After decades of research and development hiccups, therapeutic approaches that modify the course of Alzheimer’s disease (AD) are finally available to patients. The successful development of amyloid β targeting antibodies marks a major advancement for AD. Biogen (NASDAQ: BIIB) and Eisai (TSE: 4523) developed Leqembi (lecanemab), which was approved for early-stage AD by the FDA in July 2023. Eli Lilly (NYSE: LLY) recently reported positive Phase 3 data for its amyloid β targeting antibody, donanemab, also for early-stage AD. Donanemab is expected to be approved by the FDA by year end.

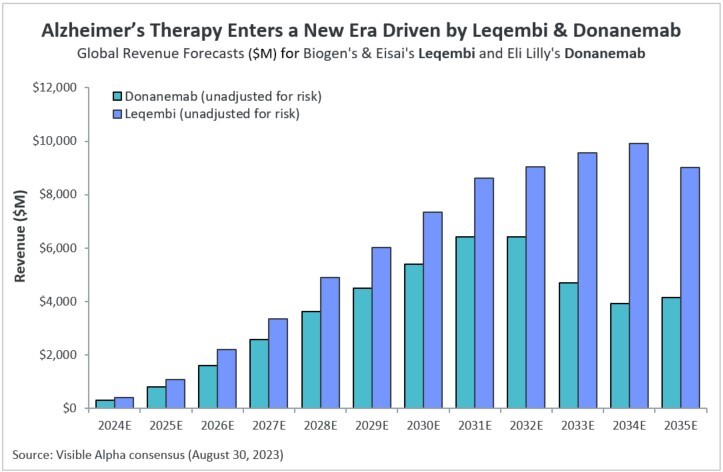

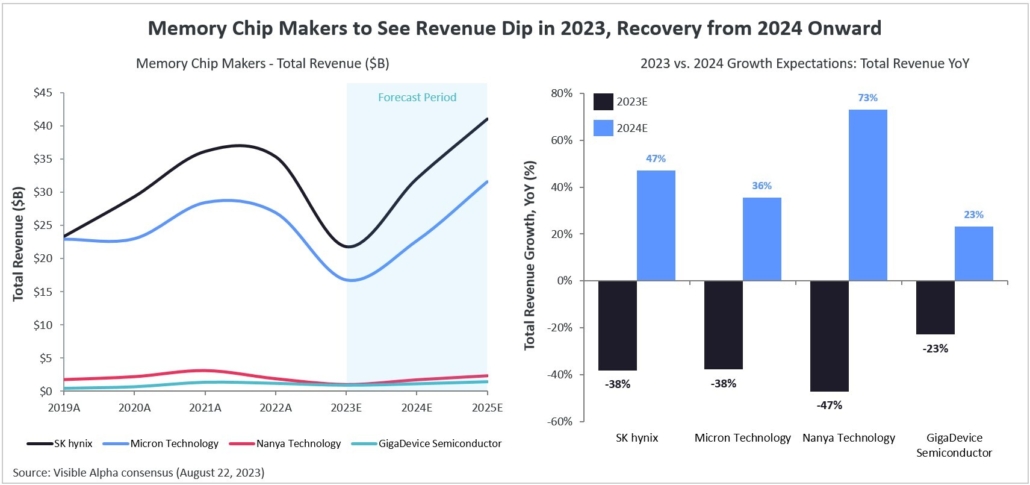

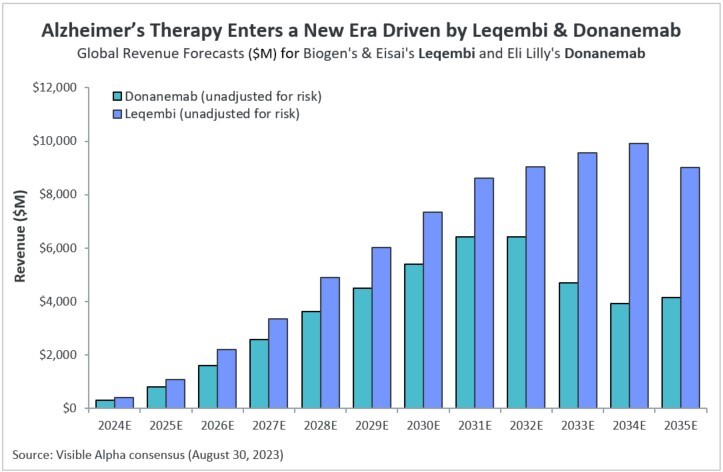

Both Leqembi and donanemab are novel disease-modifying antibody-based therapies that target the underlying cause of Alzheimer’s disease. According to Visible Alpha consensus, revenue projections for Leqembi substantially exceed projections for donanemab.

