Questions Coming Out of Meta Connect 2023

Key Takeaways

|

Meta Platforms (NASDAQ: META) hosted its Meta Connect 2023 conference on September 27-28, 2023. In the opening keynote speech, CEO Mark Zuckerberg highlighted three new product innovations all geared toward making people feel closer and strengthening relationships. On the hardware side, the company showcased a faster, smoother Quest 3 VR headset and an upgraded pair of Ray-Ban Meta smart glasses. In addition, Zuckerberg discussed the new Meta AI innovations.

Quest 3 mixed reality headset

Meta’s Quest 3 mixed reality headset will go on sale on October 10 for $499.99, a fraction of Apple’s $3,499. The headset will also include the game Asgard’s Wrath to appeal to gamers. Looking ahead to the holiday season, Microsoft’s Xbox cloud gaming is coming to Quest in December.

Quest 3’s resolution will be an upgrade from Quest 2, but will still trail Apple’s Vision Pro by a significant margin. The 10x increase in pixels in Passthrough will give users improved accuracy within their play space. Given the big price differential, however, will these improvements help to stimulate sales with core gamers this holiday season?

In addition to the consumer market, Meta is also going after the enterprise market with Meta Quest for Business. Due out next month, it will be compatible with Microsoft and other business applications and take mixed reality to the workplace at scale. How big could this opportunity be for Meta?

Smart glasses

The next-gen smart glasses will feature a better camera/audio, a livestream capability, and Meta AI. The glasses will be available October 17 and retail for $299. A free software update next year will make the smart glasses multi-modal. According to the company, this multi-modality will be a natural way to put holograms into the world and the ideal way to let an AI assistant see what a user is doing. Could these smart glasses be a hot item this holiday season?

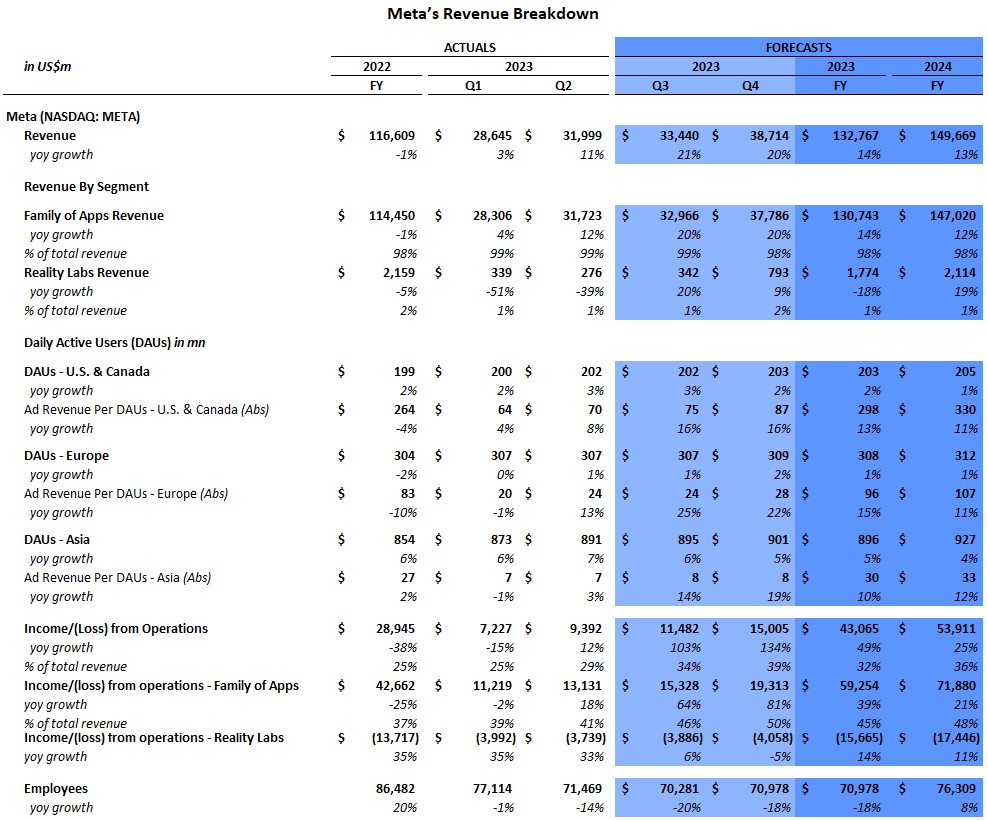

Implications for Reality Labs

With these new product releases, how they will help to drive revenues in this segment will be key. Reality Labs has been a meaningful drag on the company’s total operating profit margin with little visibility into when this drag will improve. According to Visible Alpha consensus, Reality Labs sales expectations have been trending down since Q2. Analyst estimates for Reality Labs revenues have come down from $1.9 billion to $1.7 billion for FY 2023 and from $2.2 billion to $2.1 billion for FY 2024. Analysts’ forecasts of operating losses at Reality Labs have increased from -$15.9 billion to -$17.4 billion in FY 2024.

Figure 1: Meta Platforms’ CEO Mark Zuckerberg’s keynote address

Source: Meta Connect 2023 on September 27, 2023

Meta AI

Meta’s new AI capabilities were in focus at the conference. Meta AI is a basic assistant to help answer questions and requests based on Llama 2 with Microsoft’s Bing search. Emu, Meta’s image-generation model, will enable users to create and send AI-generated stickers in chat. Emu is built directly into Meta AI to generate images in chat. Next year, AI Studio, Meta’s platform for building AIs, will roll out a sandbox for people that do not code.

The company partnered with celebrities on a number of Meta AI chat categories. For example, the company featured Snoop Dogg as the Dungeon Master for its Dungeons and Dragons AI chatbot. Will these enhancements help to drive engagement in Meta’s family of apps, leading to higher metrics and sales in Q4 and FY 2024?

Figure 2: CEO Mark Zuckerberg’s demo of Snoop Dogg as AI Dungeon Master

Source: Meta Connect 2023 on September 27, 2023

AI and the numbers

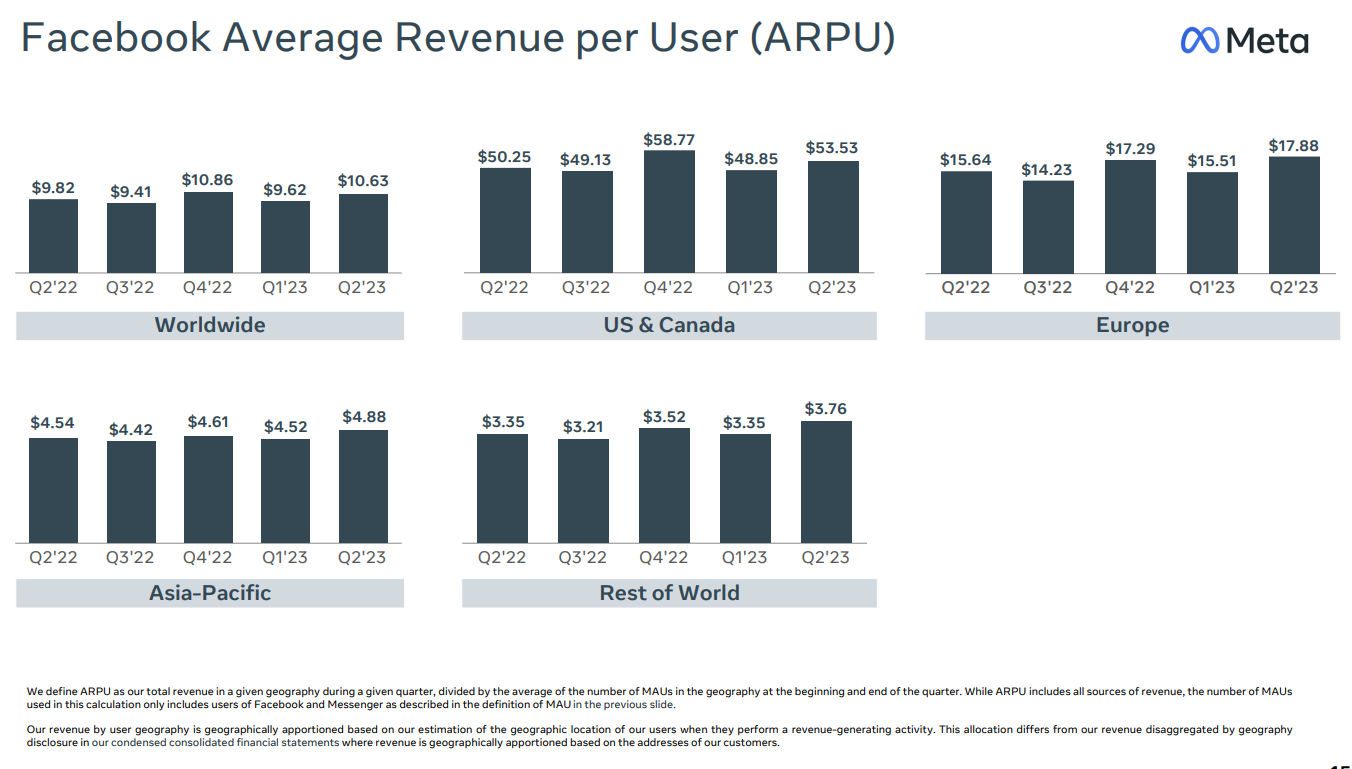

Could the new AI chatbots and stickers help to drive higher ARPU (Average Revenue per User) and ad revenue per DAU (Daily Average User) overseas? Increasing the monetization of Meta (Instagram, Facebook, WhatsApp) users overseas may be a positive going forward, especially in Asia. ARPU for the U.S. and Canada was up quarter over quarter and year over year to $53.53 in Q2, while international markets remained well below that level, diluting the worldwide ARPU to $10.63. In particular, Asia ad revenue per DAU (Daily Average User) was a fraction of U.S. and Europe levels in the first half.

Going forward, Asia ad revenue per DAU is expected to be a mere $30 in FY 2023, compared to significantly higher U.S. ad revenue per DAU projected to be $298, and EMEA ad revenue per DAU at $96. Could these enhancements make Meta’s WhatsApp more competitive against Tencent’s WeChat?

Figure 3: Facebook’s Average Revenue per User (ARPU)

Source: Meta Q2 2023 slide deck

https://s21.q4cdn.com/399680738/files/doc_financials/2023/q2/Earnings-Presentation-Q2-2023.pdf

Figure 4: META segment revenue and income consensus

Source: Visible Alpha consensus (October 3, 2023)

References:

- Meta Connect: https://www.facebook.com/Meta/videos/1038522214125952

- Meta Q2 2023 slide deck: https://s21.q4cdn.com/399680738/files/doc_financials/2023/q2/Earnings-Presentation-Q2-2023.pdf

Palantir Profitability; Generics Threaten Pfizer/BMS Drug; DoorDash to Deliver International Growth

In our weekly round-up of the top charts and market-moving analyst insights: Palantir Technologies (NYSE: PLTR) is on track to achieve full-year profitability in 2023; generics pose revenue threat to Eliquis drug from Pfizer (NYSE: PFE) and Bristol-Myers Squibb (NYSE: BMY); analysts expect DoorDash (NYSE: DASH) to see robust growth in international revenue.

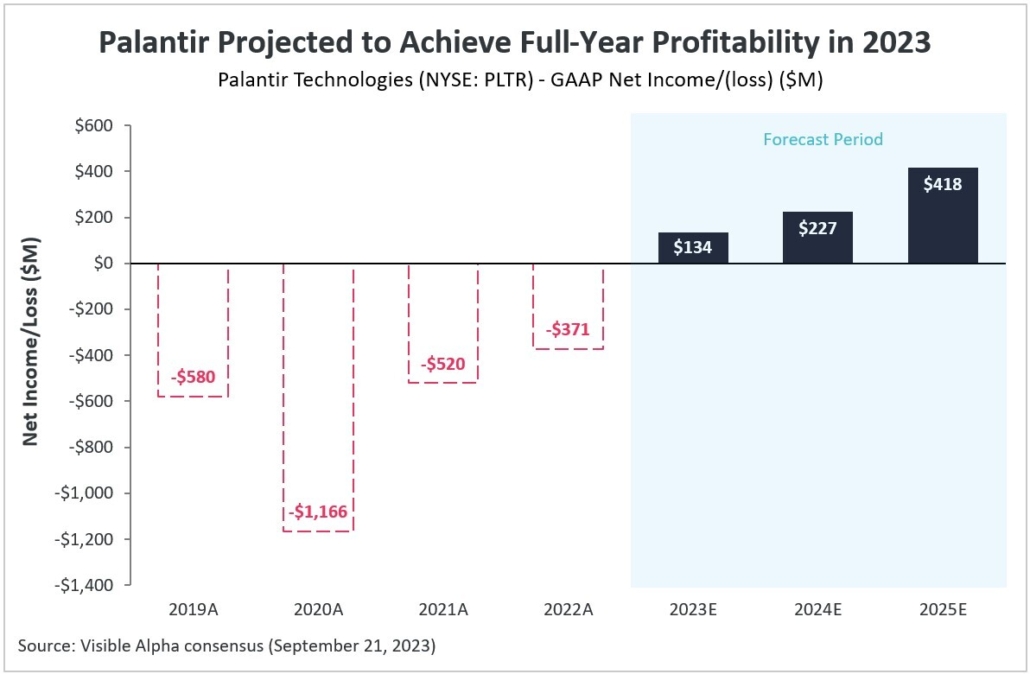

Palantir Projected to Achieve Full-Year Profitability in 2023

Palantir Technologies (NYSE: PLTR) is on track to achieve full-year profitability in 2023. The application software company marked its first profitable quarter in the fourth quarter of 2022, recording net income (GAAP) of $33.5 million. According to Visible Alpha consensus estimates, the company is projected to generate net income (GAAP) of $133.7 million in 2023, up from a net loss of -$371.1 million last year.

