The Visible Alpha AI Monitor aggregates publicly-traded U.S. technology companies, providing a comprehensive measure of the current state and projected growth of the core AI industry. This encompasses the AI-exposed revenues for companies that are building AI infrastructure and capabilities for both enterprises and consumers.

Investors may use the Visible Alpha AI Monitor to generate new ideas to capture growth emanating from the core AI industry, as well as to evaluate the potential AI exposure of technology stocks in their existing portfolios.

We have identified specific line items that capture potential growth of AI-related revenues that are available in the Visible Alpha Insights platform (see the goals, objectives, and methodology of the AI Monitor towards the bottom of this page).

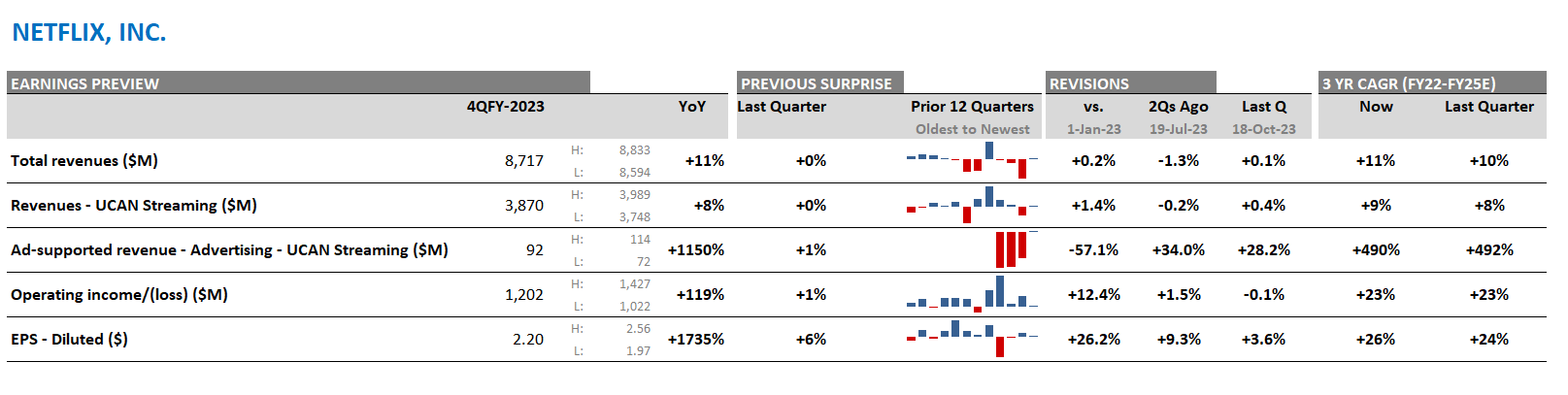

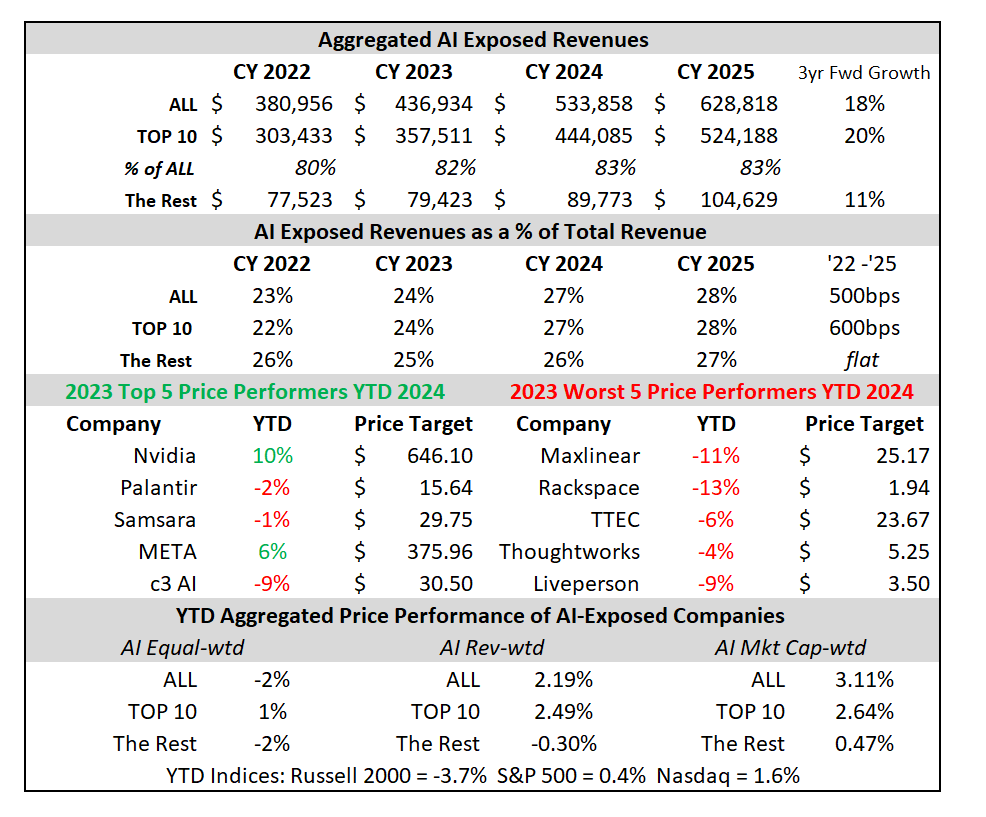

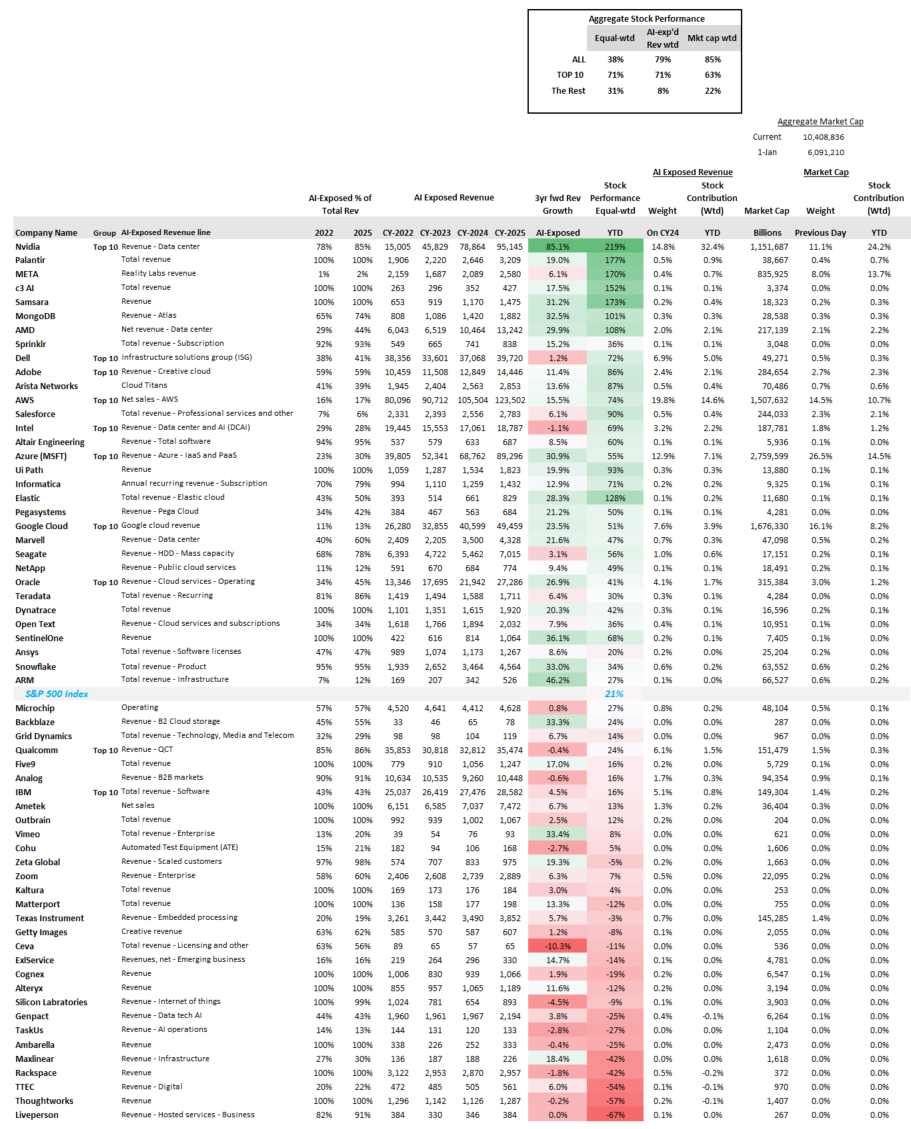

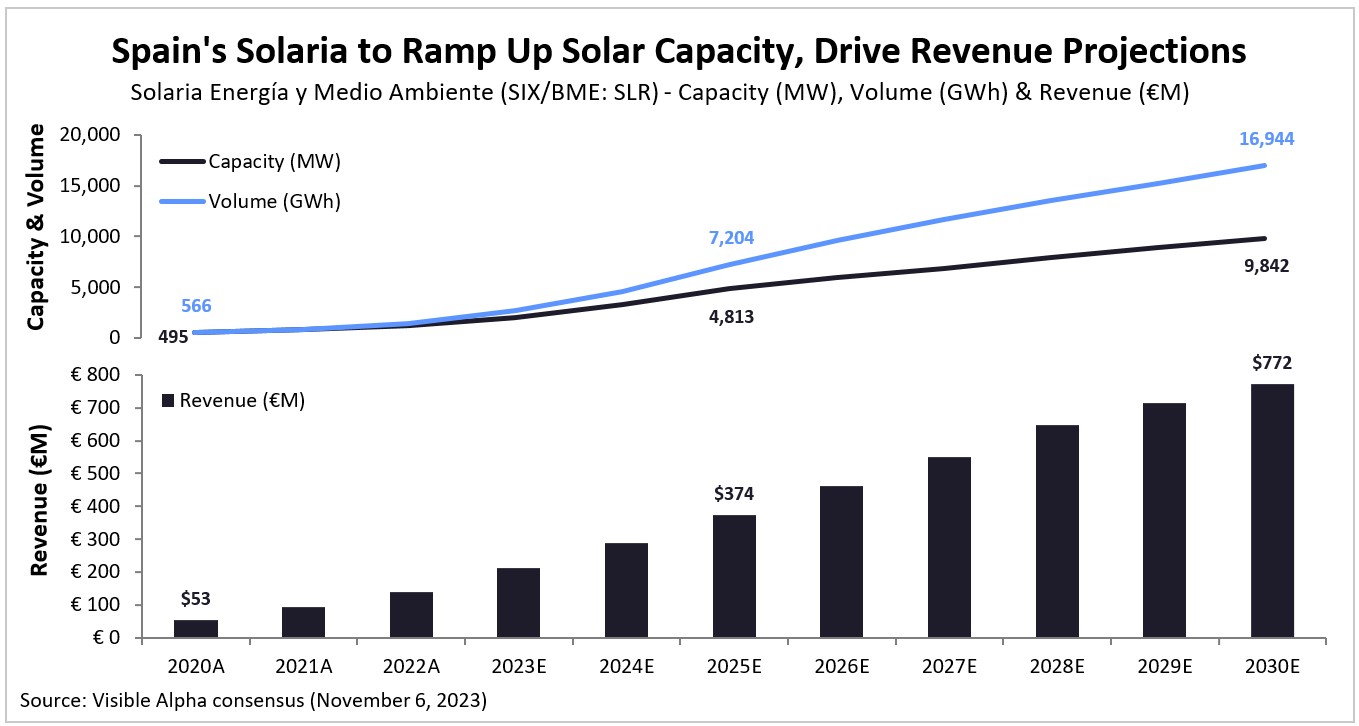

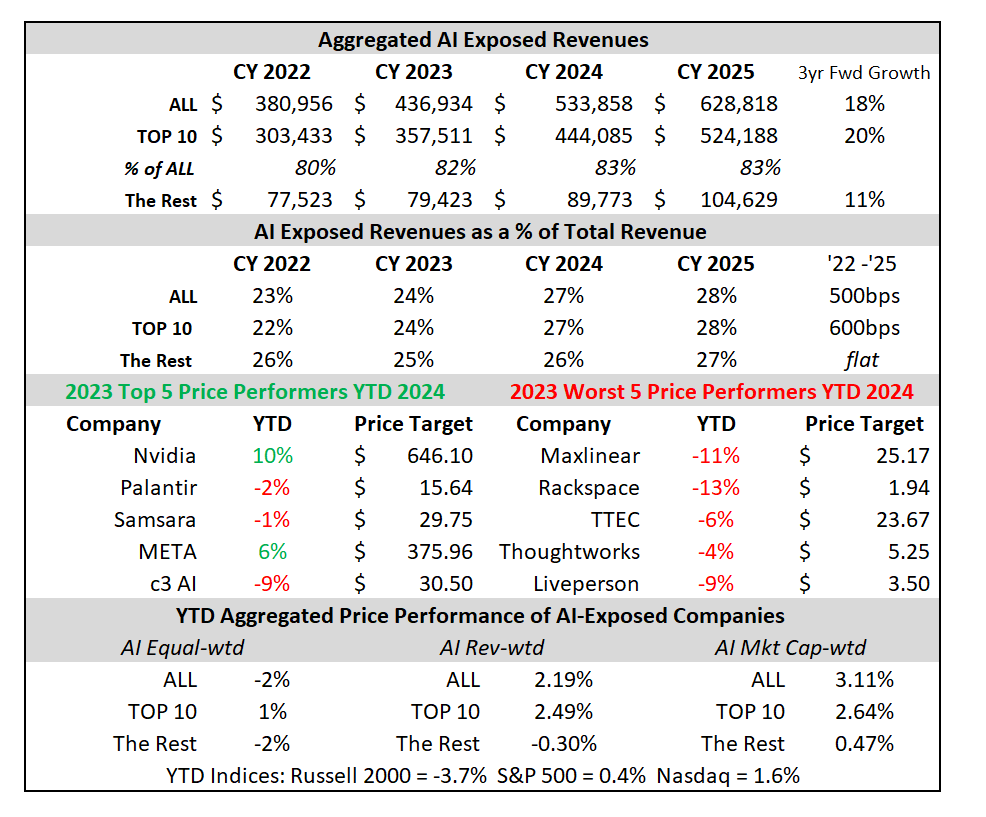

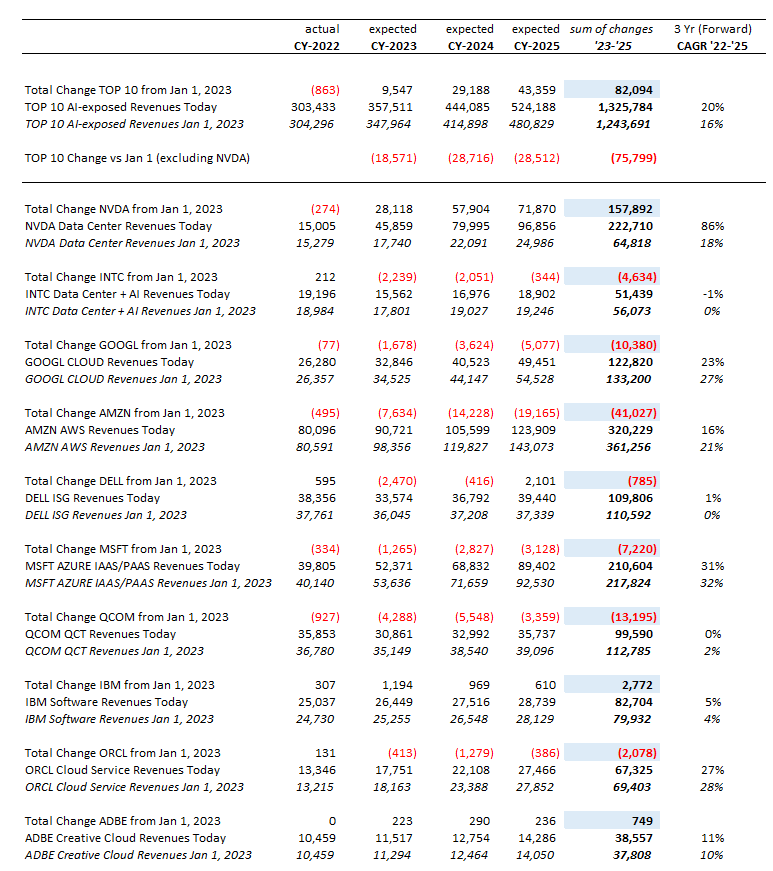

Figure 1: AI growth and performance overview

Source: Visible Alpha consensus (January 16, 2023). Stock price data courtesy of FactSet. Current stock prices are as of the market close on January 12, 2023. TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Adobe, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI.

