Multiple and intermittent waves of disruption have impacted the home building industry in recent years. After more than two years of Covid-induced upheaval, home buyers and builders are now grappling with decades-high inflation. Furthermore, the U.S. Federal Reserve’s policy interest rate hike to tackle inflation is, in turn, raising mortgage rates, making home purchases much more expensive for home buyers. In this blog, we analyze the impact of these economic factors on the top five U.S. homebuilders by revenue: D.R. Horton (DHI), Lennar (LEN), PulteGroup (PHM), NVR (NVR_US), and Toll Brothers (TOL).

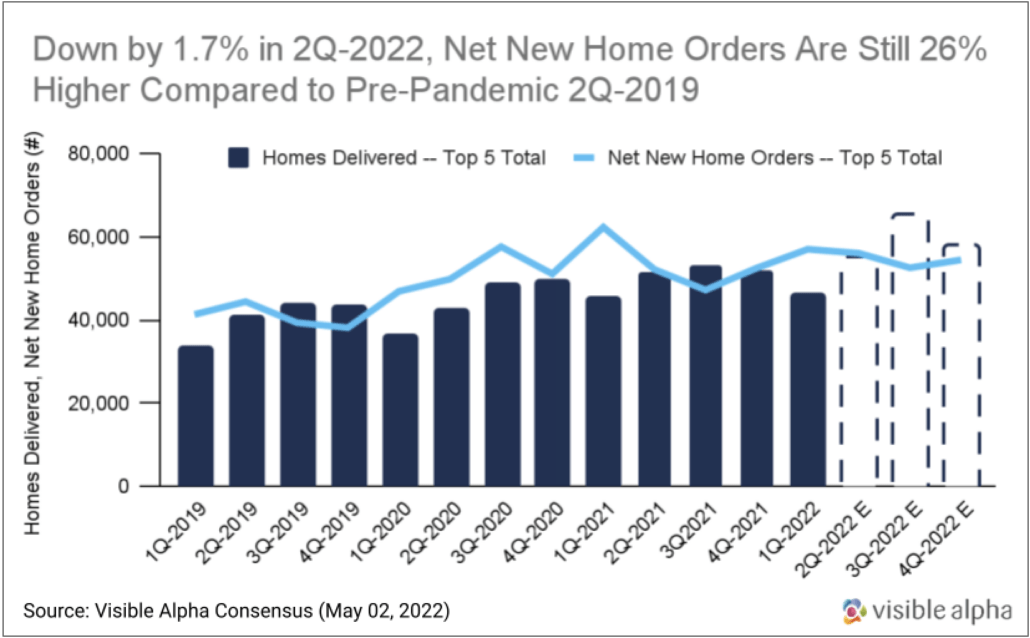

A look at Visible Alpha consensus data on homes delivered vs. net new home orders of the five home building companies shows that home supply lagged behind demand through most of 2020-2021. Constrained by high lumber prices, shortages of other building materials, and labor, home deliveries held back the industry growth despite strong demand. Demand soared as home buyers opted for additional space encouraged by the shift to work-from-home and low mortgage rates. Analysts now expect the strong demand from the past two years to ease as higher prices and rising mortgage rates cut into demand. Data from the U.S. Census Bureau shows sales of new residential homes as of March 2022 were down 8.6% from February 2022 and down by 12.6% from a year ago. For the home building industry, this has brought the demand for homes closer in line with the supply.

Higher mortgage rates are generally closely correlated with lower home prices. This relationship, however, has weakened over the past two decades. The shortage of homes available to buy in the U.S. has contributed to soaring housing prices. Thus, although analysts project homebuying demand to slow down due to rising rates, the housing market is expected to only moderate when supply catches up.