Palantir’s total revenue is projected to grow by 16.2% year-over-year to $2.2 billion in 2023. Revenue growth for the company has been moderating over the last few years, following a revenue growth peak of 47% in 2020. Total government revenue, which accounts for around 56% of the company’s total revenue, is expected to see 17.4% growth in 2023 (down from 77% growth in 2020), while commercial revenue is projected to grow by 14.6% year-over-year in 2023.

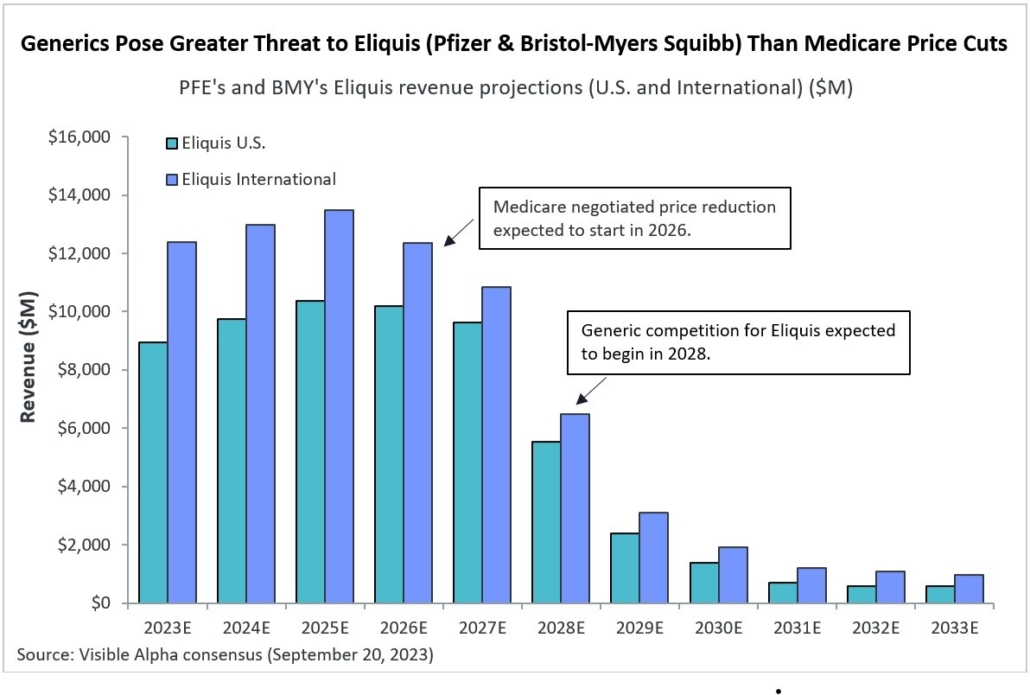

Generics Pose Greater Threat to Eliquis (Pfizer & Bristol-Myers Squibb) Than Medicare Price Cuts

Pfizer (NYSE: PFE) and Bristol-Myers Squibb (NYSE: BMY) are partnered worldwide to commercialize the oral anticoagulant, Eliquis, which is approved to prevent blood clots and strokes in patients with atrial fibrillation. Eliquis is one of 10 prescription drugs that initially fall under the Inflation Reduction Act (IRA) of 2022, which allows Medicare to negotiate lower prices directly with drug companies. The reduction in U.S. prices is expected to take effect beginning in 2026. Of all drugs on the list, Eliquis accounted for Medicare’s highest gross expenditure of approximately $1.6 billion for the period between June 2022 and May 2023.

Despite these price cuts, the significant reduction in revenue projections for Eliquis is driven largely by U.S. and international generic competition expected to begin in 2028. According to Visible Alpha consensus, U.S. and international revenues for Eliquis decline in tandem as generics are expected to make it to market starting in 2028. Note that generic versions of Eliquis have been available in the relatively smaller markets of the UK and Canada since mid-2022.

Apixaban, the generic version of Eliquis, was approved by the FDA in January 2020, but Pfizer and Bristol-Myers Squibb filed lawsuits charging patent infringement against the generic manufacturers. In August 2020, a U.S. district court upheld two relevant Eliquis patents covering composition of matter and formulation that favored Pfizer’s and Bristol-Myers Squibb’s stance. Based on agreements reached among the two companies and generic manufacturers, generic versions of Eliquis are expected to launch after 2027.

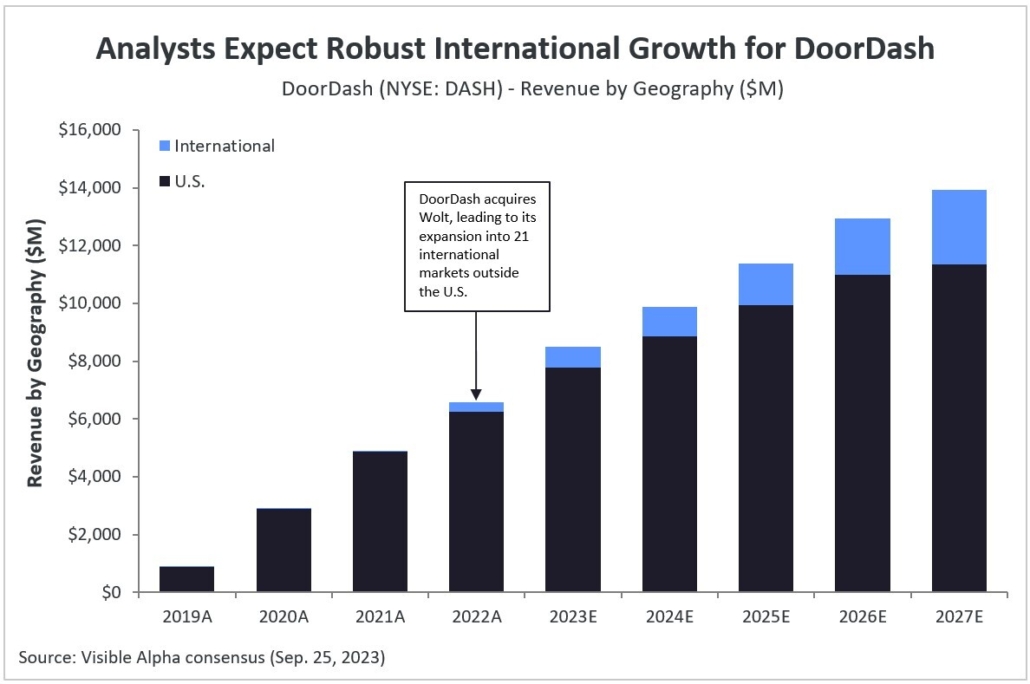

Analysts Expect Robust International Growth for DoorDash

Analysts expect DoorDash (NYSE: DASH) to see strong growth in international revenue in 2023, based on Visible Alpha consensus estimates. U.S. revenue is projected to continue to see steady growth, reaching $7.8 billion (+24% year over year) in 2023. While the U.S. remains the primary market for the company, revenue from the food delivery app’s international operations is estimated to surge to $724 million in 2023, or +118% year over year from $332 million in 2022. According to consensus, the international segment is projected to reach over $1 billion in revenue by the end of 2024.

Outside the U.S., DoorDash has operated in Canada and Australia since 2015 and 2019, respectively. In 2021, DoorDash expanded its footprint into Germany and Japan. In 2022, the company acquired Finland-based online delivery platform Wolt. With this acquisition, DoorDash expanded into 21 major markets throughout Europe. Also in 2022, DoorDash launched operations in New Zealand, further diversifying its international reach.

The company recently announced that it will transfer its stock exchange listing to the Nasdaq Stock Market (NASDAQ) from the New York Stock Exchange. It expects to begin trading as a Nasdaq-listed company on September 27, 2023.

Novartis Drug to Face Generics and Price Cuts; Salesforce Expands Margins; Sleep Country Wakes Up With Acquisitions

In our weekly round-up of the top charts and market-moving analyst insights: Novartis’ Entresto (NYSE: NVS) faces generic competition & Medicare price cuts in the U.S.; Salesforce (NYSE: CRM) mitigates its revenue slowdown with margin expansion; and Sleep Country Canada (TSX: ZZZ) expands its portfolio amid a growth slowdown.

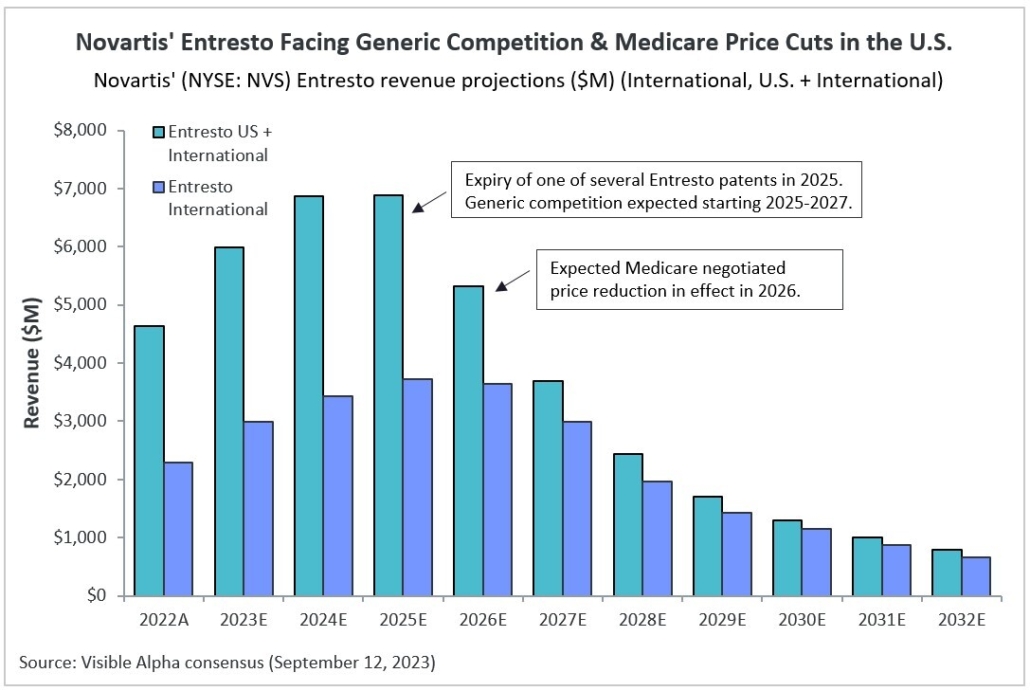

Novartis’ Entresto Facing Generic Competition & Medicare Price Cuts in the U.S.

Novartis’ (NYSE: NVS) Entresto is one of 10 prescription drugs that initially fall under the Inflation Reduction Act (IRA) of 2022, which allows Medicare to negotiate lower prices directly with drug companies. Entresto is prescribed for patients with heart failure to help reduce the risk of death and hospitalization. The expected reduction in U.S. prices will take effect from 2026.

In the case of Entresto, however, generic competition is expected to be a greater threat than lowered pricing for U.S. revenue from 2025 onward. Analysts expect generic competition to begin taking effect between 2025 and 2027.

Novartis has thwarted attempts by generic makers of Entresto since 2019, utilizing patent infringement lawsuits. Notably, the company has settled with several generic companies regarding a U.S. launch date for Entresto generics. Novartis has guided investors to model 2025 as a reasonable timeline to assume generic competition. Even though one Entresto patent will expire in 2025 based on a recent court decision, other key Entresto patents could survive through 2027.

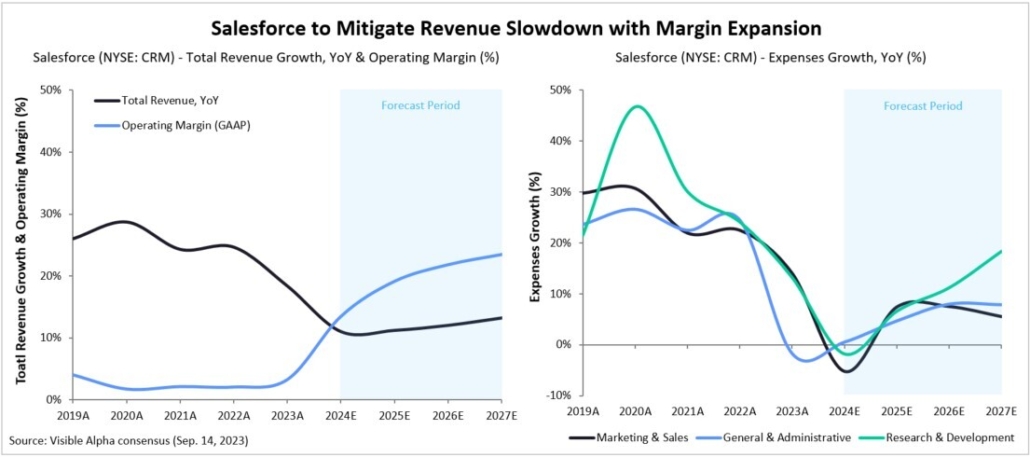

Salesforce to Mitigate Revenue Slowdown with Margin Expansion

Salesforce (NYSE: CRM) has seen its revenue growth slow down significantly over the last year as economic challenges prompted many companies to tighten their spending. Analysts expect the company’s total revenue to increase by 11% in 2024, a notable slowdown from its 18.3% growth in fiscal 2023 and the 24.7% surge in fiscal 2022.