Commercial prospects for Leqembi versus donanemab for early AD

Both Leqembi and donanemab are approved for early-stage AD which includes patients with mild cognitive impairment or mild dementia. It is estimated that in the U.S. there are 6.7 million people living with Alzheimer’s dementia¹. Globally, the prevalence of AD-related dementia is about 55 million.² Early-stage AD accounts for approximately 31.5 million patients globally and about 6.1 million of those are addressable and positive for amyloid β³, thus potential candidates for Leqembi and donanemab.3,4 Analysts estimate 1 million to 2 million patients in the U.S. could qualify for amyloid β therapy.

Visible Alpha consensus revenue projections show Leqembi reaching peak unadjusted revenues of $9.9 billion in 2034 and donanemab reaching peak unadjusted revenues of $6.4 billion in 2032 (Figure 1). These reflect unadjusted revenues — not accounting for regulatory risk for Leqembi approval in the EU or the rest of the world, as Leqembi is currently approved only in the US. Donanemab is not yet approved in the U.S., EU or the rest of the world. Based on the Phase 3 data, analysts expect approval of both drugs globally. Leqembi’s superior market prospects are largely driven by a safer profile (discussed below) and the potential approval of a subcutaneous injection that would allow convenient at-home administration using an auto-injector. Potentially, donanemab could gain from targeting younger preclinical AD patients with milder disease.

While Biogen/Eisai have set the annual cost of Leqembi at $26K in the US, analysts’ consensus net annual price is capped at approximately $20.9K in 2030, after discounts and rebates. Donanemab is likely to be within range or less. It is likely that the cost for amyloid β PET scans and biomarker analysis could increase actual cost per patient.

Figure 1: Visible Alpha consensus revenue projections for Leqembi and donanemab for early Alzheimer’s disease. Analysts project a broader market penetration for Leqembi over donanemab, mainly driven by Leqembi’s better safety profile. Efficacy was generally similar between Leqembi and donanemab (see Table 1 and 2)

Significance of targeting amyloid β plaques and tau proteins for AD

AD patients are in dire need of effective medicines that provide more than mere symptomatic relief. Before the recent advent of approaches targeting amyloid β plaques, available drugs treated cognitive symptoms (memory and thinking) by affecting chemical messages between neurons. These drugs temporarily improve symptoms but do not alter the underlying course of the disease, and they fall into two main categories – cholinesterase inhibitors and glutamate regulators. Examples include Aricept (Donepezil), Razadyne (Galantamine), Exelon (Rivastigmine), Namenda (Memantine) and Namzaric (Memantine + Donepezil).5

The development of antibodies targeting amyloid plaque formation marks a major advance in changing the course of the disease by targeting the underlying pathology. Biogen’s and Eisai’s Leqembi (lecanemab) is the first antibody approved (traditional or full approval) that targets amyloid β plaque formation in the treatment of AD. Previously, Leqembi was granted accelerated (conditional) approval in January 2023. Following in the footsteps of Leqembi is Eli Lilly’s donanemab, expected to be approved by the end of 2023. We discount Biogen’s Aduhelm which was granted accelerated approval in June 2021 under controversy and has since been withdrawn from the market.

