Drug approvals by the U.S. Food and Drug Administration (FDA) of next-generation glucagon-like peptide-1 (GLP-1) receptor agonists mark a new era for the treatment of type 2 diabetes (T2D) and obesity.

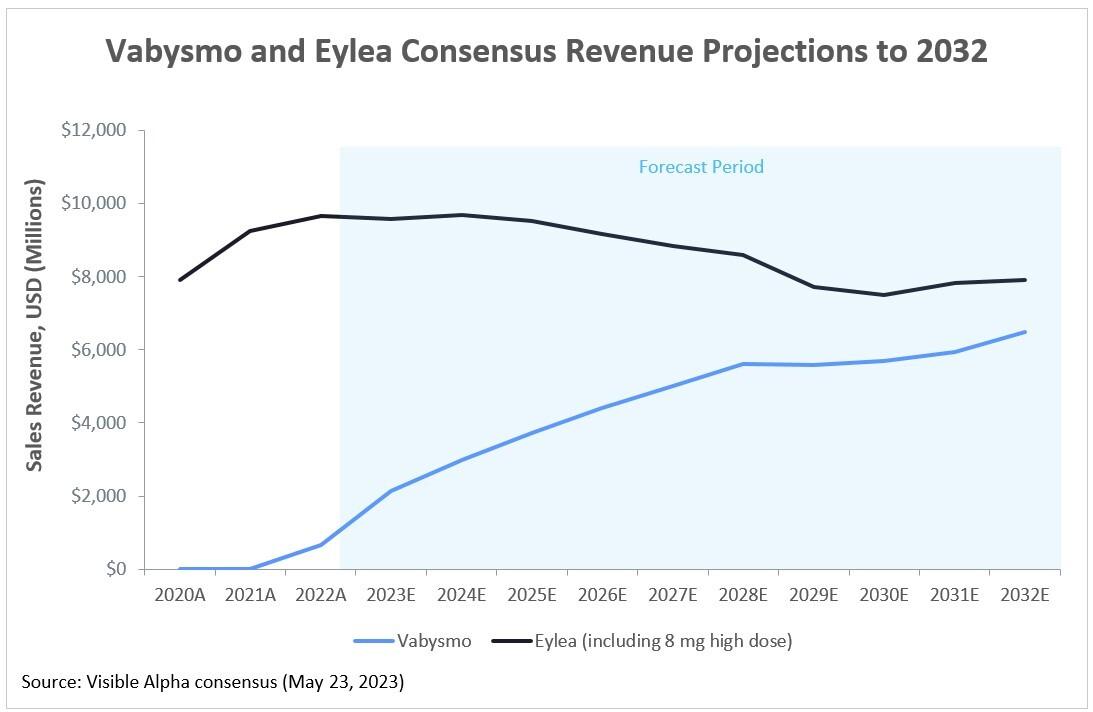

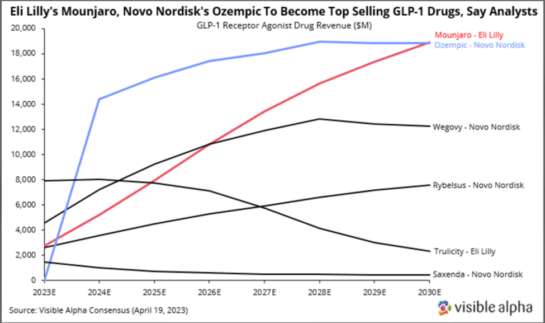

The four leading FDA-approved GLP-1 receptor agonist drugs, Mounjaro (Eli Lilly), Ozempic (Novo Nordisk), Wegovy (Novo Nordisk), and Rybelsus (Novo Nordisk) are forecasted to generate over $55 billion combined in 2030, based on Visible Alpha consensus revenue estimates.

This market potential driving GLP-1 receptor agonist drug revenues is supported by a more nuanced understanding of the biology underlying T2D and obesity along with innovation in GLP-1 receptor agonist drug development.

GLP-1 receptor agonists

The GLP-1 receptor agonists (also called GLP-1 agonists) class of drugs for T2D and obesity/weight loss have generated unusually broad interest among investors and even the general public. The next generation of GLP-1 agonist drugs — tirzepatide and semaglutide — are an improvement over first-generation GLP-1 agonist drugs — dulaglutide, liraglutide, and exenatide — and also superior to various other mechanistically distinct drugs for T2D.