According to Visible Alpha consensus, however, Salesforce’s margins are expected to continue to expand. Analysts expect the company to generate an operating margin (GAAP) of 13.5% in 2024, up from 3.3% in fiscal 2023, and 2.1% in fiscal 2022.

The growth in profitability is on the back of several measures the company has implemented over the past year. Salesforce laid off about 10% of its workforce in early 2023, halted all major acquisitions, and has also reined in its operating expenses. The company’s selling and marketing expenses, a major expense line for the company, are projected to decline by -5.2% in 2024, while total operating expenses are projected to fall by -2.8%.

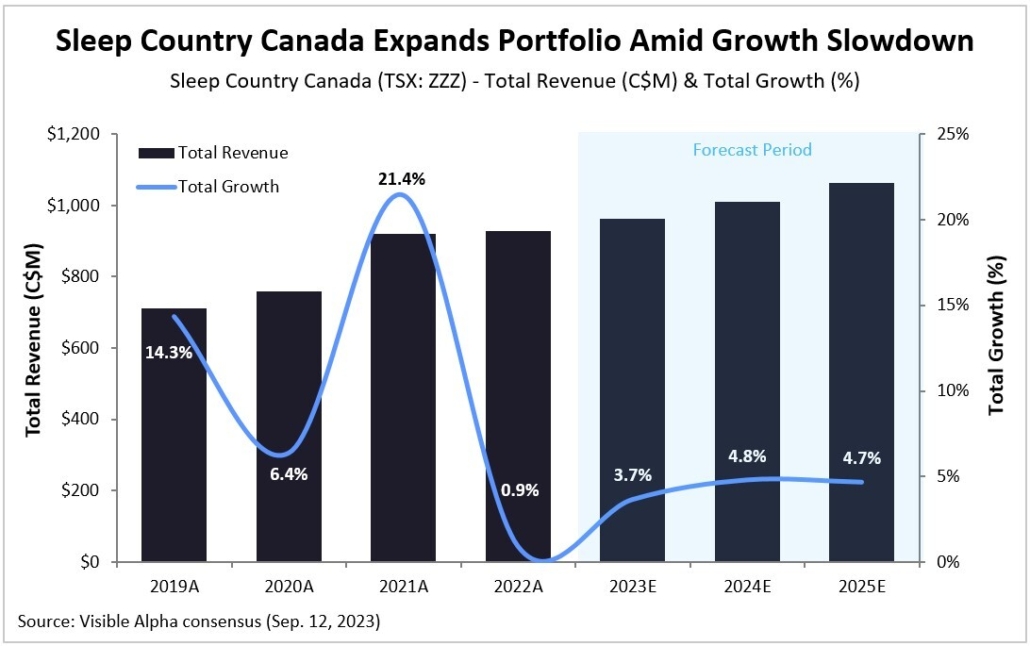

Sleep Country Canada Expands Portfolio Amid Growth Slowdown

Analysts expect Canadian specialty sleep retailer Sleep Country Canada (TSX: ZZZ) to see total growth improve starting in 2023, following a sharp decline in 2022, according to Visible Alpha consensus. The company has seen total growth slow down since last year due to reduced consumer spending on big-ticket discretionary items. Total growth combines the percentage increases in same-store sales and sales from new stores.

In an effort to enhance its portfolio, the omnichannel specialty sleep retailer has been on an acquisition spree since 2021. Earlier this year, the company acquired the Canadian operations of mattress retailer Casper Sleep, and late last year, it acquired the direct-to-consumer sleep brand Silk & Snow. Additionally, in 2021, Sleep Country Canada made investments in Hush Blankets and Sleepout, a start-up curtain company.

Bringing AI to Heavy Industry

Key Takeaways

|

The move to accelerated computing could have the potential to enable deeper integration of AI into heavy industry. How could this impact companies that adopt and scale innovative solutions to their manufacturing processes?

As we’ve seen already, this move to accelerated computing in data centers has been underpinning the investment story for Nvidia. As Cloud Service Providers (CSP) and consumer internet companies have raced to transform their data centers from general purpose computing to accelerated computing, the platform shift has opened questions about the broader, longer-term implications of moving from the CPU (central processing unit) to the GPU (graphics processing unit).

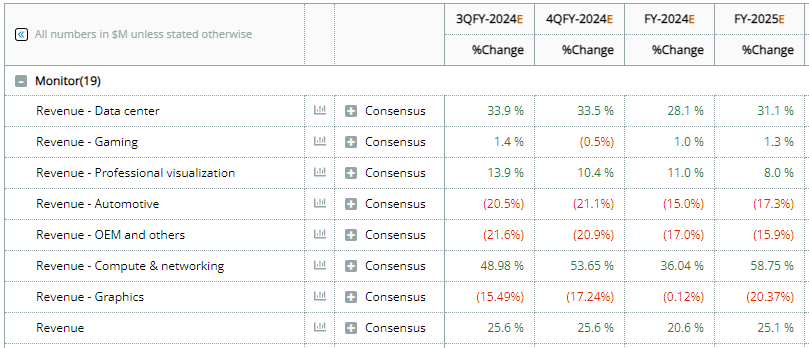

Figure 1: Upward revenue revisions (%) for Nvidia (NASDAQ: NVDA) segments

Source: Visible Alpha Insights (September 14, 2023)

Accelerated computing enables faster data processing with lower power consumption. In addition to speed and energy efficiency, accelerated computing is highly optimized for specific tasks, making it easier to scale tasks that can be parallelized (i.e., big data applications), making it ideal for AI/ML, modeling, and graphics. Generative AI (GAI) is currently used mainly by light industry (information, words, images, and music), but not broadly by heavy industry as of yet.

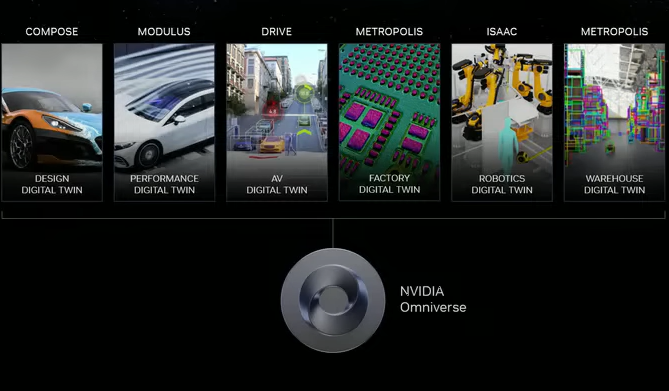

This platform move has the potential to enable deeper integration of AI/ML to heavy industry and to provide a foundation for the broader use and application of robotics. At Computex 2023, Nvidia CEO Jensen Huang highlighted the Omniverse and how the Digital Twin will provide a virtual environment for replicating environments and situations ideal for testing automation.

The Digital Twin can be applied to many industrial scenarios and help manufacturers manage risks and deliver more precise results and, ultimately, more impactful solutions. For example, a factory may wish to personalize parts of its assembly and want to test this in a virtual factory or want to have greater visibility into the timing of its supply chain.

Figure 2: The Digital Twin

Source: Nvidia Keynote at Computex 2023

Virtual factory: Digitalizing heavy industry

Back in October 2016, Nvidia (NASDAQ: NVDA) and Fanuc (TSE: 6954) teamed up to build AI-powered factory robots with GPU-accelerated deep learning in the cloud. Given the innovations with the Omniverse, manufacturing, factory automation and industrial robotics may begin to show new capabilities.

According to Huang, the $45 trillion global manufacturing industry is racing to have its factories become software defined to ensure they can produce products with quality and speed, and as cost efficiently as possible. The application of AI via software to manufacturing can support these objectives.

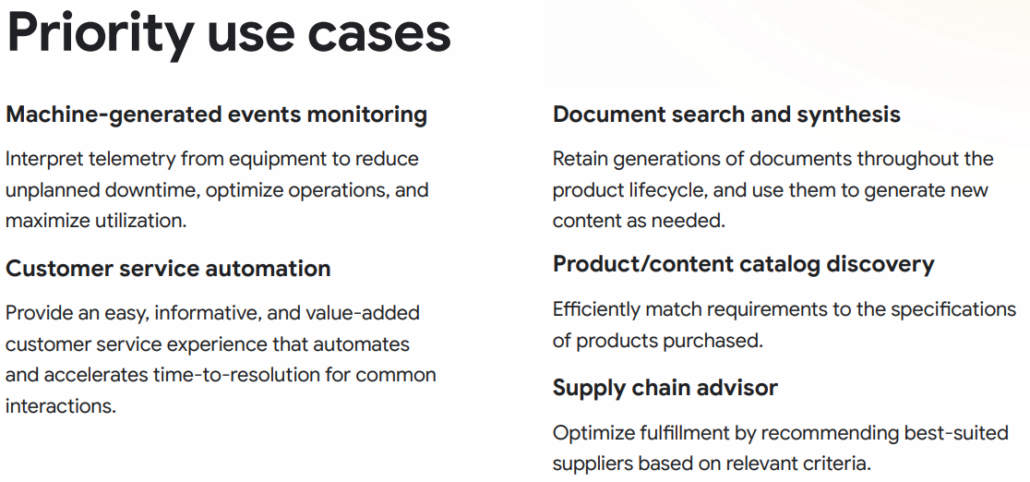

Figure 3: GAI use cases for manufacturing

Source: Google Cloud GAI Use Cases for Manufacturing

By leveraging one unified source of data across the company, teams can virtually design, build, and operate a factory before actually breaking ground. In the Omniverse, teams can start by building a Digital Twin of their factory, unifying siloed datasets to provide a real-time view of their factory data to their planning teams, stakeholders, and suppliers. In the cloud, native Digital Twin planners can then optimize the factory virtually before deploying changes to the real factory.

Figure 4: Factory simulation in a Digital Twin

Source: Nvidia Keynote at Computex 2023

Fully autonomous robots can be trained on complex tasks entirely in simulation and operations can be validated before deployment to the real world. This process has the potential to significantly help manufacturers reduce risks, improve efficiency, and reduce cost in heavy industries like automotive and electronics manufacturing.

Companies and expectations

There are several players in the factory automation and industrial robotics space. Based on Visible Alpha data, growth and profitability vary among the players. Additionally, China’s slowing, foreign exchange impacts, and product cyclicality have created some volatility in the pace and outlook for growth. However, with the consensus outlook looking cautious, could this be an interesting time to revisit these names, given the broader industry trends?

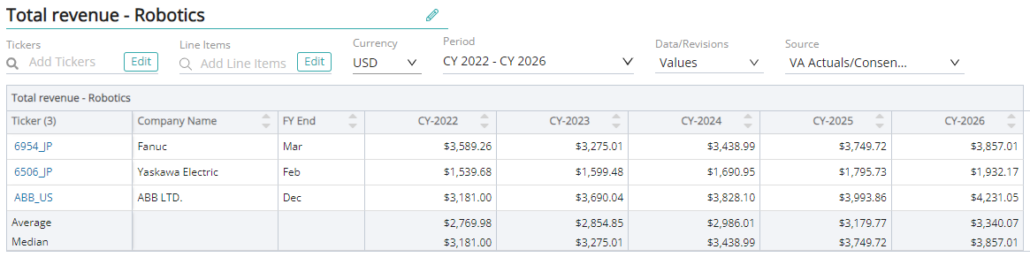

Figure 5: Peer analysis of robotics revenue in U.S. dollars

Source: Visible Alpha Insights (September 14, 2023)

How these firms integrate some of the new AI capabilities to the brain of the robot and to aspects of automation will be critical to the investment story and outlook. The potential growth could be significant for companies that adopt and scale innovative solutions to their manufacturing processes. Additionally, based on the platform shift to accelerated computing, Nvidia seems well-positioned to support the tech stack and data unification that needs to happen to embed AI more holistically into the manufacturing process and to the supply chain.

- Will these innovations drive a scalable new product cycle?

- Will these manufacturing enhancements have higher price points and margins?

- Which companies are positioned to benefit longer term?

