BYD vs. Tesla; Accenture’s Growth Dip; Solaria Ramps Up Solar

In our weekly round-up of the top charts and market-moving analyst insights: BYD (SZSE: 002594) leads in vehicle sales but Tesla (NASDAQ: TSLA) leads in revenue; Accenture (NYSE: ACN) is expected to see a modest growth rebound in 2024 after a tough 2023; Spain’s Solaria (SIX/BME: SLR) is ramping up solar capacity, driving revenue projections.

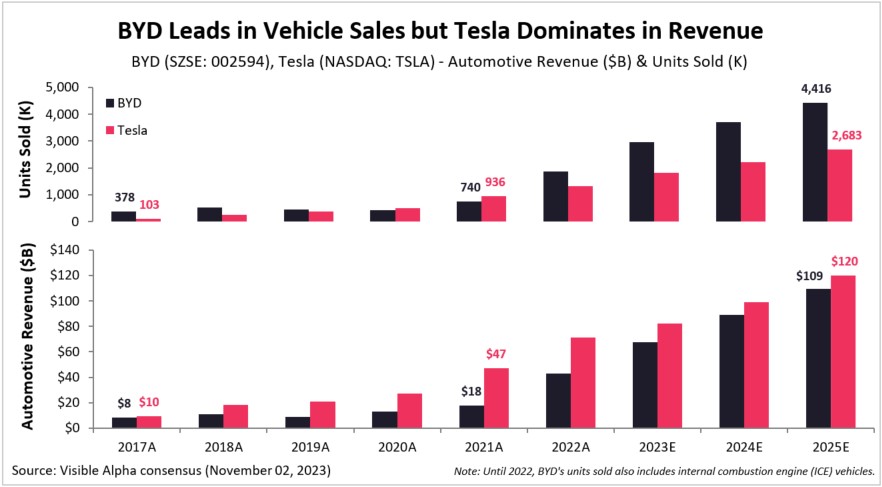

BYD Leads in Vehicle Sales but Tesla Dominates in Revenue

BYD and Tesla are two of the biggest players in the global electric vehicle (EV) space. While Tesla sells only EVs, BYD sells both EVs and plug-in hybrid electric vehicles. In 2022, China-based BYD (SZSE: 002594) sold 1.9 million vehicles, 555K units more than Tesla (NASDAQ: TSLA) did globally. According to Visible Alpha consensus, the gap between the units sold by the two companies is only expected to widen in 2023, with BYD projected to sell nearly 3 million vehicles, 1.1 million units more than Tesla. By 2025, BYD is projected to sell 4.4 million vehicles versus Tesla at an expected 2.7 million.

Despite BYD selling more units, however, Tesla still generates higher automotive revenue. In 2023, analysts expect Tesla to generate $82.4 billion in automotive revenue, compared to $67.8 billion for BYD. Between 2023-2025, BYD’s automotive revenue is projected to grow at a CAGR of 27% to $109 billion, while Tesla’s automotive revenue is expected to grow at a CAGR of 21% to $120 billion.

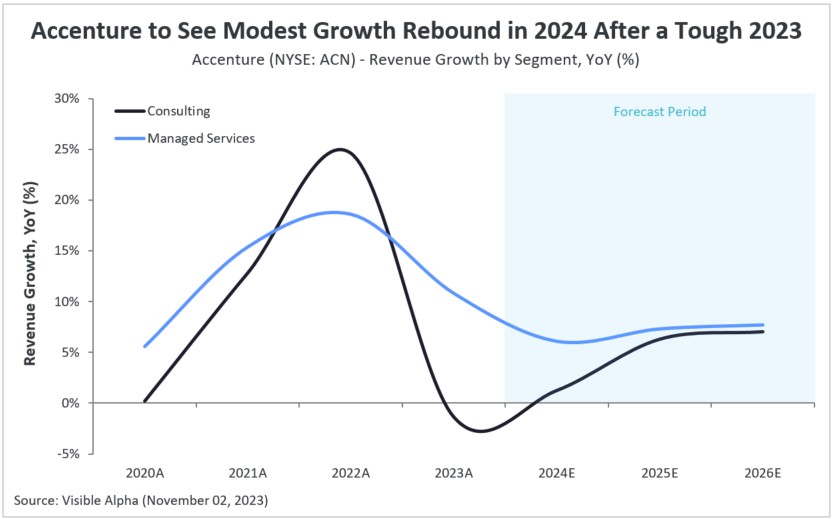

Accenture to See Modest Growth Rebound in 2024 After a Tough 2023

In 2023, Accenture (NYSE: ACN) experienced a significant decline in revenue growth as macroeconomic headwinds saw IT project ramp-downs, cautious spending patterns, and softer-than-expected bookings. According to Visible Alpha consensus, the company is expected to see a modest recovery in fiscal 2024, with a projected 4% growth in revenue. Specifically, Accenture’s Consulting business, which saw a -1% year-over-year decline in revenue in 2023, is anticipated to rebound with 1% revenue growth in 2024, reaching $34 billion. However, growth in the company’s Managed Services division is expected to slow down further to 6% in 2024, hitting $32.4 billion.

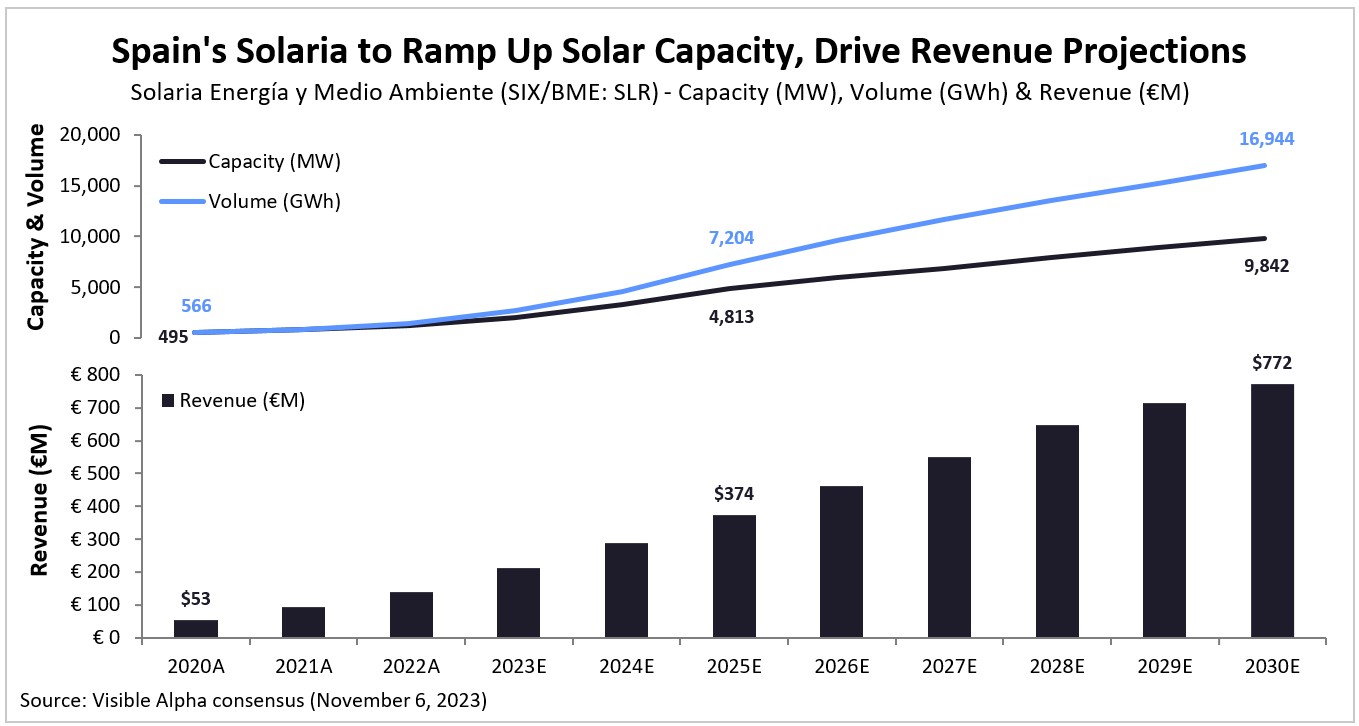

Spain’s Solaria to Ramp Up Solar Capacity, Driving Revenue Projections

Spain’s Solaria Energía y Medio Ambiente (SIX/BME: SLR), a solar power generation company, is set to substantially boost its installed capacity. According to Visible Alpha consensus, analysts expect Solaria’s total capacity to increase from 1,172 megawatts (MW) in 2022 to an estimated 2,048 MW in 2023, reaching 9,842 MW by 2030. Between 2023 and 2026, the company is projected to see annual double-digit growth in its installed capacity in Spain, Italy, and Portugal. This expansion is expected to drive the company’s solar production volume from 1,434 gigawatt hours (GWh) in 2022 to 2,729 GWh in 2023, and then grow at a projected CAGR of 30% to 16,944 GWh by 2030. With rising capacity and volume, Solaria’s total solar revenue is forecasted to increase to €211 million in 2023, and then grow at a CAGR of 20% to €772 million by 2030.