Biology behind amyloid β plaque and tau protein in the pathology of AD

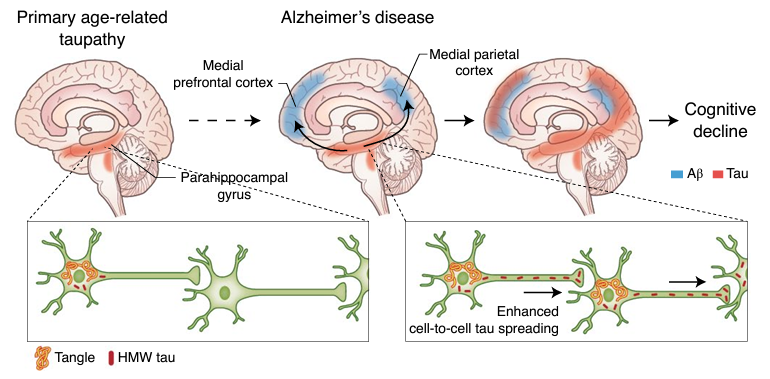

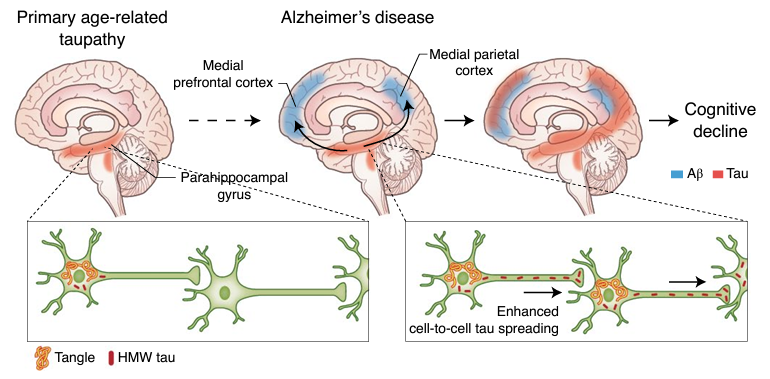

AD is characterized by amyloid plaque and neurofibrillary tangle formation in the brain. Amyloid β protein is the central component of extracellular amyloid plaques and is considered the major pathological driver of AD along with tau protein that make up the neurofibrillary tangles.6 Amyloid plaque accumulation directly results in synaptic dysfunction, neurodegeneration, and, ultimately, clinical symptoms.7 Drug development over the past decade or more has been directed at resolving amyloid β plaques. Notably, several earlier attempts at developing therapies targeting amyloid-beta plaques failed in clinical trials, casting doubt on the amyloid β plaques hypothesis in the development of AD.

Figure 2: Depiction of experimental model of amyloid β (Aβ) and tau protein synergy in propagating Alzheimer’s disease. Aβ plaques accelerate tau spreading and cognitive decline in Alzheimer’s disease (Busche & Hyman; Synergy between amyloid-β and tau in Alzheimer’s disease. Nature Neuroscience; 23, 1183–1193; 2020).

Comparing Leqembi and donanemab

Target AD patient population: Leqembi and donanemab were both tested in early AD, i.e., patients with mild cognitive impairment/mild dementia8 . However, within the early-AD patient populations patients were further classified based on the extent of the amyloid plaque and/or tau protein that correlates with disease progression.

Regulatory status: The FDA approved Leqembi on January 6, 2023, under the accelerated approval pathway sought by Biogen and Eisai based on Phase 2 data. Following the completion of the Phase 3 confirmatory trial that verified the clinical benefit and safety, the FDA converted the accelerated approval to traditional full approval on July 6, 2023. Ely Lilly applied for accelerated approval for donanemab after Phase 2 studies, but the FDA rejected the accelerated application. Phase 3 donanemab studies have now been completed and we expect FDA approval of donanemab the end of 2023.

Targeting amyloid β plaque formation: Both Leqembi and donanemab are monoclonal antibodies targeting amyloid β plaques that develop in AD. Leqembi binds to soluble amyloid β protofibrils (prior to plaque formation), which are known to be more toxic to neurons than monomers or insoluble fibrils.9 On the other hand, donanemab binds to a truncated form of β-amyloid present only within formed amyloid plaques.8 The binding of donanemab to the truncated form of β-amyloid facilitates plaque clearance through microglial mediated phagocytosis.

Dosing: Both are administered by intravenous injection, but donanemab is administered every four weeks and Leqembi every two weeks. It is notable that an extension clinical trial is ongoing that is testing a subcutaneous injection auto-injector of Leqembi administered every week. If approved, it would allow patients to administer at home without the need to visit an infusion center. This ease of self-injection at home with an auto-injector is a meaningful advantage for Leqembi.

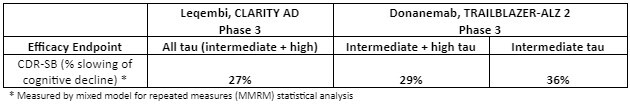

Efficacy data, patient populations, and endpoints: Phase 3 registration study data has been published in peer reviewed journals for both Leqembi and donanemab.8,9 Donanemab data was presented at the Alzheimer’s Association International Conference (AAIC) in Amsterdam on July 17, 2023. Though the two trials enrolled early-stage AD patients, there were differences in how the patient population were stratified based on AD progression as measured by brain protein tau, a predictive biomarker of disease progression in the case of the donanemab trial, and in the Leqembi trial based on evidence of amyloid deposits. The Leqembi trial enrolled all comers that also included patients with earlier stages of early AD (low amyloid or low tau) in addition to intermediate and high amyloid/tau patients indicating a more advanced form of early AD. The donanemab trial included medium and high amyloid/tau patients implying intermediate to more advanced stages of early AD.8,9