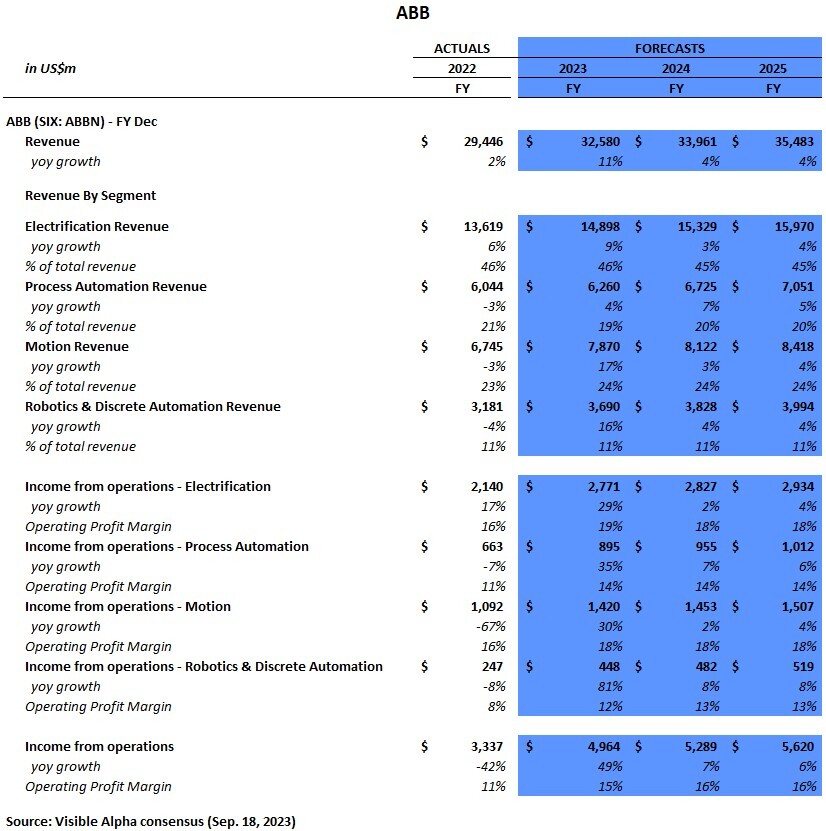

ABB: Sweden/Switzerland-based ABB (SIX: ABBN) has a leading electrification, robot, automation, and motion portfolio that it connects to software to drive better performance.

ABB is projected to generate a 16% margin, driven by its higher margin Electrification and Motion segments, but revenue growth is only projected to be 4% for FY 2024 and FY 2025. Could longer-term innovations in factories drive an uptick to numbers?

Figure 6: ABB segment revenue and income consensus

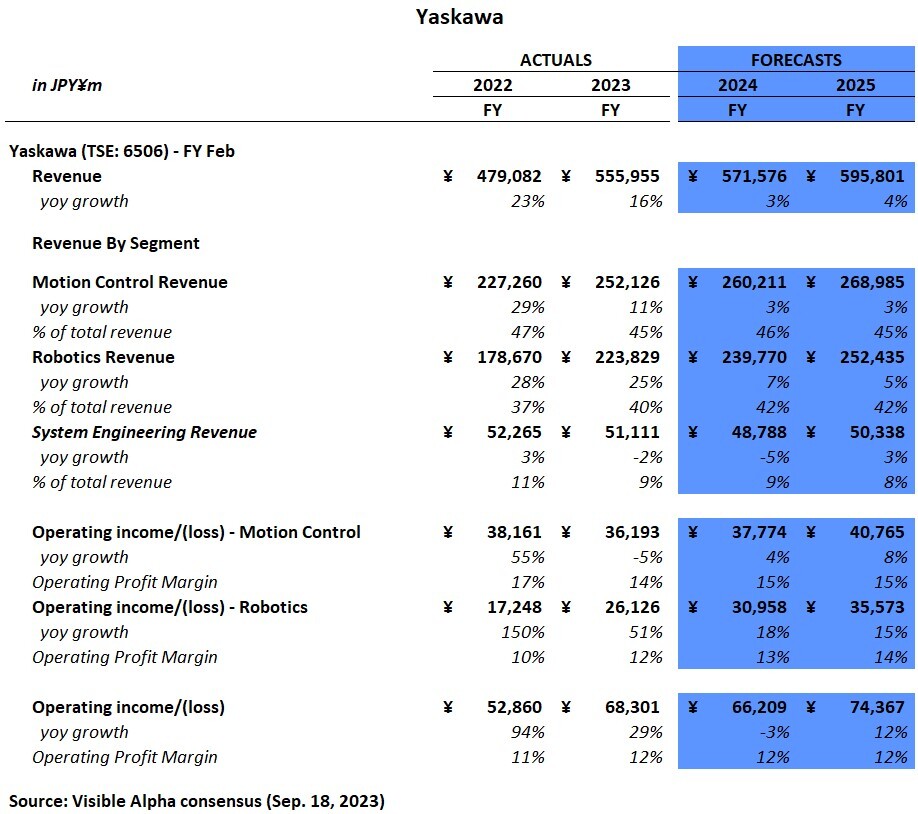

Yaskawa: Japan-based Yaskawa (TSE: 6506) is a leading manufacturer of motion controls and robotics for the automobile, semiconductor, food and biotech industries.

Similar to ABB, Yaskawa is projected to generate a 12% margin, driven by its higher margin Robotics and Motion segments. While the revenue and profitability growth of its robotics segment is expected to outperform other segments, the company overall is expected to see mild growth till FY 2026. Could longer-term expectations be overly cautious given the shift toward AI?

Figure 7: Yaskawa segment revenue and income consensus

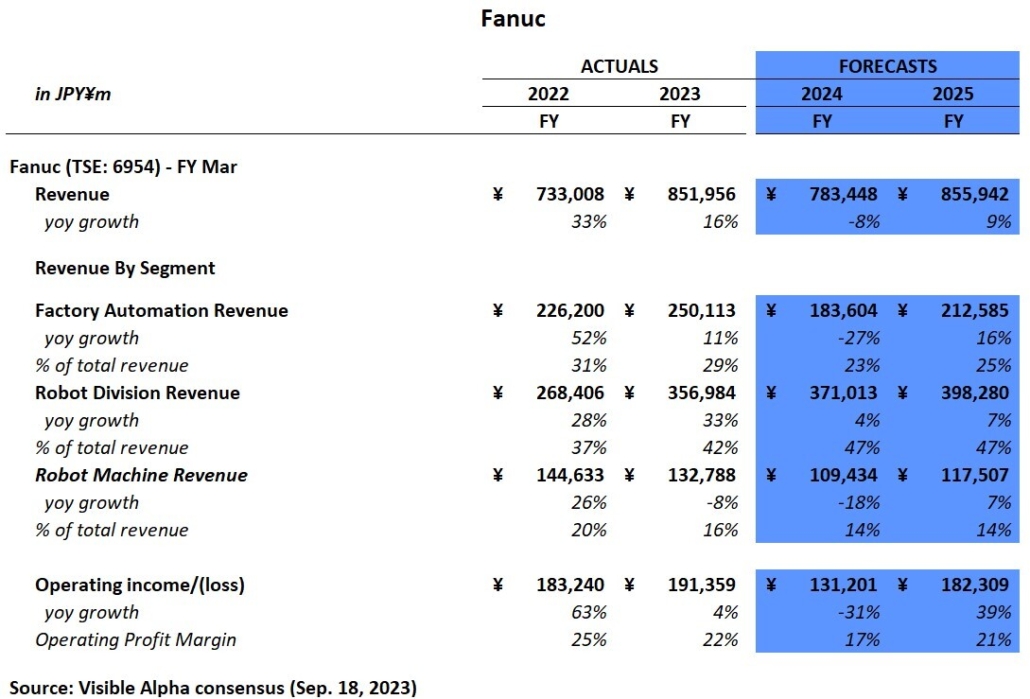

Fanuc: Japan-based Fanuc (TSE: 6954) is a global leader in factory automation and robotics. Fanuc is the clear leader for profitability in automation and robotics with over 20% operating profit margins expected. With enhancements to robotics and factory automation, could Yaskawa, ABB and Kuka (Midea) catch up to Fanuc? Could Fanuc’s projected margins return to their FY 2022 level of 25%?

Figure 8: Fanuc segment revenue and income consensus

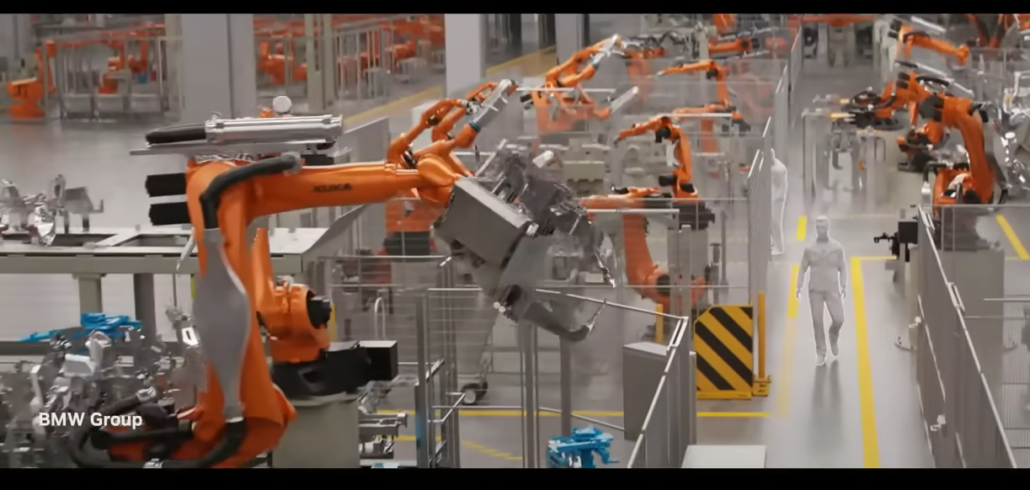

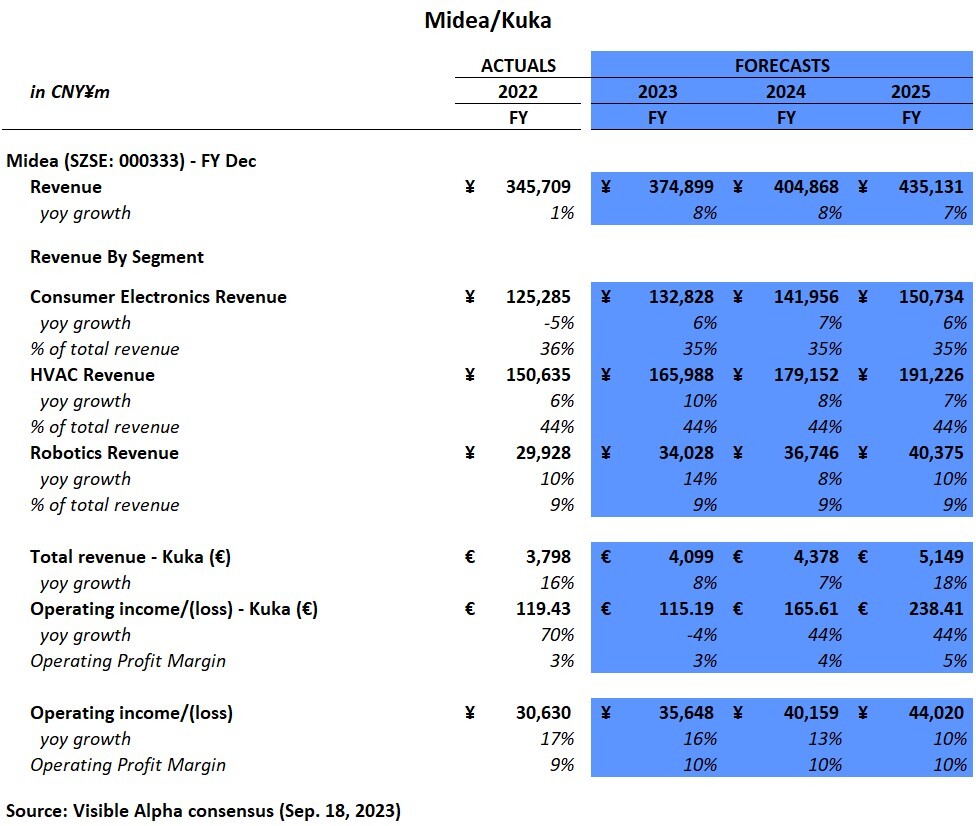

Midea (Kuka): Midea (SZSE: 000333) is an electrical appliance manufacturer based in China. Leading German-based robotics firm, Kuka, was acquired by Midea in 2016.

Figure 9: BMW factory simulation using Kuka robots

Source: Nvidia Keynote at Computex 2023

Kuka’s margins remain well-below both Midea’s 10% margin and the 15-20% ranges of competitors. Will parent company Midea be able to drive margin expansion at Kuka?

Figure 10: Midea (and Kuka) segment revenue and income consensus

Will Google Cloud Become a New Earnings Driver for Alphabet?