Key Takeaways from 2023

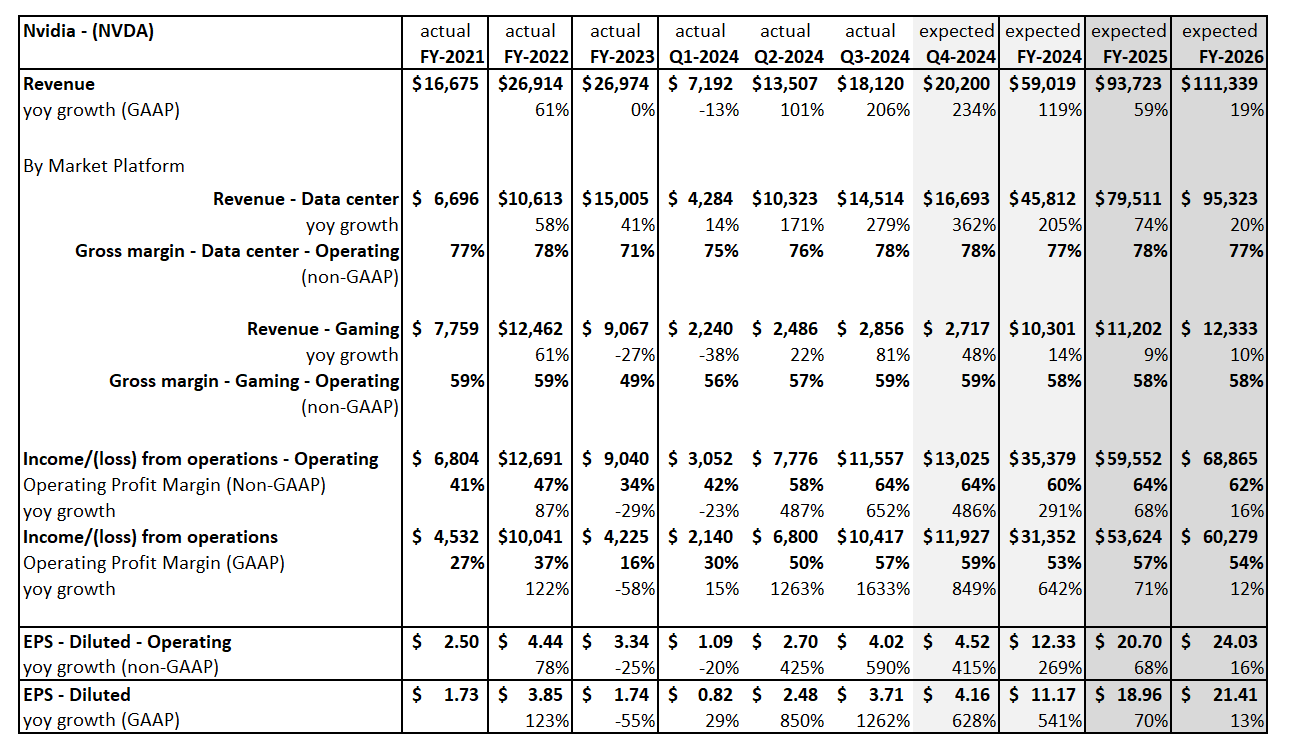

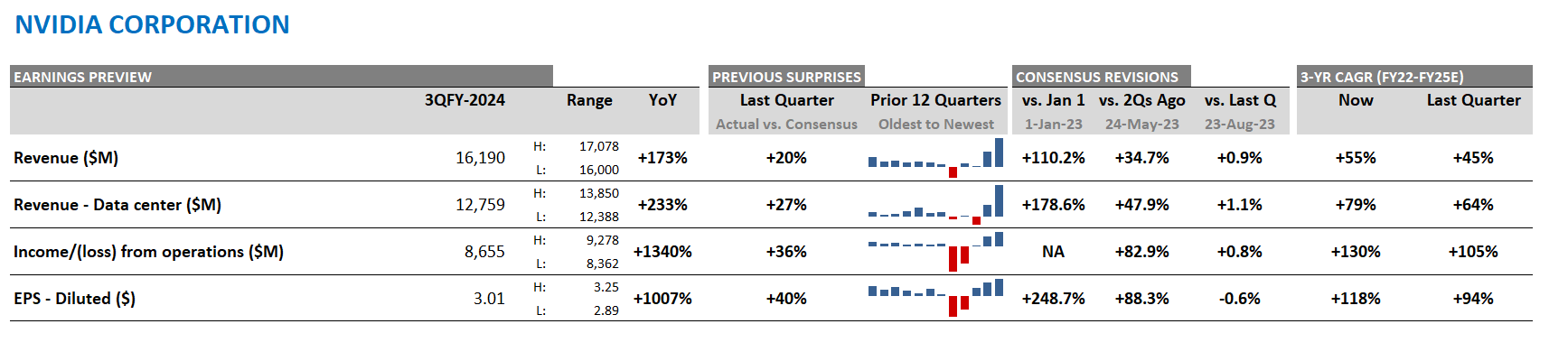

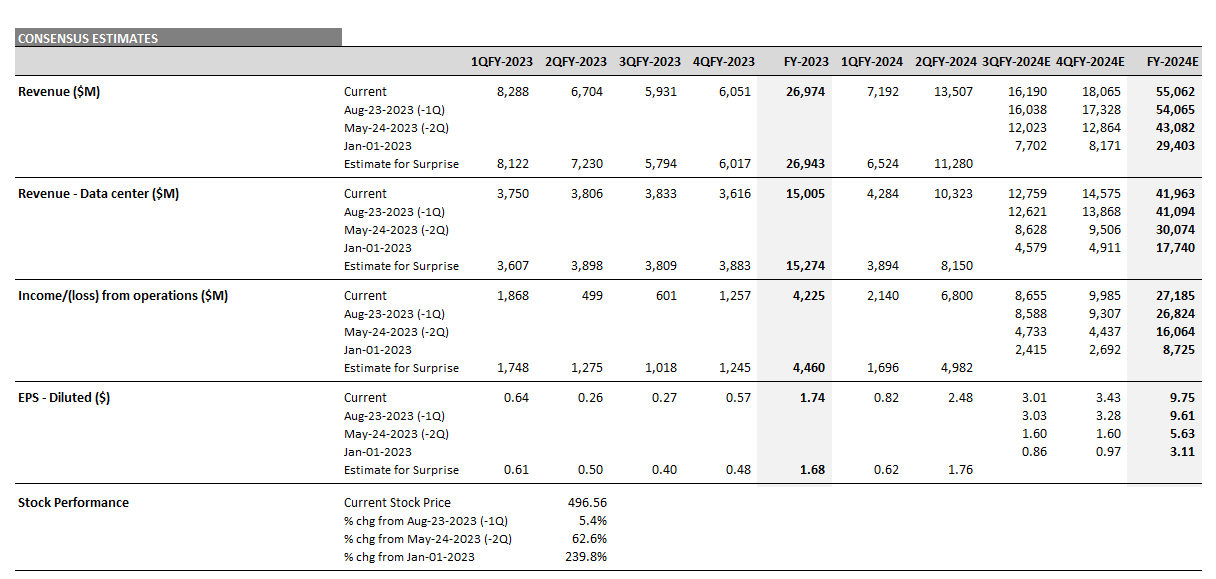

In 2023 (see our Dec 2023 AI Monitor report), eight out of the 10 largest AI-exposed revenue generators drove strong outperformance, while more than 50% of the smaller-cap AI stocks underperformed. In December, AI-exposed revenues were expected to grow by almost $250 billion, from $382 billion at the end of 2022 to $627 billion at the end of 2025, driven overwhelmingly by the Top 10 in the AI Monitor. The revenue growth of the Top 10 was driven almost exclusively by the significant $150 billion of upward revisions analysts made to Nvidia’s AI-exposed Data Center revenues, which contributed significantly to both the AI-exposed revenue concentration and stock performance of the AI Monitor. How may these dynamics change in 2024?

What to Watch For in 2024

In 2024, we are watching the pace at which companies will be moving more of their data to the cloud and enabling innovation with AI. The AI Monitor aims to help users observe the pace of data migration to the cloud by highlighting companies and line items. In particular, we have identified a few companies that we are watching.

We are closely tracking the performance of Oracle’s Cloud Services and Microsoft Azure’s Infrastructure and Platform as a Service businesses. Together, this partnership may bring more organizations to the cloud and position enterprises for integrating AI into their workflows.

