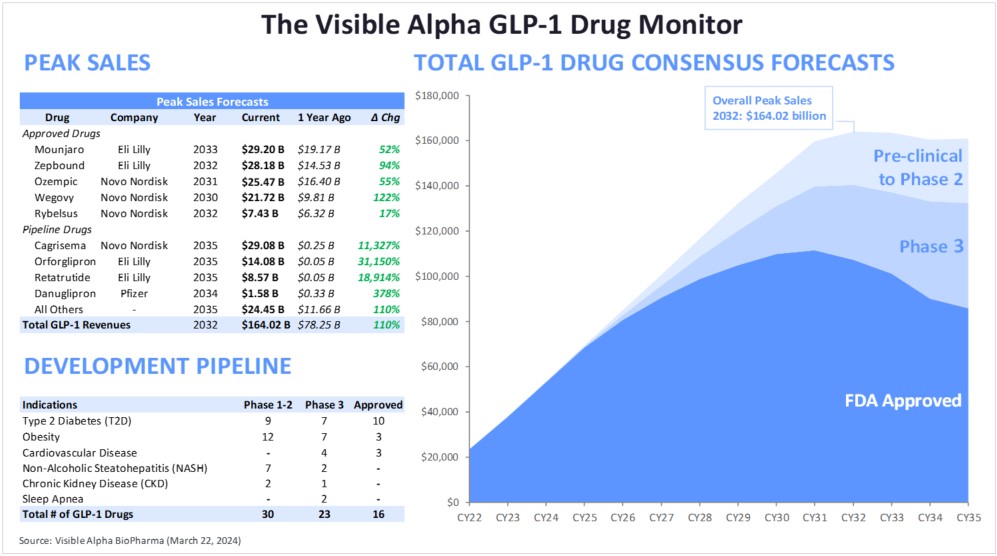

The Visible Alpha GLP-1 Drug Monitor reflects the current and projected growth of the GLP-1 (glucagon-like peptide-1) receptor agonist family of therapeutics marketed by publicly traded companies for type 2 diabetes, obesity/weight management, and other indications. The monitor evaluates both approved GLP-1 drugs and developing GLP-1 drug candidates in the pipeline based on revenue potential, and takes into account innovation and mechanism-of-action impact as well as clinical and regulatory risk.

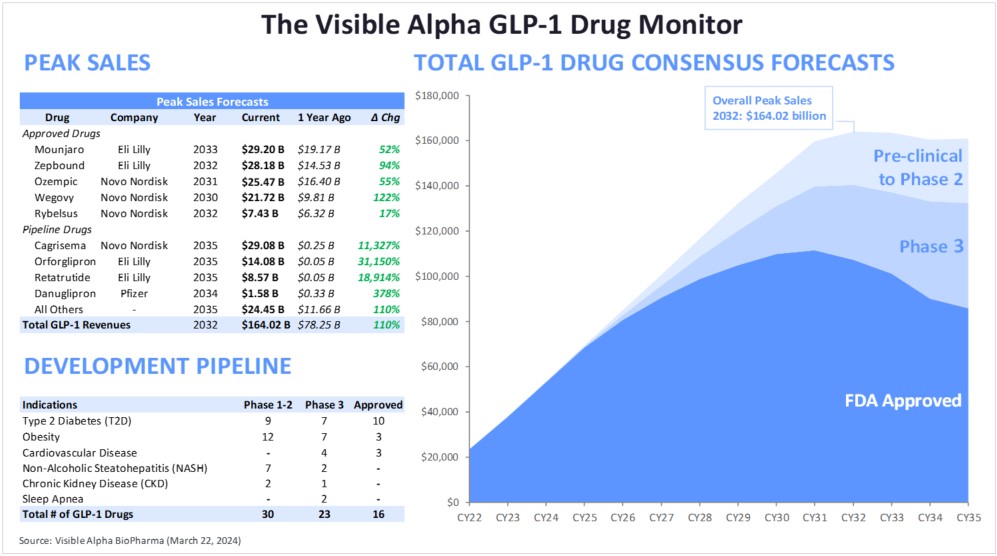

Figure 1: The Visible Alpha GLP-1 Drug Monitor

Source: Visible Alpha BioPharma consensus (March 22, 2024); forecasts are in millions of U.S. dollars

The GLP-1 drug monitor provides investors with a reference point to measure the growth performance of marketed drugs and the growth potential of the emerging pipeline based on Visible Alpha BioPharma consensus revenue projections. By monitoring marketed GLP-1 receptor agonists and the emerging pipeline, investors may better understand innovation trends, potential generic competition, and the interplay between marketed GLP-1 drugs and the GLP-1 pipeline. A grasp of these metrics paints an informed view of the future growth and direction of the rapidly growing GLP-1 drug development space.