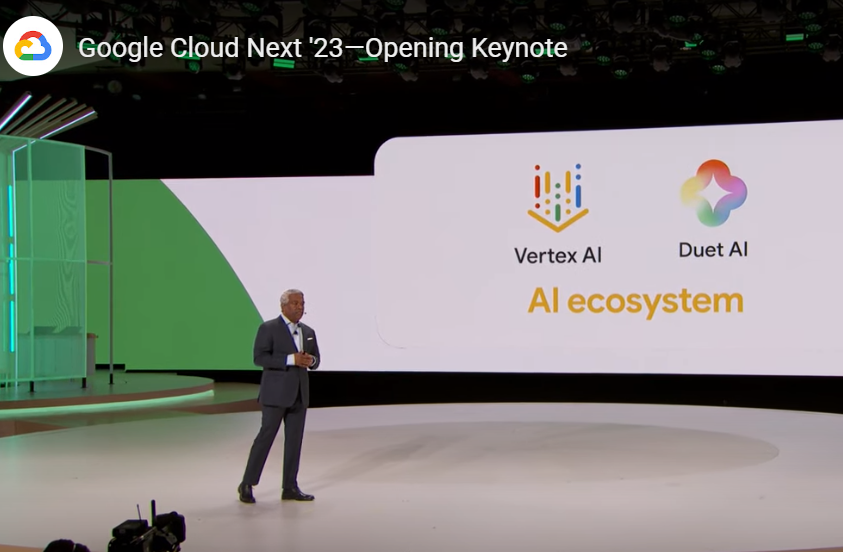

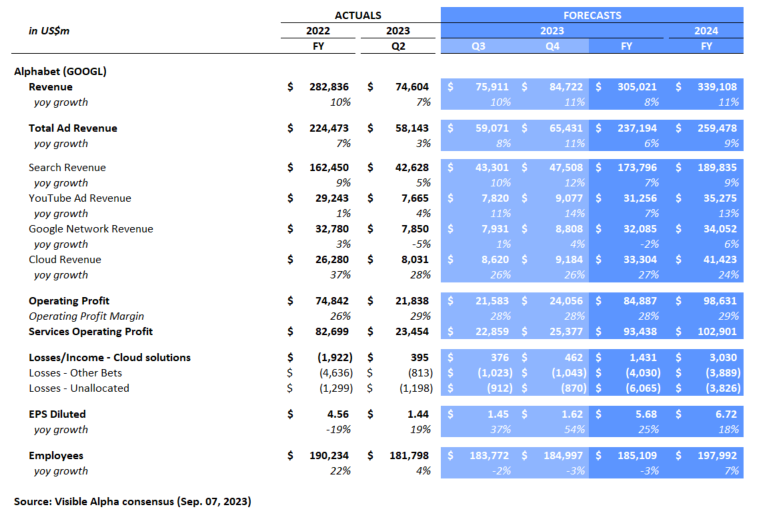

Alphabet Inc.’s (NASDAQ: GOOGL) Google Cloud CEO Thomas Kurian hosted the latest Google Cloud Next conference last week. What happened during the conference, and what are the questions to focus on?

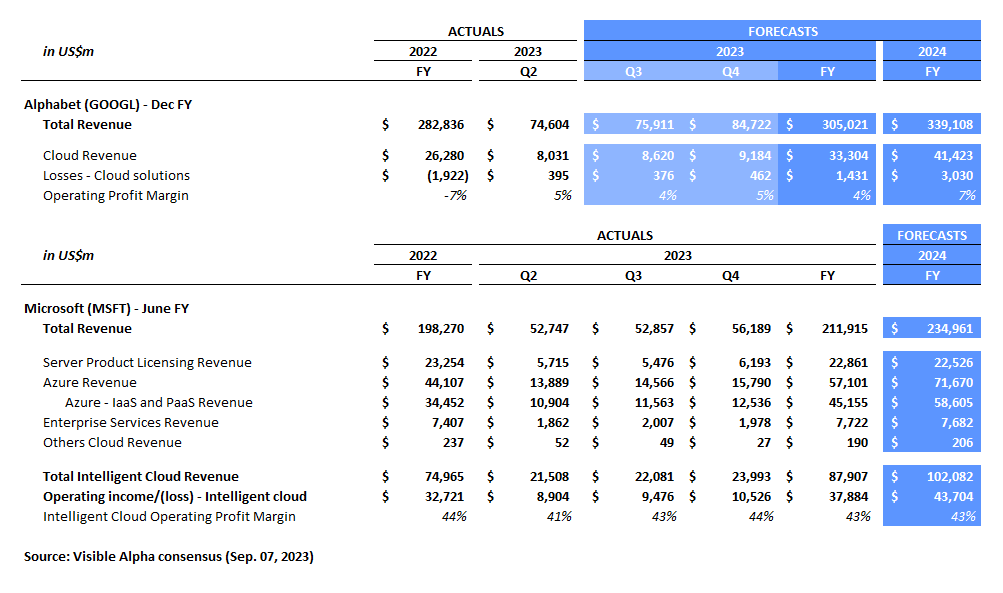

One of the key aspects of the Alphabet investment story is about Google Cloud continuing to improve its operating margin. This business recently broke even and is projected by analysts to generate a 4% operating profit margin in FY2023, or $33 billion in revenue and $1.4 billion in operating profit. Based on Visible Alpha data, Google Cloud is expected to generate a 7% operating margin, or $3 billion in operating income on $41 billion in revenue, by the end of FY2024. While this margin improvement for Google Cloud is positive, it remains far from the profitability of some of the company’s Cloud competitors, especially Microsoft.

At the Google Cloud Next 2023 conference, the company showcased a number of AI-related demos, including Duet AI for Workspace/Cloud and Vertex AI for Developers. Could the innovations from Duet AI and Vertex AI help to drive margin expansion for Google Cloud in FY2024 and beyond?

Figure 1: Google Cloud CEO Thomas Kurian giving opening keynote at Google Cloud Next ‘23

Commercializing Duet AI

For $30/month/seat, Duet AI can be accessed in a user’s Workspace tools, like Gmail, Docs, Sheets, and Slides, as of August 29, 2023, and will be integrated to the Cloud later this year. These innovations are designed to add value to the user’s existing workflows by helping to make the user more efficient and productive with their existing tools. However, it is unclear how meaningfully these AI product innovations will drive revenues and profitability in the Google Cloud business segment, especially among small enterprise and individual users.

Management noted that they have 10 million paying enterprise customers in this business, but the impact to revenues and operating profit seems to remain relatively small, at least in the near term. Google Cloud will need to deepen its monetization with all users to move the needle meaningfully on revenues and operating profit, which may prove challenging given Microsoft’s size and profitability in Cloud and legacy workplace tools.

Figure 2: Alphabet’s segment breakdown

Cloud Competition

In contrast to Google Cloud, Microsoft’s Intelligent Cloud business is projected to generate a much larger 42.8% operating margin on $102 billion in revenues by the end of FY2024. Microsoft has also been aggressively integrating Generative AI (GAI) tools and development capabilities to Azure.

Microsoft’s Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) are key to its Azure cloud business and are projected to generate an additional $13.5 billion in revenue for the company from FY2023 to FY2024, an uptick of 30% year over year. Given the existing profitability of this business, it will be interesting to monitor the direction of margins and growth at both Google Cloud and Microsoft Azure as the GAI trends begin to scale and take hold.

At the moment, Microsoft’s Intelligent Cloud margins are superior, but Google Cloud’s have started expanding significantly. From the end of FY2022 to FY2024, Google Cloud’s operating profit is projected to swing from -$1.9 billion to $3.0 billion, an improvement of over 1400 basis points in margin. Can Google Cloud maintain this momentum in their operating profit margin or has the low-hanging fruit already been picked?

Figure 3: Alphabet and Microsoft Cloud Businesses

Final Thoughts

The development and adoption of GAI is in its infancy, but evolving quickly. Google Cloud and Microsoft Azure both seem poised to benefit from this technology shift. However, how the profitability of these businesses will ultimately shake out will be a critical long term investment question for these stocks. With the help of Duet AI and Vertex AI, will Google Cloud be able to carve out a profitable place in the Cloud landscape and move more quickly toward a double-digit operating profit margin?

Tesla’s Race to Challenge Ford and GM; Nel ASA’s Rising Green Hydrogen; AppLovin’s Software Surge

In our weekly round-up of the top charts and market-moving analyst insights: Tesla (NASDAQ: TSLA) is poised to challenge Ford Motor (NYSE: F) and General Motors (NYSE: GM) in automotive units sold by 2027; Nel ASA’s (OSE: NEL) green hydrogen revenue is expected to surge in the coming years amid the clean energy wave; and AppLovin (NASDAQ: APP) is projected to see software platform revenue grow by 60% year over year in 2023.

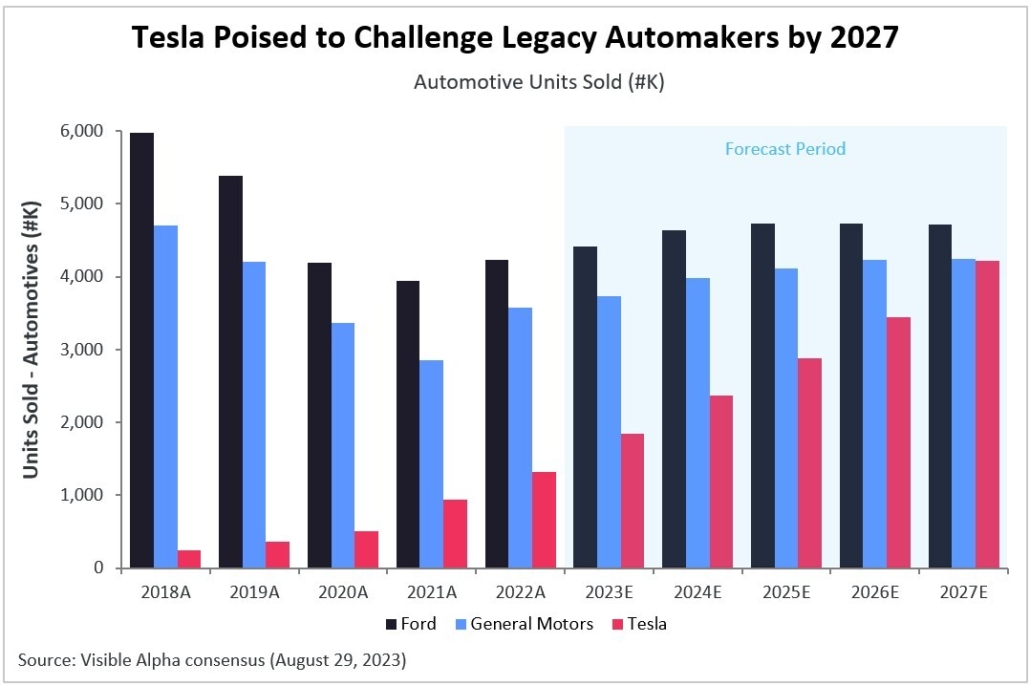

Tesla Poised to Challenge Legacy Automakers by 2027

While Ford Motor (NYSE: F) and General Motors (NYSE: GM) plan to ramp up EV production, analysts expect Tesla (NASDAQ: TSLA) to sell nearly as many automotive units overall as General Motors by 2027. Based on Visible Alpha consensus estimates, Tesla is forecasted to sell 4.21 million units in 2027, up from 1.85 million units expected in 2023. This is in comparison to Ford’s 4.72 million units and General Motors’ 4.25 million units expected to be sold in 2027.

In terms of revenue, analysts expect Tesla’s automotive revenue to surpass both Ford and General Motors by 2027. Tesla’s automotive revenue is projected to grow from an estimated $85 billion in 2023 to $185 billion by 2027. In comparison, Ford is projected to generate $178 billion while General Motors is expected to generate $172 billion in 2027. Between 2023-2027, Tesla’s automotive revenue is expected to grow at a CAGR of 21%, whereas Ford and General Motors are both expected to see their automotive revenues grow at a CAGR of 3%.

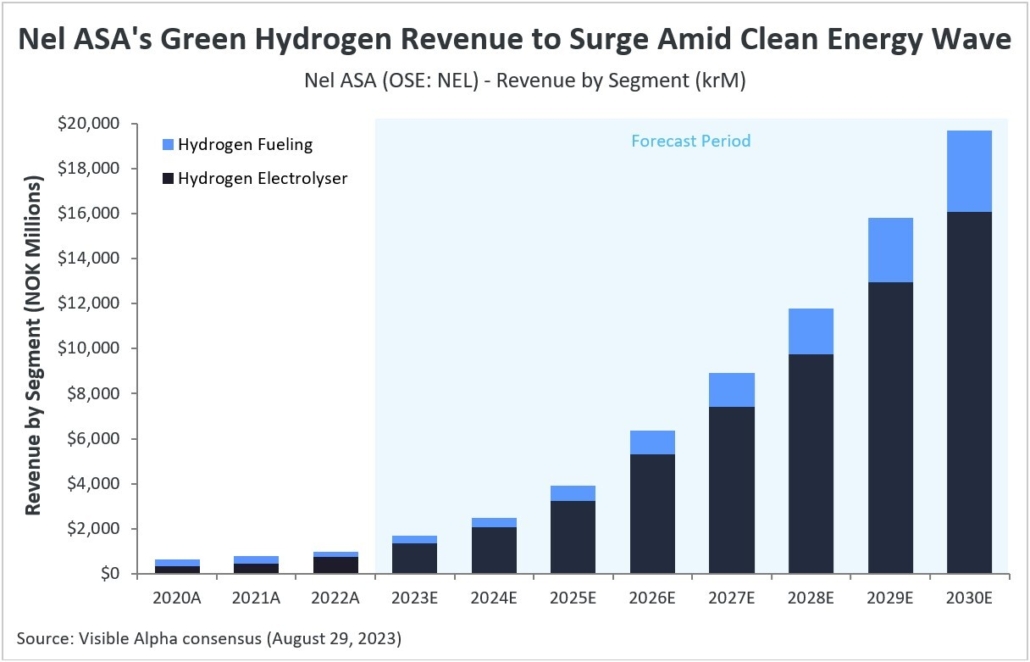

Nel ASA’s Green Hydrogen Revenue to Surge Amid Clean Energy Wave

Nel ASA (OSE: NEL), a Norwegian company specializing in hydrogen production solutions, is poised for significant growth in the forecast period according to Visible Alpha consensus. The company is a leading provider of hydrogen electrolyzers and is a key player in the emerging hydrogen economy. Green hydrogen, recognized as the most sustainable type of hydrogen, is positioned to be pivotal in the global shift towards cleaner and more sustainable energy sources.

