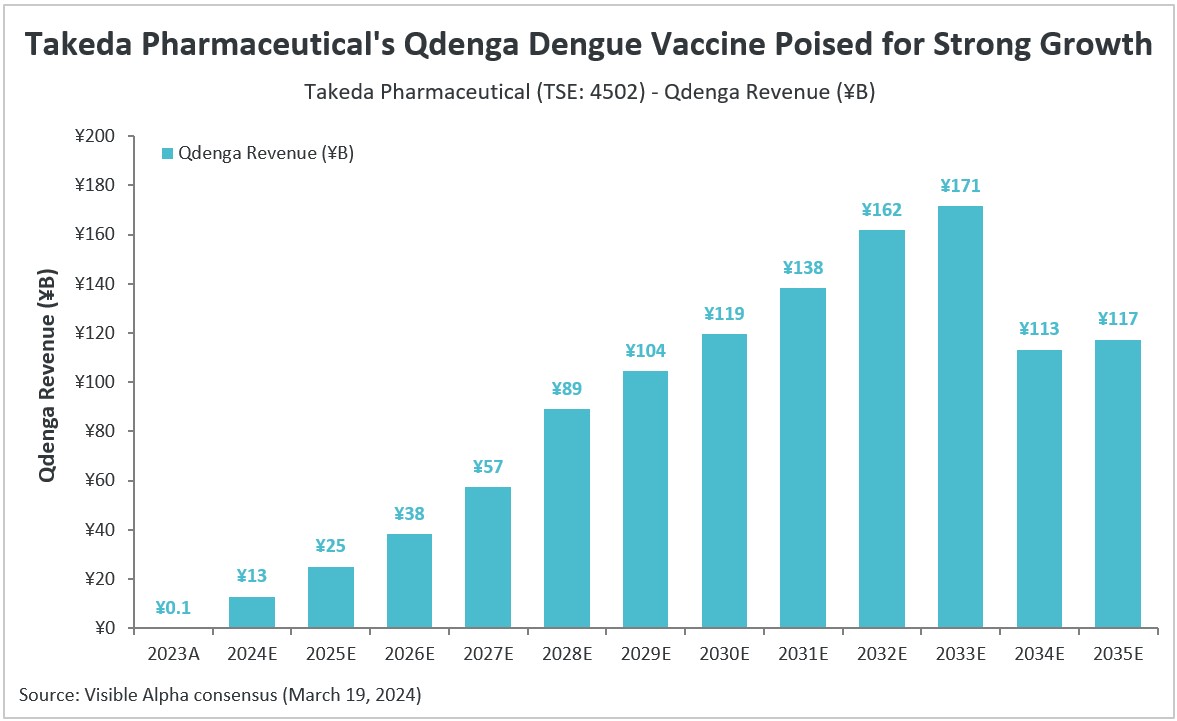

According to Visible Alpha consensus, Takeda Pharmaceutical’s (TSE: 4502) dengue vaccine Qdenga (TAK-003) is expected to generate ¥13 billion in revenue in 2024, and is anticipated to grow at a strong double-digit pace until 2032. Visible Alpha consensus revenue estimates show peak global sales of ¥171 billion for Qdenga by 2033. Sales are projected to dip starting in 2034 as Qdenga’s patent is set to expire on September 17, 2035.

The rise of Qdenga is timely, as two of Takeda’s leading drugs, Vyanase for attention deficit hyperactivity disorder (ADHD) and Azilva for hypertension, lost patent exclusivity in 2023, opening the door for generic competition.

About dengue fever and Qdenga

Dengue fever is caused by the dengue virus that is spread via the bite of an infected mosquito. According to the Centers for Disease Control and Prevention (CDC), a population of around 4 billion (half the world’s population) live in areas at risk for dengue virus infection. Each year, about 40,000 individuals die from serious dengue infection. An estimated 400 million get infected and about 100 million become ill from infection with dengue virus.

The Qdenga vaccine is based on a live-attenuated dengue serotype 2 virus that provides a genetic backbone for the four known dengue virus serotypes. It is designed to protect against all of the dengue virus serotypes. Qdenga aims to improve upon Sanofi’s Dengvaxia, the world’s first dengue virus vaccine. Following safety concerns, Dengvaxia’s use has been restricted to children aged 6 to 16 with evidence of prior dengue infection, specifically in endemic regions.

Qdenga not yet FDA-approved

First approved for use in Indonesia in 2022, Qdenga is currently approved in the U.K., Brazil, Argentina, Indonesia, Thailand, and Malaysia. Qdenga was approved in Europe in 2023. Approval by the FDA in the U.S. encountered obstacles. In November 2023, the FDA initiated a priority review for Qdenga, a process that typically takes less than six months, as opposed to the standard 10-month review. However, Takeda voluntarily withdrew its U.S. application because the FDA required additional data that Takeda had not captured in the Phase 3 trial. Takeda has not re-initiated the application with the FDA.

Reviewed by Rahul Jasuja, PhD

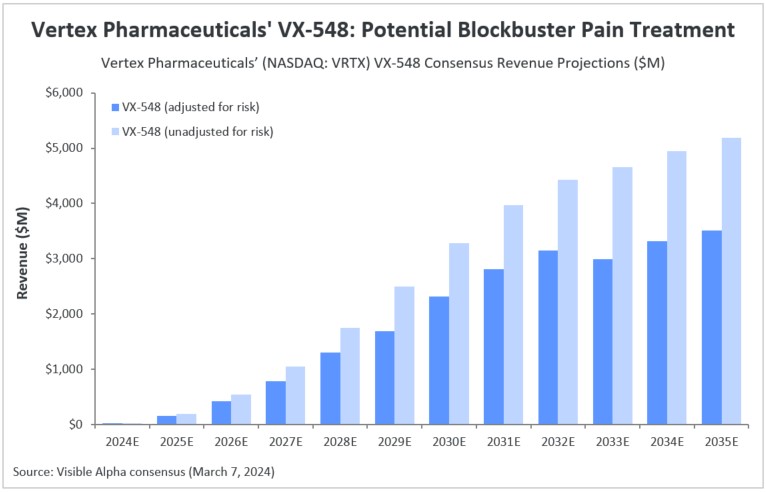

Vertex Pharmaceuticals (NASDAQ: VRTX) is expected to generate $21.1 million in revenue from its non-opioid pain treatment VX-548 in 2024. The company is currently preparing a new drug application (NDA) for VX-548, which has been granted both breakthrough therapy and fast track designations. This application is set to be submitted to the FDA by mid-2024. According to Visible Alpha consensus, analysts project risk-adjusted revenue of $1.3 billion by 2028 and $3.3 billion by 2034. Analysts estimate the likelihood of success for VX-548 at 75%.

About VX-548

VX-548’s mechanism does not hold addictive potential, thereby achieving opioid-like efficacy without the abuse potential of that class of effective, but problematic, drugs. In January, Vertex announced successful results from three Phase 3 studies of VX-548, showing significant pain reduction for both surgical and non-surgical patients. However, it failed to meet the secondary goal in two trials of reducing pain when compared to a combination of the opioid drug hydrocodone and acetaminophen, the basis for popular pain medications like Tylenol. Vertex is also pursuing a broad label for VX-548 in peripheral neuropathic pain, with positive Phase 2 results in painful diabetic peripheral neuropathy reported and plans to advance pivotal development in this area.

Prior to VX-548, Vertex discontinued development of three other non-opioid drugs—VX-128, VX-150, and VX-961—due to unsuccessful Phase 1 and 2 trials. This makes VX-548’s Phase 3 results a significant win for Vertex.

Potential advantages of VX-548

Selective inhibition of voltage-gated sodium channel NaV1.8 with VX-548 for acute pain is a novel approach. Most approved pain drugs either act on the opioid-receptor system, or are non-steroidal anti-inflammatory drugs (NSAIDs), or are non-selective sodium-channel inhibitors (for example, lidocaine). Opioid use is limited by safety concerns and the potential for misuse and addiction, and NSAIDS and non-selective sodium-channel inhibitors have safety and efficacy limitations. Selective inhibition of voltage-gated sodium channel NaV1.8 is an important addition in the armory of pain drugs.