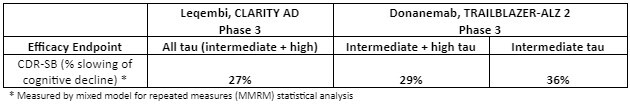

The two trials were also designed with partly different efficacy endpoints. The donanemab study included as its primary endpoint the change in integrated Alzheimer’s Disease Rating Scale (iADRS) and Clinical Dementia Rating-Sum of Boxes, or CDR-SB. The Leqembi trial did not use iADRS as an efficacy endpoint, but used CDR-SB.8,9 Therefore, comparing the two trials can be challenging due to the different patient populations and the different endpoints.

Evaluation of the Phase 3 studies shows that efficacy is generally similar between Leqembi and donanemab when similar patient populations are compared for the same endpoints. The efficacy of donanemab as measured by CDR-SB is predominantly driven by patients with intermediate disease (intermediate tau) that show a 36% slowing of CDR-SB decline vs ~14% for high-tau patients.8,9 When the same (intermediate + high tau) patient subgroups are compared, Leqembi and donanemab are generally similar in efficacy as measured by percent slowing of cognitive decline.8,9

The efficacy of donanemab was most effective in AD patients that had milder disease and were younger, as determined by subgroup analysis. These patients had milder cognitive function loss and less tau pathology. Eli Lilly has planned a Phase 3 study in pre-clinical AD patients to capture milder disease in younger patients.

It should be noted that Leqembi or donanemab cannot repair the cognitive damage that has already occurred in AD patients, nor can it reverse the course of the disease or stop it from getting worse. However, the rate of decline in cognitive damage is measurably slowed down by targeting amyloid β clearance – therefore changing the course of the disease.

Table 1: Comparing Phase 3 trial early-AD efficacy measurements for Leqembi and donanemab. Clinical Dementia Rating-Sum of Boxes (CDR-SB) was used in the Leqembi CLARITY AD Phase 3 trial and the donanemab TRAILBLAZER-ALZ 2 Phase 3 trial. Within the same AD subpopulation (intermediate and high tau), the two antibodies are generally similar in efficacy as measured by CDR-SB. Donanemab does better in intermediate tau subpopulation – no comparator available with Leqembi in this subpopulation (adapted from reference 3,4,8,9).

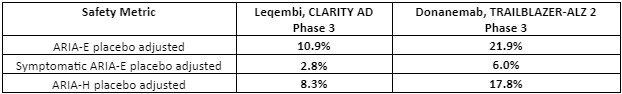

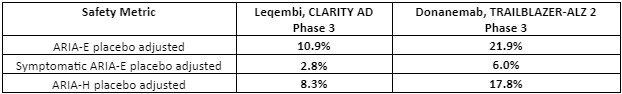

Safety data: Both Leqembi and donanemab target amyloid plaques via immunotherapy mechanisms – an antibody-based targeting of amyloid plaque that develops in AD. A consequence of this therapeutic approach is amyloid-related imaging abnormalities (ARIA), a term that encompasses a spectrum of MRI (neuroimaging) findings observed in patients receiving anti–amyloid beta immunotherapies for AD.7 These amyloid-targeting antibodies are known to cause brain swelling and bleeding as observed in ARIA – edema/effusion (ARIA-E) or microhemorrhages/superficial siderosis (ARIA-H) are observed.Therefore, ARIA is a safety issue that is carefully monitored for amyloid plaque targeting therapies.

There were three donanemab-related deaths in the Phase 3 clinical trial that were related to ARIA as detected by MRI imaging. There were three deaths in the Leqembi trial in patients, but those were related to patients on anticoagulant therapy.8,9 In general, the Phase 3 data shows that Leqembi has a superior safety profile compared to donanemab based on ARIA – see table below. Safety is where Leqembi has a distinct advantage over donanemab – the ARIA safety issue favors Leqembi.

Table 2: Safety favors Leqembi over donanemab. Amyloid-related imaging abnormalities (ARIA) were far more acute for donanemab. Note that the donanemab Phase 3 trial included 3 patient deaths related to ARIA (adapted from reference 3,4,8,9).

FDA prescription has a Black Box warning: The FDA-approved Leqembi has a Black Box warning on the prescription label. We expect donanemab also to be approved with a Black Box warning, especially since the safety profile of Leqembi is superior to donanemab.

