November 2019 Company Newsletter

Note from the Communications Committee: We are looking for additional support in improving communication at Visible Alpha. This newsletter is a great step in the right direction, but there is more we can do with your help! Email [email protected] to learn how to get involved.

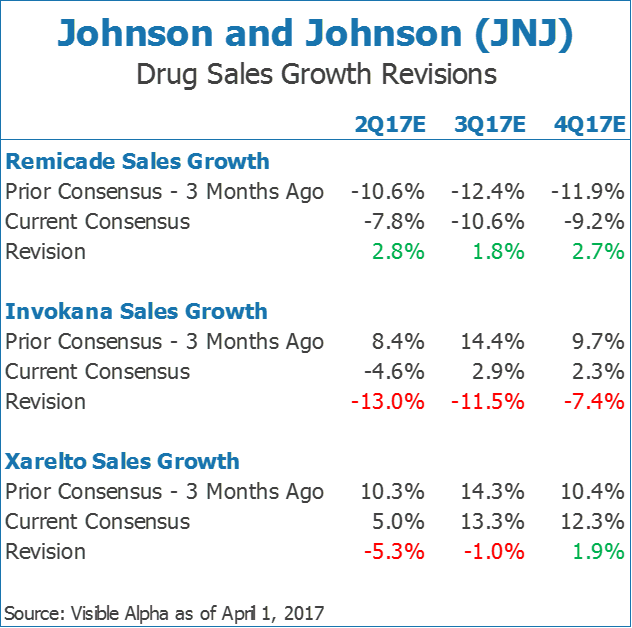

Prior to Johnson & Johnson’s 1Q results on April 18, investors were concerned about the outlook for the Pharmaceutical segment. Pharmaceutical (Pharma) is the largest of the three segments, and represents 47% of sales. Investors have worried that growth within the Pharma segment would slow from its historical rate of double digit organic growth to a low single digit rate. A big factor for the decline was an expected slowdown in Remicade, as the drug faced competition from Pfizer’s Inflectra biosimilar, announced late last year.

Prior to Johnson & Johnson’s 1Q results on April 18, investors were concerned about the outlook for the Pharmaceutical segment. Pharmaceutical (Pharma) is the largest of the three segments, and represents 47% of sales. Investors have worried that growth within the Pharma segment would slow from its historical rate of double digit organic growth to a low single digit rate. A big factor for the decline was an expected slowdown in Remicade, as the drug faced competition from Pfizer’s Inflectra biosimilar, announced late last year.