OpenAI DevDay with OpenAI CEO Sam Altman & Microsoft (MSFT) CEO Satya Nadella

OpenAI DevDay

OpenAI CEO Sam Altman gave a keynote on November 6, 2023 that highlighted the current state of ChatGPT and showcased a series of product updates, including ChatGPT-4 Turbo. Altman explained that increased context length, more control, better world knowledge, new modalities, customization, and higher rate limits will be part of the new offerings. In addition to these enhancements, he noted that the pricing will come down, making Turbo 2.75x cheaper to work on, and that speed will begin to increase. Will these enhancements be a catalyst for the development of GPTs?

Figure 1: OpenAI’s new announcements

Source: OpenAI DevDay (November 6, 2023)

Current stats: OpenAI

- 2 million developers building on the API

- 92% of Fortune 500 companies are building on OpenAI products

- 100 million weekly active users on ChatGPT

What’s new: ChatGPT Turbo and 6 major new enhancements

- Context length will now support 128,000 tokens of context

- More control over responses and output

- Better world knowledge by bringing knowledge into the model — now up to April 2023

- New modalities will go into the API today — vision and voice capabilities launched

- Customization — fine-tuning program and custom models in the API

- Higher rate limits will double the tokens per minute for all ChatGPT4 customers

Microsoft and OpenAI partnership

There was a cameo appearance at OpenAI DevDay by CEO of Microsoft (MSFT), Satya Nadella, during which he discussed the Microsoft partnership with OpenAI. According to Nadella, Microsoft is building in partnership with OpenAI and that this is causing the shape of Azure to shift with this alignment. Nadella also highlighted that Microsoft aimed to build the best system so that OpenAI could build the best models. Will this effort start to drive upside in revenues for Azure, Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) businesses within Intelligent Cloud?

Figure 2: Microsoft CEO Satya Nadella and OpenAI CEO Sam Altman at OpenAI DevDay

Source: OpenAI DevDay (November 6, 2023)

GPTs: Gateway to the agent

GPTs are a way to create a tailored version of ChatGPT and are precursors to agents. These will integrate instructions and its expanded knowledge and then ultimately deliver tailored actions. Users will be able to build a GPT with natural language instead of having to code. These can be public, private, or specific to an organization. OpenAI plans to offer revenue sharing for GPTs and give developers $500 of OpenAI credits to incentivize the creation of new applications. In addition, these agent concepts will all come to the API.

Figure 3: Key Consensus Trends for Microsoft

Source: Visible Alpha consensus (November 6, 2023). Stock price data courtesy of FactSet. Microsoft’s current stock price is as of the market close on November 3, 2023.

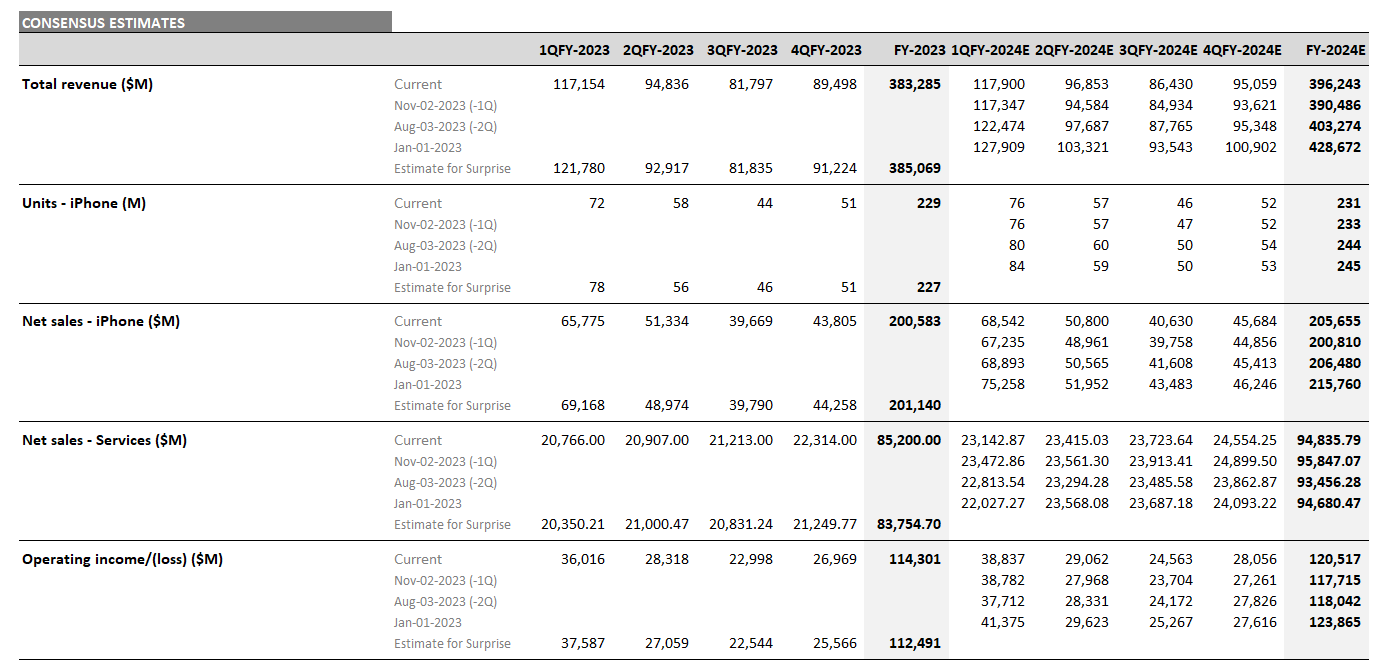

Three Key Questions About Apple (AAPL) Earnings in November 2023

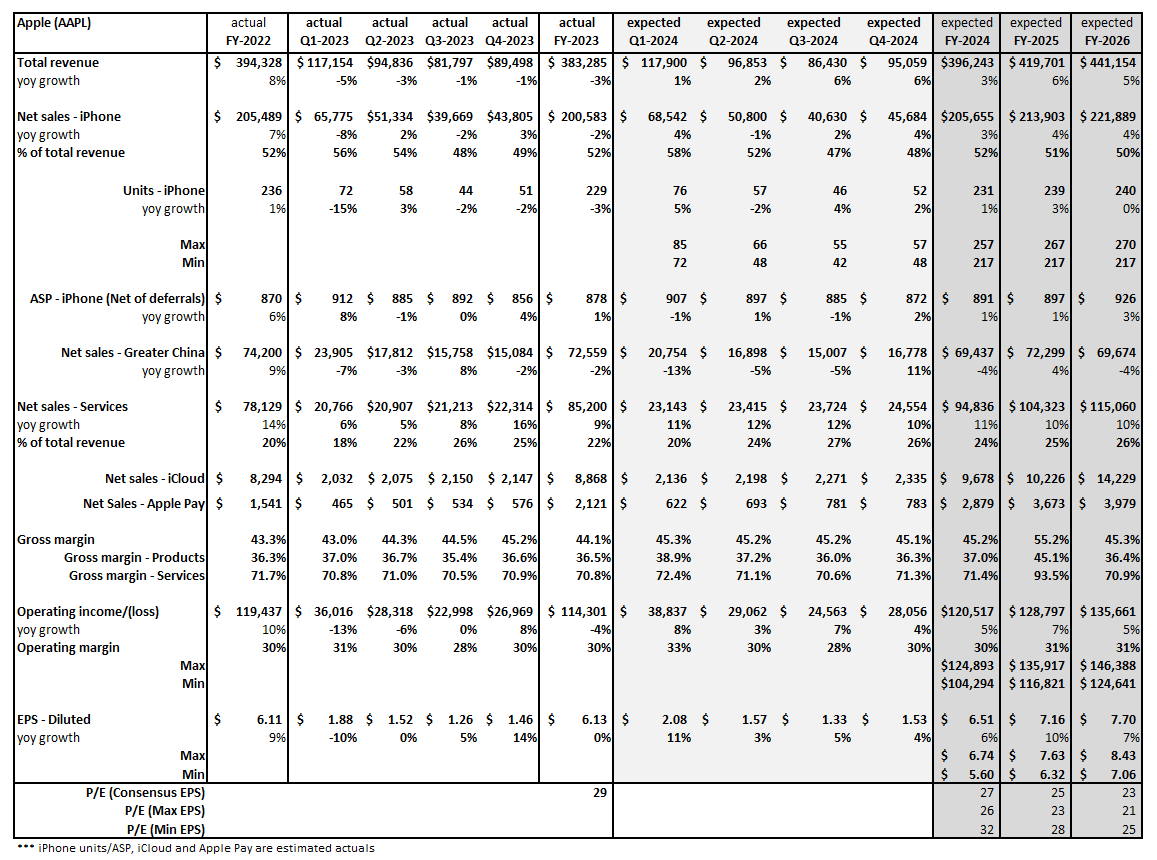

Apple (NASDAQ: AAPL) reported earnings for fiscal Q4 2023 after the market close on Thursday, November 2, 2023. After the earnings release and looking ahead to Q1 and FY 2024, what are the questions we are focusing on?

1. What happened with iPhone sales and what does the outlook look like?

Apple’s fiscal Q4 2023 total company revenues came in right in line with consensus at $89.5 billion. Drilling down into the revenues, Services outperformed and iPhone was in line, but Mac, Wearable, and iPad were disappointing.