Reviewed by Rahul Jasuja, PhD

Madrigal Pharma’s Resmetirom Approaching FDA Review for NASH

The FDA is slated to review Madrigal Pharmaceuticals’ (NASDAQ: MDGL) Resmetirom for patients with nonalcoholic steatohepatitis (NASH) with fibrosis — the FDA’s Prescription Drug User Fee Act (PDUFA) date is set for March 14, 2024. NASH is a dangerously progressive liver disease with no approved pharmacological agent. If Resmetirom is approved, it will be the first FDA-approved drug for NASH. Several NASH drug candidates have failed in clinical trials or in regulatory review, and a long pipeline of NASH drug candidates are in clinical trials.

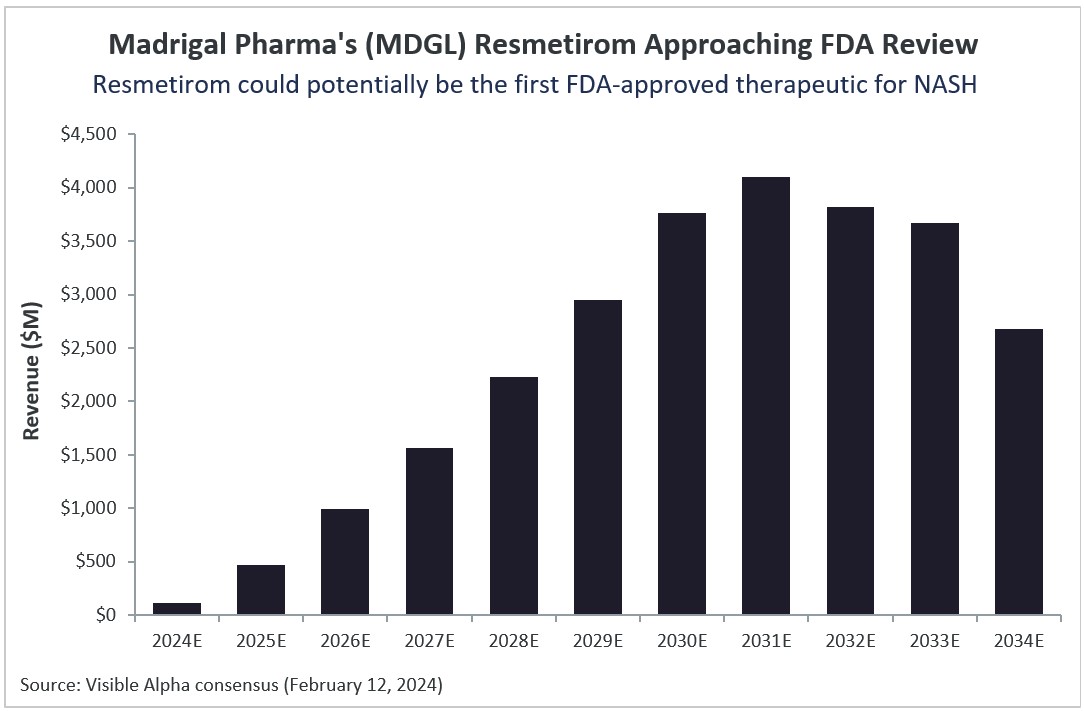

Resmetirom projections

Based on Visible Alpha consensus, Resmetirom is projected to generate over $4.1 billion in risk -adjusted revenues in its peak sales year in 2031. Visible Alpha consensus pegs the probability of success (POS) for Resmetirom approval by the FDA in NASH patients with liver fibrosis at 86.3%.

NASH and NAFLD

According to the American Liver Foundation, NASH, now also called metabolic dysfunction-associated steatohepatitis (MASH), is a form of nonalcoholic fatty liver disease (NAFLD) in which patients have inflammation of the liver and liver damage, in addition to excess fat accumulation in the liver. Patients with NASH have significant liver fibrosis leading to compromised liver function. Ultimately, NASH may progress to cirrhosis and/or liver cancer. At that stage, the liver may be permanently damaged and the only option is liver transplantation.

Resmetirom’s mechanism of action

Resmetirom has a novel mechanism of action — it is an oral thyroid hormone receptor beta-selective agonist. In NASH, the beta thyroid hormone receptor function is impaired, leading to reduction in mitochondrial function as well as reduction in β-oxidation of fatty acids that progresses to fibrosis (Harrison et al; New England Journal of Medicine 390;6, February 8, 2024). Resmetirom was a topic of discussion in our recent publication: Potential FDA Approvals: A Look Ahead for 2024.

Potential FDA Approvals: A Look Ahead for 2024

In 2023, we saw the FDA approve 55 drugs under the Center for Drug Evaluation and Research (CDER) and 17 under the Center for Biologics Evaluation and Research (CBER), one of the most prolific FDA drug approval years. Aside from this high number of approvals in 2023, the innovation in drug development was notable, marked by the approval of the first CRISPR-based gene therapy and the approval of the first beta amyloid antibody therapy for Alzheimer’s disease (see our note on 2023 drug approvals here).

Our evaluation of drug candidates lined up for potential FDA approvals in 2024 looks promising on both the innovation and market potential fronts. Here, we highlight select drug candidates that are expected to be approved in 2024 and that have significant innovation impact and revenue potential.

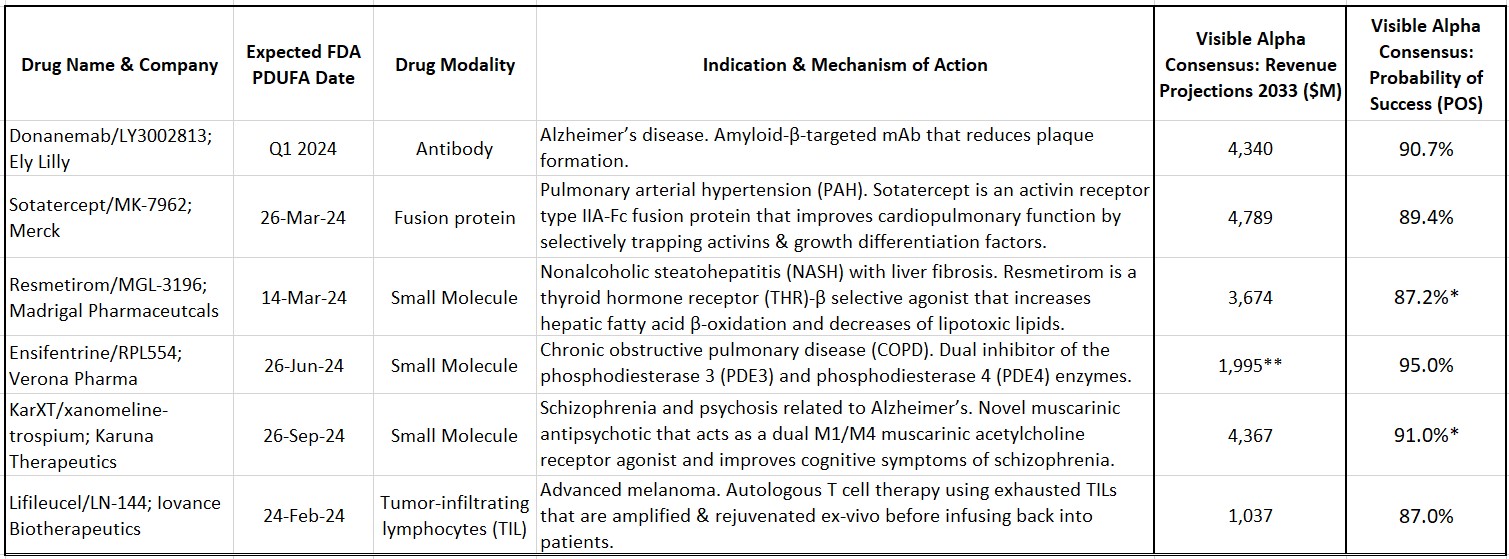

Key drug candidates slated for FDA review in 2024

Sotatercept (MK-7962) is being developed by Merck (NYSE: MRK) for pulmonary arterial hypertension (PAH). PAH is a rare and progressive blood vessel disease accompanied by increased arterial blood pressure and narrowing of the arteries in the lungs. Sotatercept is a first-in-class activin-signaling inhibitor with a novel mechanism of action that will add to the current treatment options for PAH. Based on approval in 2024, Visible Alpha consensus estimates project 2033 risk-adjusted revenues of $4.8 billion (consensus probability of success is at 89.4%).