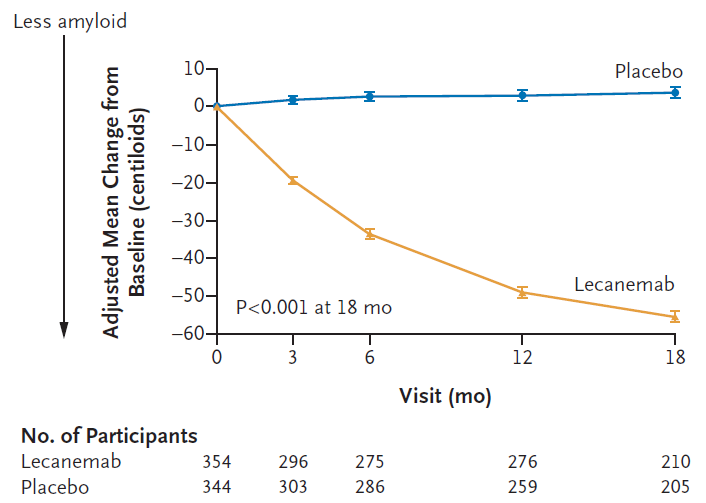

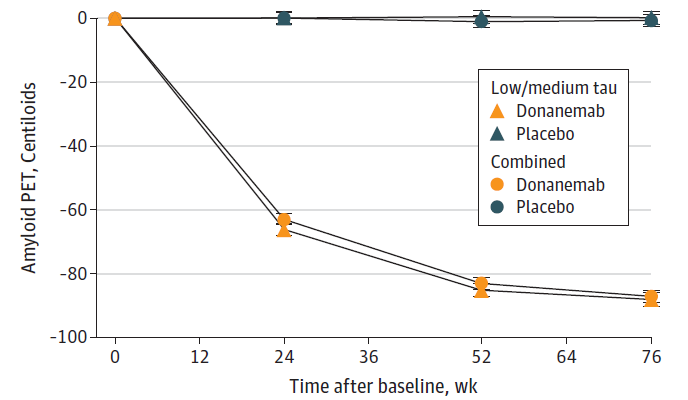

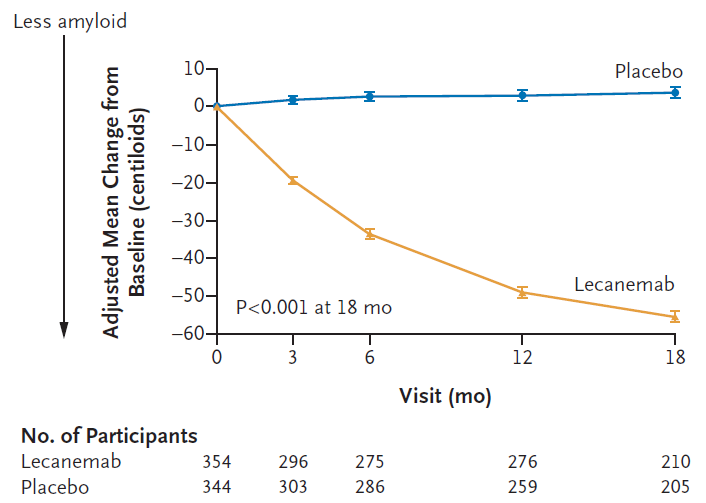

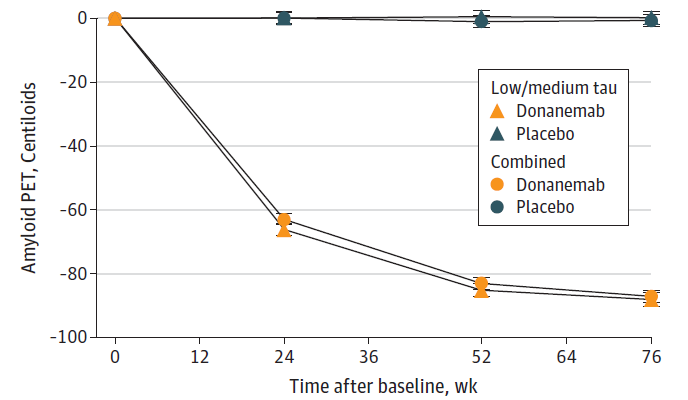

Measure of amyloid plaque clearance on treatment: The desired consequence of amyloid β targeting antibody therapy is clearance of amyloid deposits and reduction of the amyloid burden that contributes to the pathology in AD. A measure of amyloid plaque clearance was an important secondary endpoint in both the Leqembi and donanemab trials. Amyloid clearance was measured by positron emission tomography (PET) imaging. The early and significant changes in amyloid burden suggests that brain PET scans may provide a tool for clinical monitoring of the effect of therapy. Therapy with both antibodies showed significant amyloid clearance in treated patients compared to patients in the placebo arm (see Figures 3a and 3b).8,9

Figure 3A: Leqembi (lecanemab) treatment leads to amyloid plaque clearance as measured by PET scans in a sub-study that included 698 patients. Measured as change from baseline over 18 months (Van Dyck et al; Lecanemab in Early Alzheimer’s Disease; NEJM 388;1, 2023).