The company highlighted again that the opportunity in India continues. However, it is unclear how big this market can be for Apple/iPhone. While India may not generate the same volume of revenues as China’s estimated $69 billion, it may still increase penetration and make a meaningful contribution to revenue over the next few years. This market may begin to break away from other emerging markets as penetration increases. The company noted strength overall in many emerging markets.

Coming into earnings, analysts were expecting the company to guide Q1 2024 to be up 5% for iPhone revenues. However, Apple guided below expectations to flat year-over-year when adjusted for FX (2pts) and an extra week (7pts).

There has been increasing bearish sentiment on the iPhone outlook. The current iPhone estimates for FY 2024 revenues and units have come down since August, driven by projected lower growth assumptions in core markets and foreign exchange. However, as of November 3, the range of unit estimates still skewed to the high end, with unit expectations ranging from 72 million to 85 million for Q1 2024 and consensus settling at 76 million units.

Figure 1: Expectations for FY 2024

Source: Visible Alpha consensus (November 3, 2023)

New Question: How will the iPhone do this holiday season and how might that color the outlook for the rest of the year?

2. How did the Services segment perform and what is next for this segment?

Services outperformed expectations by nearly $1 billion, coming in at $22.3 billion, and given the much higher gross margin (71%), this segment was able to offset a meaningful decline in operating income.

For Q1 2024, Services are expected to deliver $23.1 billion, up 11% year over year, driven by cloud, music, and ads. For FY 2024, analysts currently forecast Services revenue to jump 11% to $95 billion, and another $20 billion to $115 billion by the end of FY 2026.

Cloud: For FY 2024, Apple is projected to generate nearly $10 billion in cloud sales. Based on color from Q4 earnings, growth in cloud looks poised to continue.

Apple Pay: For FY 2024, analysts, on average, are projecting $3 billion in sales.

Margins: Services currently generate a 71% gross margin, nearly double the 36% for the Products segment, and could shift Apple toward higher profitability. The company’s total operating profit is expected to grow 5% year over year in FY 2024 to $120 billion, driven by an increase in mix toward Services.

Growth: Apple’s significant installed base of 2 billion devices, with nearly 1 billion estimated to be iPhone, may be a great platform for growing ads, cloud, payments, and other content revenues (like music, games and TV). It is worth noting that Apple has been relatively quiet about Generative AI and we wonder if an announcement may emerge in this segment in FY 2024.

New question: What could drive higher-than-expected Services revenue in Q1 and FY 2024?

3. What did Apple’s performance in China reveal?

In Q4, Greater China generated $15 billion in revenues, but this was $1.3 billion below projections. While CEO Tim Cook noted his optimism for the China market, questions linger about the company’s performance in this market. There is some debate about what the region will deliver for sell-through units in FY 2024 and beyond.

Competition is likely to weigh on Apple in the China market, as sales are expected to drop 13% year-over-year to $20.8 billion in Q1. For FY 2024, analysts project China to deliver $69.4 billion in revenues, down 4% from 2023 levels. For FY 2024, expectations have declined 10% from $76.6 billion back in the spring. The verdict is still out on how China will perform in FY 2024 and beyond. Currently, analysts expect China to hit $72 billion by the end of FY 2025, flat with FY 2023.

New question: Will China sales resume a growth trajectory?

Figure 2: Apple’s key financial items

Source: Visible Alpha consensus (November 3, 2023)

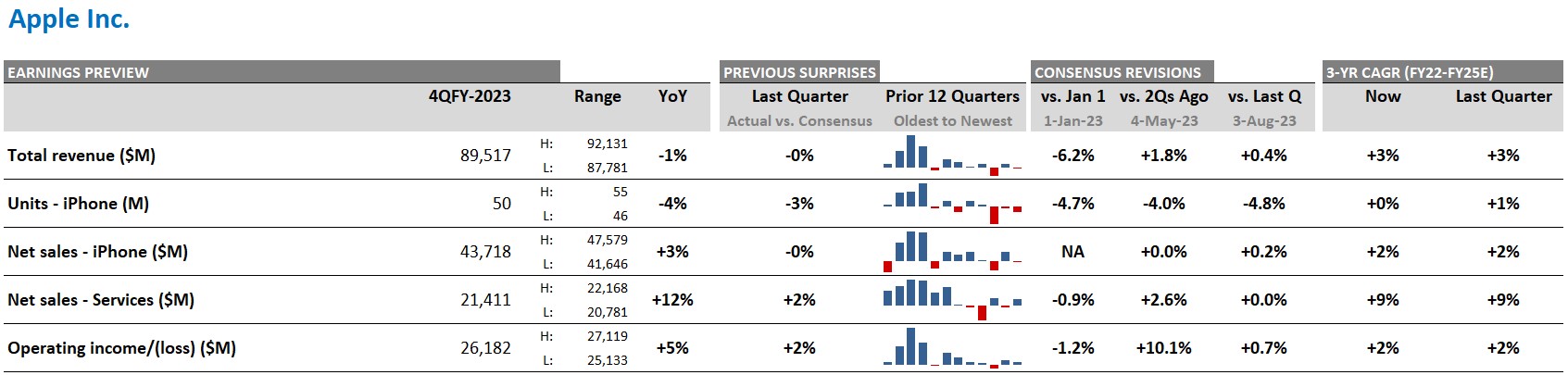

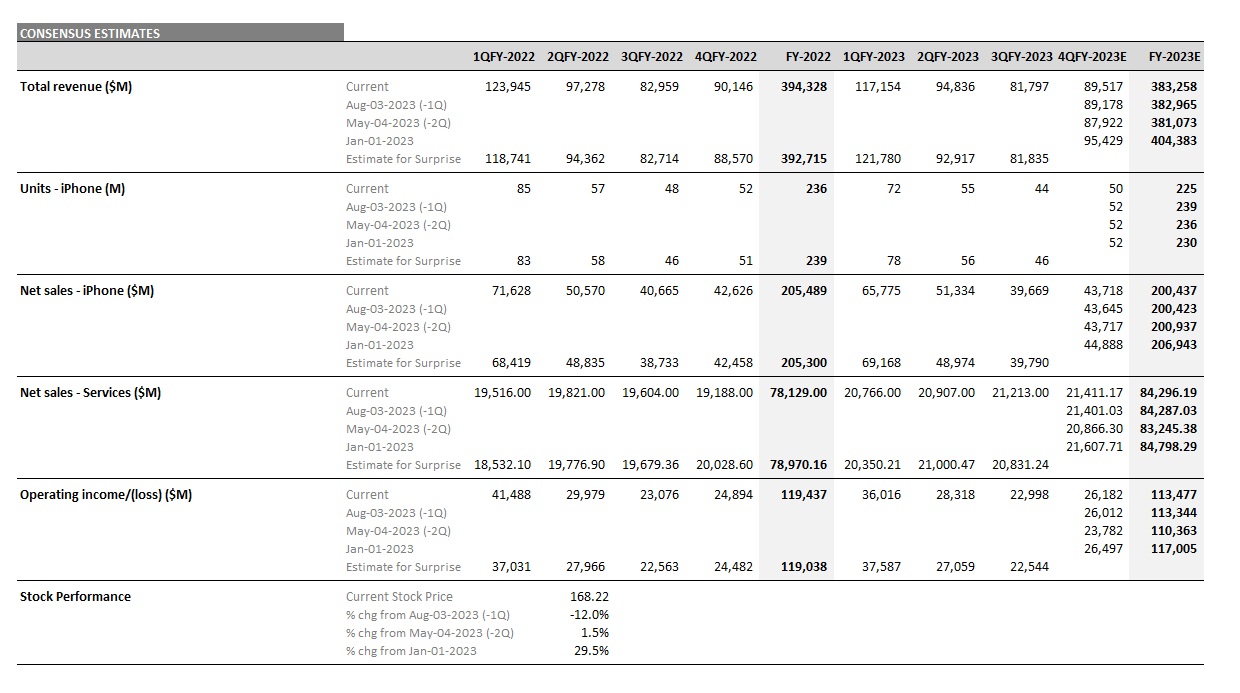

Apple (AAPL) Q4 2023 Earnings Preview

Apple Inc. (NASDAQ: AAPL) will report fiscal Q4 2023 results on Thursday, November 2, 2023. Here are the key numbers that we’re watching.

Figure 1: Apple – consensus expectations for Q4, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (October 30, 2023). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Apple Q4 Earnings Preview

According to Visible Alpha consensus, total revenues expected for Q4 have come down from the beginning of the year, from $95.4 billion to $89.5 billion, driven by decreased optimism about Apple’s new iPhone. Since August, total expected iPhone unit sales have come down from 52 million to 50 million, driven by debate among analysts about the performance of the new iPhone. Expected Q4 iPhone units range from 45.5 million to 54.5 million, with most of the 9 million unit difference explained by a 7 million unit variance in estimates for the iPhone 15 specifically, ranging from 19 million to 26 million units.

While iPhone sentiment has come down, expectations for the high-margin Services segment and for total operating profit have remained consistent all year. Gross margin for the Services segment is over 70%, significantly higher than the 36% gross margin for Products. It will be interesting to hear what the Company says in the earnings release about growth in Services and if this is enough to offset any sluggishness in iPhone sales.

The stock has traded down -12% (as of the October 27 market close) since last quarter’s July release, but is up nearly 30% year to date. Could the Q4 release provide the next positive catalyst for the stock?