As more data goes into the cloud, we are also monitoring Snowflake’s growth. This company enables organizations to de-silo their data and compare/share with other data sources across the enterprise, serving as a good starting point for leveraging AI across their enterprise. At a recent tech conference, Snowflake management said: “the most common type of data going into Snowflake is CRM data.”

And as more customer relationship data moves to the cloud and into Snowflake for sharing between marketing, sales, and other teams, Sprinklr and Zeta Global may benefit from the need to unify and understand customer interactions.

As companies large and small establish their data, cloud, and AI strategies, what new innovations and companies will drive AI-exposed revenues in 2024?

5 Companies to Watch in 2024

- Oracle (NYSE: ORCL)

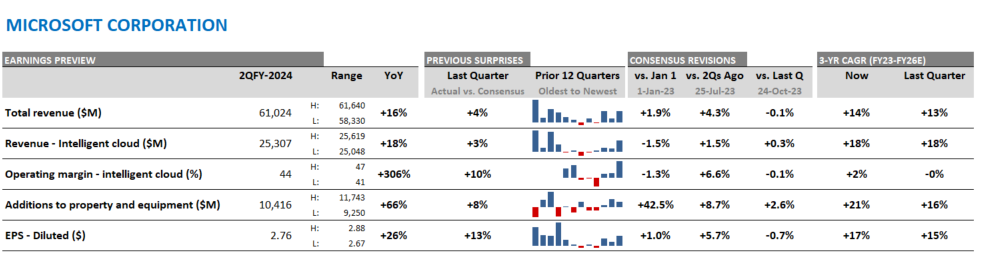

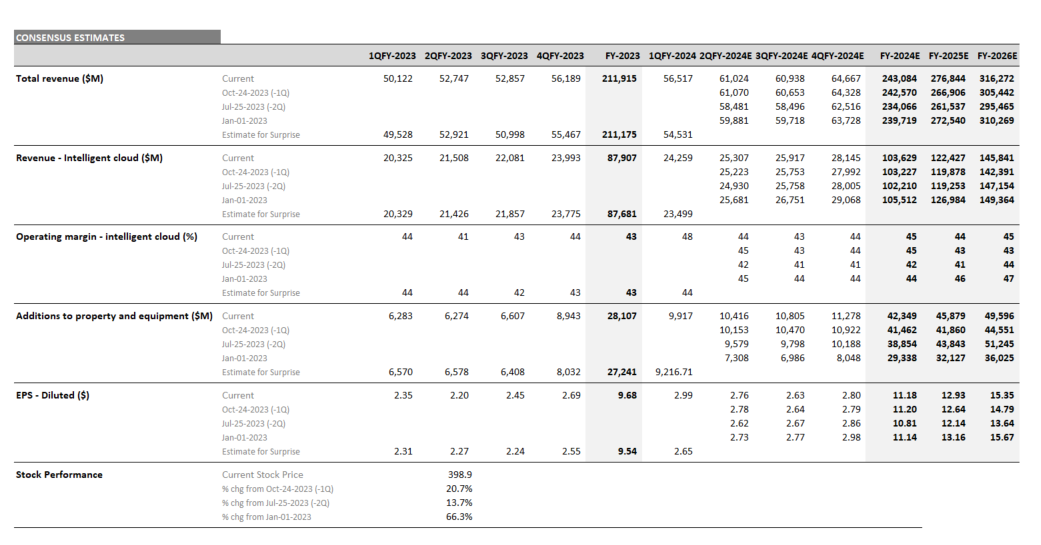

- Microsoft (NASDAQ: MSFT)

- Snowflake (NYSE: SNOW)

- Sprinklr (NYSE: CXM)

- Zeta Global (NYSE: ZETA)

Oracle and Microsoft: How will this partnership help to drive cloud migration and AI in 2024?

Access to data will be a critical dimension to anything a customer wants to do with AI. Back in the fall of 2023, Oracle CTO Larry Ellison and Microsoft CEO Satya Nadella explained that their partnership will enable customers to co-locate the Oracle hardware and software within the Azure Data Center, which will be key for fine-tuning, pre-training, or meta-prompting a model for AI.

With a large portion of data still located on-premise, they believe this collaboration should encourage companies to move to the cloud by lowering latency and increasing security. Once the data is in the cloud, customers can begin to innovate with it. From the Azure portal, users can provision an Oracle database, then marry that to Open AI, and ultimately to the library of Microsoft technology.