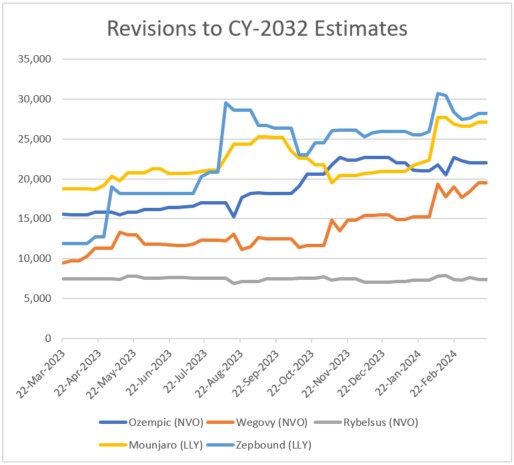

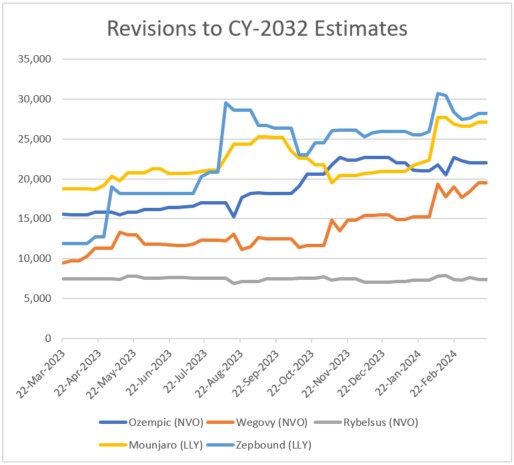

Figure 2: Revisions to 2032 estimates for five leading GLP-1 drugs

Source: Visible Alpha BioPharma consensus (March 22, 2024); estimates are in millions of U.S. dollars

Key Takeaways

- The GLP-1 receptor agonists and related class of drugs are projected to reach over $164 billion in combined revenue by 2032, based on Visible Alpha consensus, ramping up from $37.9 billion in 2023. These are record-breaking revenues for any drug class in the history of drug development.

- Over the past few years, analysts have frequently revised revenue estimates higher as scientific, clinical, and regulatory data have demonstrated efficacy and safety with the new generation of GLP-1 drugs for type 2 diabetes, obesity/weight management, and related cardiometabolic diseases. In particular, the efficacy for obesity and weight loss (with generally manageable tolerability), coupled with cardiovascular benefits, is a big driver of market acceptance and revenue growth.

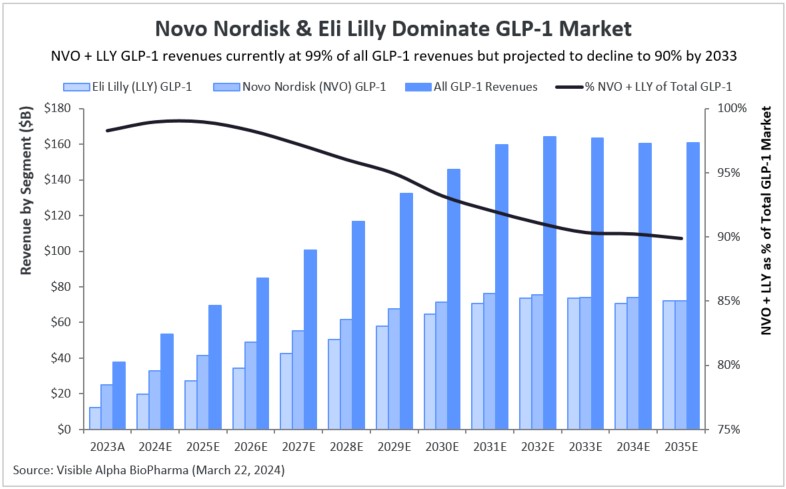

- Novo Nordisk (NYSE: NVO) and Eli Lilly (NYSE: LLY) are the dominant companies by far, currently accounting for 99% of GLP-1 receptor agonist drug revenues. While analysts project continued domination by NVO and LLY in the years ahead, innovation in the developing pipeline could change the competitive landscape.

|

Unprecedented impact of GLP-1 drug class on obesity/weight management, related cardiometabolic diseases

The success of the GLP-1 receptor agonist class of drugs is unprecedented. The first of the first-generation GLP-1 receptor agonist drugs was approved in 2005 for type 2 diabetes (Byetta, an exenatide). The first GLP-1 receptor agonist for obesity/weight management was approved in 2014 (Saxenda, a liraglutide).

It was the development of the second generation of GLP-1 receptor agonists with an improved drug profile that led to the current successes – especially for obesity/weight management and cardiovascular benefits. Second-generation GLP-1 receptor agonists include the semaglutides (Ozempic, Wegovy, Rybelsus) and the tirzepatides (Mounjaro and Zepbound). Undoubtedly, the medical benefits of the second-generation GLP-1 drugs in addressing type 2 diabetes, in addition to obesity/weight management and cardiovascular health, has changed the practice of medicine in the treatment of cardiometabolic and metabolic disorders. Beyond the utility in medicine, the impact of second-generation GLP-1 drugs on society, driven largely by an effective weight-loss function, has lifestyle, consumer behavior, and cosmetic ramifications.

There have been barely a few instances in the history of drug development in which a drug class has had such a monumental paradigm-shifting impact on medicine and society as the GLP-1 receptor agonists drugs. Penicillin and insulin, both discovered in the 1920s, saved millions of lives and had a dramatic effect on society in alleviating sickness and death. In modern times, checkpoint inhibitors for immuno-oncology (Keytruda and Opdivo) have made a significant impact in cancer treatment and in generating lucrative revenues – projected to reach an estimated $46 billion in 2027 for Keytruda and Opdivo combined, based on Visible Alpha consensus. The anti-TNF class of drugs (Enbrel, Humira, etc.) are also worth mentioning. However, none of these drug classes compares to the revenue potential of the GLP-1 drugs.