Figure 2: Apple consensus estimates

Source: Visible Alpha consensus (October 30, 2023). Stock price data courtesy of FactSet. Apple’s current stock price is as of the market close on October 27, 2023.

Source: Visible Alpha consensus (October 30, 2023). Stock price data courtesy of FactSet. Apple’s current stock price is as of the market close on October 27, 2023.

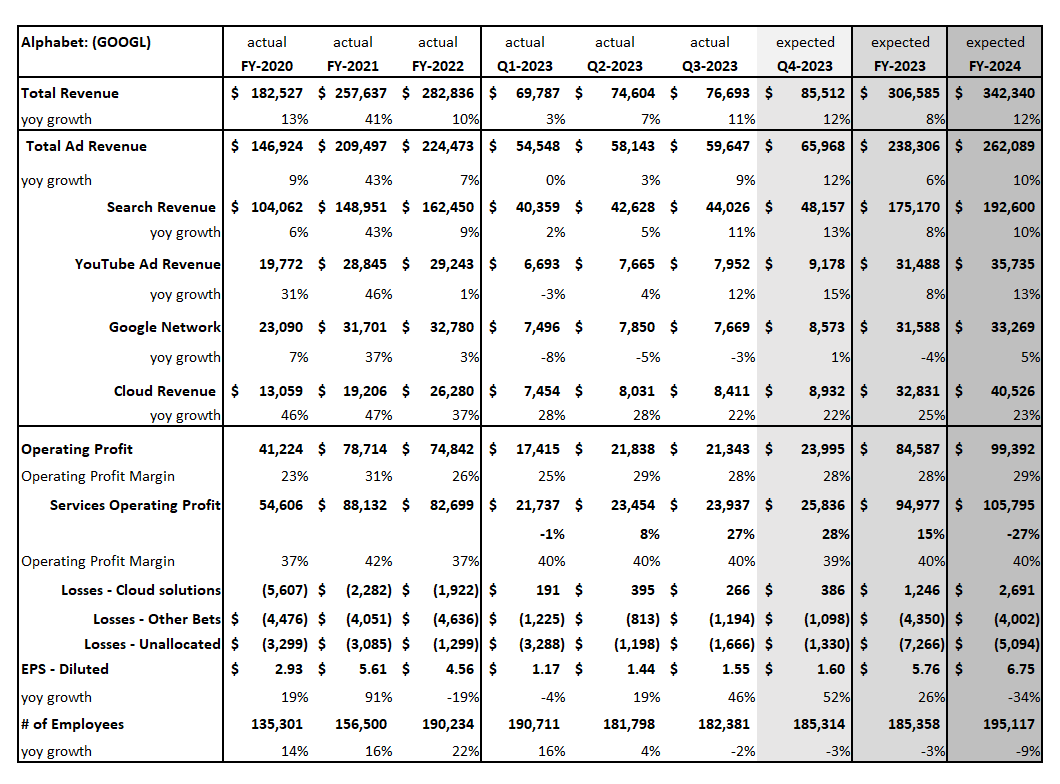

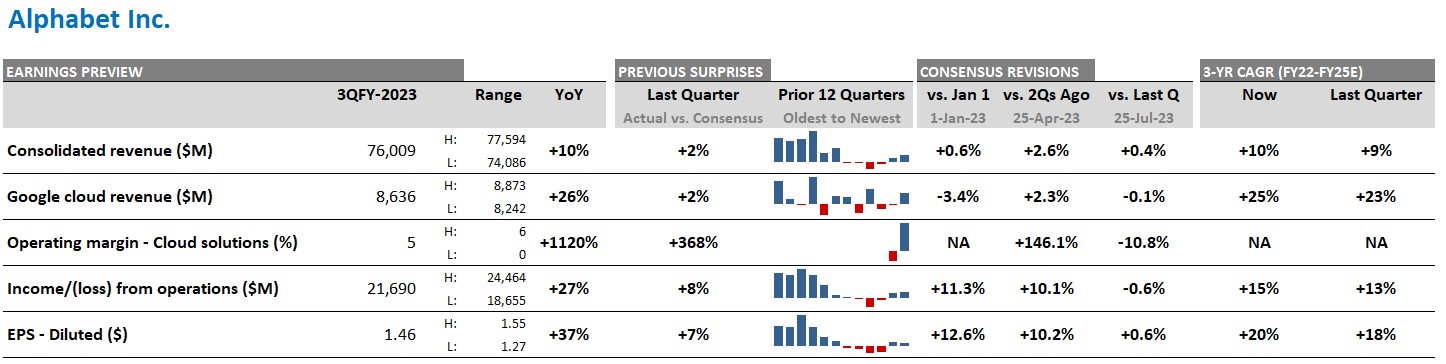

Key Questions About Alphabet (GOOGL) Earnings in October 2023

Alphabet Inc. (NASDAQ: GOOGL) reported earnings for Q3 2023 after the market close on Tuesday, October 24, 2023. What happened during the release and earnings call, and what’s next?

What happened in Q3?

Alphabet Inc. (NASDAQ: GOOGL) reported earnings a bit below expectations for Q3 2023 after the market close on Tuesday, October 24, 2023, driving the stock down after the release. Alphabet’s core business of Search and YouTube delivered revenues 1.5% ahead of expectations. However, the Cloud and Network search businesses together were -3% below expectations. In particular, the Cloud business appeared to lose share in the quarter and AI efforts seem to be behind competitors, which likely contributed to higher-than-expected costs.

More concerning, the operating profit margin of 27.8% for Alphabet overall came in 70 basis points below expectations, driven by a combination of higher-than-expected losses in other businesses and a cloud margin nearly 200 basis points below estimates. Coming into the quarter, analysts were expecting Alphabet to maintain the same 5% margin it achieved in Q2 for the cloud business, and the level of losses for the other bets and unallocated segments to remain around $2 billion. In Q3, however, the cloud margin dipped to 3% and the other bets and unallocated losses jumped 42% quarter-over-quarter to $2.9 billion.

Question: Will Google Cloud margin improve in Q4 or stay around 3%?

Q4 and Beyond

Looking ahead, the revenue growth from the Cloud business is expected to be an outsized chunk of Alphabet’s total revenue growth for FY 2024, meaning it is growing at a much faster 20-25% pace than the 10% expected year-over-year growth for Alphabet’s core Search and YouTube revenue streams. While Cloud revenues are expected to hit $40 billion in FY 2024 and almost $50 billion by FY 2025, profitability remains a looming concern.

Analysts were initially projecting the Cloud business to generate a 5% margin in Q4, but this estimate has ticked down to 4.4% since the release. For FY 2024, analysts are expecting Cloud revenues to grow to $40 billion, up 23% year-over-year, and operating income to more than double from an expected $1.3 billion in FY 2023 to $2.7 billion. Analysts project a strong 6.6% operating profit margin in the Cloud business in FY 2024 and for this margin to jump to 13% by the end of FY 2026, which may be aggressive given the Cloud margin performance in Q3 and lower expectations into Q4 2023.

Question: Will Vertex AI help to drive share gains and margin expansion going forward?

In addition, the other bets revenues are expected to remain just over $1 billion, but losses are expected to decrease around $2.5 billion year-over-year in FY 2024. Losses for these line items are projected to be over $11.5 billion in FY 2023 and to decline to $9 billion in FY 2024 and $8 billion in FY 2025. Given the performance this quarter, questions remain about how Alphabet may reduce these losses.

While the company has a strong cash position of $120 billion, CapEx is projected to increase $12 billion from an expected $31 billion in FY 2023 to $43 billion in FY 2026. In order to catch up to competitors in the AI space, further investments and CapEx may be required.

Question: Will Alphabet be able to rein in these losses, while still innovating and maintaining its strong cash position in 2024?

Figure 1: Alphabet’s Key Financial Items

Source: Visible Alpha consensus (October 27, 2023)

Source: Visible Alpha consensus (October 27, 2023)