The weight-loss efficacy of GLP-1 agonist drugs, more than their utility for T2D, is responsible for the heightened public interest. No other FDA-approved drug for obesity/weight loss has shown such therapeutic efficacy as the next-generation GLP-1 agonist class — tirzepatide and semaglutide. Furthermore, scientific and clinical data over the past few years point to the benefits of weight loss for T2D patients — primarily improvement of blood glucose control and cardiovascular benefits. To date, the GLP-1 agonist drugs are considered to be safe and have an acceptable tolerability profile.

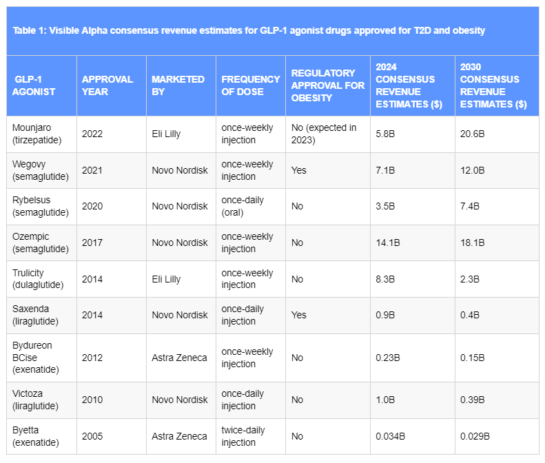

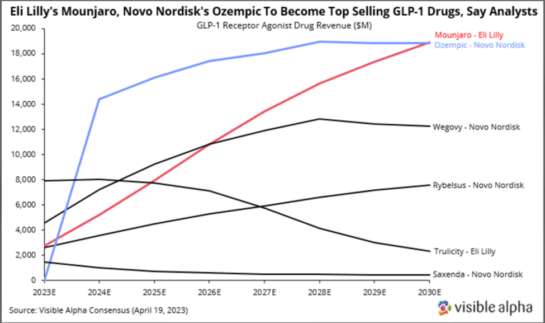

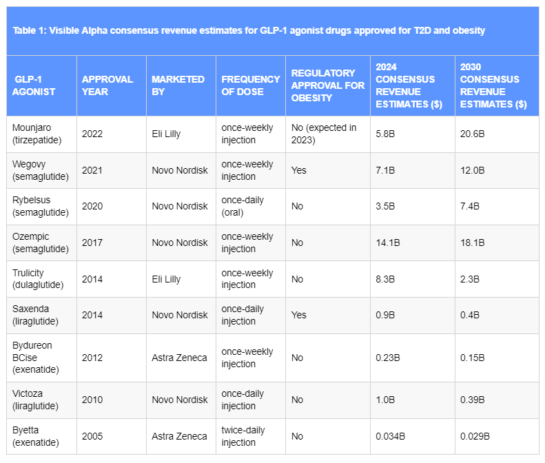

Visible Alpha consensus revenue estimates for 2030 show Mounjaro leading the pack with $20.6 billion, Ozempic at $18.1 billion, Wegovy at $12.0 billion, and Rybelsus at $7.4 billion. As these next-generation GLP-1 agonist drugs ramp up, gain market share, and expand the market for T2D and obesity, the older GLP-1 agonist drugs such as Trulicity, Saxenda, and Victoza are expected to dwindle in market share. Of the GLP-1 agonists, Wegovy and Saxenda are the only two approved specifically for obesity/weight loss.

Background on GLP-1 and GIP biology

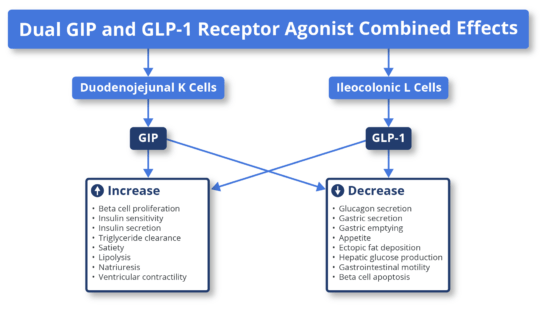

Glucagon-like peptide-1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) are peptide hormones or incretins released by the gut in response to nutrients. This hormone pathway is a self-regulating feedback system connecting the gut with the brain, pancreas, and liver.