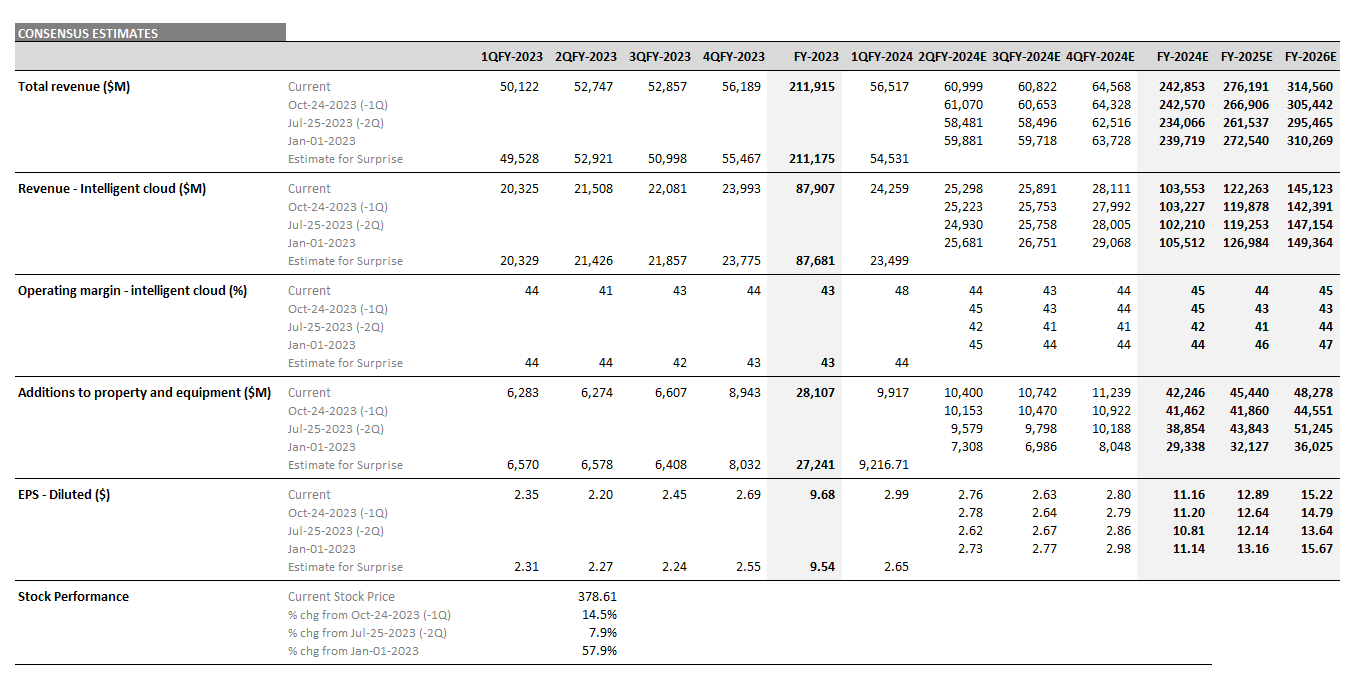

Currently, analysts are expecting Microsoft’s June 2024 Azure revenue to be $72 billion and to double to $144 billion by June 2027, driven by growth of Infrastructure and Platform as a Service businesses within Azure. Similarly, Oracle’s May 2024 revenue from Cloud Services is projected to double from $19 billion to nearly $38 billion by May 2027. Given the partnership, could the pace of this growth show up faster for both Microsoft’s Azure and Oracle’s Cloud Services business lines?

Snowflake

Speaking at a tech conference in December, Snowflake CFO Mike Scarpelli echoed points around the cloud, data, and AI that were similar to Oracle and Microsoft. He explained that to reap the benefits of generative AI, companies are going to use it in the cloud, instead of on prem. Therefore, organizations will need to ensure their data is clean and in the cloud for their large language models to be useful.

As companies look to integrate AI into their organizations, the market for the Snowflake product looks poised to reaccelerate over the next year. In December, Scarpelli noted that Snowflake was seeing more stabilization and they were not hearing of any big optimizations. This stability should give them more visibility into their current customer base and enable the company to position for growth and product expansion. Scarpelli explained that the company is working on a number of new initiatives that it was not ready to disclose and which are not baked into its current outlook.

According to Visible Alpha consensus, revenues from product are estimated to grow from $2.6 billion in FY 2024 to $5.9 billion in FY 2027 and for the gross margin to expand from 73.2% to 74.9%, driven by improving consumption, customer growth, and product innovation.

According to Scarpelli, the most common type of data going into Snowflake is customer relationship management data. Therefore, we wanted to highlight two smaller-cap companies that are bringing AI innovations to their clients’ marketing teams: Sprinklr and Zeta Global.

Sprinklr

Through its specialized AI models, Sprinklr aims to provide a unified customer-experience platform for tracking all the places a customer may interact with a company’s brand, especially on social media outlets. With a market cap of $3.3 billion, Sprinklr may benefit from any rotation to smaller-cap stocks that are benefiting from the AI theme and its growth trends.

In its previous earnings release, Sprinklr missed expectations and the stock plummeted over 30%. However, recently the company has taken steps to try to improve operational visibility and address the challenges in its core business. According to Visible Alpha consensus, AI-exposed subscription revenue projections have decreased since last quarter for FY 2024, from $770 to $740 million, and for FY 2025, from $896 to $836 million. Given the cut to FY 2025 expectations, could Sprinklr rise above the challenges and beat consensus?

Zeta Global

With a market cap of $1.8 billion, Zeta Global is a small-cap company that looks well-positioned to benefit from its exposure to AI. Through the Zeta Marketing Platform (ZMP), CEO Steve Gerber’s vision is to leverage their proprietary AI and data tools to unify identity, intelligence, and omnichannel activation into a single platform. Having clean data in the cloud for data sharing within organizations may become an increasingly important driver, as customers look to centralize data for AI applications. Zeta Global’s partnership with data-sharing platform Snowflake may play a critical role in supporting the company’s growth.

According to Visible Alpha consensus, Zeta Global’s AI-exposed revenues are estimated to hit close to $1 billion by year-end 2025 from $726 million in FY 2023, as organizations adopt more advanced marketing technology.