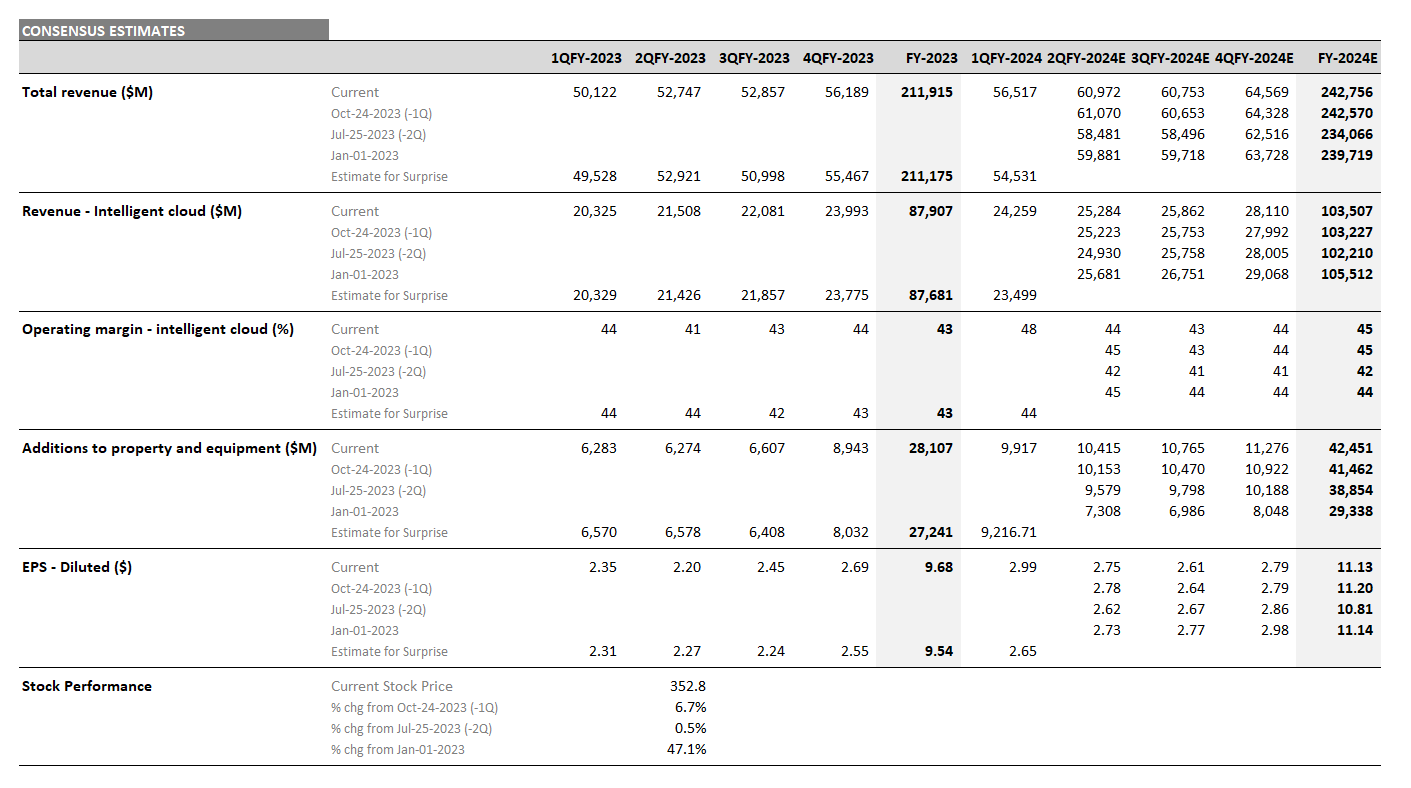

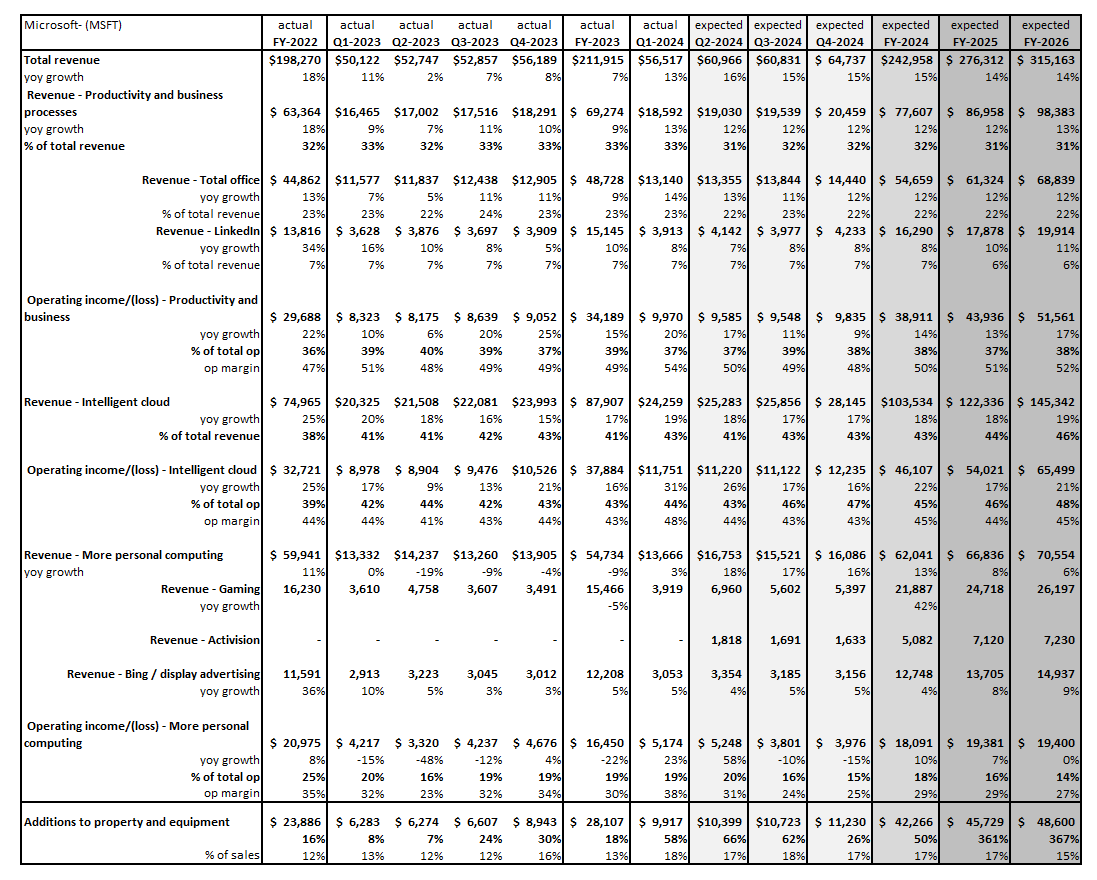

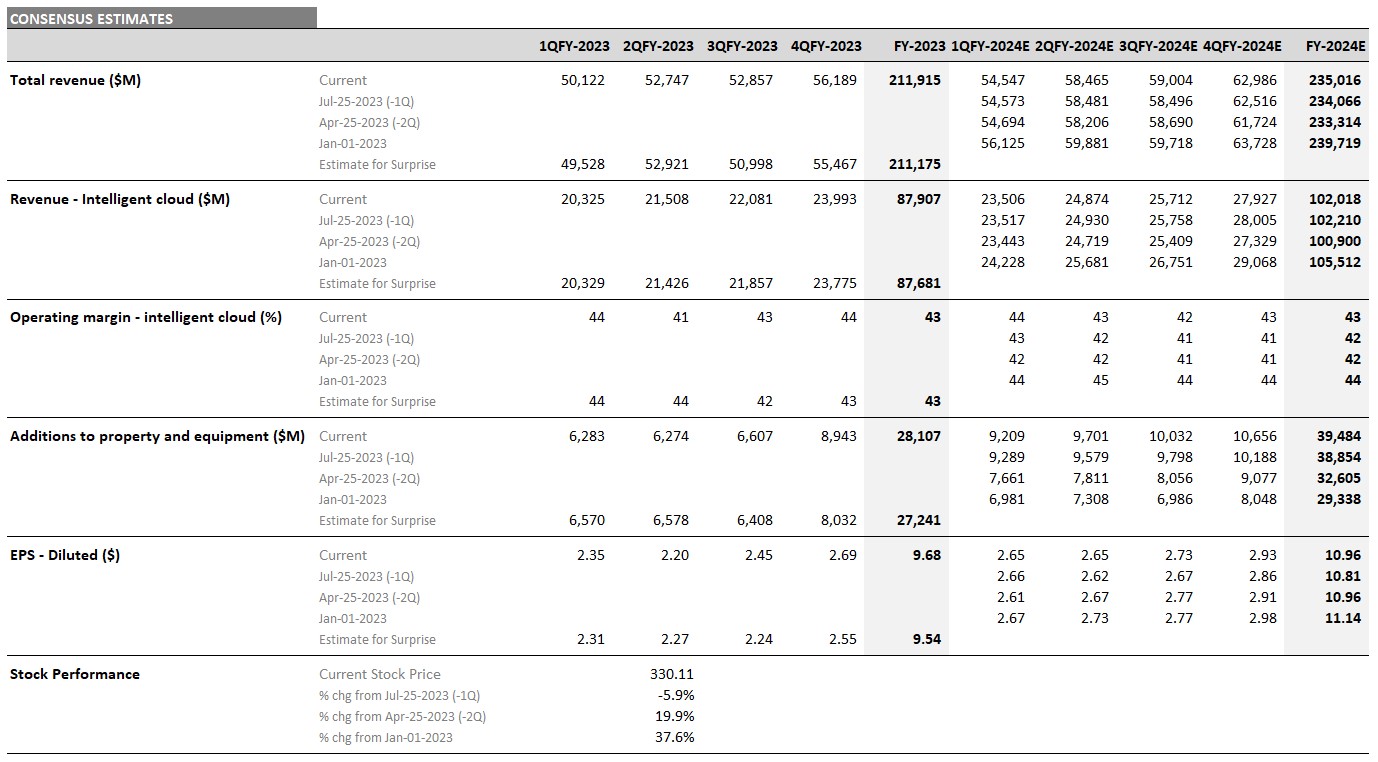

Three Key Questions About Microsoft (MSFT) Earnings in October 2023

Microsoft (NASDAQ: MSFT) reported earnings for fiscal Q1 2024 after the market close on Tuesday, October 24, 2023. What happened during the release and earnings call, and what are the questions to focus on?