Resmetirom (MGL-3196) is developed by Madrigal Pharmaceuticals (NASDAQ: MDGL) for nonalcoholic steatohepatitis (NASH) with liver fibrosis. NASH is an advanced form of nonalcoholic fatty liver disease (NAFLD). NAFLD is estimated to afflict more than 20% of adults globally, about 30% in the U.S. Of that NAFLD population, 20% may have NASH. The prevalence of NAFLD/NASH, along with type 2 diabetes and obesity, is rising worldwide. Resmetirom is a thyroid hormone receptor (THR)-β selective agonist that increases hepatic fatty acid β-oxidation and decreases the burden of lipotoxic lipids. Based on approval in 2024, Visible Alpha consensus estimates project 2033 risk-adjusted revenues of $3.6 billion (consensus probability of success is at 87.2% for the U.S./FDA).

Ensifentrine (RPL-554) is being developed by Verona Pharma (NASDAQ: VRNA) for chronic obstructive pulmonary disease (COPD). Ensifentrine is a first-in-class, inhaled, dual inhibitor of the phosphodiesterase 3 (PDE3) and phosphodiesterase 4 (PDE4) enzymes. The selective and dual inhibition combines bronchodilator and non-steroidal anti-inflammatory properties in one compound, differentiating it from other marketed COPD drugs. In addition, Ensifentrine activates the Cystic Fibrosis Transmembrane Conductance Regulator (CFTR), making it effective in reducing mucous viscosity and improving mucociliary clearance (currently in Phase 2 for cystic fibrosis). Based on approval in 2024, Visible Alpha consensus estimates project 2032 risk-adjusted revenues of $2.0 billion (consensus probability of success is at 95.0%).

Table 1: Select drug candidates with upcoming 2024 Prescription Drug User Fee Act (PDUFA) dates

Source: Visible Alpha consensus (January 30, 2024) *POS for Resmetirom and KarXT are for U.S./FDA approval **Reflects 2032 revenues for Ensifentrine

KarXT (xanomeline-trospium) is being developed by Karuna Therapeutics (NASDAQ: KRTX) for schizophrenia. KarXT is based on a novel mechanism of action in the treatment of schizophrenia. It is a muscarinic antipsychotic that acts as a dual M1/M4 muscarinic acetylcholine receptor agonist in the central nervous system and improves cognitive symptoms of schizophrenia. KarXT does not block dopamine receptors like currently approved schizophrenia therapies and presents as a new mechanism of action in the treatment of schizophrenia. It is also in development for psychosis related to Alzheimer’s disease. Based on approval in 2024, Visible Alpha consensus estimates project 2033 risk-adjusted revenues of $4.4 billion (consensus probability of success is at 88.9% for the U.S./FDA for schizophrenia).

Lifileucel (LN-144) is being developed by Iovance Biotherapeutics (NASDAQ: IOVA) for advanced melanoma. Lifileucel is the first tumor-infiltrating lymphocyte (TIL) therapy to be reviewed by the FDA. TILs are immune cells that have recognized tumor antigen but are rendered ineffective or “exhausted” by the tumor. These TILs can be harvested from the patient, expanded, and rejuvenated ex-vivo and then infused back into the patient. TIL therapy is a novel approach in immunotherapy based on the pioneering work of tumor immunologist Steve Rosenberg at NIH. Based on approval in 2024, Visible Alpha consensus estimates project 2033 risk-adjusted revenues of $1.0 billion (consensus probability of success is at 87.0%).

Donanemab (LY3002813) is being developed by Eli Lilly (NYSE: LLY) for early Alzheimer’s disease. Donanemab is a beta-amyloid targeting antibody that follows in the footsteps of Leqembi (lecanemab), approved in 2023. Both Donanemab and Leqembi reduce amyloid plaques and slow disease progression. Based on approval in 2024, Visible Alpha consensus estimates project 2033 risk-adjusted revenues of $4.3 billion (consensus probability of success is at 90.7%). Our previous evaluation of Leqembi and donanemab can be viewed here.

Drug development themes and trends continuing in 2024

The following drug development trends will continue to interest investors and corporate business development through 2024 and beyond:

- Antibody Drug Conjugates (ADC)-based drugs will continue to drive investor and corporate interest with several acquisitions already completed in recent months. Even though we don’t see any FDA approvals upcoming for novel ADC drugs in 2024 (except for supplemental applications for indication extensions for already approved ADCs), ADC drug development remains an area of significant innovation and Big Pharma acquisitions. Notable was Pfizer’s (NYSE: PFE) acquisition of Seagen in 2023 and Johnson & Johnson’s (NYSE: JNJ) acquisition of Ambrx (NASDAQ: AMAM) in January 2024.

- Investors will be anxiously watching the performance of beta-amyloid antibodies for Alzheimer’s disease — Leqembi approved in 2023 and donenamab (PDUFA date in March 2024). Unlike currently marketed drugs, Leqembi and donanemab target the underlying cause of Alzheimer’s and have the potential to modify the course of the disease. Several next generation beta-amyloid targeting inhibitors for Alzheimer’s disease are in the pipeline.

- Investors will also keep an eye on the 2020 Nobel Prize winning technology, CRISPR-based gene therapy. Following the approval of the first CRISPR gene therapy, Casgevy, for sickle cell disease (SCD) in 2023, we expect novel CRISPR-based gene therapies to progress to the market in the near future. Casgevy for beta thalassemia was recently approved by the FDA on January 16th, 2024.

- The GLP-1 pathway space will continue to be prominent beyond just the blockbuster revenues for the two leaders, Novo Nordisk (NYSE: NVO) and Eli Lilly. Several GLP-1 mid-stage and late-stage clinical trials are ongoing in cardiometabolic indications other than obesity and type 2 diabetes. The developing pipeline for the next generation GLP-1 is long and other Big Pharma companies are vying to compete with the leaders. The frequent business development activity that occurred in 2023 is bound to continue in 2024. Big Pharma companies are seeking novel early-stage private and public GLP-1 and GLP-1-related pathway assets.

Drug development innovation continues at a robust pace as several first-in-class and groundbreaking therapies were approved by the FDA in 2023. Visible Alpha provides consensus revenue projections for novel therapeutic drugs approved in 2023 with the highest market potential and those with a major innovation impact. (See also our overview of 2022 FDA-approved drugs.)

Our picks for the two potentially most lucrative and innovative therapeutic drug development approvals in 2023 are Leqembi and Casgevy. We chose Leqembi for overcoming the scientific, clinical, and regulatory challenges in developing the first beta amyloid inhibitor for Alzheimer’s disease, a disease with complex and poorly understood biology as well as for the potential for blockbuster annual revenues of almost $10 billion by 2033. We picked Casgevy primarily for the innovation behind CRISPR gene-editing technology that marks a milestone in drug development history. Casgevy’s revenue potential is also impressive — over $4 billion in 2033.

Standouts in the class of 2023: Leqembi for Alzheimer’s and the first CRISPR gene-editing therapy

The 2023 FDA therapeutic drug approval list reflects continued innovation in drug development. In our view, the approval of the first beta amyloid targeting antibody for Alzheimer’s disease, Leqembi (lecanemab), marks a major milestone after decades of research and development hiccups in attempting to develop a beta amyloid inhibitor. Leqembi was developed by Eisai (TSE: 4523) and Biogen (NASDAQ: BIIB), and was approved in July 2023 as the first disease-modifying therapy that targets the underlying cause of Alzheimer’s disease (see also our previous article on Leqembi). With the approval of Leqembi, we expect a long pipeline of improved beta amyloid pathway inhibitors in clinical development. According to Visible Alpha consensus, analysts project revenues of $9.8 billion for Leqembi in 2033.

The invention of the first gene-editing CRISPR technology (“genetic scissors”) was awarded the Nobel Prize in chemistry in 2020, less than a decade after the discovery of all the various molecular components of the system (CRISPR/Cas9). Casgevy (Exa-cel), the first CRISPR-based gene-editing therapy for sickle cell disease (SCD), was approved by the FDA in December 2023. The rapid pace of innovation and drug development within a short timespan is remarkable. The approval of the first CRISPR-based therapeutic opens the floodgates to many more CRISPR-based therapeutics targeting a broad repertoire of gene-editing targets for several indications. According to Visible Alpha consensus, analysts project 2033 revenues of $4.1 billion for Casgevy.