Analysts expect the company to see revenue grow at a CAGR of 41% between 2020 and 2030. Looking at the company’s revenue segments, Hydrogen Electrolyser revenue is expected to grow at a CAGR of 47% between 2020-30, while Hydrogen Fueling revenue is projected to grow at a CAGR of 28%. Analysts expect the company to turn profitable by 2026, generating an operating income of NOK 7.9 million.

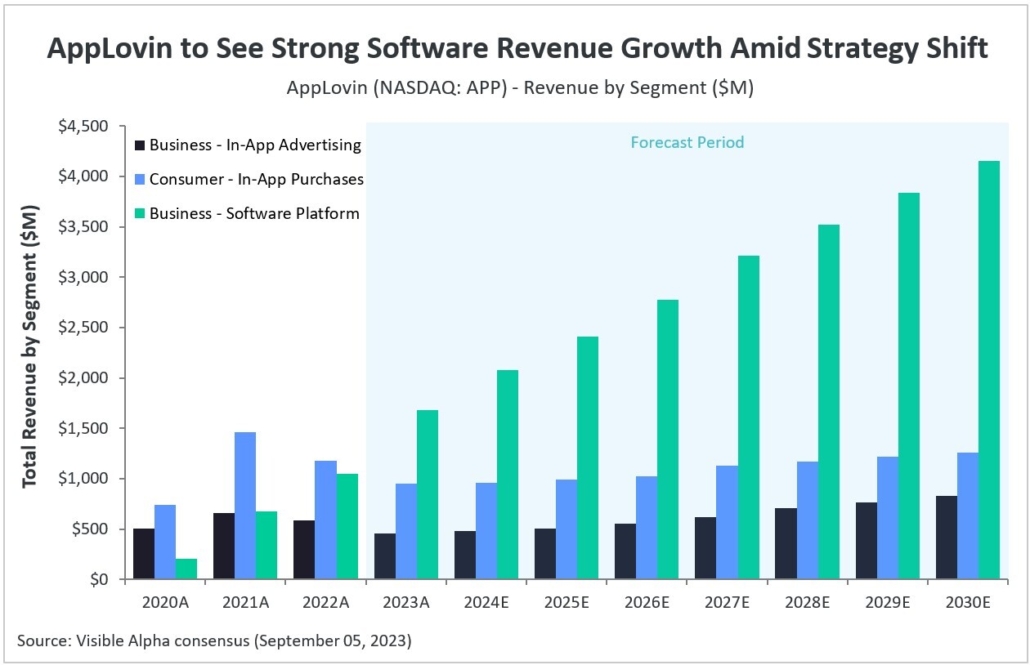

AppLovin to See Strong Software Revenue Growth Amid Strategy Shift

AppLovin (NASDAQ: APP), a mobile advertising company that delivers advertisement platforms for app developers, is projected to see software platform revenue grow by 60% year over year in 2023, based on Visible Alpha consensus. This growth is expected to be driven by Axon 2.0, the latest version of the company’s AI-based ad tech platform, which it launched earlier this year.

While consumer in-app purchases used to be the company’s primary revenue-generating segment, analysts anticipate that software platform revenue will outpace in-app revenue in 2023, reaching a total of nearly $1.68 billion. As the company shifts its focus towards its software platform, app-related revenue is projected to continue to decline. After dropping by 11% last year, in-app advertising revenue from the company’s business segment is expected to decline by 23% in 2023, while in-app purchase revenue from its consumer segment is expected to decline by 19% in 2023, after also declining by around 19% in 2022.

Memory Chip Dip; Pfizer’s New Cancer Drug; Rare Earths Slump; Oil Refiners’ Profit Slide

In our weekly round-up of the top charts and market-moving analyst insights: Memory chip makers are expected to see revenues decline in 2023; Pfizer’s (NYSE: PFE) Elrexfio marks the third bispecific antibody approved for multiple myeloma by the FDA; Lynas Rare Earths (ASX: LYC) is projected to experience a decline in revenue in 2023-24; and U.S. oil refiners are expected to see a decrease in gross profit per unit between 2023-2025.

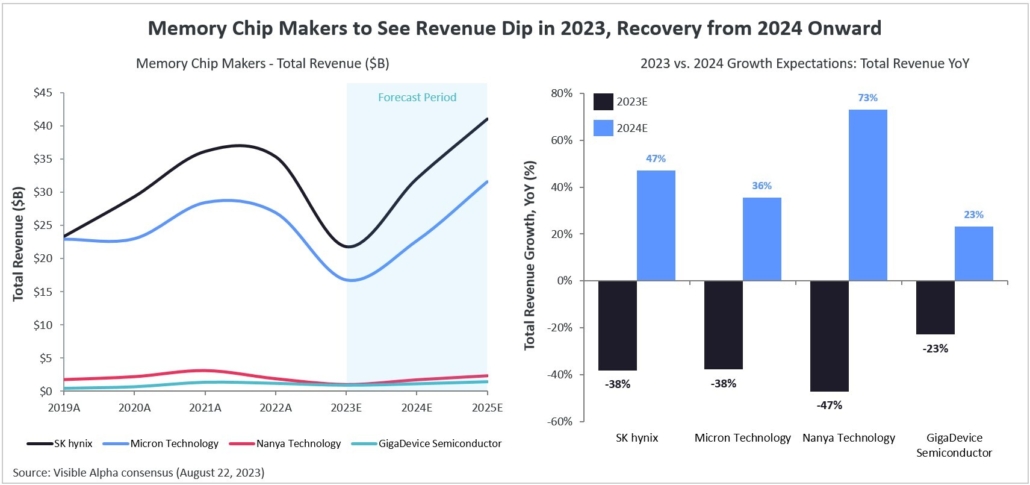

Memory Chip Manufacturers to See Revenue Dip in 2023, Recovery from 2024 Onward

Memory chip makers, including SK hynix (KRX: 000660), Micron Technology (NASDAQ: MU), Nanya Technology (TWSE: 2408), and GigaDevice Semiconductor (SSE: 603986) are expected to see revenues decline in 2023, according to Visible Alpha consensus. The memory semiconductor industry is dealing with overcapacity and excess inventory coupled with sluggish demand. This has been placing downward pressure on average selling prices (ASP) of DRAM (Dynamic Random-Access Memory) and NAND memory technologies. Analysts expect both DRAM and NAND revenues to decline in 2023 as sluggish demand and high inventory eat into ASPs. However, these companies are expected to see revenue rebound starting in 2024 as the market potentially transitions towards undersupply.

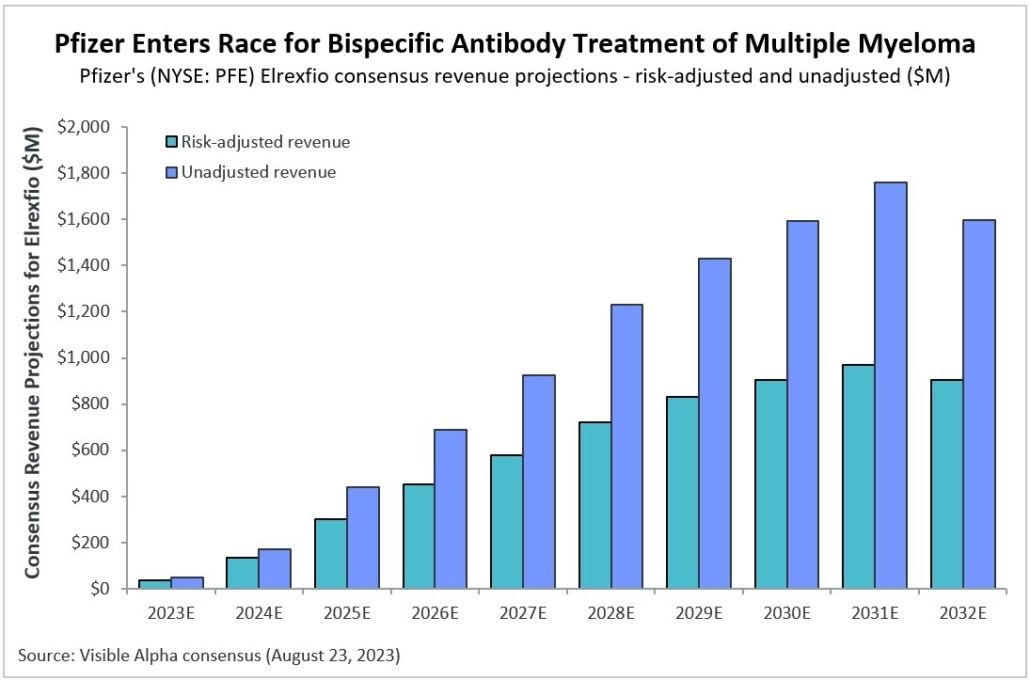

Pfizer Enters Race for Bispecific Antibody Treatment of Multiple Myeloma

Pfizer’s (NYSE: PFE) Elrexfio marks the third bispecific antibody approved for multiple myeloma by the FDA – Elrexfio was granted accelerated (conditional) approval by the FDA on August 14, 2023. The other two bispecific antibodies approved for multiple myeloma belong to Johnson & Johnson (NYSE: JNJ): Tecvayli (approved in October 2022) and Talvey (approved on August 10, 2023).

According to Visible Alpha consensus, analysts’ expectations for the probability of success of full approval for Elrexfio is 59%, reflecting the risk associated with a successful registration (Phase 3) trial for full approval. Visible Alpha consensus risk-unadjusted revenue projections of close to $1.8 billion in 2031 (peak) are significantly lower than PFE’s guidance of $4 billion in peak sales. Peak risk-adjusted revenue expectations in 2031 are $971M.

Elrexfio (elranatamab) is a bispecific antibody that targets B-cell maturation antigen (BCMA) and CD3 on T cells. Elrexfio is a T cell engager that activates T cells, which results in killing multiple myeloma tumor cells.

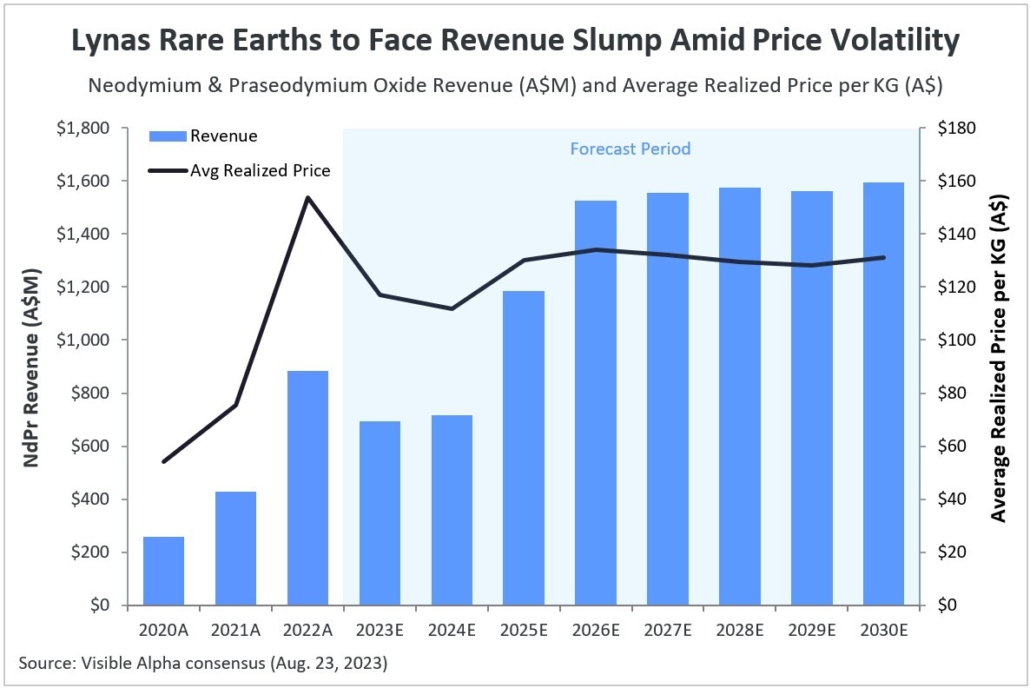

Lynas Rare Earths to Face Revenue Slump Amid Price Volatility

Lynas Rare Earths (ASX: LYC), an Australian rare-earths mining and processing company, is projected to experience a decline in revenue in 2023-24, according to Visible Alpha consensus. This decline is primarily attributed to an expected decrease in revenue generated from neodymium and praseodymium (NdPr) oxide, which constituted 96% of the company’s total revenue in 2022. NdPr are essential components in the manufacturing of high-performance magnets that are used in electronics, electric and hybrid vehicles, and wind turbines, among others.

Prices of rare earth minerals have declined over the past year due to increased supply from China and softer demand from renewable energy companies and the automotive sector. Analysts anticipate that the lower average realized prices from NdPr will be key to pushing down revenue expectations between 2023-24. However, it is expected that revenues and, to a lesser extent, prices will rebound starting in 2025.