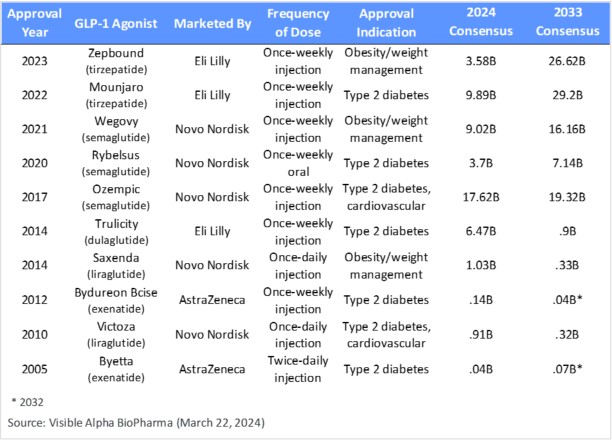

Landscape for GLP-1-related therapeutics

Marketed GLP-1 receptor agonists: The market is dominated by Novo Nordisk’s (NYSE: NVO) and Eli Lilly’s (NYSE: LLY) portfolio of GLP-1 receptor agonists. Ozempic, Rybelsus (oral version of Ozempic for type 2 diabetes), and Wegovy (approved for obesity/weight management, twice the dose of Ozempic), are marketed by NVO and belong to the semaglutide class of GLP-1 receptor agonists. Mounjaro (type 2 diabetes) and Zepbound (same as Mounjaro but branded differently for obesity/weight management) are marketed by LLY and belong to the tirzepatide class of GLP-1 receptor agonists.

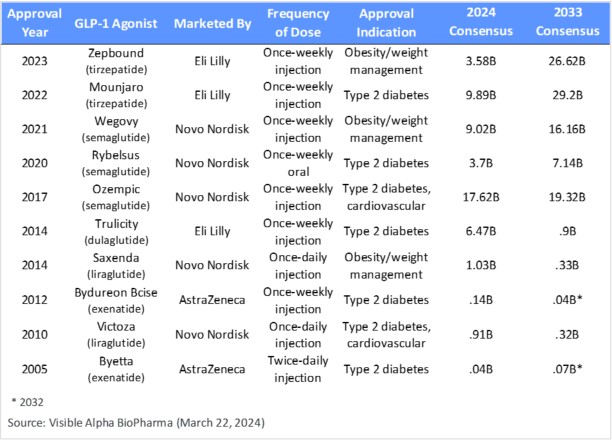

The semaglutide and tirzepatide classes are the second-generation GLP-1 receptor agonists with significant market potential projections (Table 1). The first-generation GLP-1 agonists, liraglutide (Victoza and Saxenda), dulaglutide (Trulicity), and exenatide (Byetta and Bydureon) were only modestly successful and declined significantly in projected market share from 2024 through 2033 (Table 1). The first generation of GLP-1 receptor agonist drugs had a relatively inferior drug profile, lacking in safety/tolerability, frequency of dosing, blood glucose regulation for type 2 diabetes, extent of weight loss, and overall effect on cardiovascular and cardiometabolic function.

Based on Visible Alpha consensus, the five leading GLP-1-based drugs (Ozempic, Rybelsus, Wegovy, Mounjaro, and Zepbound) combined, ramp up from $44 billion in projected revenues in 2024 to almost $99 billion in projected revenues in 2033 (Table 1).

Table 1: Approved GLP-1 receptor agonists drugs; semaglutides (Ozempic, Rybelsus, Wegovy) are GLP-1 receptor agonists; tirzepatides (Mounjaro and Zepbound) are agonists of GLP-1 receptors and GIP receptors

Source: Visible Alpha BioPharma consensus (March 22, 2024); forecasts are in U.S. dollars