Comparing market potential with GLP-1 drugs approved in prior years

While Leqembi and Casgevy are potentially blockbuster drugs by most historical standards, they are dwarfed when compared to the market potential of the GLP-1 based drugs approved in prior years. Last year, we projected Eli Lilly’s Mounjaro, approved in 2022 for type 2 diabetes, at around $20B in estimated consensus revenues for 2030. Mounjaro has since been granted expanded FDA approval for obesity in 2023, marketed under the brand name Zepbound. Currently, Visible Alpha consensus revenue projections for 2033 for Mounjaro and Zepbound combined are at a staggering $45 billion ($22 billion for Mounjaro for type 2 diabetes plus $23 billion for Zepbound for obesity). Novo Nordisk’s competing GLP-1 franchise, which includes Ozempic (approved in 2017 for type 2 diabetes), Wegovy (approved in 2021 for obesity), and Rybelsus (approved in 2019 as an oral drug for type 2 diabetes), are projected to reach a combined $38 billion in revenue by 2033.

Checkpoint inhibitors also have large market potential

Another drug with massive market potential is Keytruda, the checkpoint inhibitor targeting the PD-1/PD-L1 pathway for oncology that was first approved by the FDA in 2014 for advanced melanoma. Keytruda is FDA approved for 16 different cancers today. Visible Alpha consensus revenue estimates project peak revenues in 2027 of $34.4 billion.

Other notable drugs approved in 2023 with significant market potential

There are several other drugs approved in 2023 that are noteworthy in their own right in overcoming an innovation challenge or in addressing an unmet medical need for patients:

- Bimzelx (bimekizumab), developed by UCB, is projected to reach $3.4 billion in revenue by 2033. Bimzelx, a monoclonal antibody against IL-17A and IL-17F, is approved for moderate-to-severe plaque psoriasis. While there are other approved IL-17A inhibitors, Bimzelx is the first that targets both IL-17A and IL-17F. Both IL-17A and IL-17F contribute to inflammatory signals in autoimmune disease.

- Arexvy, developed by GSK with 2033 consensus revenue estimates at $3.1 billion, and Abrysvo, developed by Pfizer with 2033 consensus revenue estimates at $2.3 billion, are pioneering RSV vaccines approved for adults over 60 years of age. Abrysvo is also approved for pregnant women at risk for transmitting RSV to their infants. The RSV vaccine is poised to have a major impact globally — there are over 33 million RSV infections worldwide and over 100,000 deaths annually.

- Elevidys (delandistrogene moxeparvovec-rokl), developed by Roche, Sarepta, and Chugai, is projected to reach revenue of $2.7 billion in 2033. Elevidys is the first gene therapy approved for patients aged 4 through 5 years with Duchenne Muscular Dystrophy (DMD) with a confirmed mutation in the DMD gene. The gene therapy corrects for a mutation in the dystrophin gene that regulates muscle cell cytoskeleton and muscle cell membrane interaction with the extracellular matrix. The mutation results in loss of muscle function (muscular dystrophy) affecting walking, breathing, cardiovascular health and even learning disabilities. Elevidys is a one-time treatment that will alter the course of a disease with acute unmet needs.

- Truqap (capivasertib), developed by AstraZeneca with 2033 consensus revenue estimates at $926 million in 2033, is the first AKT inhibitor approved in combination with estrogen receptor antagonist fulvestrant for hormone-receptor-positive, HER2-negative metastatic breast cancer that is biomarker positive.

- Vowst (fecal microbiota spores, live, in a capsule form), developed by Seres Therapeutics, has consensus revenue estimates of $334 million by 2033. Vowst is approved to prevent the recurrence of Clostridioides difficile infection. The drug is derived from human fecal matter sourced from qualified donors. The repertoire of healthy natural microbiota in Vowst competes with Clostridioides difficile and restores the gut’s natural resistance to infection with Clostridioides difficile.

Below, we’ve selected 16 therapeutic drugs with a high market potential and notable innovation, and provide consensus revenue estimates for the year 2033 (Table 1).

Table 1: Consensus revenue estimates for therapeutic drugs approved in 2023 with robust market potential and notable innovation

A Breakdown of the CDER and CBER 2023 Approvals

There are two branches that approve drugs under the FDA — Center for Drug Evaluation and Research (CDER) and Center for Biologics Evaluation and Research (CBER). CDER approves new molecular entities (NMEs, or small molecule drugs) under a New Drug Application (NDA), or as new therapeutic biological products (large molecule drugs that include antibody-based therapeutics, enzymes, peptides) under a Biologic License Application (BLA). The CBER branch regulates vaccines, blood products, cell therapies (including CAR-T cells), gene therapies, and CRISPR/gene-editing therapies.

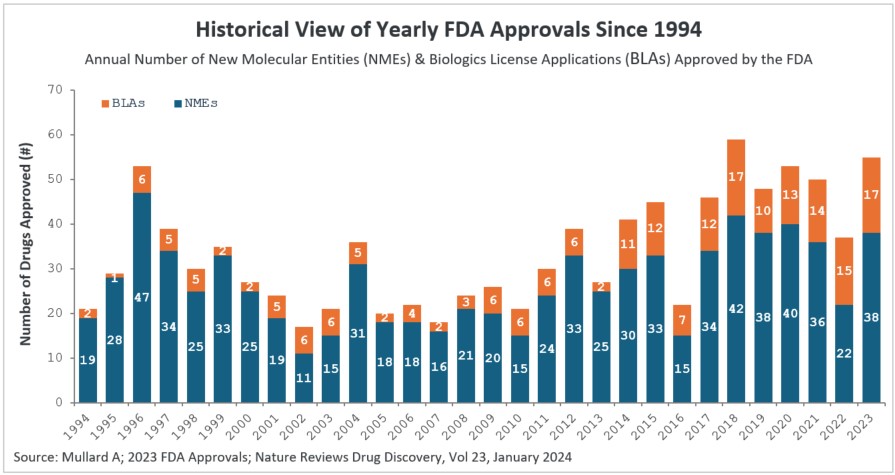

- There was a substantial increase in 2023 approvals compared to 2022. In 2023, the CDER branch approved 53 novel therapeutic drugs (see Table 2). We exclude Posluma, the prostate cancer diagnostic agent, and Paxlovid, the COVID anti-viral, since it had already been granted Emergency Use Authorization (EUA) during the pandemic in 2021 (including Posluma & Paxlovid, the 2023 CDER approvals are 55). The 53 novel therapeutic drugs approved is a significant increase over the 37 drugs approved by CDER in 2022. The 2023 rate of drug approval is in keeping with prior years — 2022 was an anomaly (see Figure 1), with COVID being a major factor. Notably, 2023 had the second highest number of drugs approved by CDER, behind the 59 drugs approved in 2018.

- CBER approved 16 novel drugs in 2023 — we count the RSV vaccine Abrysvo, approved for pregnant women and for adults above the age of 60, as one approval (CBER lists it separately). In comparison, in 2022, CBER approved 14 novel drugs.

- CDER approvals in 2023 based on modality included: 29 small-molecule drugs (not including a diagnostic agent small molecule), 12 antibody-based drugs (these include bispecifics and ADCs), 8 proteins/peptides/fusion proteins, and 4 DNA/RNA-based drugs.

- CBER approvals in 2023 based on modality included: 5 vaccines, 2 autologous cell therapy gene therapies (including CRISPR), 2 allogeneic cell therapies, 3 viral vector-based gene therapies, 1 fecal microbiota, 1 enzyme replacement therapy, 1 fusion protein, and 1 natural plasma derived protein.

- The highest number of drugs approved in 2023 were for oncology (17), followed by neurology (6), infectious diseases (5), metabolic disorders (5), and ophthalmology (3).

- Based on the FDA regulatory pathway of approval (some drugs may fall under more than one regulatory pathway): 9 Accelerated Approvals, 8 Orphan Drug designations, 16 Fast-Track designations, 24 Priority Reviews, and 9 Breakthrough Therapy designations.

See Tables 2 and 3 for descriptions, including modality, indication, and mechanism of action for CDER and CBER approvals in 2023.

Figure 1: Historical view of yearly FDA approvals since 1994

New molecular entities (NMEs) and biologics license applications (BLAs) approved by the FDA’s Center for Drug Evaluation and Research (CDER) branch since 1994. Note that CBER approvals are not depicted here. The 55 drug approvals in 2023 were significantly higher than the 37 drugs approved by CDER in the previous year.