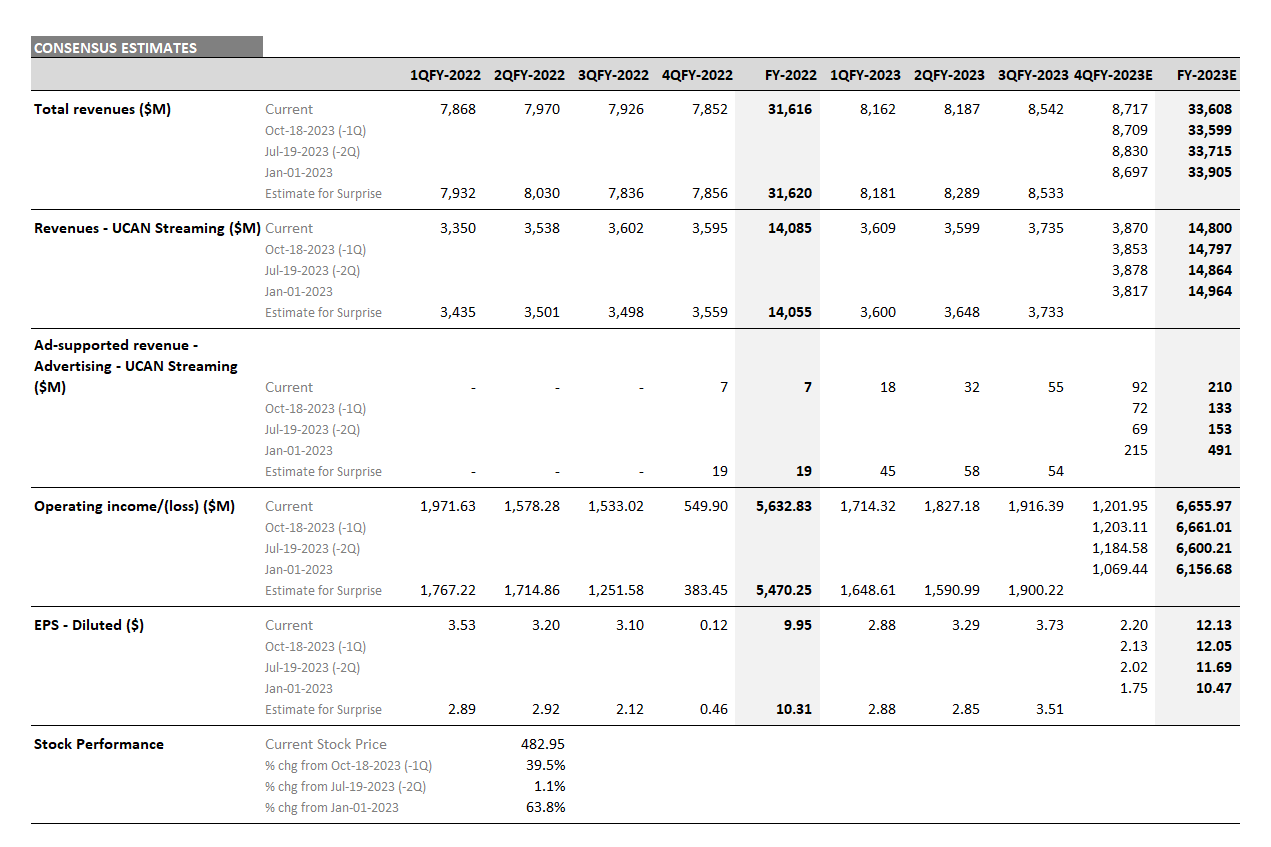

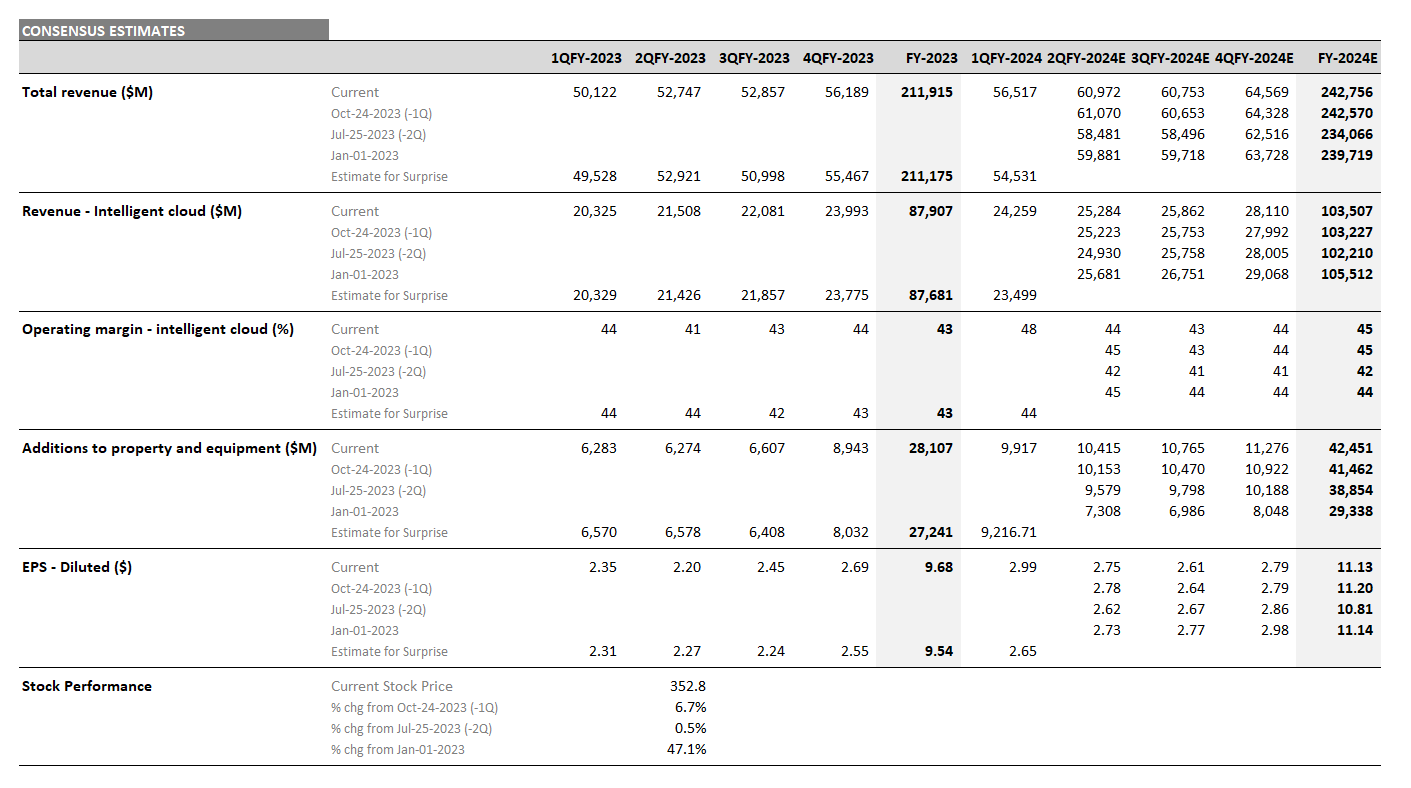

Figure 2: Top 10 breakdown of AI-exposed revenue expectations

Source: Visible Alpha consensus (January 16, 2023). TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Adobe, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI. Based on higher analyst counts, we are using the non-GAAP revenue number for Oracle.

