Dow Jones Industrial Average Monitor: A look at 30 US large-caps

Looking at the direction of Visible Alpha consensus pre and post earnings season of the thirty companies in the Dow Jones Industrial Average (DJIA), the data points to the potential for further surprises. The macroeconomic and company-specific challenges vary significantly by company. With greater clarity emerging around tariffs and trade issues, markets are reaching new highs. Despite persistent inflation and a softening US dollar in 2025, companies seem to be navigating the challenges. While the full impact of tariffs and trade on the macro environment remains an open question, many companies currently show a stable earnings outlook, which may or may not be the case going into the second half of the year.

United Healthcare is down 40% year-to-date and the worst performer in the index, likely due to the tragedy involving its former CEO and the significant downward revisions, especially to its profitability. The company presents perhaps the most idiosyncratic downside risk. In addition to weakness at UnitedHealth Group (NYSE: UNH), Merck & Co. (NYSE: MRK), Apple (NASDAQ: AAPL), Salesforce (NYSE: CRM), and Nike (NYSE: NKE) have also weighed on the DJIA, due to concerns about the outlook for key areas of these companies.

Apple and Nike are two examples of companies impacted by China exposure, but with different expectations. Apple’s exposure to both China’s end market and supply chain has created headwinds for its fundamentals. The overall expectation for iPhone continues to move lower, as the upgrade cycle continues to get pushed out in the US. This combination poses a particular challenge to its outlook for the second half of the year. In contrast to Apple, Nike’s outlook beat expectations. Nike was the last to report and surprised the market on June 26, 2025, by delivering an earnings outlook that gave gross margin weakness that was not as bad as expected. Nike’s outlook seemed to be the catalyst that has driven the stock up over 20% on June 27, 2025, offsetting its previous negative contribution. China continues to be an open long-term question for both the company’s manufacturing and growth.

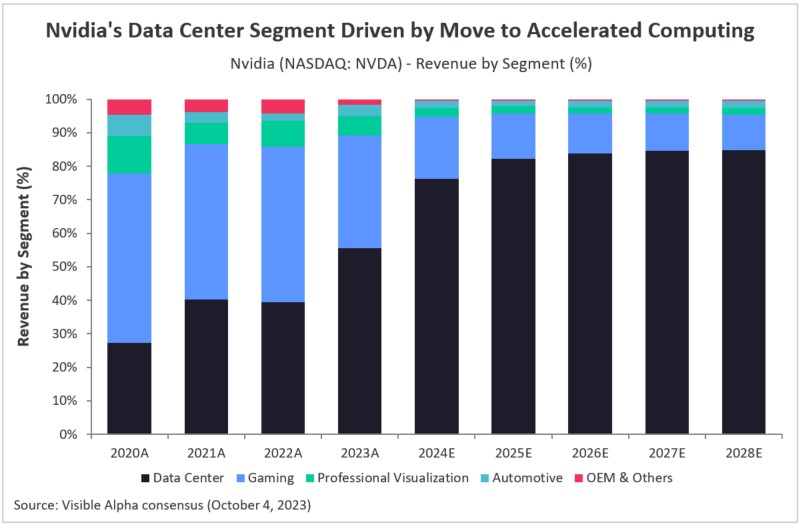

While trade and tariffs have been a headwind, the AI technology theme has helped the DJIA. Microsoft (NASDAQ: MSFT), NVIDIA (NASDAQ: NVDA), and IBM (NYSE: IBM) are outperformers benefiting from the company’s specific strategies around AI. Nvidia’s fundamentals have been moving around on debates around its new Blackwell solution and the magnitude of growth going forward. Microsoft and IBM have seen clear upward revisions to earnings drivers and their growth outlooks. However, all three seem to signal that the AI trend is supporting company fundamentals.

One area that is a wildcard is consumer discretionary. Walmart (NYSE: WMT), Home Depot (NYSE: HD), Walt Disney Co. (NYSE: DIS), and Amazon (NASDAQ: AMZN) have seen some downward pressure on retail sales forecasts. Their ability to cut costs seems to support their earnings stability. However, if consumption starts to slow more significantly, this may impact top-line growth further, which may cause estimates to come down more. We are watching the estimates at these companies carefully.

As the market moves into the second half of the year, the performance of the overall macro backdrop in the US is likely to be a key factor in determining when the Fed may cut interest rates. Given the significant amount of volatility in markets this year, trading volumes are up, which seems to support the strength of JPMorgan Chase (NYSE: JPM) and Goldman Sachs (NYSE: GS). In the meantime, the awkward combination of inflation, slower growth and a weakening US dollar make the environment particularly tricky.

The tables below provide a snapshot of how analyst expectations have shifted pre- and post-earnings across the DJIA constituents, highlighting where issues impacting company fundamentals —positive or negative—have reshaped the outlook.