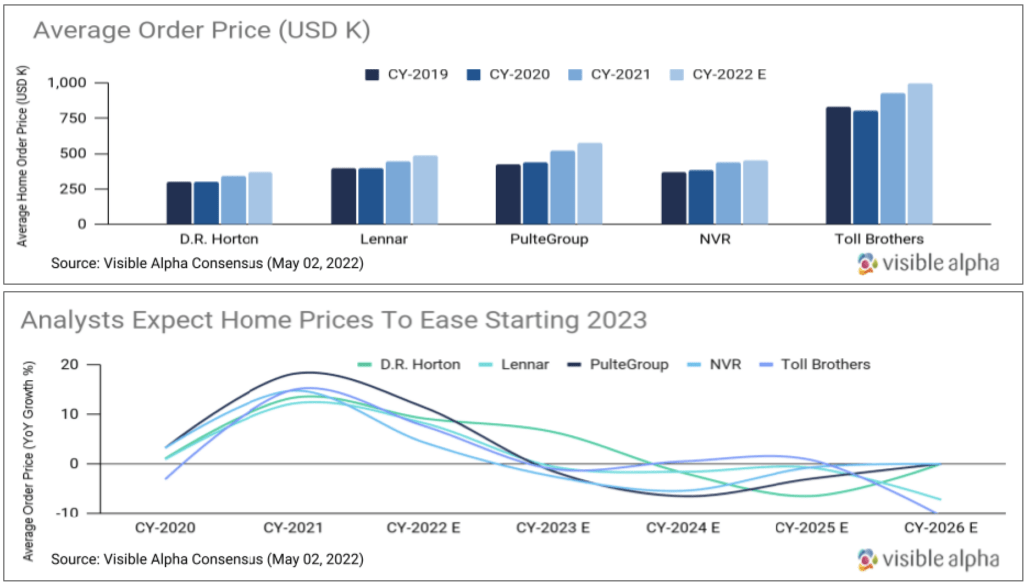

While analysts’ expectations of home demand ease, home prices for leading home building companies are projected to continue to climb for the rest of the year. Analysts expect average order prices for leading home builders to continue to rise throughout 2022, after seeing double-digit growth in 2021. PulteGroup is projected to see average order prices grow by 11% in 2022, after growing by 18% in 2021. Similarly, analysts expect home prices for D.R. Horton to rise by 9%, followed by Lennar and Toll Brothers at 8%, and NVR at 4% in 2022. As high mortgage rates slowly rein in price growth, analysts expect average order prices to slow down starting in 2023, with all except D.R. Horton, projected to see negative growth in prices in 2023.

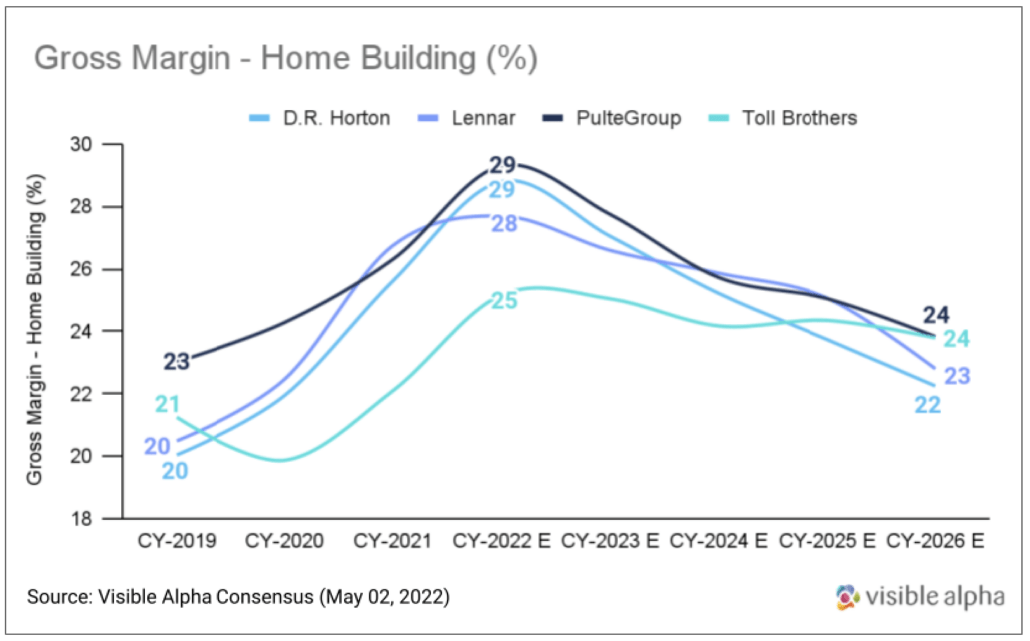

Although analysts do expect the slowdown of prices, easing in demand, and the elevated cost of construction to slowly weigh down on home builders’ gross margins, overall the margins in the home building industry are expected to remain above pre-pandemic levels between 2022 to 2026.

U.S. homebuilders have enjoyed robust growth in the last two years as strong demand allowed them to charge higher prices; however, the focus now will shift to navigating the drop in demand and dealing with high construction costs brought on by rising inflation. Overall, analyst expectations of industry estimates suggest that the economic conditions in the U.S. will hit consumers much more harshly before it impacts the home building industry growth.

Learn more about revenue drivers and other KPIs in the home building industry, as well as forecasts across other industries, by visiting Visible Alpha’s KPI Dashboards. For a primer on the home building industry, featuring key metrics that will aid in identifying trends to project future company performance, please visit our Guide to Home Building KPIs.