References

- Novel Drug Approvals for 2023 (CDER). https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/novel-drug-approvals-2023

- 2023 Biological Approvals (CBER). https://www.fda.gov/vaccines-blood-biologics/development-approval-process-cber/2023-biological-approvals

- FDA Approves Many New Drugs in 2023 that Will Benefit Patients and Consumers. Patrizia Cavazzoni, M.D., Director, Center for Drug Research and Evaluation. https://www.fda.gov/news-events/fda-voices/fda-approves-many-new-drugs-2023-will-benefit-patients-and-consumers

- Mullard A; 2023 FDA approvals. Nature Reviews Drug Discovery, 2024 Jan 2. https://pubmed.ncbi.nlm.nih.gov/38168801/

Key Takeaways

|

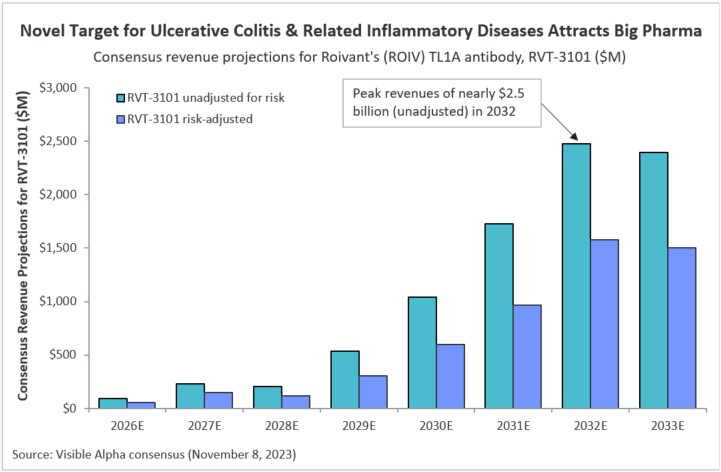

TL1A (TNF-like ligand 1A) is a high-value target that has gained significant interest of late. This target has implications across several auto-immune inflammatory diseases, including ulcerative colitis and Crohn’s disease.

In June 2023, Merck & Co. (NYSE: MRK) acquired Prometheus Biosciences for $10.8 billion, driven by the promise of its TL1A antibody, PRA-023.

In October 2023, Roche (SIX: ROG) agreed to acquire rights to RVT-3101, Roivant Sciences’ (NASDAQ: ROIV) TL1A-targeting antibody, for $7.1 billion upfront and $150 million in upcoming milestone payments. RVT-3101 is held under Telavant Holdings, a Roivant and Pfizer (NYSE: PFE) joint venture. Roivant owns 75% of the joint venture and Pfizer owns 25%.

Analysts’ projections for RVT-3101 revenue

Visible Alpha consensus estimates project peak global revenues of nearly $2.5 billion in 2032 (not adjusted for risk). Risk-adjusted consensus revenue projections for 2032 are nearly $1.6 billion. Analysts apply a probability of success of 61.7% for RVT-3101. Currently, RVT-3101 has completed Phase 2 studies and is ready to begin Phase 3 clinical trials for ulcerative colitis. For Crohn’s disease, RVT-3101 is currently in Phase 2.

Figure 1: Consensus revenue projections for Roivant’s RVT-3101

About TL1A

TL1A is secreted from antigen-presenting cells upon stimulation and plays a central role in activating innate and adaptive immune pathways by binding to TNFRSF25 (or death receptor 3 (DR3)) on T cells. Under disease conditions, loss of regulation of TL1A-TNFRSF25 signaling leads to proinflammatory effects including excessive T cell activation. This inflammatory pathology is implicated in inflammatory bowel disease that collectively includes Crohn’s disease and ulcerative colitis. The potential for blocking TL1A across numerous other auto-immune inflammatory diseases is also promising.

Emerging Drugs Show Promise in Targeting Difficult-to-Treat Cancers

Key Takeaways

|

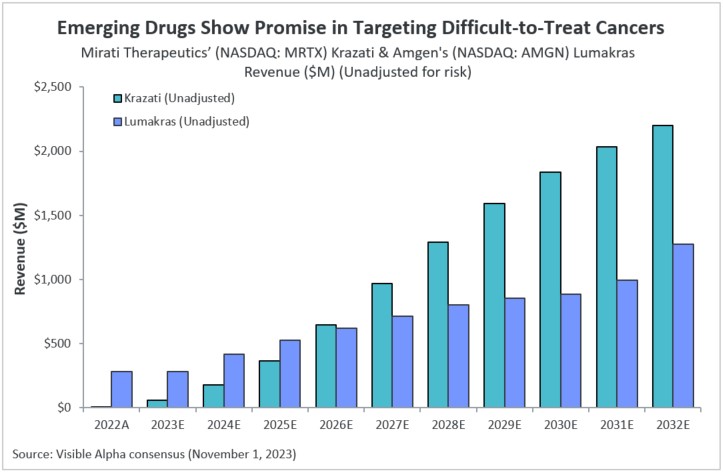

Cancers harboring KRAS mutations have historically been a challenge to treat. After almost four decades of research, two KRAS mutation-targeting therapies that have already been granted conditional (accelerated) approval by the FDA for non-small cell lung cancer, are undergoing the process towards full approval – Amgen’s (NASDAQ: AMGN) Lumakras and Mirati Therapeutics’ (NASDAQ: MRTX) Krazati.

Visible Alpha consensus revenue projections show Krazati at approximately $2.2 billion and Lumakras at approximately $1.3 billion in 2032 global revenues. Based on clinical trial data and recent FDA Advisory Committee views, analysts are wary of Lumakras given the recent regulatory concerns (discussed below), and view Krazati as the potentially superior KRAS inhibitor.

Figure 1: Revenue projections for Amgen’s Lumakras and Mirati Therapeutics’ Krazati

Conditional approvals of Lumakras and Krazati

Amgen’s KRAS inhibitor, Lumakras (sotorasib), was granted conditional approval for non-small cell lung cancer in May 2021, and Mirati Therapeutics’ Krazati (adagrasib) was granted conditional approval for non-small cell lung cancer in December 2022. Lumakras has also received conditional approval by the European Medicines Agency. Krazati was refused conditional approval by the European Medicines Agency, but Mirati Therapeutics will request re-examination.

Confirmatory trials for full approval of Lumakras and Krazati

Amgen has completed Phase 3 confirmatory trials for Lumakras and submitted the application for full approval to the FDA. On October 5, 2023, the FDA Advisory Committee meeting briefing document revealed the negative views of the Advisory Committee on the trial data supporting full approval of Lumakras for non-small cell lung cancer. Several of the points raised by the Advisory committee related to bias in the two arms of the clinical trial. The FDA has not made a decision yet, but it is likely that additional trials may be required in order for Lumakras to be fully approved for non-small cell lung cancer. Analysts have reduced the revenue potential for Lumakras given the regulatory concerns. Lumakras clinical trial data in other tumors such as colorectal cancer or in combination studies may be more positive.

The Krazati Phase 3 confirmatory trials are yet to be reviewed by the FDA. Krazati, in combination (with PD-1) or as a monotherapy, has a better safety profile and efficacy than Lumakras.

Bristol-Myers Squibb to acquire Mirati Therapeutics – driven partly by Krazati potential

On October 9, 2023, Bristol-Myers Squibb (NYSE: BMY) and Mirati Therapeutics entered into an agreement under which BMY will acquire MRTX for $58 per share, valued at $4.8 billion, plus a Contingent Value Right (CVR) potentially worth an additional $1 billion. The transaction is expected to close in the first half of 2024. Both BMY’s and MRTX’s boards have agreed to the terms of the transaction.

Even though the KRAS space faces regulatory challenges, Bristol-Myers Squibb clearly believes that the Krazati confirmatory Phase 3 data will be the basis for full approval in non-small cell lung cancer. The issues with Lumakras that the FDA Advisory Committee raised are specific to Lumakras, and not for KRAS in general. Mirati Therapeutics also has additional promising oncology targets in its pipeline.

About KRAS

KRAS is the most frequently mutated oncogene in cancer. KRAS, a member of the RAS family, is a key regulator of signaling pathways that orchestrate cell proliferation, differentiation, and survival. Mutations in the RAS pathway can drive uncontrolled tumor growth. Effective RAS pathway inhibitor drugs have been elusive for decades – the structural biology and chemistry of RAS has made it a challenge to design effective inhibitors. Both Lumakras and Krazati are selective inhibitors of tumors that specifically harbor a KRAS G12C mutation (i.e. where the mutation results in a glycine to a cysteine substitution) that drives tumor growth.

First CRISPR-based Gene Therapy for Sickle Cell Disease On Track for FDA Approval

Key Takeaways

|

Two groundbreaking gene therapy treatments for sickle cell disease (SCD), offering potential cures, are on track for FDA approval with the expectation that both could be approved by December 2023. In April 2023, CRISPR Therapeutics (NASDAQ: CRSP) and Vertex Pharmaceuticals (NASDAQ: VRTX) submitted a Biologics License Application (BLA) for exa-cel (exagamglogene autotemcel), formerly known as CTX001. Exa-cel is intended to treat severe SCD and transfusion-dependent beta-thalassemia (TDT).