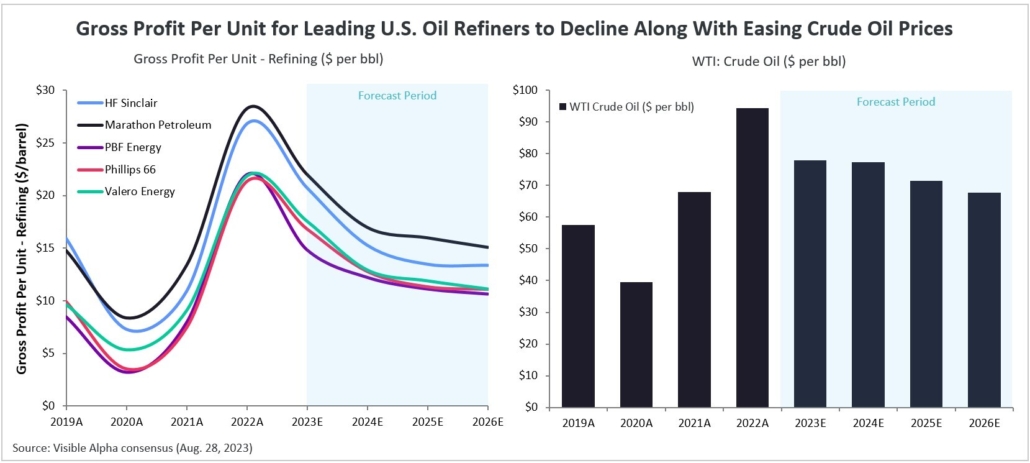

Gross Profit Per Unit for Leading U.S. Oil Refiners to Decline Along With Easing Crude Oil Prices

According to Visible Alpha consensus estimates, Phillips 66 (NYSE: PSX), Valero Energy (NYSE: VLO), Marathon Petroleum (NYSE: MPC), PBF Energy (NYSE: PBF), and HF Sinclair (NYSE: DINO) are projected to see a decrease in gross profit per unit between 2023-2025. U.S. refiners enjoyed bumper profits in 2021-22, as Western sanctions on Russia and COVID lockdowns in China crimped global fuel supplies at a time when demand was recovering from pandemic lows, creating increased demand for U.S. crude oil. In 2023, however, rising oil exports from Russia and China are expected to dampen the demand for U.S. crude derivatives.

The decline in profits is also partly due to the anticipated decline in crude oil prices during the forecast period. Lower crude oil prices translates to reduced prices for refined products, impacting margins for refiners. Crude oil prices are anticipated to decrease to an average of $78 per barrel (bbl) in 2023, down from the peak levels observed last year. Despite the decline, profits are generally still expected to maintain above pre-pandemic levels.

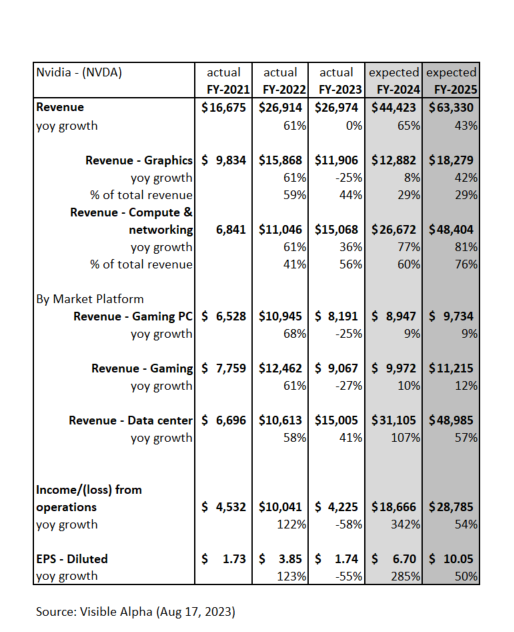

Nvidia (NVDA) Post-Q2 FY2024 Earnings: The Shift to AI

Here’s a look at the key highlights from Nvidia’s (NASDAQ: NVDA) Q2 FY2024 earnings release and the company’s strong outlook.

- Could Nvidia be the next $2 trillion market cap company?

- Will the platform shift to accelerated computing happen by 2027?

- Will the bulls continue to be right about the magnitude and pace of Data Center demand?

Nvidia’s Big AI Moment Continues

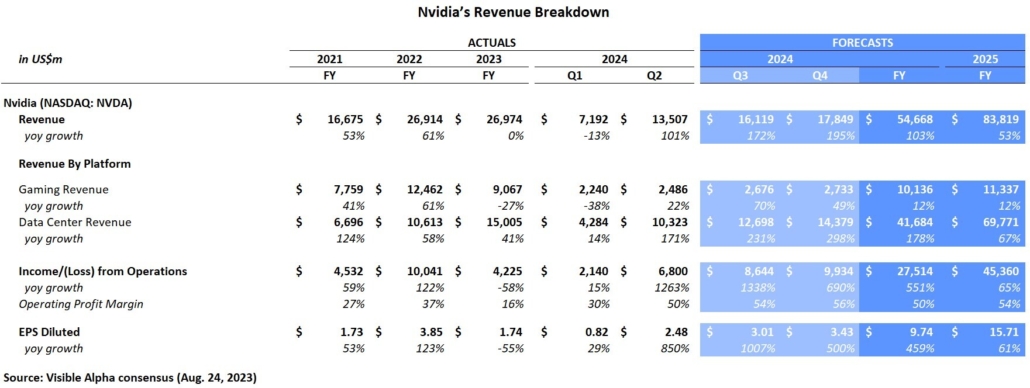

Nvidia announced a topline beat of $2.2 billion in Q2 FY 2024, which dropped almost completely to operating income, driving further upside in the stock. Customer demand in Q2 came primarily from cloud service providers (just over 50% of revenue) and consumer internet. However, this quarter was all about the outlook and supply, which both exceeded expectations. The combination of clear supply visibility and the Q2 beat and Q3 guidance delivered a surprise of over $5 billion above consensus expectations. Nvidia will be presenting at a number of sell-side conferences in early September and it will be valuable to get further clarity on the outlook on both demand and supply.

The company guided Q3 revenues to $16 billion, over $3 billion ahead of where Q3 consensus was at the end of Q2. The company guided gross margins to expand to 71.5-72.5% in Q3, ahead of the previous estimate of 68% for FY2024.

Ahead of the Q2 announcement, analysts had been expecting the company to generate $14 billion in revenues and $7 billion in operating income in Q4. However, post-Q2, numbers were revised up and the new consensus number for Q4 revenues is now $18 billion and nearly $10 billion in operating income.

FY2024 is now expected to generate $9.74/share, driven by $54.7 billion in revenues and $27.5 billion in operating income.

Could Nvidia be the next $2 trillion market cap company?

Platform Shift to Accelerated Computing

On the Q2 earnings call, the company called out that “data center demand is tremendous,” driven by the move from general purpose computing to accelerated computing. According to Nvidia CEO Jensen Huang, the trend is very clear and Nvidia is seeing this platform shift. The shift to accelerated computing reduces cost and energy, driving higher throughput, and the industry is responding to this improved efficiency. This is driving the development of new applications.

According to Huang, $1 trillion of data centers are populated by CPUs, not accelerated computing. He noted on the call that he believes $250 billion/year in CapEx dollars will lean into generative AI infrastructure (Training and Inference). With generative AI (GAI) continuing to move toward accelerated computing, this shift is continuing to drive significant order flows to build out the accelerated computing in data centers.

Prior to the Q1 earnings release, revenue from data centers was expected to generate a mere $23 billion by the end of FY2025. Prior to the Q2 earnings release, analysts projected $51.6 billion, but the Data Center segment is now expected to reach nearly $70 billion in revenues, tripling from the initial Q1 expectations.

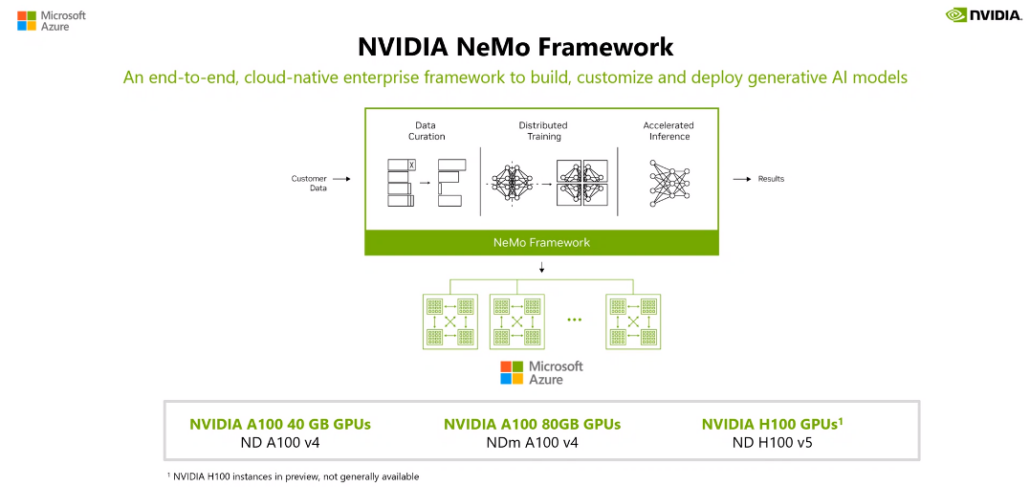

As the gold standard in AI infrastructure, Nvidia together with Microsoft will enable Machine Learning Training and Inference. In addition, this partnership will enable an Omniverse cloud to live within the Microsoft Azure cloud which will allow new applications to be built and serviced together. Also, Nvidia’s CUDA applications can operate with Windows and allow for integration of existing software, bringing innovation and freshness to existing applications with GAI.

Nvidia has also partnered with Hugging Face, the world’s largest AI community, to offer a new service to enable training directly on the Nvidia DGX cloud. Training models directly can support both more scalable and more curated integration into a new or existing legacy application, which is ultimately what can bring GAI to life for large organizations or individuals.

Figure 1: From data to results: How Microsoft and Nvidia will work together

Source: Microsoft Build (May 24, 2023)

Will the platform shift to accelerated computing happen by 2027?

Data Center Demand Drives Upside

The company highlighted strong demand for their products in data centers, driven by customers racing to integrate AI. In response to the Data Center demand visibility into H2 and next year, the company has procured supply that is substantially larger and expects supply to increase each quarter into next year. The company noted that this will lower cycle times and add capacity.

The pace of potential growth in computing and networking is driving lofty analyst expectations for Nvidia. Looking ahead to FY2025, analysts have taken up their estimates substantially on the strong Data Center demand and the company’s ability to secure supply into next year. Analysts now estimate NVDA to deliver $15.71/share with the most aggressive analysts expecting $19.18/share. Consensus revenues for the Data Center business in FY2025 are expected to come close to $70 billion. Several analysts have over $80 billion in Data Center revenues already baked into FY2025 forecasts and the most aggressive analyst is projecting over $100 billion from this division.

Will the bulls continue to be right about the magnitude and pace of Data Center demand?

Figure 2: Nvidia’s revenue breakdown

The Bottom Line

The potential for AI developers to create the next generation of must-have applications at scale has only just started. Over the next 4-5 years, there will likely be significant CapEx investment in data centers, development, and integration to ready the world for what’s to come next. The magnitude of the shifts is likely to blur the lines between cloud, chip, software, and search providers. Both workplaces and consumers are likely to win in the end with enhanced efficiency and productivity coupled with better-curated information. Like it or not, AI is here to stay.

Nvidia (NASDAQ: NVDA) Q2 FY2024 Earnings Preview & Takeaways From SIGGRAPH

The big tech companies have offered up an array of AI initiatives to drive their future growth and the value they add to their marketplaces. Nvidia (NASDAQ: NVDA) has positioned itself as a key leader in supporting the growth and scalability of the Generative AI (GAI) space. Here is a look at the key highlights from the recent keynote by CEO Jensen Huang, at the computer graphics conference, SIGGRAPH 2023, and a preview of Nvidia’s upcoming earnings release.

The enormous potential shift in data centers to reconfigure and adopt accelerated computing positions Nvidia to help drive the future direction of AI. The potential opportunities that lie ahead for democratizing AI will enable the integration of GAI into many different applications. According to Huang, “the iPhone moment for AI” is here.

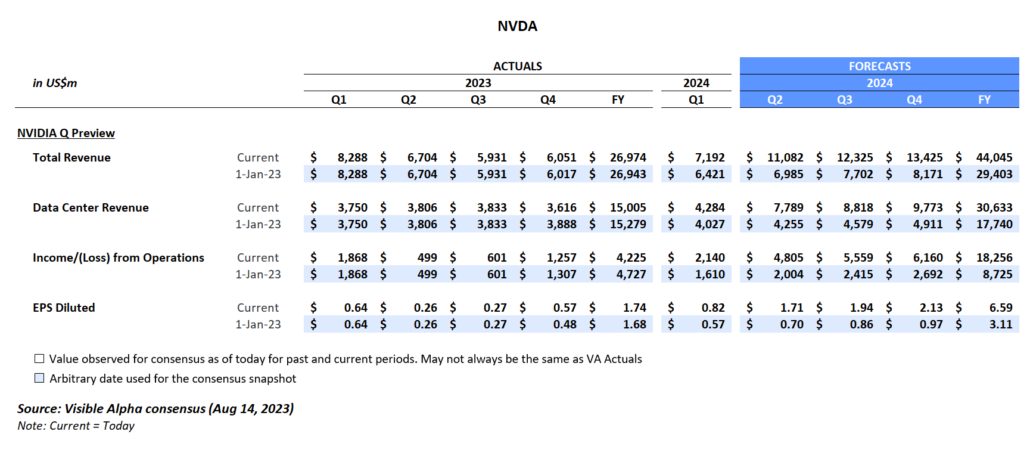

Expectations coming into Q2

Investor questions coming into the Q2

- Will the strong demand for Hopper GPUs continue?

