatively large premium versus its peers.

Download Now: Tesla Whitepaper

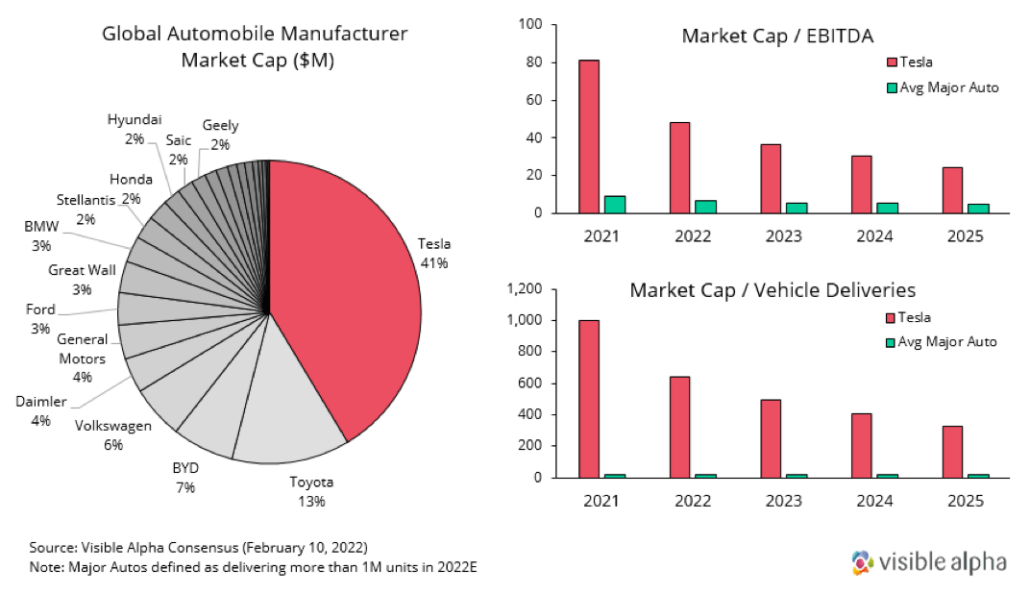

Tesla currently accounts for 41% of the Global Automobile Manufacturer Equity Market Cap. The market cap to vehicle deliveries ratio for Tesla stock using Visible Alpha consensus estimates is substantially larger than other major auto manufacturers (see chart below). Tesla is about to face more competition than ever with 60 new EV models planned to be released in 2022 and original equipment manufacturers (OEMs) accelerating their investments for EV transitions. The automobile market is generally considered “zero-sum,” and skeptics wonder how much room there is for Tesla to achieve its lofty goals at the expense of peers.

Auto Industry Market Cap, Valuation Rates

Tesla benefits from being a first mover, and its market leadership in EVs has given the company a technological head start and the ability to develop disruptive technologies. While many major auto manufacturers had contracting unit sales and margins in 2021, Tesla grew automotive revenues by 73% and expanded operating margins by 580 bp YoY. Demand for Tesla vehicles has been outstripping supply, and production capacity is the only inhibitor for growing deliveries. The EV market might still be considered under penetrated, as EVs accounted for less than 9% of total global car sales last year but are expected to reach about 40% by 2030, according to CleanTechnica and IEA.

Download the industry report to learn more >