1. What drove the margin surprises for the key segments in fiscal Q1 2024?

Both Productivity & Business Processes and Intelligent Cloud (including Azure) came in slightly ahead of Visible Alpha consensus estimates for sales and operating profit.

Productivity & Business Processes: In Q1, the Productivity & Business Processes segment delivered $18.6 billion in revenue and $10 billion in operating profit, resulting in a 54% operating profit margin driven by strength in Office Commercial, ahead of the 51% margin that was expected based on Visible Alpha consensus.

Microsoft guided to $18.8-19.1 billion in Productivity & Business Processes revenue for Q2, in line with analysts’ estimates of $19.0 billion. In FY 2024, the segment is expected by analysts to grow to $77.1 billion in revenue, which would be up 11% year over year.

Intelligent Cloud: Prior to the Q1 earnings release, analysts expected the Intelligent Cloud business (including Azure) to generate $23.5 billion in revenue for Q1 and $102 billion for FY 2024, and for operating margins to remain around 43% for FY 2024. In Q1, Intelligent Cloud delivered revenue of $24.3 billion and operating profit of $11.8 billion, ahead of the $10.3 billion expected, resulting in a 48% operating profit margin, well ahead of the consensus estimate of 43%.

According to management, Azure took share and got a boost from AI. Intelligent Cloud Q2 guidance of $25.1-25.4 billion with Azure up 26-27% (in constant currency) is in line with current expectations. However, it is worth noting that Microsoft was more conservative in its cloud outlook than Amazon by noting that H2 will be stable for Azure.

In FY 2024, Intelligent Cloud is expected to deliver $103.5 billion, up 18% year over year, and to grow to $122.3 billion by the end of FY 2025, according to Visible Alpha consensus. Some analysts are suggesting that the company can deliver better-than-expected growth in this business, with top-end estimates coming in closer to $105 billion in 2024 and $130 billion in 2025.

New Question: Will Office’s and Azure’s growth and margins continue in FY 2024?

2. CapEx continues to grow: Where is Microsoft investing?

Microsoft’s CapEx levels by FY 2025 are expected to be 10X from FY 2013, 5X from FY 2017, and 3X from FY 2019. CapEx for Q1 came in ahead of expectations and was up $1 billion quarter over quarter to $9.9 billion, and 58% year over year. CapEx as a percentage of revenue has ticked up to 18% from 16% in Q4 2023 and from 13% in FY 2023.

The company guided to further increased sequential CapEx spending for cloud infrastructure in FY 2024. Analysts expect total CapEx of $42.3 billion for FY 2024, up 50% year-over-year. This level of CapEx spend is likely to help drive cloud revenue and Microsoft’s position in AI.

According to CEO Satya Nadella, the easiest path for companies to adopt generative AI is via Copilot and the Cloud. Microsoft’s combination of its Copilots and its full stack approach should help customers optimize GPU utilization and may provide a compelling competitive advantage. Microsoft wants to help customers build generative AI capabilities and expects this benefit to be weighted toward H2 2024. According to CFO Amy Hood, AI-related gross margins should scale faster and the pace of adoption should be quicker than in previous cycles.

New Question: What will be the catalyst to drive revenue and profit from Microsoft’s CapEx investments?

3. What’s the expected impact of the Activision Blizzard deal?

Microsoft completed the acquisition of Activision Blizzard on October 13, 2023. Going forward, results will be in the Gaming segment under More Personal Computing. According to Microsoft, the company expects “revenue growth in the mid to high 40s. This includes roughly 35 points of net impact from the Activision acquisition.” Analysts are expecting a $1.8 billion revenue impact from Activision in Q2 2024 and $5 billion for FY 2024 from the deal. In addition, the company will move from third-party to first-party accounting.

New Question: How long will it take the Activision Blizzard acquisition to add $10 billion to Gaming revenues?

Figure 1: Microsoft’s key financial items

Source: Visible Alpha consensus (October 27, 2023)

Source: Visible Alpha consensus (October 27, 2023)

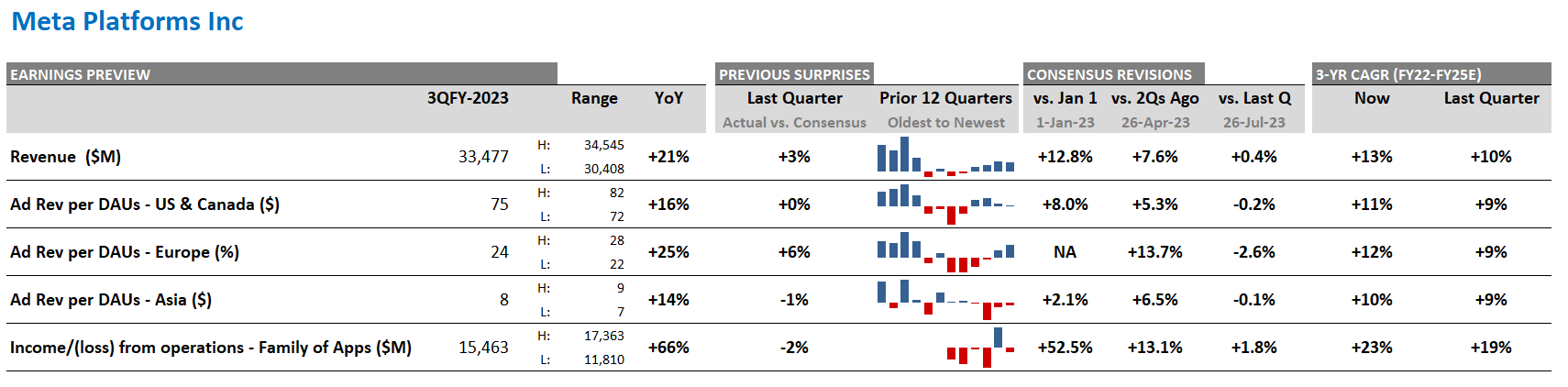

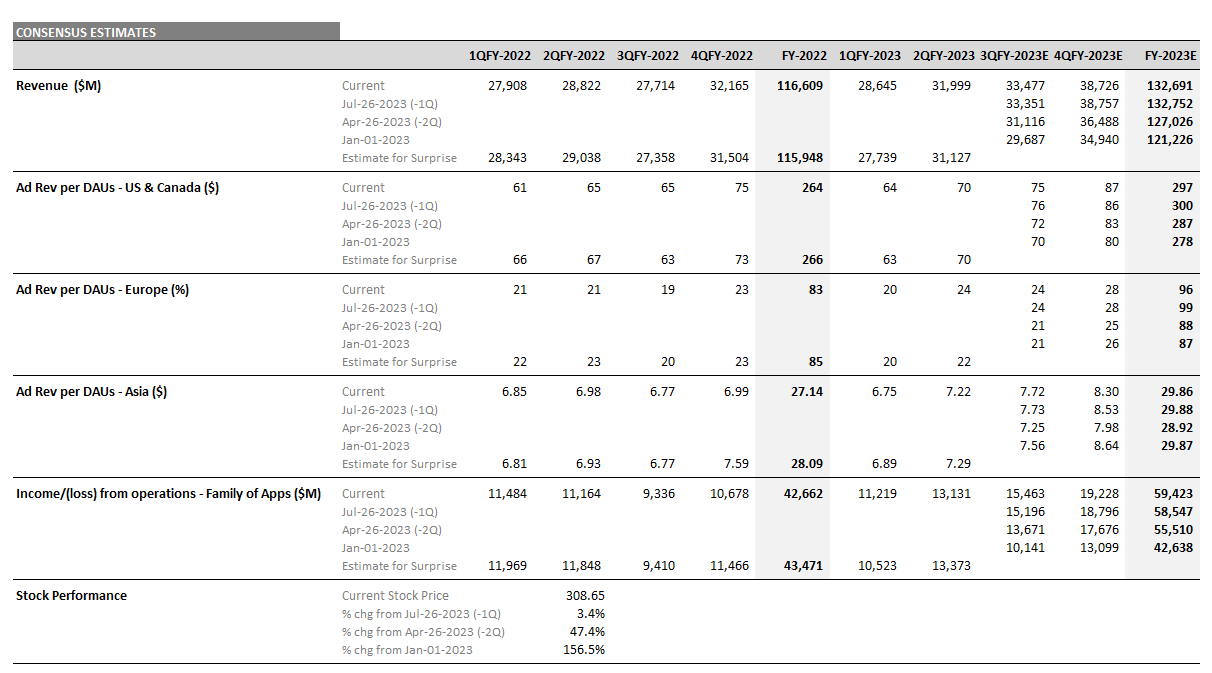

Meta Platforms (META) Q3 2023 Earnings Preview

Meta Platforms, Inc. (NASDAQ: META) will report Q3 2023 results on Wednesday, October 25, 2023. Here are the key numbers that we’re watching.

Figure 1: Meta Platforms – consensus expectations for Q3, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (October 23, 2023). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Source: Visible Alpha consensus (October 23, 2023). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Meta Q3 Earnings Preview

According to Visible Alpha consensus, total revenues expected for Q3 have come up from the beginning of the year, from $29.7 billion to $33.5 billion, driven by an increase in expectations for Meta’s Family of Apps.