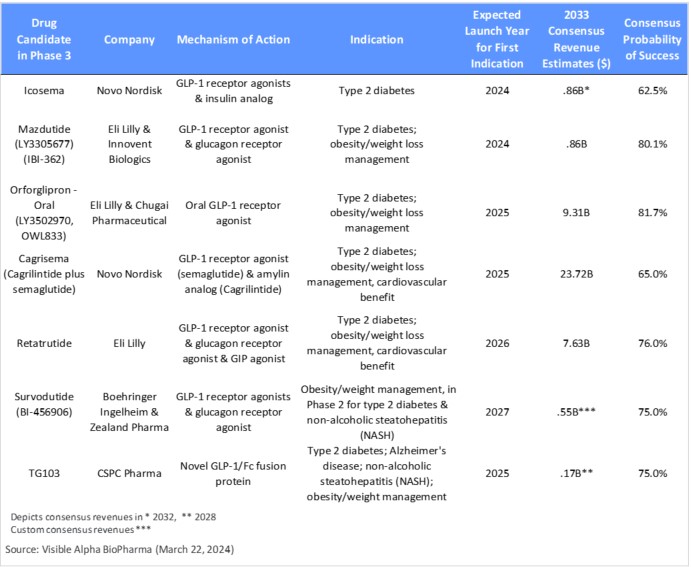

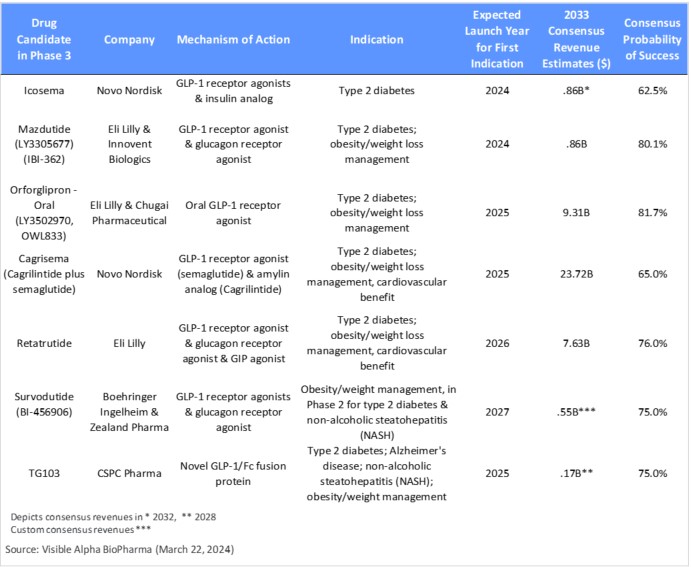

GLP-1 and related biology drug candidates in Phase 3 development: As depicted in Table 2, GLP-1 receptor agonists and related biology drug candidates with a novel mechanism of action that are in Phase 3 could compete with the current market leaders, if approved, and change the future competitive landscape We classify these as third-generation GLP-1 drugs that aim to improve over the semaglutides and tirzepatides.

- Cagrisema (cagrilintide plus semaglutide) is being developed by NVO. Within the Phase 3 pipeline, Cagrisema is the most promising based on Visible Alpha consensus revenue projections and the novel mechanism of action leading to potentially improved efficacy. This is especially the case for weight loss, though it is yet to be confirmed in ongoing Phase 3 trials (https://pubmed.ncbi.nlm.nih.gov/37364590/). Cagrisema combines a GLP-1 agonist (semaglutide) with an amylin analog. In addition to the effects of GLP-1 receptor agonism, the amylin analog induces weight loss and blood glucose control. Cagrisema is projected to garner revenues of $23.7B in 2033 (peak not reached), based on Visible Alpha consensus. Analysts see considerable risk in Cagrisema’s regulatory approval, with the consensus probability of success at 65%. If approved, Cagrisema will be the first GLP-1 receptor agonist plus amylin analog to make it to market.

- Orforglipron (LY3502970, OWL833) is an oral GLP-1 receptor agonist being developed by LLY for weight loss and type 2 diabetes. Orforglipron is an oral, non-peptide GLP-1 receptor agonist. According to Visible Alpha consensus, analysts project 2033 revenues of $9.3B and a probability of success at 81.7%.

- Retatrutide (LY-3437943) targets 3 pathways that modulate cardiometabolic function: a GLP-1 receptor agonist, a glucagon receptor agonist, and a glucose-dependent insulinotropic polypeptide (GIP) agonist. Retatrutide is in Phase 3 studies for obesity/weight management, type 2 diabetes, and cardiovascular benefits. Notably, in a Phase 2 study retatrutide demonstrated a 17.5% reduction in mean weight at 24 weeks (primary endpoint) and a 24.2% reduction in mean weight at 48 weeks (secondary endpoint). According to Visible Alpha consensus, analysts project 2033 revenues of $7.6B and a probability of success at 76.0%.

Table 2: GLP-1 receptor agonist-based drug candidates in Phase 3 studies; emerging GLP-1 receptor agonist-based drug candidates with a novel mechanism of action or an improved drug profile (e.g., oral versus injectable) are designed to compete with the current market leaders, if approved

Source: Visible Alpha BioPharma consensus (March 22, 2024); forecasts are in U.S. dollars