In the same month, Bluebird Bio (NASDAQ: BLUE) submitted a BLA for lovo-cel (lovotibeglogene autotemcel) for SCD patients 12 years and older with a history of vaso-occlusive events. Both submissions received FDA Priority Review status for SCD, indicating a regulatory decision within 6 months.

Exa-cel and lovo-cel

Exa-cel is a CRISPR-based gene editing approach to gene therapy, while lovo-cel is a lentivirus-based gene therapy. Exa-cel will be the first CRISPR-based therapy to be reviewed by the FDA — a major milestone for CRISPR gene editing, which was awarded the Nobel Prize in 2022. Both exa-cel and lovo-cel are potential one-time therapies that provide a functional cure for SCD by modifying the patient’s hematopoietic stem cells. Gene therapy approaches are particularly beneficial for those without a suitable bone marrow donor.

Current treatment options for SCD

Patients with SCD have limited treatment options and hematopoietic stem cell transplant (HSCT) is the only curative treatment for SCD that can restore red blood cell and hemoglobin function. HSCT is invasive, requires a suitable donor and is associated with immune rejection risk.

Other than HSCT, currently approved treatments for SCD address symptom management and prevention of complications. Pfizer’s (NYSE: PFE) Oxbryta is an oral medication for SCD approved in the U.S. and the EU that increases hemoglobin by inhibiting red blood cell sickling, improving red blood cell function, and reducing whole blood viscosity.

Novartis’s (NYSE: NVS) Adakveo is a P-selectin antibody that reduces the frequency of vaso-occlusive events and prevents SCD-related pain. Adakveo was approved in the U.S. in November 2019 and was granted conditional approval in the EU in October 2020. However, the EU revoked its authorization in August 2023 following an unsuccessful Phase 3 trial.

Shift toward gene therapy

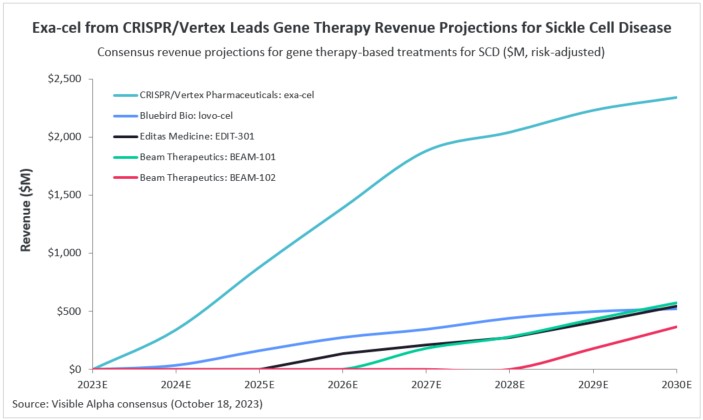

With the expected approval of gene therapy treatments this year, analysts expect a growing shift toward gene therapy as an effective treatment option for SCD. According to Visible Alpha consensus, Exa-cel (CRISPR and Vertex) for SCD is expected to generate $2.34 billion in risk-adjusted revenue by 2030. Analysts peg the probability of success for exa-cel at 77.8%. Bluebird Bio’s lovo-cel is expected to generate $520 million by 2030, with a probability of success of 78.3%.

Other gene therapy drugs in clinical trials for SCD include BEAM Therapeutics’ (NASDAQ: BEAM) BEAM-101 and BEAM-102, as well as Editas Medicine’s (NASDAQ: EDIT) EDIT-301. BEAM-101 is currently in Phase 2 trials, BEAM-102 is in the preclinical stage, and EDIT-301 is in Phase 1.

Figure 1: Gene therapy revenue projections for sickle cell disease (SCD)

By: Aarti Surendran

Reviewed By: Rahul Jasuja, PhD

Eli Lilly’s Obesity Drug Surge; Plug Power’s Hydrogen Ecosystem; OPAL’s Renewable Natural Gas Focus

In our weekly round-up of the top charts and market-moving analyst insights: Eli Lilly’s (NYSE: LLY) Mounjaro is poised for a surge in sales with expected approval for obesity; Plug Power (NASDAQ: PLUG) is expected to see rising revenues fueled by its hydrogen ecosystem; OPAL Fuels’ (NASDAQ: OPAL) strategic focus on renewable natural gas is set to boost future revenue.

Eli Lilly’s Mounjaro Set for Revenue Surge with Expected Obesity Approval

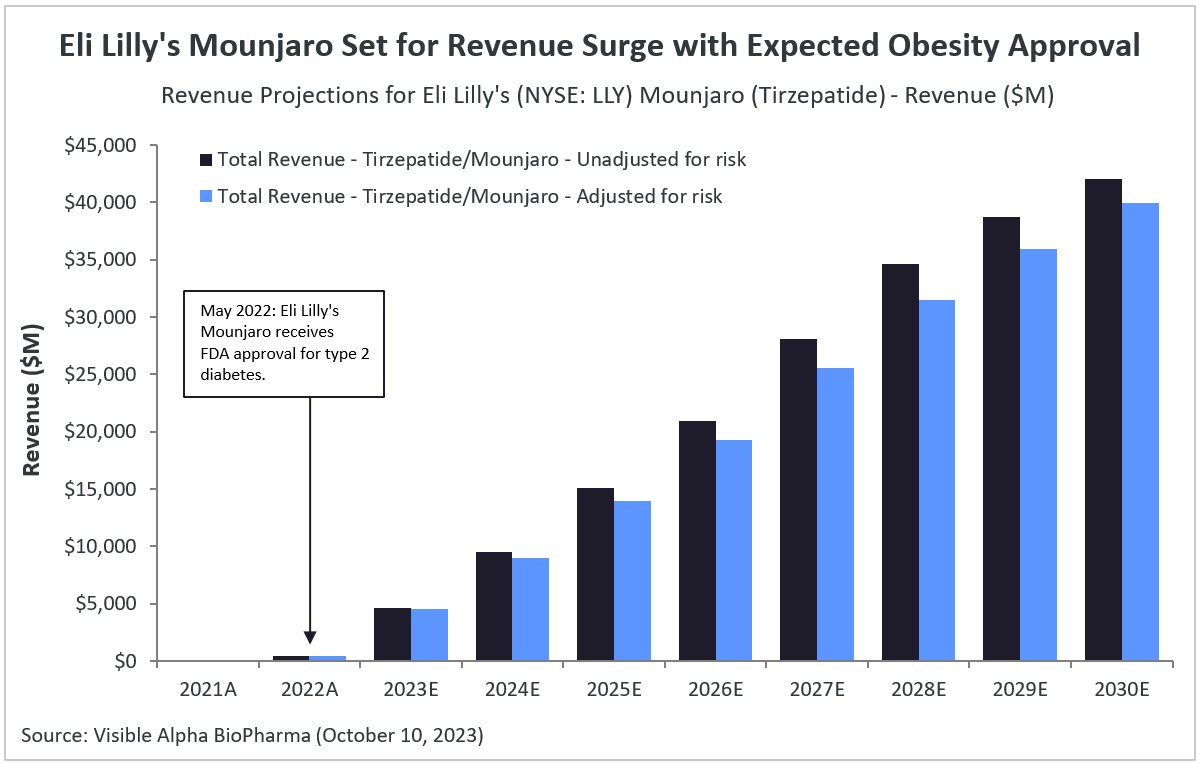

According to Visible Alpha consensus, Eli Lilly’s (NYSE: LLY) Mounjaro is expected to generate revenue of $4.61 billion in 2023 and more than double in 2024, reaching a total of $9.51 billion. Looking ahead to 2030, consensus estimates suggest that Mounjaro’s revenue for type 2 diabetes (T2D) and obesity is projected to reach as high as $42 billion.

Mounjaro was approved in May 2022 for T2D, but has not yet been approved for obesity. In October 2022, Eli Lilly secured FDA fast-track designation for the possible approval of Mounjaro for obesity. FDA approval for obesity is expected by the end of 2023. Risk-adjusted revenue projections for Mounjaro are nearly as high as projections that are not adjusted for risk, as the probability of success for FDA approval for obesity is 97.33%, according to Visible Alpha consensus.