Performance Summary

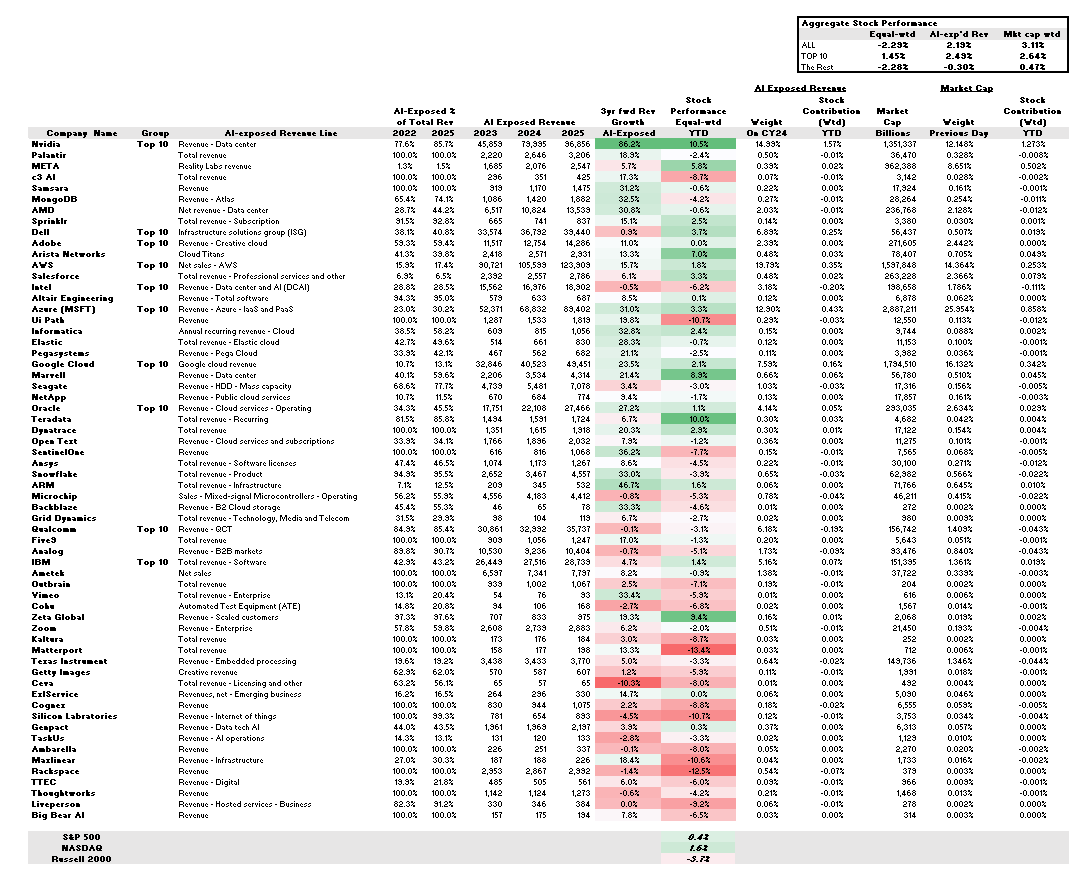

Currently, the Visible Alpha AI Monitor universe of 63 publicly-traded U.S. companies is 82% weighted to the 10 largest companies, with the remaining 18% dispersed among 53 companies.

On a market-cap weighted and AI-exposed-revenue weighted basis, the Visible Alpha AI Monitor continues to be driven by substantial stock price outperformance (vs. the S&P 500 index) of the largest companies. In addition, the smaller companies are continuing to underperform (vs. the S&P 500 index), especially on an equal-weighted basis. However, the AI-exposed companies, in general, have outperformed the Russell 2000 small-cap index.

On an equal-weighted basis, the AI Monitor generated significantly lower return when compared to the market-cap and AI-exposed-revenue weighted aggregations so far this year, driven by the drag of a lower return generated by the smallest names.

Top 10

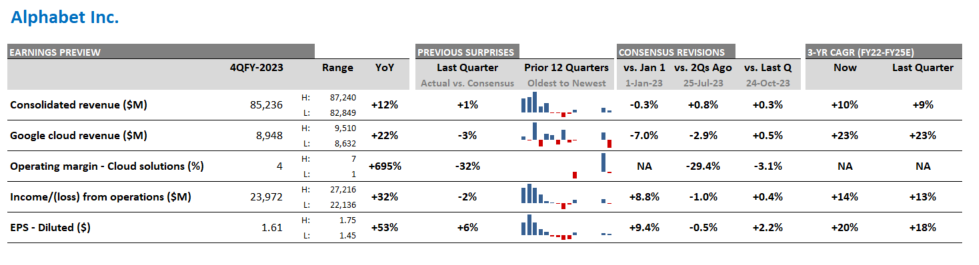

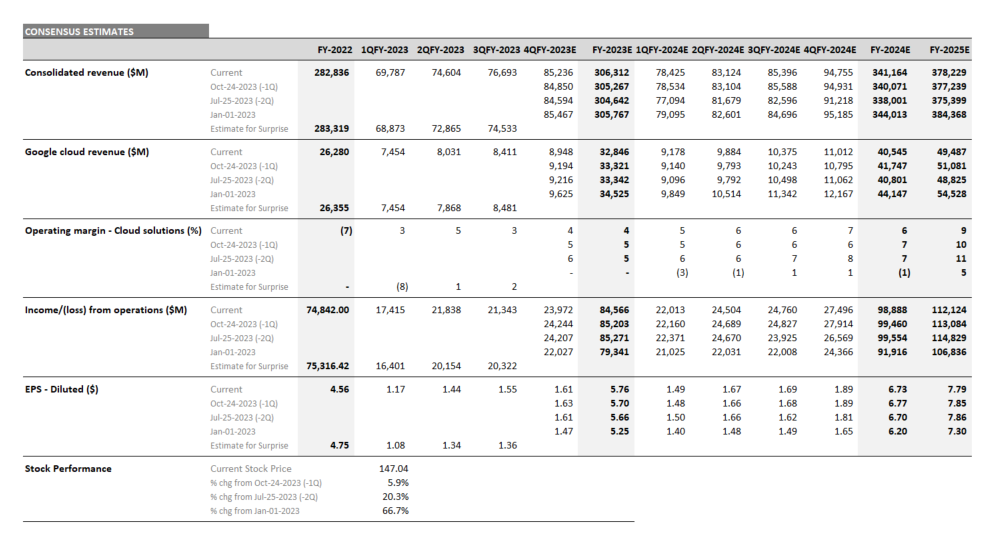

Based on an analysis of the 10 largest players, 2025 revenue forecasts for AI-exposed-revenue segments increased by $43 billion from January 2023 to now, which is $3 billion more than in December 2023. However, nearly $72 billion of that is from Nvidia, which means that the rest of the Top 10 saw revenue estimates decline over $30 billion in aggregate. This was driven by lower expectations for AWS, Google Cloud, and Qualcomm QCT. However, though expectations came down for these companies, stock performance was strong for eight of the Top 10 companies, the exceptions being Qualcomm and Intel.

The Rest (smaller contributors)

The remaining list of 53 companies may serve as a good place for investors to discover new ideas by surfacing expanding new players. While smaller companies in aggregate have not performed as well as the Top 10, there have been some clear outperformers relative to others.

Among the smaller firms, revenue growth expectations are very mixed. Strong double-digit revenue growth is expected at some firms, while others are seeing estimates decline. These dynamics may help investors identify emerging trends in the space. In 2023, we have already seen that to be true with Palantir, C3 AI, Samsara, and MongoDB delivering very strong outperformance (vs. the S&P 500 index), while more than half of the smaller companies in the AI Monitor substantially underperformed the index. Rackspace, TTEC, Thoughtworks, and Liveperson fell by more than 50% in 2023. Year to date in 2024, larger names that are not in the Top 10 are showing positive performance, while the performance of small-cap and micro-cap companies are mixed.