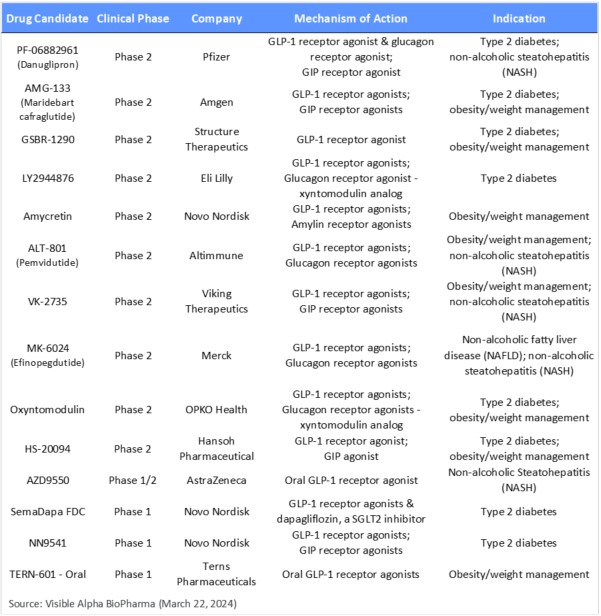

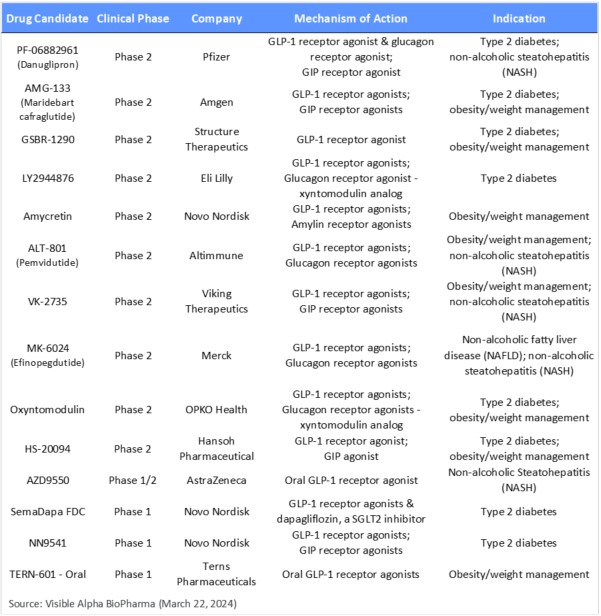

GLP-1 and related biology drug candidates in Phase 2 and earlier development: The Phase 2 and earlier pipeline of GLP-1 and related drug candidates is long, with drug candidates having novel mechanisms of action. Notable is a GLP-1 fusion protein in development as an agonist. Amgen’s AMG-133 is a GLP-1 receptor agonist and a GIP antagonist (not a GIP agonist) – Amgen believes that GLP-1 receptor agonism combined with GIP antagonism leads to more effective weight loss.

Late last year, Pfizer halted twice-daily dosing of its oral obesity drug candidate danuglipron (PF-06882961) due to safety and tolerability. Pfizer will continue to develop oral danuglipron at a modified once-daily dose. It is yet to be determined if the modified lower dose can compete on efficacy.

Table 3: Earlier-stage GLP-1 receptor agonist-based pipeline of drug candidates in Phase 2 studies and earlier

Source: Visible Alpha BioPharma consensus (March 22, 2024)

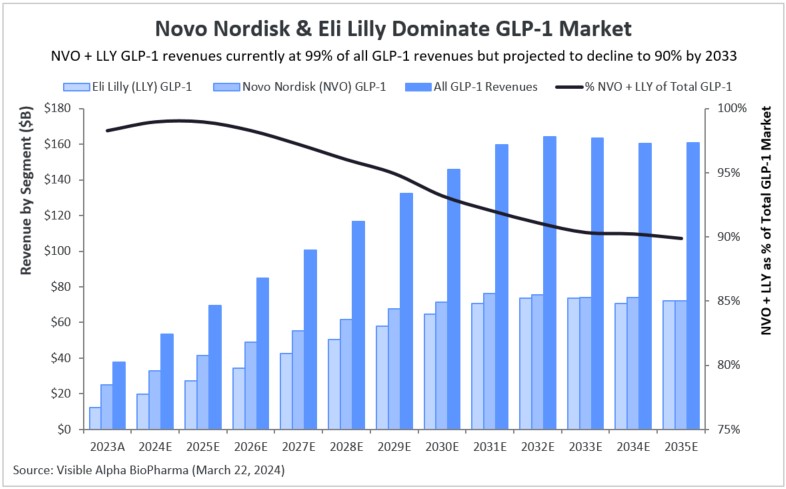

NVO and LLY overwhelmingly dominate the GLP-1 receptor agonist market

NVO and LLY accounted for 98% of the total revenues derived from the global GLP-1 markets in 2023. NVO markets Ozempic, Rybelsus, Wegovy, Saxenda, and Victoza, generating $24.9 billion in 2023 GLP-1 drug revenues. LLY markets Mounjaro, Zepbound, and Trulicity, generating $12.4 billion in GLP-1 drug revenues in 2023. Total GLP-1 revenues in 2023 were $37.9 billion of which $37.3 billion were accounted for by NVO and LLY.

Based on Visible Alpha consensus, NVO and LLY will continue to dominate, accounting for 91% of all GLP-1 revenues in 2033. In 2033, NVO’s and LLY’s GLP-1 pipelines are expected to generate $74.1 billion and $73.7 billion, respectively.

NVO and LLY have promising drug candidates in the pipeline that follow their current lead-marketed drugs, which should sustain their market dominance. However, other competing pipeline programs with novel mechanisms of action may turn out to be superior in efficacy, safety, or patient convenience, and could change the dynamics of the NVO/LLY dominance.

Figure 3: GLP-1 domination by Novo Nordisk (NYSE: NVO) and Eli Lilly (NYSE: LLY)

Source: Visible Alpha BioPharma consensus (March 22, 2024); forecasts are in U.S. dollars

Factors underlying the impressive revenue projections for the GLP-1 agonist drug class

Though the GLP-1 receptor agonist drug class has been around since 2005, the increased interest and lucrative revenue projections are a more recent phenomenon. Several underlying scientific, clinical, and market factors over the last few years played a role in bolstering the utility and market potential of GLP-1 receptor agonists for type 2 diabetes and obesity/weight management, as listed below.

Second-generation GLP-1 receptor agonists have an improved drug profile: With the advent of the second-generation GLP-1 receptor agonists — semaglutide and tirzepatide — improved efficacy, safety, and tolerability were observed for type 2 diabetes and obesity/weight management over the older GLP-1 receptor agonists — liraglutide, dulaglutide, and exenatide.

Improved dosage and delivery: Less-frequent dosing, from daily to weekly, has driven broader patient compliance and increased market share. For example, once-daily Victoza (liraglutide) has been steadily replaced by once-weekly Ozempic (semaglutide). Rybelsus, an oral semaglutide, is now approved, which provides the patient with more options. Table 1 depicts the improvement in dosing frequency since the first GLP-1 drug was approved in 2005.