Upon nutrient intake, GLP-1 and GIP peptide hormones bind to their respective receptors (GLP-1 receptors and GIP receptors) on beta cells of the pancreas (beta cells produce insulin) and stimulate the secretion of insulin. The secreted insulin facilitates the uptake of glucose by peripheral tissues. At the same time, the release of glucagon by alpha cells of the pancreas is reduced, preventing an increase in blood glucose. Note that insulin and glucagon have opposing effects. Insulin allows uptake of glucose by tissues (muscle, fat, liver, etc.), and glucagon releases glucose in the blood.

GLP-1 and GIP are naturally released upon ingestion of nutrients to overcome high glucose levels (hyperglycemia after a meal) by increasing insulin secretion and reducing glucagon secretion (glucagon increases blood glucose, the opposite of insulin). This effect of GLP-1 and GIP reduces glucose fluctuations in the blood. GLP-1 and GIP receptors are present on the beta cells of the pancreas, as well as in the central nervous system (CNS) and gastrointestinal tract. Under normal conditions, the interaction of released GLP-1 and GIP hormones on GLP-1 receptors and GIP receptors on pancreatic beta cells, in the CNS, and the gastrointestinal tract leads to regulation of blood glucose, reduced appetite and delayed glucose absorption due to slower gastric emptying, i.e., a feeling of satiety.

The diminished activity of GIP and GLP-1 are pathophysiological features of T2D and obesity. Pharmacological intervention to restore GLP-1 and GIP biological activity in T2D and obesity patients with GLP-1 and GIP receptor agonist drugs is therefore therapeutic in treating T2D and obesity. The GLP-1 and GIP receptor agonist drugs act as peptide mimetics, i.e., they act as synthetic mimetics of natural GLP-1 and GIP that are diminished or inadequate in T2D and obesity.

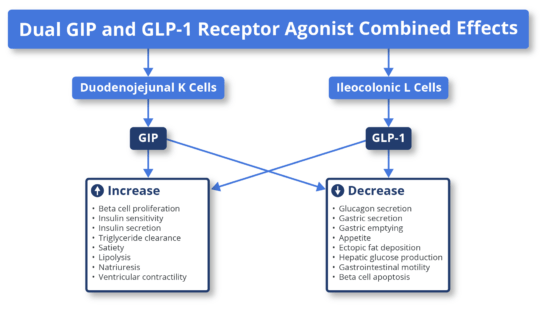

GLP-1 and GIP receptor agonists drugs are peptides that mimic natural GLP-1 and GIP. The binding of GLP-1 agonists and GIP agonists drugs to their respective receptors to induce insulin secretion and decrease glucagon secretion are among several other biological processes that reduce appetite and positively affect glucose metabolism (see Figure 1).

Source: Fisman & Tenenbaum, Cardiovascular Diabetology, volume 20: 225; 2021

Figure 1: The mechanism of action of GLP-1 agonists and GIP agonists. The example depicted above is that of a dual GLP-1 agonist and GIP agonist, tirzepatide (Mounjaro). Note that Mounjaro is the only dual GLP-1 agonist and GIP agonist approved. Ozempic, Rybelsus, Wegovy, and the remaining are exclusively GLP-1 agonists. (Adapted from Fisman & Tanenbaum, 2021, Cardiovascular Diabetology). |

Mounjaro and Ozempic lead the pack

Eli Lilly’s Mounjaro leads the Visible Alpha 2030 consensus revenue estimates with $20.6 billion, followed closely by Novo Nordisk’s Ozempic at $18.1 billion. The steep ramp-up of Mounjaro from FDA approval in 2022 to $20.6 billion in estimated revenues in 2030 is notable. Mounjaro belongs to the tirzepatide class, a dual agonist targeting both GLP-1 and GIP pathways (as discussed above) that was approved in 2022 for T2D. Following in the footsteps of Mounjaro is Novo Nordisk’s Ozempic at $18.1 billion. Ozempic is a semaglutide targeting only GLP-1 and was approved in 2017. To date, both Ozempic and Mounjaro are only FDA-approved for T2D. Analysts expect Mounjaro approval for obesity in 2023. However, both are likely used off-label for obesity/weight loss.

Figure 2: Visible Alpha consensus revenue estimates for leading GLP-1 receptor agonists for T2D and obesity: The next generation GLP-1 receptor agonists (Mounjaro, Ozempic, Wegovy, and Rybelsus) show a steady rise from 2023 through 2030, while the older generation GLP-1 receptor agonists, Trulicity and Saxenda, decline in revenues.

Note that Ozempic and Mounjaro are used off-label for obesity/weight loss since neither one is FDA approved for obesity yet. Mounjaro was granted FDA fast-track designation for obesity/weight loss in October 2022, and analysts expect FDA approval for obesity later this year. Mounjaro is the first and only drug to help patients lose more than 20% of their body weight (in non-T2D patients).