Mounjaro (tirzepatide) is a dual agonist targeting the GLP-1 (glucagon-like peptide-1) and GIP (glucose-dependent insulinotropic polypeptide) receptor pathways. Agonism of GLP-1 and GIP receptors leads to an increase in insulin secretion, improvement of insulin sensitivity, reduction in glucagon levels, decreased food intake, and slowing of gastric emptying. The net effect is glucose control for T2D, and weight loss for obesity.

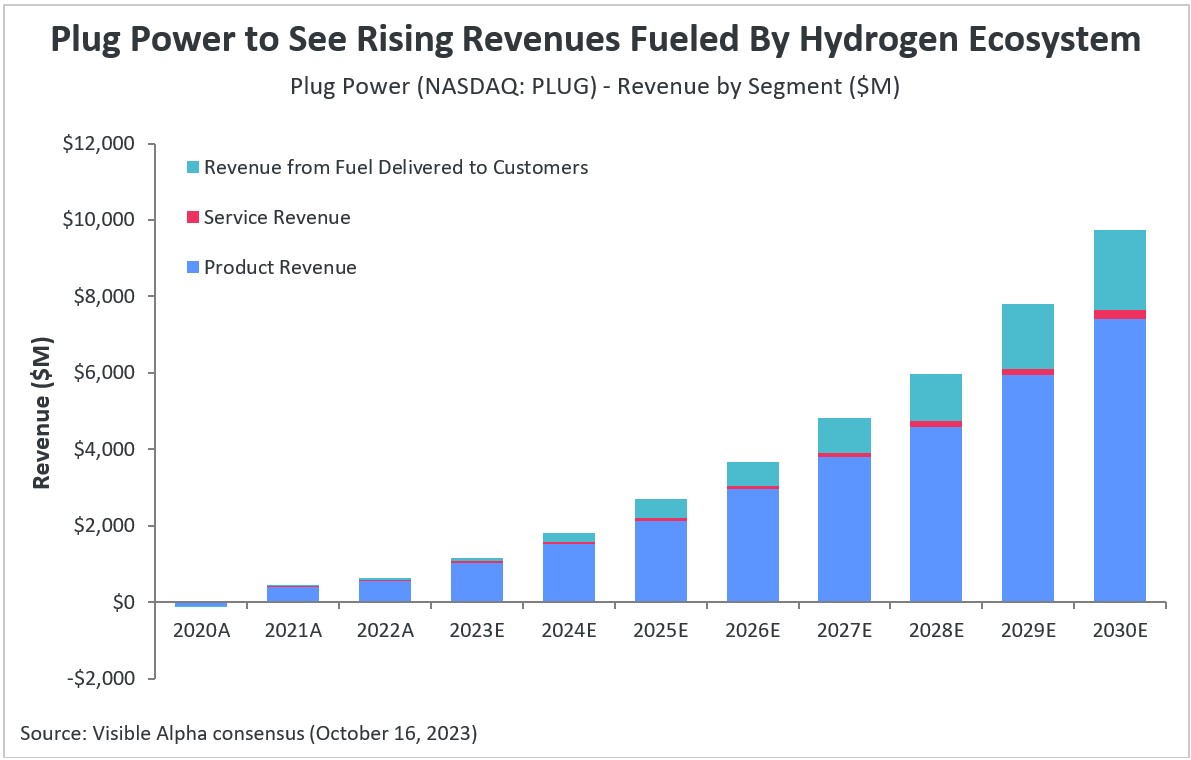

Plug Power to See Rising Revenues Fueled By Hydrogen Ecosystem

According to Visible Alpha consensus, hydrogen fuel cell company Plug Power (NASDAQ: PLUG) is expected to see revenues jump across all of its segments in the forecast period, boosted by the company’s investments in building a hydrogen ecosystem. Plug Power has ambitious plans to build a vertically integrated ecosystem with the aim of becoming a one-stop shop for the hydrogen economy.

Analysts expect the company’s three main revenue segments — product, services, and fuel delivered to customers — to see annual revenue growth in 2023 of 85%, 17%, and 38%, respectively. Between 2023-2030, total product revenue is projected to grow at a CAGR of 32%, services at 27%, and fuel delivered to customers at 60%.

Within products, the company’s largest revenue-generating segment, revenue from electrolyzers is projected to reach $210 million (+639% YoY) in 2023, hydrogen infrastructure sites revenue to $266 million (+88% YoY), and cell system/forklift units/gendrive units revenue to $298 million (+43% YoY). The company’s total revenue is projected to be $1.2 billion in 2023, and analysts expect the company to become profitable by 2024, generating an estimated gross profit of $228 million.

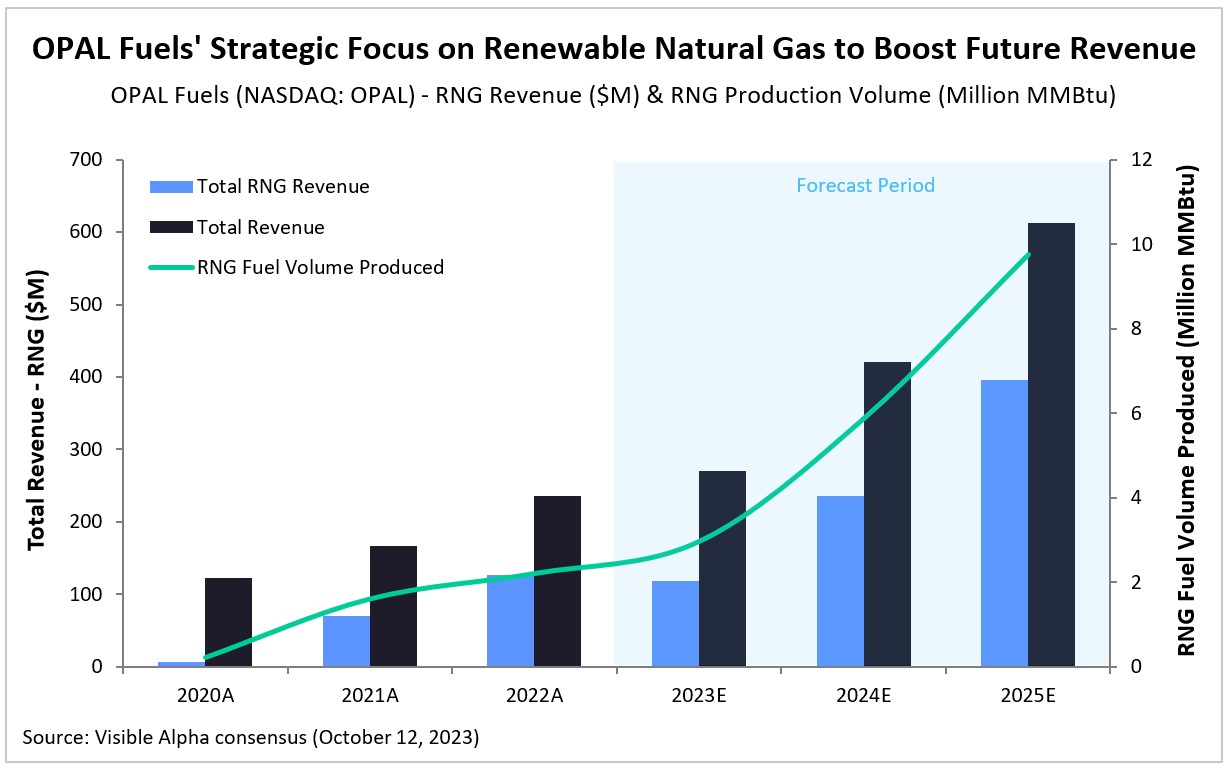

OPAL Fuels’ Strategic Focus on Renewable Natural Gas to Boost Future Revenue

OPAL Fuels (NASDAQ: OPAL), which specializes in the production and distribution of renewable natural gas (RNG) and renewable electricity, has recently made a strategic shift, placing a stronger emphasis on RNG generation. With the RNG transition, analysts anticipate robust revenue growth for the company in the coming years. According to Visible Alpha consensus, OPAL Fuels is expected to boost its RNG production volume from an estimated 3.0 million MMBtu in 2023 to a projected 9.7 million MMBtu by 2025, growing at a CAGR of 82%.

Total revenue for the company is estimated to grow by 15% year over year in 2023, partially offset by an expected 7% decline in RNG revenue. This decline is primarily due to the company selling fewer units of RNG fuel in the first half of 2023, deferring environmental credit sales amid lower market prices, as the market awaited new clean fuel standards from the U.S. Environmental Protection Agency (EPA). In 2024, however, analysts expect RNG revenues to pick up, growing 100% year over year to $236 million, while total revenue is projected to grow by 56% to $421 million.