Innovation in pharmacotherapy of obesity: A crucial development in the last few years has been the innovation in obesity/weight management drug development, leading to relatively safe and dramatically more effective drugs. For years, drugs for obesity were plagued with the lack of meaningful efficacy and a challenging safety profile, especially related to cardiovascular risks.

Impressive efficacy in weight reduction: Second-generation GLP-1 receptor agonists in the semaglutide class improve efficacy over liraglutides, and the most advanced second-generation GLP-1 receptor agonist class — tirzepatides — improves efficacy over semaglutides (example below).

- Wegovy improves over Saxenda: Individuals who received Wegovy lost an average of 14.9% of their initial weight on Wegovy versus 2.4% for placebo. Wegovy is a semaglutide that improves over Saxenda, a liraglutide that had demonstrated an average loss of 5.2% of initial body weight compared to individuals who received a placebo (Wilding et al; NEJM, 2021) (Lingvay et al; Lancet 2022).

- Zepbound (Mounjaro) improves over Wegovy: Individuals who received the highest 15mg dose of Zepbound lost an average of 20.9% of their initial weight versus 3.1% in the placebo arm. Those on the 10mg dose of Zepbound lost 19.5% of their initial weight versus 3.1% on placebo (LLY press release, April 28, 2022).

Third-generation GLP-1 drugs currently in clinical development (e.g., Cagrisema) are designed to improve over the semaglutides and tirzepatides by harnessing related mechanistic pathways that synergize or are additive to the foundational GLP-1 receptor agonism pathway. Early data shows promise in improving weight reduction metrics and cardiovascular benefits.

Obesity management as a primary treatment goal for type 2 diabetes: Obesity and type 2 diabetes share pathophysiological mechanisms that lead to overlapping metabolic complications. GLP-1/GIP biology regulates insulin and glucagon via the pancreas (addressing glucose control in type 2 diabetes), the gastrointestinal tract, and the CNS, which leads to satiety, or reduced appetite, and weight loss. Obesity and diabetes are interlinked – the term “diabesity” is used to describe obesity and type 2 diabetes, which go hand in hand. Lingvay et al. (Lancet, 2022), pointed out that: “Weight loss is known to reverse the underlying metabolic abnormalities of type 2 diabetes and, as such, improve glucose control; loss of 15% or more of body weight can have a disease-modifying effect in people with type 2 diabetes, an outcome that is not attainable by any other glucose-lowering intervention.”

Conceptual change in treating type 2 diabetes beyond glucose control: Treatment of type 2 diabetes has undergone a conceptual change over the last few years, with treatment objectives shifting to include a cardio-centric goal in addition to the long-held gluco-centric goal of regulating blood sugar. This has changed the landscape for treatment of patients with type 2 diabetes. Professional societies (diabetes, endocrinology, and cardiology) have responded to this paradigm shift by advocating for the use of GLP-1 agonists for type 2 diabetes, further driving GLP-1 receptor agonist revenues.

Reduced risk of cardiovascular disease with GLP-1 agonists: Results from cardiovascular outcome studies have demonstrated that GLP-1 receptor agonist therapy leads to a robust and consistent reduction in atherothrombotic events, particularly in patients with established atherosclerotic cardiovascular disease. This is an important metric since type 2 diabetes and obese patients are at increased risk for cardiovascular disease. Most recently (March 8, 2024), Wegovy (a semaglutide), was approved by the FDA for reducing the risk of cardiovascular complications in individuals with obesity and heart disease. Mounjaro/Zepbound, belonging to the tirzepatide class, have also shown cardiovascular benefits in clinical trials, but are not yet FDA approved for reduction in risk of cardiovascular disease.

2022 guidelines on type 2 diabetes by the American Association of Clinical Endocrinology and the American Diabetes Association: Guidelines include recommendations for the use of GLP-1 receptor agonist-based drugs for type 2 diabetes. The positive benefits of GLP-1 receptor agonists in reducing risks of cardiovascular disease, renal disease, liver fibrosis, and obesity, in addition to glycemic control, were important criteria for the recommendation.

Strong market demand for Wegovy, Mounjaro (Zepbound), and Ozempic (off-label) for weight loss: The high demand for Wegovy soon after its FDA approval led to its short supply, which was helped by a contract manufacturer delay and significant off-label use (likely for cosmetic weight loss). Subsequently, given the shortage of Wegovy, many were prescribed the other semaglutide, Ozempic, off-label for weight loss (Wegovy is the same active ingredient as Ozempic, formulated at a higher dose for obesity). This resulted in a short supply of Ozempic for type 2 diabetes patients – the patients in actual medical need versus those using Ozempic for obesity or weight loss for cosmetic needs or less urgent medical needs. This high demand for Ozempic resulted in a dramatic increase in Ozempic sales for NVO starting in late 2021. Both Wegovy and Ozempic are marketed by NVO. LLY also encountered manufacturing supply challenges for Mounjaro in 2023 due to high demand.

Third-generation GLP-1 biology-related pipeline drugs begin to emerge, amplifying GLP-1 market potential: In 2023, positive Phase 2 data on third-generation GLP-1 biology-related drug candidates Cagrisema, orforglipron, and retatrutide (described above) generated significant interest. These drug candidates improved on weight loss efficacy and showed cardiovascular benefit – Phase 2 data was presented at high-impact medical meetings (American Heart Association and American Diabetes Association meetings, 2023). The novel mechanisms behind emerging Cagrisema, orforglipron, and retatrutide were underestimated and an unknown quantity until the Phase 2 data. The positive data and potential to improve over the currently marketed GLP-1 drugs further bolstered analyst and investor confidence. The Visible Alpha GLP-1 Monitor shows dramatic increases in analyst revenue projections from last year since Cagrisema, orforglipron, and retatrutide were relatively unknown and rightly underestimated by analysts until the presentation of Phase 2 data.