Wegovy, a semaglutide like Ozempic, is approved specifically for obesity and has consensus revenue estimated at $12.0 billion in 2030. It is assumed that off-label use of Ozempic for obesity will decline in the coming years as customers and patients move to Wegovy for obesity, as an inventory shortage is now resolved. Wegovy and Ozempic have the same active ingredient — semaglutide — but Wegovy is administered at a higher dose for obesity compared to Ozempic for T2D.

Rybelsus also has the same active ingredient as Wegovy and Ozempic but is developed as an oral formulation taken daily. It has a 2030 consensus revenue estimate of $7.4 billion. Mounjaro, Ozempic and Wegovy all consist of once-weekly subcutaneous injections.

The older generation makes way for the new

Within the GLP-1 agonist class, tirzepatide (Mounjaro) and the semaglutides (Ozempic, Rybelsus, and Wegovy) show increasing market penetration from 2024 through 2030, our selected timeline. On the other hand, the older generation GLP-1 agonists, liraglutide (Victoza and Saxenda), dulaglutide (Trulicity), and exenatide (Byetta and Bydureon) decline in projected market share from 2024 through 2030. This is expected since the semaglutides and tirzepatide have a significantly improved drug profile over the older generation GLP-1 agonists. Improvements in drug profile for T2D and obesity include increased efficacy (blood glucose regulation), safety, frequency of dosing, cardiovascular benefit, and more meaningful weight loss.

(Source: Visible Alpha Estimates)

Table 1: Visible Alpha consensus revenue estimates for GLP-1 agonist drugs approved for T2D and obesity.

Mounjaro and Ozempic lead the others. Only two GLP-1 drugs are approved specifically for obesity/weight loss: Wegovy and Saxenda. Wegovy is a semaglutide, like Ozempic, but at a higher dose for obesity/weight loss, while Saxenda, approved for obesity in 2014, is a liraglutide like Victoza, but at a different dose for obesity/weight loss.

Factors underlying the impressive revenue projections for the GLP-1 agonist drug class

Though the GLP-1 agonists drug class has been around since 2005, the increased interest and lucrative revenue projections is a more recent phenomenon. Several underlying scientific, clinical and market factors over the last few years played a role in bolstering the utility and market potential of GLP-1 agonists for T2D and obesity as listed below.

Next-generation GLP-1 agonists have an improved drug profile: With the advent of the next-generation GLP-1 agonists — semaglutide and tirzepatide — improved efficacy, safety, and tolerability were observed for T2D and obesity/weight loss over the older GLP-1 agonists, liraglutide, dulaglutide and exenatide.

Improved dosage and delivery: Less frequent dosing from daily to weekly has driven broader patient compliance and increased market share. For example, once-daily Victoza (liraglutide) has been steadily replaced by once-weekly Ozempic (semaglutide). An oral semaglutide, Rybelsus, was recently approved which provides the patient with more options.

Innovation in pharmacotherapy of obesity: A crucial development in the last few years has been the innovation in obesity drug development leading to relatively safe and dramatically more effective drugs. For years, drugs for obesity were plagued with lack of meaningful efficacy and a challenging safety profile, especially related to cardiovascular risks.

Impressive efficacy in weight reduction: Next-generation GLP-1 agonists in the semaglutide class improves efficacy over liraglutide, and the most advanced next-generation GLP-1 agonist class, tirzepatide, improves efficacy over semaglutides.

- Wegovy improves over Saxenda: Individuals who received Wegovy lost an average of 14.9% of their initial weight on Wegovy versus 2.4% for placebo. Wegovy is a semaglutide that improved over Saxenda, a liraglutide that had demonstrated an average loss of 5.2% of initial body weight compared to individuals who received placebo (Wilding et al; NEJM, 2021) (Lingvay et al; Lancet 2022).

- Mounjaro improves over Wegovy: Individuals that received the highest 15mg dose of Mounjaro lost an average of 20.9% of their initial weight versus 3.1% in the placebo arm. Those on the 10mg dose of Mounjaro lost 19.5% of their initial weight versus 3.1% on placebo (Eli Lilly press release April 28, 2022).