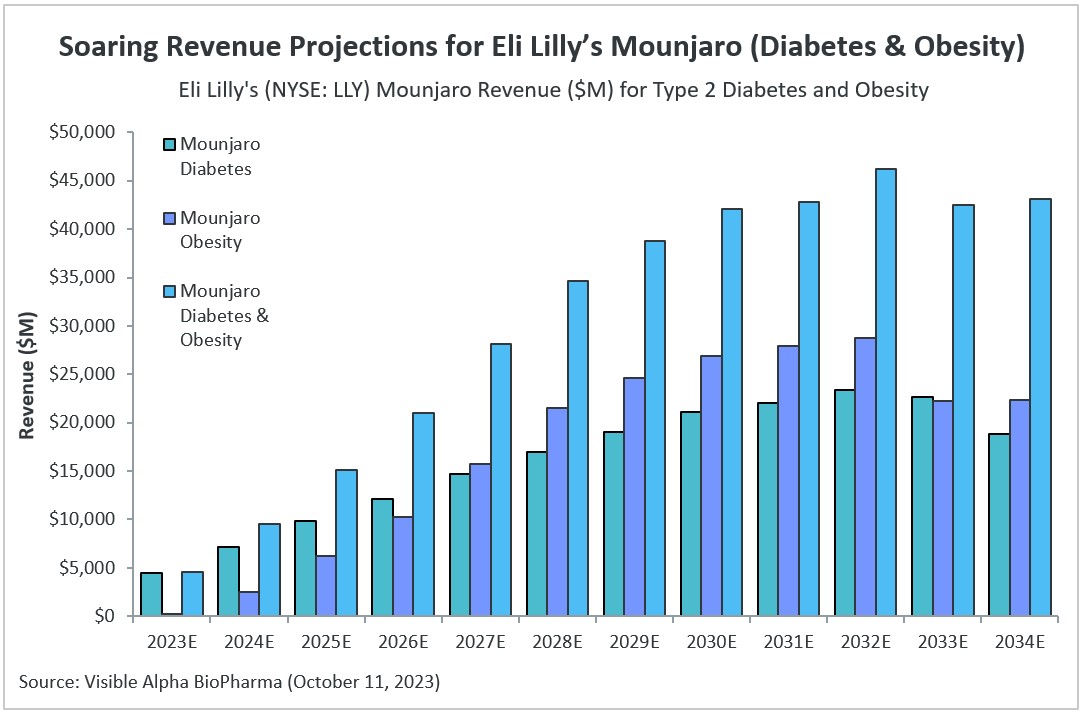

Soaring Revenue Projections for Eli Lilly’s Mounjaro (Diabetes & Obesity)

Key Takeaways

|

Revenue projections for Eli Lilly’s (NYSE: LLY) Mounjaro have been rising since its approval for type 2 diabetes (T2D) in 2022. With expected approval for obesity on the horizon, Mounjaro is projected to see dramatic revenue growth ahead.

Consensus revenue estimates for Mounjaro have increased substantially since our last evaluation in April 2023. Back in April, according to Visible Alpha consensus, Mounjaro revenue estimates (for both type 2 diabetes and obesity) stood at $20.6 billion for 2030. Currently, 2030 consensus revenue estimates have reached as high as $42.1 billion, more than doubling in six months. Analysts project peak consensus revenue for Mounjaro will be reached in 2032, at an estimated $46.2 billion.

Mounjaro is a GLP-1 receptor agonist approved for type 2 diabetes, but not yet for obesity. It was approved for T2D by the FDA in May 2022, by the European Medicines Agency (EMA) in July 2022, and by the Japanese regulatory body in September 2022.

Mounjaro is expected to gain its first approval for obesity soon – the FDA is likely to approve Mounjaro for obesity by the end of 2023. The likelihood of the FDA approving Mounjaro for obesity is high – based on Visible Alpha BioPharma consensus, the probability of success is estimated to be 97.33%.

Figure 1: Mounjaro global consensus revenue estimates for type 2 diabetes and obesity

Source: Visible Alpha BioPharma (October 11, 2023) (All projections are unadjusted for risk, as the probability of success for obesity approval currently stands at 97.33%. Total diabetes and obesity revenues include unadjusted revenues for smaller indications for which Mounjaro is not yet approved or in early stages of clinical development, including heart failure, kidney disease, NASH, and sleep apnea.)

Investor interest in Mounjaro and GLP-1 receptor agonist drugs

The interest among investors is driven by the significantly improved drug profiles for the next-generation GLP-1 receptor agonist class. These next generation GLP-1 receptor agonists demonstrate meaningful efficacy in glucose control for T2D and weight loss for obesity, acceptable safety/tolerability, and improved dosing convenience for patients.

Furthermore, the finding that GLP-1 receptor agonists are effective in controlling obesity, and not just glucose regulation for T2D, has significance because obesity and T2D are intricately linked, sharing common biology that leads to metabolic dysfunction. Clinical data has also confirmed that GLP-1 receptor agonists reduce the risk of cardiovascular disease. This finding is important because T2D patients are at increased risk of cardiovascular complications.

Adding to the above reasons for interest in these drugs, there has been clear public demand for Mounjaro and other GLP-1 receptor agonist drugs for general weight loss purposes.

Mounjaro belongs to the tirzepatide class (dual GLP-1 receptor agonists). The other next-generation GLP-1 receptor agonists are in the semaglutides class, and include Ozempic, Rybelsus, and Wegovy, all commercialized by Novo Nordisk (NYSE: NVO).

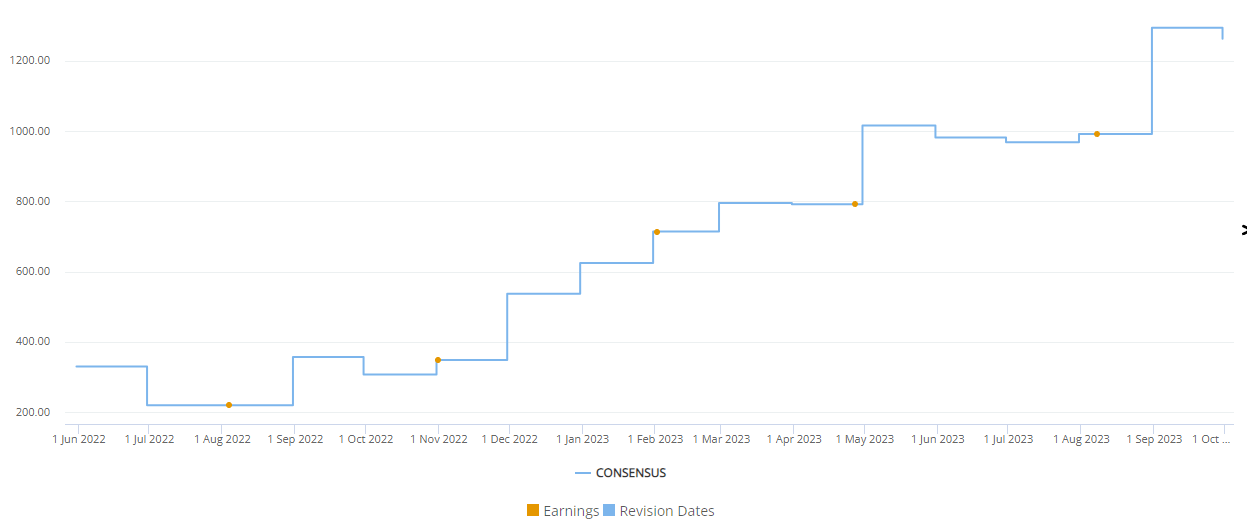

Frequent upward revisions for Mounjaro revenue

Visible Alpha consensus shows that analysts have revised Mounjaro revenue upward multiple times since the drug’s approval by the FDA in May 2022. The upward revisions have been for several reasons, as discussed above – broad market acceptance and revenue projections based on impressive scientific and clinical data showing glucose control, meaningful weight loss for obesity, cardiovascular benefits (not anticipated), acceptable safety/tolerability, and the dual impact on glucose control and obesity to improve metabolic dysfunction. Analysts also take into account off-label use for cosmetic weight loss purposes (not prescribed for T2D or obesity).

Figure 2: Frequent upward revisions for Mounjaro revenue estimates since May 2022 FDA approval

Source: Visible Alpha Insights (October 11, 2023) (Visible Alpha consensus revenue estimates show an increase of more than 3X from June 2022 through September 2023.)