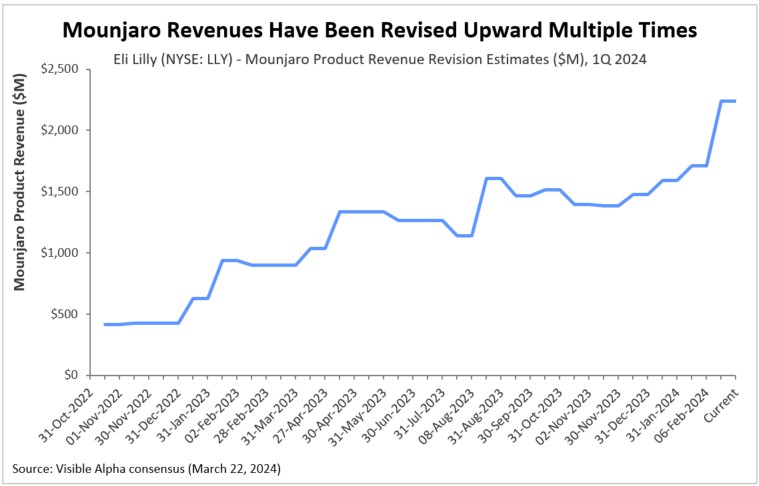

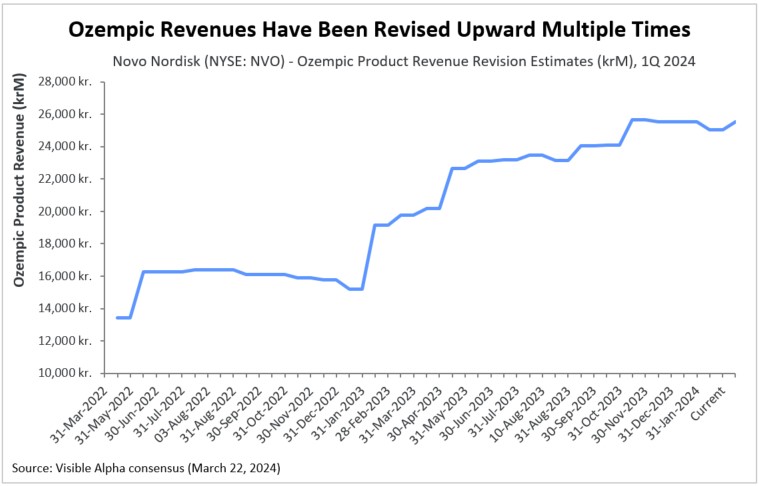

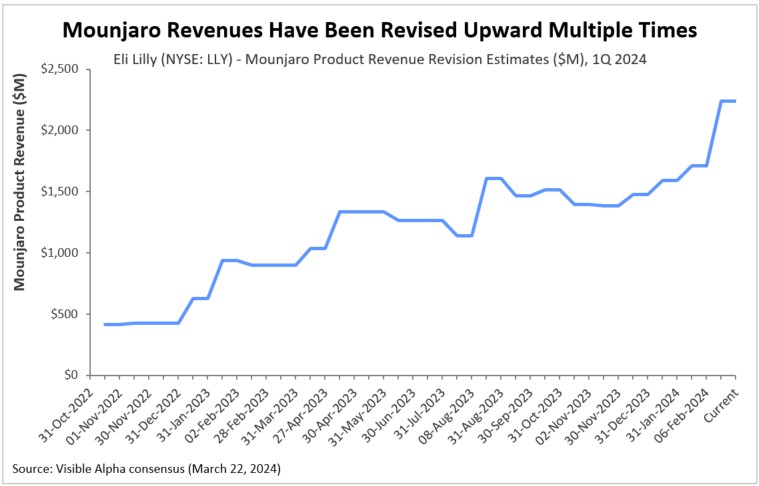

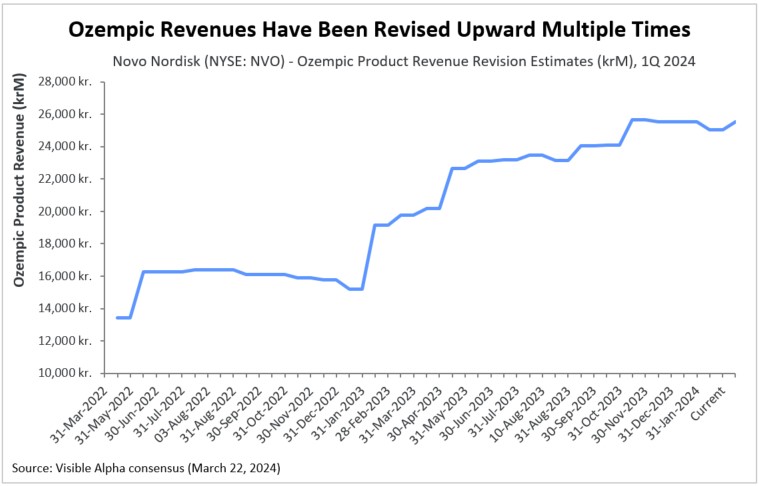

Upward revisions

As scientific, clinical, and regulatory events have unraveled, along with company announcements and quarterly updates, analysts have revised revenue estimates higher for the second-generation (semaglutide & tirzepatide) GLP-1 receptor agonist drugs. Depicted in the revision charts below are analysts’ multiple revisions to revenue estimates for Ozempic and Mounjaro. This positive sentiment for Ozempic, Mounjaro, and other second-generation GLP-1 agonists has been buoyed by the many encouraging scientific, clinical, regulatory, and market factors discussed above. Clearly, the unprecedented and unanticipated utility in obesity/weight management, coupled with cardiovascular benefits, has been the driving force.