Obesity management as a primary treatment goal for T2D: Obesity and T2D share pathophysiological mechanisms that lead to overlapping metabolic complications. As discussed above, GLP-1/GIP biology regulates insulin and glucagon via the pancreas (addressing glucose control in T2D), the gastrointestinal tract, and the CNS which leads to satiety or reduced appetite and weight loss. Obesity and diabetes are interlinked – the term “diabesity” is used to describe obesity and T2D which go hand in hand. Lingvay et al., (Lancet, 2022) pointed out that: “Weight loss is known to reverse the underlying metabolic abnormalities of T2D and, as such, improve glucose control; loss of 15% or more of body weight can have a disease-modifying effect in people with type 2 diabetes, an outcome that is not attainable by any other glucose-lowering intervention.”

Conceptual change in treating T2D beyond glucose control: Treatment of T2D has undergone a conceptual change over the last few years with treatment objectives shifting to include a cardio-centric goal in addition to the long-held gluco-centric goal of regulating blood sugar. This has changed the landscape for treatment of patients with T2D. Professional societies (diabetes, endocrinology and cardiology) have responded to this paradigm shift by advocating for the use of GLP-1 agonists for T2D, further driving GLP-1 agonist revenues.

Reduced risk of cardiovascular disease with GLP-1 agonists: Results from cardiovascular outcome studies have demonstrated that GLP-1 agonist use leads to a robust and consistent reduction in atherothrombotic events, particularly in patients with established atherosclerotic cardiovascular disease. This is an important metric since T2D and obese patients are at increased risk for cardiovascular disease.

2022 Guidelines on T2D by the American Association of Clinical Endocrinology and the American Diabetes Association: Guidelines include recommendations for the use of GLP-1 agonist-based drugs for T2D. The positive benefits of GLP-1 agonists in reducing risks of cardiovascular disease, renal disease, liver fibrosis, and obesity, in addition to glycemic control, were important criteria for the recommendation.

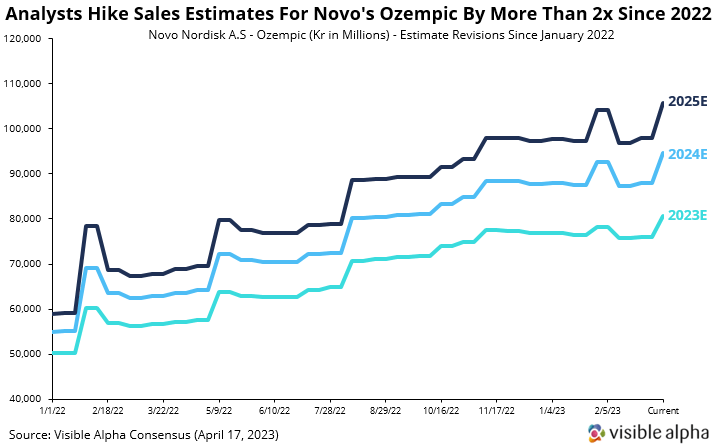

High market demand for Wegovy and Ozempic for weight loss: The recent high demand for Wegovy, soon after its FDA approval, led to its short supply, which was helped by a contract manufacturer delay and significant off-label use (likely for cosmetic weight loss). Subsequently, given the shortage of Wegovy, many were prescribed the other semaglutide, Ozempic, off-label for weight loss (Wegovy is the same active ingredient as Ozempic formulated at a higher dose for obesity). This resulted in a short supply of Ozempic for T2D patients – the patients in actual medical need versus those using Ozempic for obesity or weight loss for cosmetic needs. This high demand for Ozempic resulted in a dramatic increase in Ozempic sales for Novo Nordisk starting in late 2021. Both Wegovy and Ozempic are marketed by Novo Nordisk.

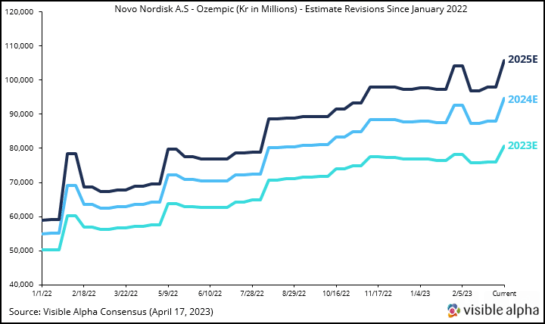

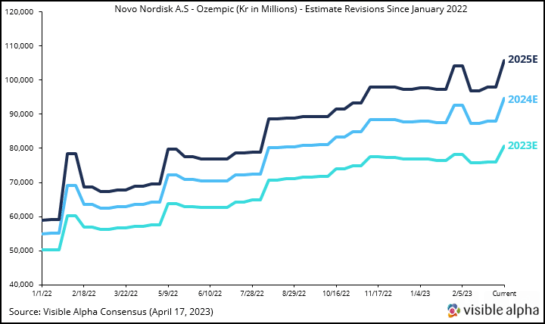

As a result, analysts revised Ozempic revenue estimates several times, as depicted in Figure 3 below, which shows revisions from January 2022 onward. This positive sentiment for Ozempic and next-generation GLP-1 agonists was also buoyed by the many other encouraging factors related to next-generation GLP-1 agonists and their utility in T2D and obesity, as discussed above.