- With the recent upward revisions to the data center business segment, is there still room for outperformance in Q2?

- Given the new announcements at SIGGRAPH, could we see upside to other divisions, like gaming?

Takeaways from SIGGRAPH 2023

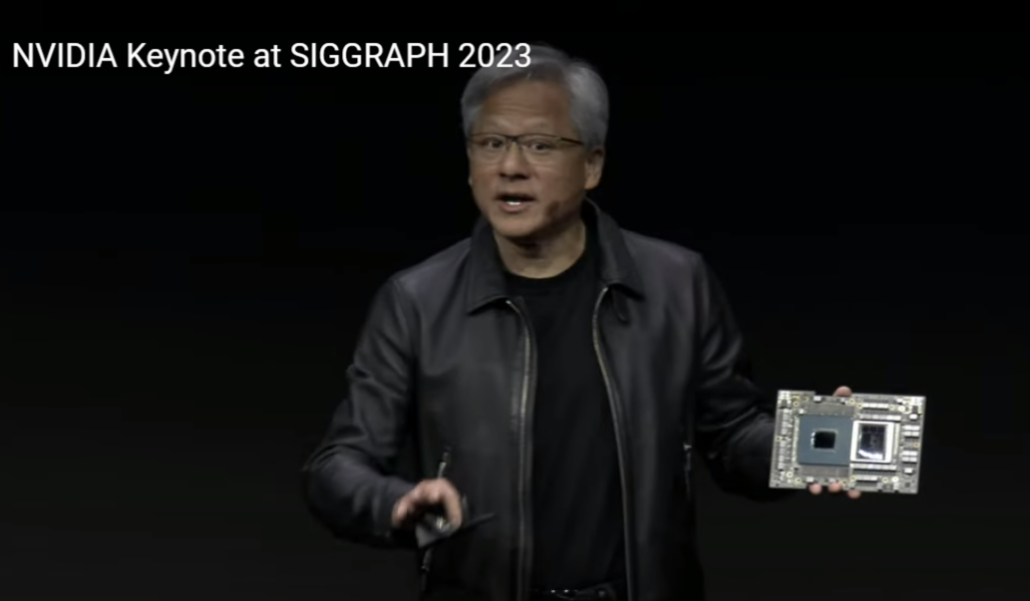

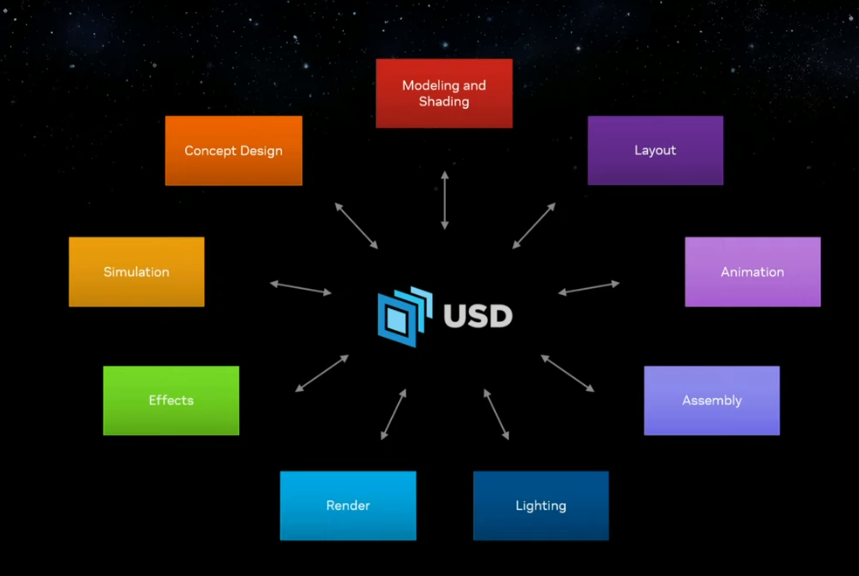

Nvidia’s revenue from Graphics is expected to grow 42% year-over-year to $18 billion by FY2025, driven by data center revenue growth. Speaking as the keynote at the SIGGRAPH 2023, a conference focused on computer graphics, CEO Jensen Huang walked through his vision and showcased several new product enhancements with GH200, OpenUSD and Hugging Face.

Based on Huang’s presentation, he believes it is possible to learn the representation of anything with structure — language, mathematics, vectors, audio, animation, 3D, DNA, proteins, chemicals. He explained that the revolutionary transformer model enables learning from a large amount of data. The model supports finding patterns and relationships, and learning these. In turn, this creates learning the representation of anything with structure and enables it to be replicated digitally (e.g., Digital Twins). The combination of a generative model and a learned language model can guide the auto-regressive diffusion models to generate anything with structure, and this guidance can happen with human natural language. In summary, accelerated computing has synced with deep learning, and the big bang of AI has begun.

All this potential learning to come from the models has significant implications on not only tech infrastructure and the stack, but also its use and application within enterprises and, more broadly, to the masses. It has the potential to enable testing and experimentation in a digital beta world that resembles real 3D physical spaces. These capabilities may move us closer to a virtual assistant fluent in all languages, autonomous driving, and new drug development. In addition, there are potential entertainment applications for short video, games, and film.

In his keynote, Huang highlighted several new product-related announcements related to driving accelerated computing in the data center segment, and this line item is where growth in new product innovations will likely continue. However, given these enhancements, gaming is another segment we are keeping an eye on.

GH200: 20x less power and 12x less cost

The basic scale out of the cloud historically was based on off-the-shelf CPUs, but general purpose computing is not the best way to do generative AI (GAI). GAI requires data centers wired for accelerated computing. According to Huang, accelerated computing is a giant step up in efficiency throughput, because it will take 20x less power and 12x less cost. This efficiency can support the expansion of investment in training and inference of any large language model and scaling it out. Huang further noted that future frontier models will start to become mainstream and scaled out.

Moving toward this vision, NVDA showcased a new processor for GAI with a new boost of memory (HBM3) that will now be connected to Grace Hopper (GH200). Huang stated that the chips are in production, will sample at year end, and be ready by the end of H1 next year. This processor is designed for scale out of the world’s data centers and may have significant implications for the pace that GAI is adopted.

The data center segment is 75% of total revenues and represents the critical growth driver for the company. Visible Alpha consensus currently projects the data center segment to hit $30 billion in revenue this year, up 2x from the previous year. Looking ahead to 2024, analysts expect growth to jump over 50% with sales from this segment to reach $46.5 billion. The most aggressive analysts are projecting the company to deliver $50 billion in revenues for the data center segment alone.

How may GH200/HBM3 drive new revenue growth beyond current expectations to the data centers segment?

Source: SIGGRAPH 2023 (August 8, 2023)

What about the other revenue segments?

Gaming is projected to generate $10 billion in revenues this year, but to grow only 13% next year. Expectations remain lackluster when compared to the data center revenue growth but may ultimately provide more room for surprise longer term. It will be interesting to see if Huang’s announcements about OpenUSD may support better than expected growth for the gaming division going forward. There seem to be significant opportunities to apply OpenUSD and GAI to gaming and the other divisions. The company’s professional visualization, automotive, and OEM segments remain small, but given the potential changes happening with GAI there may be significant room for these businesses to grow.

Source: SIGGRAPH 2023 (August 8, 2023)

At SIGGRAPH, Huang highlighted the new Omniverse release featuring GAI and OpenUSD, designed to unify 3D. OpenUSD brings the world together into one 3D interchange. According to Huang, it will be what HTML did for the web. Taking this a step further, the Omniverse and GAI need each other, because it will enable the creation of a physical world simulation. This digital simulation can be a digital environment to train a model about consequences and potentially, common sense. AI can learn in a virtual world and help to create more realistic digital worlds. There are significant potential opportunities to apply this to testing, gaming, and enterprise business tools.

Hugging Face

To democratize AI and support the streamlining of the training of models for individual enterprises, Nvidia has partnered with Hugging Face, the world’s largest AI community, to offer a new service to enable training directly on the Nvidia DGX cloud. Training models directly can support both more scalable and more curated integration into a new or existing legacy application, which is ultimately what can bring GAI to life for large organizations or individuals.

DGX footprints are going to be set up in the major cloud providers — Azure, Oracle, and Google. In addition to performance improvements, the servers used with L40S Ada Lovelace GPUs are going to be used for mainstream models that can be downloaded from Hugging Face. Or, NVDA can create models to be used in enterprise applications and work with a company via Nemo and scale enterprise level LLMs. These enhancements suggest that there continues to be substantial opportunity in this new AI era.

Final Thoughts

All eyes are on the quarter for NVDA. In particular, investors are keen to see how the company will guide and what new details will come out of their earnings call about the future trajectory of its data center business. In addition, it will be interesting to see if the company gives new details about the gaming segment and its other smaller business lines and the potential upside from the OpenUSD and Hugging Face partnerships. Overall, investors want to see if GAI momentum has legs to continue or if NVDA’s stock may take a breather in the event that expectations and its outlook are merely in line.

Three Key Questions About Apple (NASDAQ: AAPL) Earnings in August 2023

Apple (NASDAQ: AAPL) reported earnings for its fiscal Q3 2023 after the market close on Thursday, August 3, 2023. After the earnings release, what are the questions we’re focusing on?

1. What happened with sales and what is the outlook?

Apple delivered total Q3 revenues in line with Visible Alpha consensus at $81.8 billion, driven by iPhone sales of $40 billion, which were supported by solid demand in emerging markets. Coming into earnings, several analysts were expecting iPhone sales to come in higher than the $40 billion consensus, suggesting there was probably some disappointment despite the overall in-line performance. Revenues in North America came in lower at -6% year over year.

The company noted that revenue was strong again in India. This market may begin to break away from other emerging markets as retail and product penetration increases. While India may not generate the same volume of revenues as China’s estimated $73.6 billion, it may still increase penetration significantly and make a meaningful contribution to revenue over the next few years.

iPhone net sales for Q4 are expected to be $43.3 billion, up 1.6% year over year, but declines are projected for Mac and iPad. There has been some debate about the outlook for iPhone sell-through units, with a fairly wide range of unit expectations ranging from 45 million to 55 million for Q4. New iPhones are expected to go on sale toward the end of Q4 and be more of a driver in 2024, with 235 million units expected to be sold.

China’s Outlook Improved: With questions about China’s emergence from lockdown, there has been some debate about what the region will deliver for sell-through units for the remainder of 2023. China sales in Q3 beat pre-Q expectations of $14.6 billion, coming in at $15.7 billion, over $1 billion better than expectations. In addition, the Q3 operating profit margin beat pre-Q expectations by 140 basis points, delivering an operating profit margin of 39.2%.

At the end of Q1, analysts were projecting China to deliver $71.5 billion in revenues in 2023, down -4% from 2022 levels. This number rose throughout Q2 and Q3 to a post-Q3 estimate of $73.7 billion, now flat compared to last year. For 2024, growth is expected to resume to $76 billion, up 3% from 2023.

New Question: How big can the India market become for iPhone, and at what pace?

2. How did the Services segment perform and what is next for this segment?

For Q3, Services delivered $21.2 billion in revenue, ahead of a pre-Q expected $20.8 billion and up 8% year over year, driven by iCloud and App Store. For 2023, analysts now expect $84.3 billion in Services revenues, up 8% from 2022 and up slightly from previous expectations of $83.7 billion. For 2024, analysts currently forecast Services revenue to jump 10% to $93 billion. Given Apple’s enormous installed base, there seems to be room for Services to expand its penetration.

Cloud: For 2023, AAPL is projected to generate $9 billion in Cloud sales with more bullish analysts estimating $10-12 billion. Based on color from the Q3 earnings, Cloud looks poised to continue to sustain its growth path.

Margins: Services currently generate a 71% gross margin, nearly double the 36% for the Product segment, and can shift AAPL toward higher profitability. The company’s total operating profit margin is expected to dip to 29.6% in 2023 and 2024 from 30.3% in 2022. An increase in mix toward Services would shift the gross and operating profit margins higher for the company.

New question: What could drive iCloud’s revenue beyond $10 billion in 2024?

3. What new information was revealed about the Vision Pro headset?

While CEO Tim Cook noted his excitement for Apple’s new Vision Pro, there were no new details about the outlook for the new product. Apple’s new Vision Pro is expected to come out in early 2024. Given the high $3499 price point initially, Apple will likely have to find a sweet spot for bringing the price down enough to scale.

Most analysts covering Apple have not yet added a specific line item for VR/Vision Pro. Visible Alpha has a few broker models with VR/Vision Pro estimates. According to these early estimates for Vision Pro, Apple is expected to generate anywhere from around $1-3 billion in revenues by the end of 2024 and $4-10 billion by the end of 2027, but with ASP expected either to remain sticky at $3499 or to decline below $2000 from 2024 to 2027. Unit assumptions range from 2-3 million by the end of 2027.

Given that analysts expect Apple to deliver $478 billion in total revenue by the end of 2027, the Vision Pro business seems likely to remain a small percentage of their mix. It will be interesting to see both how big this product can become and how the VR/Vision Pro business model may be able to help drive high-margin Services revenue.

New question: What is the right price to meaningfully trigger demand for Vision Pro?