Figure 4: Upward revisions for Mounjaro (Eli Lilly) revenue

Source: Visible Alpha BioPharma consensus (March 22, 2024); forecasts are in U.S. dollars

Figure 5: Upward revisions for Ozempic (Novo Nordisk) revenue

Source: Visible Alpha BioPharma consensus (March 22, 2024); forecasts are in U.S. dollars

The bottom line

GLP-1 receptor agonist-based drugs have changed the treatment paradigm for cardiometabolic disease, especially obesity. While the obesity/weight management attribute of the GLP-1 receptor agonist class of drugs attracts the most attention, the efficacy in type 2 diabetes, related metabolic disease, and cardiovascular benefits may be of equal or greater medical significance. Given that the tolerability and safety of second-generation GLP-1 drugs and beyond are generally acceptable, we expect revenue potential for the GLP-1 class of drugs to be massive, as seen in Visible Alpha consensus estimates.

The second-generation GLP-1 receptor agonists (semaglutides and tirzepatides), marketed by NVO and LLY respectively, categorically dominate the GLP-1 markets. Both NVO and LLY have plans to protect their dominance with promising candidates in the pipeline. However, several innovative GLP-1-related drug candidates and combinations in development by competing Big Pharma and biotechs could potentially displace the current leaders and change the landscape. Investors may also want to keep a close watch on the third-generation of GLP-1-based drugs in Phase 3 trials: Cagrisema (NVO), orforglipron (LLY), and retatrutide (LLY). These emerging drug candidates in development aim to improve on the marketed second-generation GLP-1 drugs and could shake the competitive landscape.

In 2024 and beyond, we expect healthy revenue growth for GLP-1 drugs marketed by NVO and LLY. In addition, we expect more clinical data for GLP-1 drugs with respect to related cardiometabolic diseases – reduction in risk of cardiovascular events (heart attack and stroke), non-alcoholic steatohepatitis (NASH), chronic kidney disease, and sleep apnea.

References:

1. Ussher & Drucker; Glucagon-like peptide 1 receptor agonists: cardiovascular benefits and mechanisms of action. Nature Reviews Cardiology. Volume 20 (7) 463-474; July 2023

2. Jastreboff et al; Triple-Hormone-Receptor Agonist Retatrutide for Obesity — A Phase 2 Trial. New England Journal of Medicine, Volume 389, 514-526, August 2023

3. Sheahan et al; An overview of GLP-1 agonists and recent cardiovascular outcomes trials. Postgraduate Medical Journal; Volume 96, Issue 1133, March 2020

4. Sharma et al; Recent updates on GLP-1 agonists: Current advancements & challenges. Biomedicine & Pharmacotherapy; Volume 108, December 2018

5. Jastreboff & Kushner; New Frontiers in Obesity Treatment: GLP-1 and Nascent Nutrient-Stimulated Hormone-Based Therapeutics. Annual Review of Medicine; Vol. 74:125-139, January 2023

6. Nauck et al; GLP-1 receptor agonists in the treatment of type 2 diabetes – state-of-the-art. Molecular Metabolism; Volume 46, April 2021

7. Shaefer et al; User’s guide to mechanism of action and clinical use of GLP-1 receptor agonists. Postgraduate Medicine; Volume 127 (8), September 2015

8. Marx et al; GLP-1 Receptor agonists for the reduction of atherosclerotic cardiovascular risk in patients with type 2 Diabetes. Circulation; 146:1882–1894; December 2022

9. Lingvay et al; Obesity management as a primary treatment goal for type 2 diabetes: time to reframe the conversation. Lancet 22;399 (10322); January 2022

10. Wilding et al; Once-Weekly Semaglutide in Adults with Overweight or Obesity. New England Journal of Medicine; 384; March 2021

11. Fisman & Tenenbaum; The dual glucose-dependent insulinotropic polypeptide (GIP) and glucagon-like peptide-1 (GLP-1) receptor agonist tirzepatide: a novel cardiometabolic therapeutic prospect. Cardiovascular Diabetology: Vol 20; 225 November 2021

12. Georgeo-Martinez et al; Clinical recommendations to manage gastrointestinal adverse events in patients treated with GLP-1 receptor agonists: a multidisciplinary expert consensus. Journal of Clinical. Medicine.12(1), 145; January 2023

13. Eli Lilly news release April 28, 2022: https://investor.lilly.com/news-releases/news-release-details/lillys-tirzepatide-delivered-225-weight-loss-adults-obesity-or

14. Novo Nordisk press release March 8, 2024: https://www.novonordisk.com/news-and-media/news-and-ir-materials/news-details.html?id=167030