In addition, Q3 expectations for operating income have increased significantly from $5.8 billion at the beginning of the year to $11.6 billion ahead of Q3 earnings, driven by both better profitability in the Family of Apps and smaller losses for Reality Labs. Expectations increased by 50% for the Family of Apps’ income from operations, taking the consensus number from $10.1 billion to $15.5 billion into Q3. However, there is a significant range of analyst estimates into Q3 for this business, from $11.8 billion to $17.4 billion.

The stock has been a big outperformer this year, up more than 150% year to date. Coming out of the META Connect 2023 event, the company’s new products and features have increased focus around the potential to increase the revenue generated per DAU (daily active user), especially outside the U.S. What new information will come out of the Q3 release that could potentially maintain the positive momentum?

Figure 2: Meta consensus estimates

Source: Visible Alpha consensus (October 23, 2023). Stock price data courtesy of FactSet. Meta stock price is as of the market close on October 20, 2023.

Source: Visible Alpha consensus (October 23, 2023). Stock price data courtesy of FactSet. Meta stock price is as of the market close on October 20, 2023.

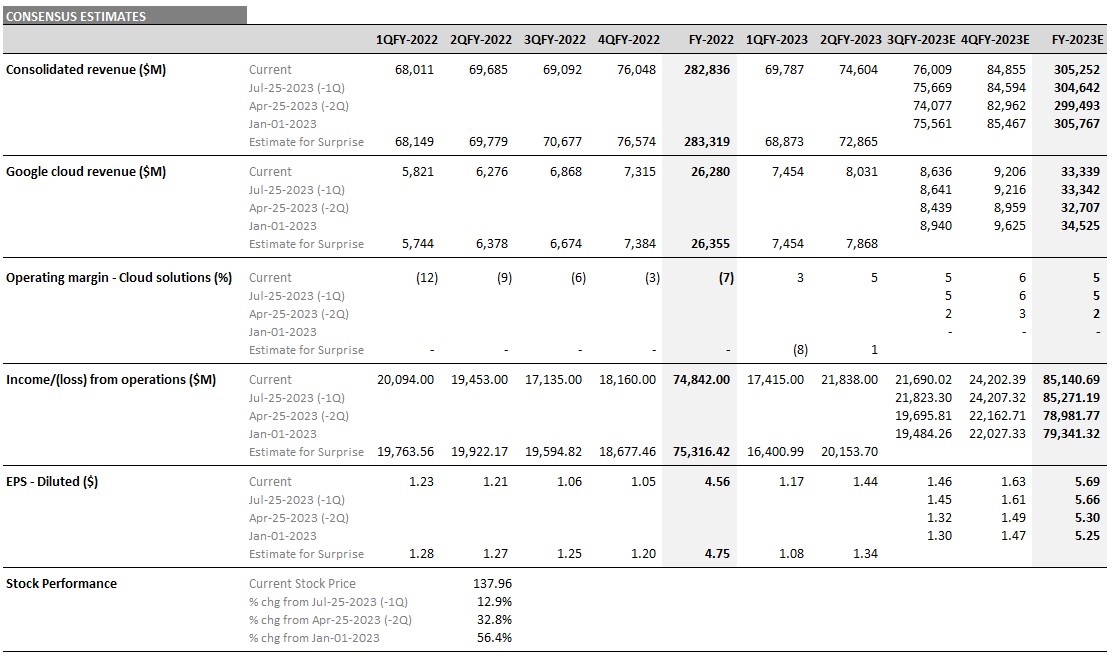

Alphabet (GOOGL) Q3 2023 Earnings Preview

Alphabet Inc. (NASDAQ: GOOGL) will report Q3 2023 results on Tuesday, October 24, 2023, after the market close. Here are the key numbers that we’re watching.

Figure 1: Alphabet – consensus expectations for Q3, past earnings surprises, consensus revisions, and CAGR

Source: Visible Alpha consensus (October 19, 2023). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Alphabet Q3 2023 Earnings Preview

According to Visible Alpha consensus, total revenues expected for Q3 have come up slightly from July, from $75.7 billion to $76.0 billion, driven by resilience in its ad business. In addition, the Q3 consensus expectations for operating income and EPS have increased from the beginning of the year, but show a slight dip to the projections from the end of Q2 to current levels.

We are closely monitoring the trend of the Cloud business, given its new AI products and improved profitability. The operating profit margin, which turned positive in Q1 and showed further improvement in Q2, is projected to remain at 5% in Q3, but increase to 6% in Q4.

Alphabet stock has traded up 12.9% since last quarter’s July release and up 56.4% since the beginning of the year, outperforming the S&P 500. The stock has remained resilient, driven by expected ad growth and the projected outlook for profitability in the Cloud business. Could the Q3 release provide a new catalyst for the stock?

Figure 2: Alphabet – consensus revenues, operating income, EPS, and stock performance

Source: Visible Alpha consensus (October 19, 2023). Stock price data courtesy of FactSet. Alphabet stock price is as of the market close on October 18, 2023.

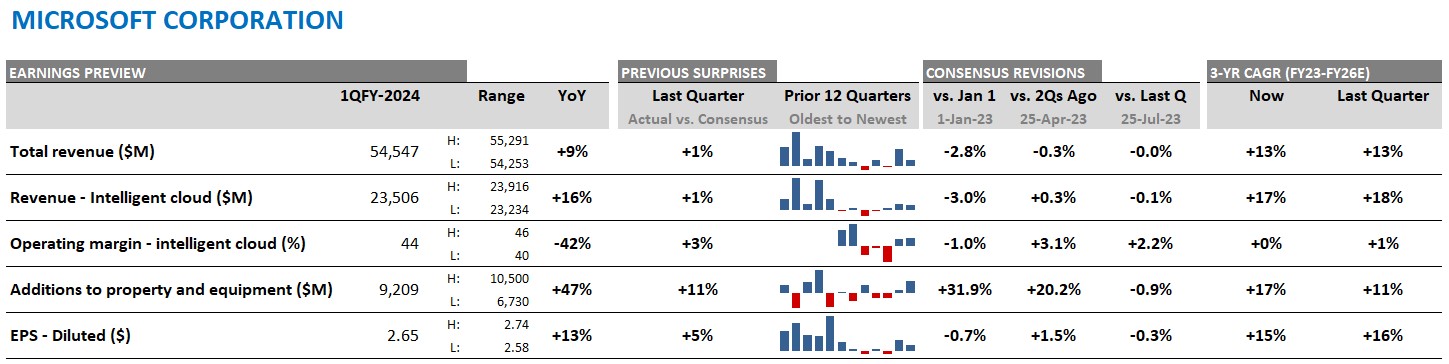

Microsoft (MSFT) Q1 2024 Earnings Preview

Microsoft Corporation (NASDAQ: MSFT) will report Q1 2024 results on Tuesday, October 24, 2023, after the market close. Here are the key numbers that we’re watching.

Figure 1: Microsoft – consensus expectations for Q1 2024, past earnings surprises, consensus revisions, and CAGR

Source: Visible Alpha consensus (October 19, 2023). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Microsoft Q1 2024 Earnings Preview

According to Visible Alpha consensus, total revenues expected for Q1 have remained around $54.5 billion since April, driven by resilience in its core business segments. We are closely watching what the company will say about the outlook for AI and Copilot, as Microsoft’s FY 2024 CapEx numbers have continued to increase steadily since January. According to consensus projections, CapEx estimates have climbed over $10 billion from $29.3 billion to $39.5 billion in FY 2024, up 3x from FY 2019 and ahead of both Meta’s (NASDAQ: META) and Alphabet’s (NASDAQ: GOOGL) estimated CapEx levels.

In particular, the Intelligent Cloud segment, which makes up over 40% of total revenues, is projected to remain solid, with consensus estimates around $102 billion for FY2024, driven by Azure. The profitability of this segment is a source of debate among analysts and may explain some of the stock’s recent sluggish performance. Currently, the FYQ1 consensus of 12 analysts for the Intelligent Cloud business’s operating profit margin is 44%, but ranges from 40% to 46%, suggesting this segment may deliver a surprise in the Q1 release.

Microsoft stock has traded down -5.9% since the July earnings release, but is up 37.6% from January 1, 2023. Could the Q3 release provide a positive catalyst to get the stock back on an outperformance path?

Figure 2: Microsoft – consensus revenues, operating income, EPS, and stock performance

Source: Visible Alpha consensus (October 19, 2023). Stock price data courtesy of FactSet. Microsoft stock price is as of the market close on October 18, 2023.