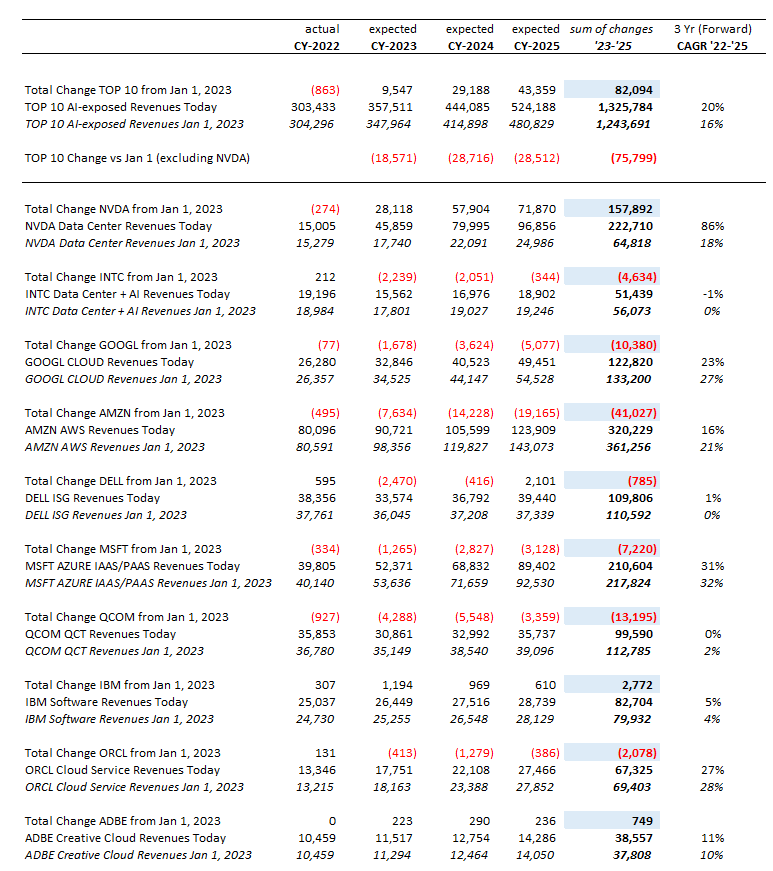

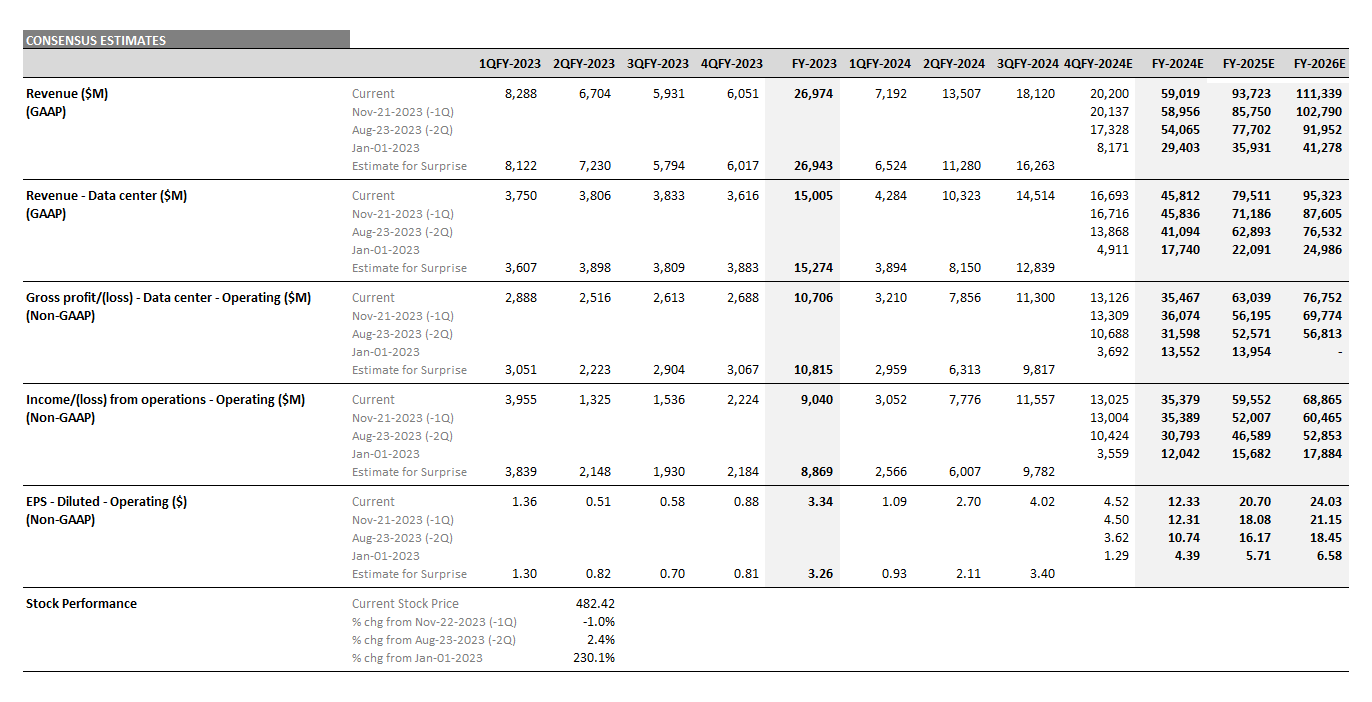

Figure 3: AI Monitor detailed breakdown

Source: Visible Alpha consensus (January 16, 2023). Stock price data courtesy of FactSet. Current stock prices are as of the market close on January 12, 2023. TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Adobe, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI. Based on higher analyst counts, we are using the non-GAAP revenue number for Oracle and Ansys.

Final Thoughts

Last year was clearly the Year of Nvidia, along with Palantir and C3 AI, having seen their exposure to AI translate into meaningful stock outperformance relative to the S&P 500 index. For many firms, however, it is not clear how AI-exposure will impact business models.

In 2024, we are watching the pace at which companies will be moving more of their data to the cloud and enabling innovation with AI. We are interested to see how the partnership between Oracle and Microsoft could help to drive more organizations to the cloud and set up their enterprises for integrating AI into their workflows. Through its data sharing and analytics capabilities, Snowflake is likely to play a critical role in the roll out of the AI ecosystem. Snowflake’s clients seem to be increasingly aiming to de-silo their data and organizations to understand how best to serve their customer base. As more customer relationship data moves to the cloud and into Snowflake for sharing and AI, it will be interesting to see if smaller firms, Sprinklr and Zeta Global, may benefit from these dynamics happening in different parts of the tech stack.

Which firms will drive the Visible Alpha AI Monitor in 2024? Will we see a rotation into less-appreciated firms where the growth may not yet be priced in?

AI Monitor Goals and Objectives

The objective of the Visible Alpha AI Monitor is to show the investment community which companies are likely to drive AI going forward. As the world embraces AI and its applications to enterprise workflows and our daily lives, big questions exist about how AI’s impact on company business models will unfold over the next 3-5 years. AI can potentially free people from tedious work to enable more focus on critical workflows that require human creativity and analysis.

A primary goal of the Visible Alpha AI Monitor is to show which U.S. companies and specific line items we are keeping an eye on as the embryonic AI theme emerges across company fundamentals and begins to scale broadly across the economy. We are monitoring how AI may be reflected in the numbers and which companies may be benefitting more or less. This universe attempts to be comprehensive and to show investors the dynamics of both the large and smaller U.S. players. Additionally, it aims to help investors identify new names that may be smaller and less covered, but potentially growing and emerging more quickly.

AI Monitor Methodology

Using Visible Alpha’s comprehensive database of detailed estimates pulled directly from sell-side analysts’ spreadsheet models, we have assembled an aggregation with an initial universe of 63 publicly-traded companies that are contributing to the infrastructure and broad scaling of AI capabilities. This monitor aims to provide a current and future snapshot as to where AI-related revenues are and are not growing across each of these 63 companies, and particularly the ten largest.

We have aggregated the revenues of specific business segments at firms that are driving the wider AI trend. For larger firms, we have attempted to pinpoint where in their revenue model AI is driving growth. For some smaller firms, we are simply incorporating 100% of revenues. The AI-exposed revenue lines we identify are intended to be used as a proxy for monitoring the growth of each company’s AI business. Given both lack of discrete company disclosures and how intertwined AI and conventional technologies and services can be, these lines should not be taken as exact quantifications of AI revenues, but are, we believe, the best systematic approximation available.

For Visible Alpha subscribers, details of these companies can all be found within the Visible Alpha Insights platform. Each company included in the monitor has coverage by at least four sell-side analysts. In addition, given the quickly evolving state of the AI space, these line items are subject to change and may shift significantly over time. We plan to refresh the data on an ongoing basis and provide regular updates. |