Figure 3: Ozempic revenue estimates were revised upward several times by analysts as demand for Ozempic for obesity/weight loss increased dramatically due to Wegovy’s short supply related to manufacturing delays. Wegovy was launched in June 2021 and was approved specifically for obesity/weight loss, and is the same active ingredient (semaglutide) as Ozempic but formulated at a higher dose for obesity. Ozempic has been approved for T2D since 2017. Ozempic is not FDA-approved for obesity.

Safety and tolerability of GLP-1 agonists

The most common adverse effects of GLP-1 agonists are gastrointestinal in nature — nausea, vomiting, diarrhea, and constipation. Tolerability issues may develop in 40-70% of patients based on reports from clinical trials. These adverse events must be weighed against the superior glycemic control, weight loss, and cardiovascular benefits that GLP-1 agonists provide for T2D and obese patients. In general, the side effects are mild to moderate in intensity and transient for most patients, and usually easily managed. For obesity, however, higher doses of GLP-1 agonists are used and there is no long-term safety data with the higher doses. The use of GLP-1 agonist drugs for cosmetic loss of weight is of concern since individuals may not be monitored for adverse events or long-term risks. For weight reduction, GLP-1 agonists must be used constantly. If treatment is halted, patients will regain the lost weight.

The bottom line

The next generation of the GLP-1 agonist class of therapeutics marks a paradigm shift in the treatment of T2D and obesity. The overlapping metabolic dysfunction in T2D and obesity is appropriately addressed by modulating GLP-1 biology. The magnitude of the impact of GLP-1 agonist drugs in treating T2D and obesity can be gauged by the unusually large market potential. We expect constant innovation leading to several novel GLP-1 agonist drugs to emerge in the years ahead.

References

- Sheahan et al; An overview of GLP-1 agonists and recent cardiovascular outcomes trials. Postgraduate Medical Journal; Volume 96, Issue 1133, March 2020

- Sharma et al; Recent updates on GLP-1 agonists: Current advancements & challenges. Biomedicine & Pharmacotherapy; Volume 108, December 2018

- Jastreboff & Kushner; New Frontiers in Obesity Treatment: GLP-1 and Nascent Nutrient-Stimulated Hormone-Based Therapeutics. Annual Review of Medicine; Vol. 74:125-139, January 2023

- Nauck et al; GLP-1 receptor agonists in the treatment of type 2 diabetes – state-of-the-art. Molecular Metabolism; Volume 46, April 2021

- Shaefer et al; User’s guide to mechanism of action and clinical use of GLP-1 receptor agonists. Postgraduate Medicine; Volume 127 (8), September 2015

- Marx et al; GLP-1 Receptor agonists for the reduction of atherosclerotic cardiovascular risk in patients with type 2 Diabetes. Circulation; 146:1882–1894; December 2022

- Lingvay et al; Obesity management as a primary treatment goal for type 2 diabetes: time to reframe the conversation. Lancet 22;399 (10322); January 2022

- Wilding et al; Once-Weekly Semaglutide in Adults with Overweight or Obesity; New England Journal of Medicine; 384; March 2021

- Fisman & Tenenbaum; The dual glucose-dependent insulinotropic polypeptide (GIP) and glucagon-like peptide-1 (GLP-1) receptor agonist tirzepatide: a novel cardiometabolic therapeutic prospect. Cardiovascular Diabetology: Vol 20; 225 November 2021

- Georgeo-Martinez et al; Clinical recommendations to manage gastrointestinal adverse events in patients treated with Glp-1 receptor agonists: a multidisciplinary expert consensus. Journal of Clinical. Medicine.12(1), 145; January 2023

- Eli Lilly news release April 28, 2022: https://investor.lilly.com/news-releases/news-release-details/lillys-tirzepatide-delivered-225-weight-loss-adults-obesity-or