Figure 3B: Treatment with donanemab leads to amyloid clearance as measured by PET scans. Both sub populations of patients, intermediate (low/medium) tau) and intermediate + high (combined) tau showed similar amyloid clearance compared to baseline over 76 weeks (Sims et al; Donanemab in Early Symptomatic Alzheimer Disease: The TRAILBLAZER-ALZ 2 Randomized Clinical Trial; JAMA. doi:10.1001/jama.13239; 2023).

Aduhelm (aducanumab) controversy

Before Leqembi, Biogen/Eisai developed Aduhelm. Aduhelm was, at one time, slated to be the first targeted therapy for AD that could change the course of the disease — its development timeline was more advanced than Leqembi and donanemab. Aduhelm is a human monoclonal antibody that preferentially binds to aggregated beta-amyloid to reduce the number of beta-amyloid plaques and slow disease progression.10

As many investors may be aware, Aduhelm was evaluated in November 2020 by an FDA Advisory Committee which voted against approval, by a vast margin – 10 members voted against, and one was “uncertain.” The FDA usually heeds the advice of its Advisory Committee but is not bound by it. In June 2021 the FDA surprisingly approved Aduhelm based on an accelerated approval path, triggering significant debate about the controversial decision. The decision by the FDA was particularly notable given the resounding rejection by the Advisory Committee. Three members of the FDA Advisory Committee resigned over the FDA’s decision. The efficacy of Aduhelm was questionable and safety was also an issue.

Subsequently, Biogen and Eisai halted plans for approval in the EU after the EU regulators conveyed that approval was unlikely. With a hefty annual cost of $56K, even if FDA approved, the lack of enthusiasm with the advisory committee and the controversy surrounding the FDA approval made health insurers hesitant to cover cost. Aduhelm is not being marketed or developed further.

The bottom line

Both Leqembi and donanemab are pioneering antibody-based therapies that target amyloid β plaque formation in AD. Clearance of amyloid deposits and reduction of the amyloid burden can change the course of the disease as demonstrated in Phase 3 trials for both Leqembi and donanemab. Visible Alpha consensus shows that Leqembi is projected to capture a significantly larger market share than donanemab. Leqembi is expected to reach peak unadjusted revenues of $9.9 billion in 2034, and donanemab is expected to reach peak unadjusted revenues of $6.4 billion in 2032. Analyst estimates are driven by Leqembi’s superior safety profile over donanemab. Furthermore, an upcoming Leqembi version, if approved, could allow patients to self-inject at home using a subcutaneous auto-injector.

References

- Rajan et al; Population Estimate of People with Clinical AD and Mild Cognitive Impairment in the United States (2020–2060); Alzheimer’s Dement. 17 (12); 2021

- Alzheimer’s Disease International https://www.alzint.org/

- Eisai Company Presentation information (https://www.eisai.com/ir/library/index.html)

- Eli Lilly Information; https://investor.lilly.com/news-releases/news-release-details/results-lillys-landmark-phase-3-trial-donanemab-presented

- Alzheimer’s Association Treatments & Research | Alzheimer’s Association

- Busche & Hyman; Synergy between amyloid-β and tau in Alzheimer’s disease. Nature Neuroscience; 23, 1183–1193; 2020

- Roytman et al; Amyloid-Related Imaging Abnormalities: An Update; AJR:220, 2023

- Sims et al; Donanemab in Early Symptomatic Alzheimer Disease: The TRAILBLAZER-ALZ 2 Randomized Clinical Trial; JAMA. doi:10.1001/jama.13239; 2023

- Van Dyck et al; Lecanemab in Early Alzheimer’s Disease; NEJM 388;1, 2023

- Silvestro et al; Aducanumab and Its Effects on Tau Pathology: Is This the Turning Point of Amyloid Hypothesis? Int.J.Mol.Sci.,23,2011;2022