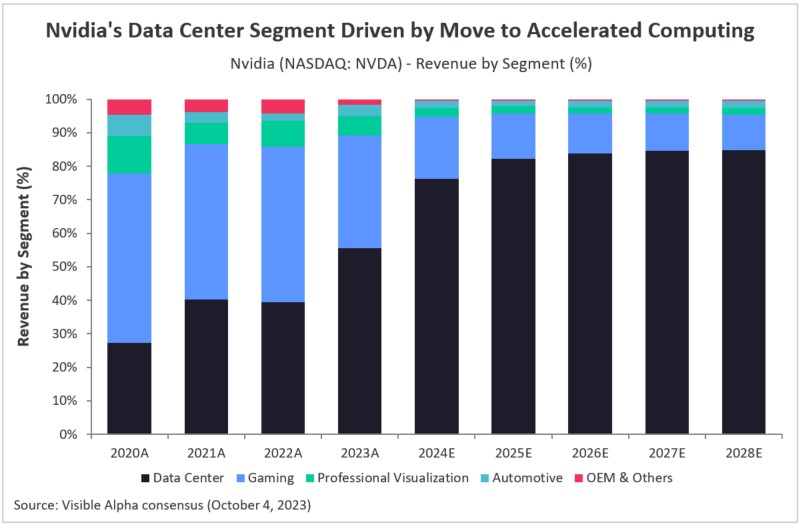

Nvidia’s Data Center Dominance; RTX’s Jet Grounding Impact on Earnings; Lundin’s Copper Mine Acquisition

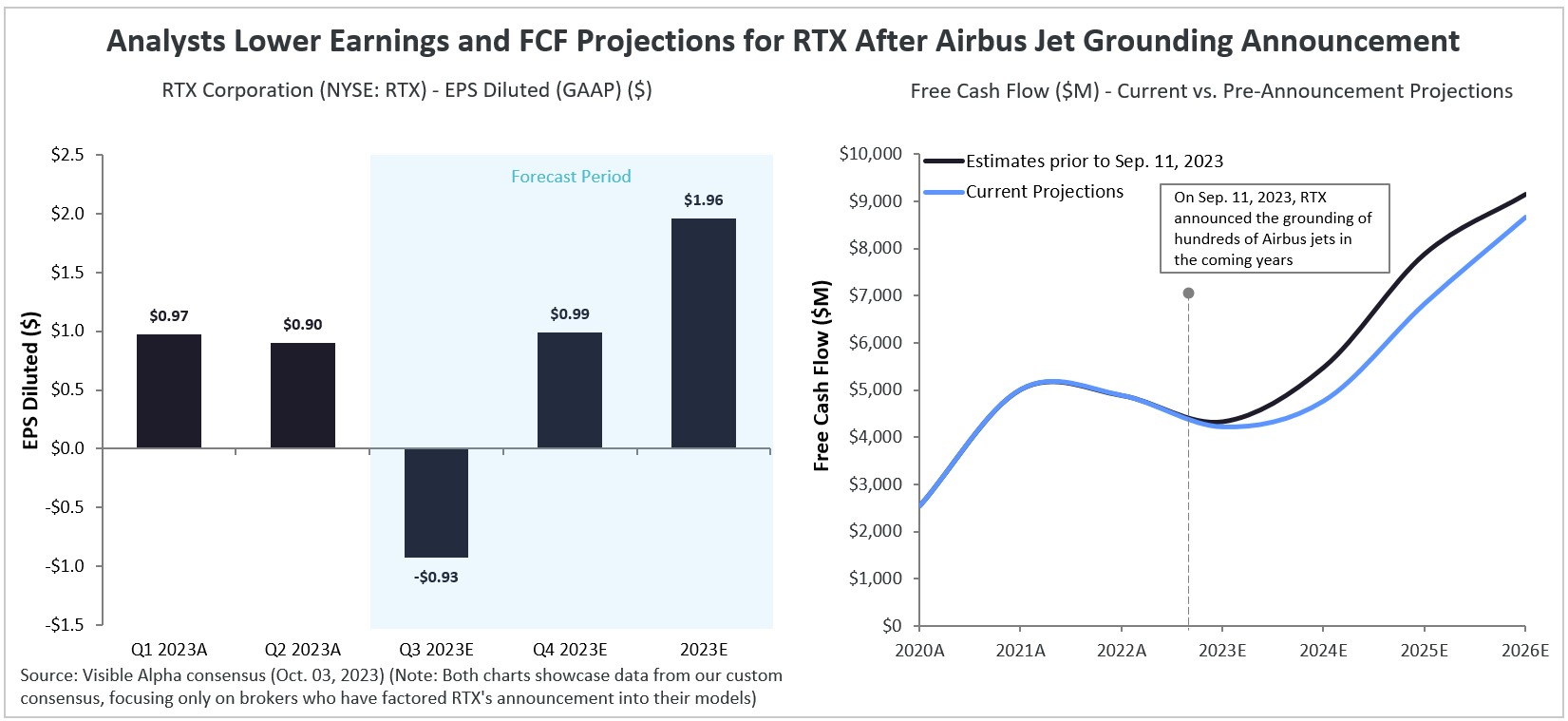

In our weekly round-up of the top charts and market-moving analyst insights: the move to accelerated computing is driving Nvidia’s (NASDAQ: NVDA) data center segment growth; analysts lower earnings and FCF projections for RTX (NYSE: RTX) after Airbus jet grounding announcement; Lundin Mining’s (TSE: LUN) copper mine acquisition is poised to boost production and cut costs.

Nvidia’s Data Center Segment Driven by Move to Accelerated Computing

Generative AI’s (GAI) continuing move toward accelerated computing has created a sharply increased demand for Nvidia’s (NASDAQ: NVDA) data center platform, especially its data center GPUs (graphics processing units).

According to Visible Alpha’s consensus, analysts expect the data center segment to account for 76.1% of Nvidia’s total revenue in fiscal 2024, a substantial increase from 55.6% in 2023. Nvidia’s total revenue is estimated to rise by 103% year over year in fiscal 2024, primarily driven by an estimated 178% year-over-year increase in data center revenue. Revenue generated from the data center segment in 2024 is projected to reach $41.7 billion in FY 2024 from $15 billion in FY 2023. Analysts also expect the company overall to generate $26.9 billion in operating income in 2024, up from $4.2 billion in 2023.

To learn more about Nvidia’s latest developments and insights following the company’s Q2 FY2024 earnings report, explore our Post-Q2 FY2024 Earnings Update on Nvidia.

Analysts Lower Earnings and FCF Projections for RTX After Airbus Jet Grounding Announcement

RTX Corporation (formerly Raytheon Technologies) (NYSE: RTX), the U.S. aerospace and defense company, announced on September 11, 2023, the grounding of an estimated 600-700 of its Pratt & Whitney Geared Turbofan (GTF) engines from Airbus A320neo jets. The reason for the grounding is to conduct quality inspections between 2023-2026 due to a manufacturing flaw. RTX operates through four segments: Collins Aerospace, Pratt & Whitney, Raytheon Intelligence & Space, and Raytheon Missiles & Defense, and this issue primarily impacts the Pratt & Whitney segment of the company.

As a result, analysts have adjusted their EPS and free cash flow expectations downward, with a projected decrease in diluted EPS (GAAP) of -44% year over year and free cash flow of nearly -14% year over year in 2023, according to Visible Alpha consensus estimates. Analysts expect an operating loss of -$1.25 billion in 2023 for the company’s Pratt & Whitney segment, but recovery is expected to commence starting in 2024. (Note: These data points are from Visible Alpha’s custom consensus, focusing only on brokers who have factored RTX’s announcement into their models.)

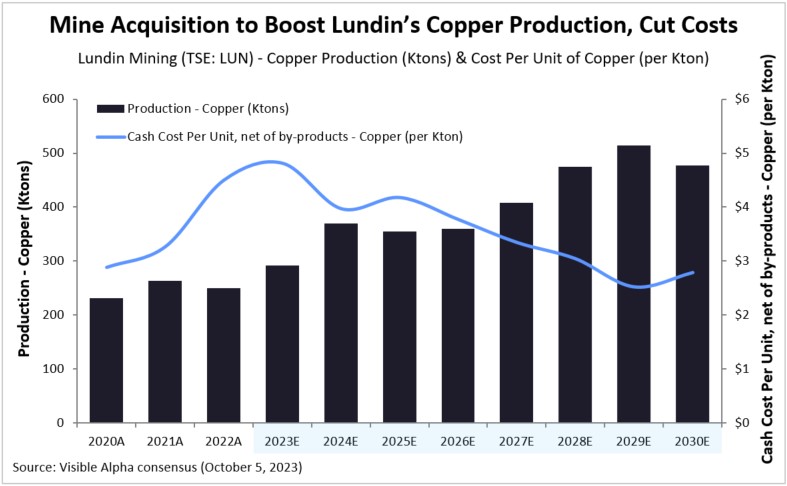

Mine Acquisition to Boost Lundin’s Copper Production, Cut Costs

Toronto-based mining company Lundin Mining (TSE: LUN) made a significant move in July 2023 by acquiring a 51% ownership stake in SCM Minera Lumina Copper Chile, which operates the Caserones copper-molybdenum mine in Chile. This mine is strategically located just around 100 kilometers away from Lundin’s Candelaria operation in Chile and only 20 km from its Josemaria project, located across the border in Argentina.

Based on Visible Alpha consensus estimates, following the acquisition, Lundin’s cash cost per unit net of by-products – copper (per Kton) is projected to trend downwards starting in 2024, while copper production volume is expected to pick up. The geographic proximity among the three mines is expected to create opportunities for synergies in terms of supply, logistics, and management. Analysts anticipate that these synergies will result in cost reductions for the company as shared resources and infrastructure are efficiently optimized. In 2024, copper production is projected to ramp up to 370 Ktons from an expected 292 Ktons in 2023 (+26.5% expected year-over-year). Meanwhile, cash cost per unit, net of by-products, is estimated to be $3.98 per Kton of copper in 2024, down from a projected $4.82 per Kton in 2023 (-17.5% expected year-over-year).